Oroco Resource Corp (OCO.V) is still aggressively drilling its flagship Santo Tomas copper project but the pace of drilling has slowed down towards the end of this year as there are plenty of results to report on and Oroco needs to keep an eye on its treasury. While the company still had approximately C$15M in working capital as of the end of August (which marked the end of Q1 of Oroco’s financial year), keep in mind the company spent in excess of C$5M on exploration in that quarter and the drill pace picked up in the subsequent few months.

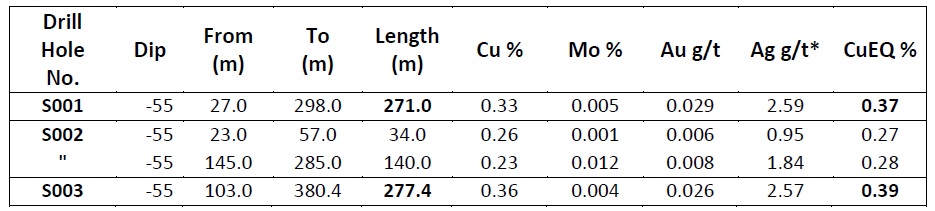

Drilling isn’t cheap, but it has been paying off for Oroco. In a November update, Oroco published the assay results from holes S001-S003, three holes drilled on the south-central area of the South Zone. All three holes intersected significant intervals of mineralization with for instance 271 meters containing 0.37% CuEq in S001, 34 meters and 140 meters at respectively 0.27% CuEq and 0.28% CuEq in hole S002 and 277 meters containing 0.39% CuEq in hole S003.

Hole S003 is the most interesting hole. Not because of the thickness of the mineralization nor the encountered average grade but because of its location. That hole is located about 1,400 meters south of the North Zone and this basically confirms the continuity of the mineralization along a 3,200 meter strike length.

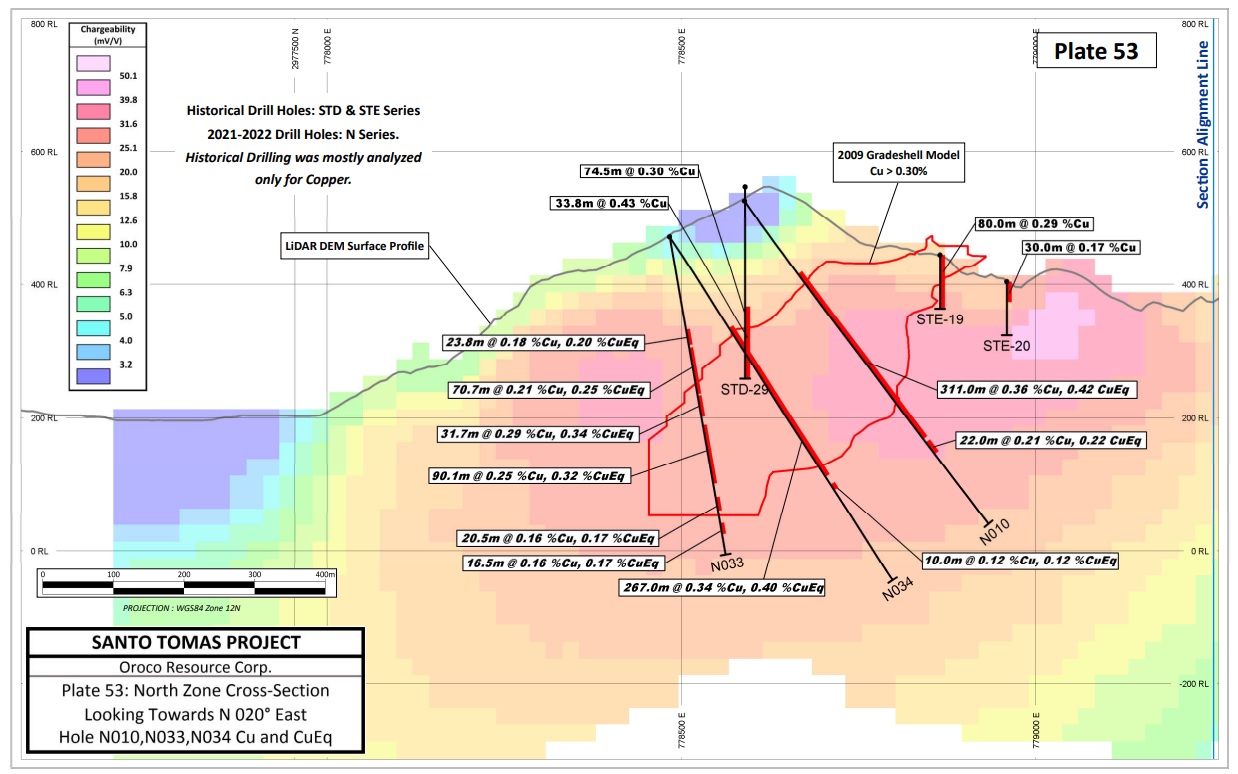

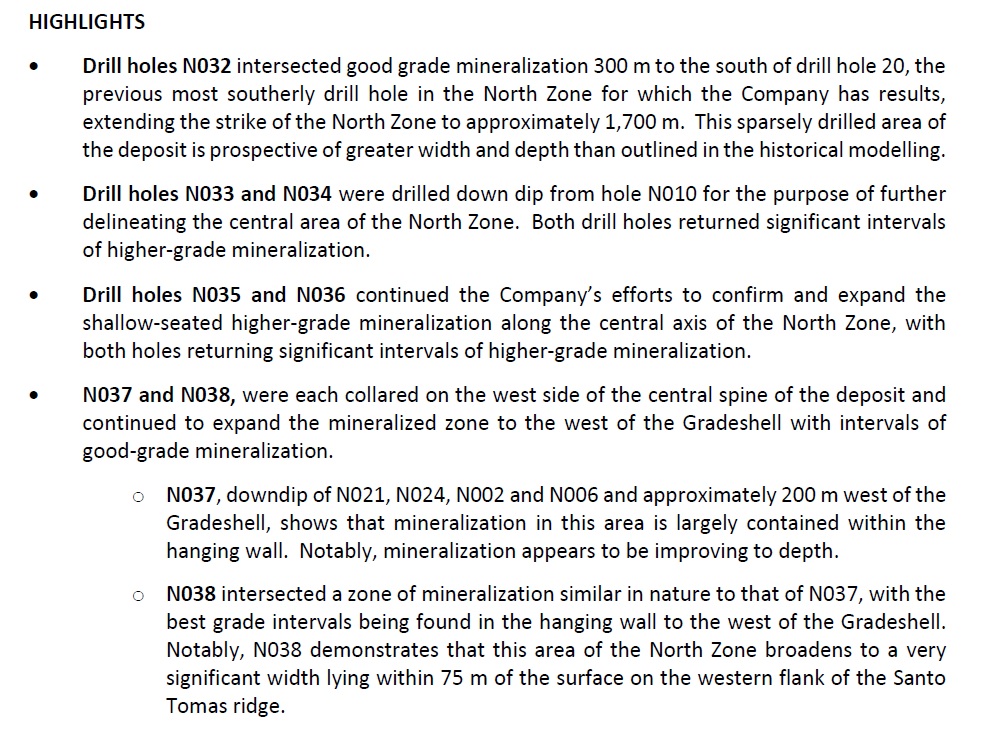

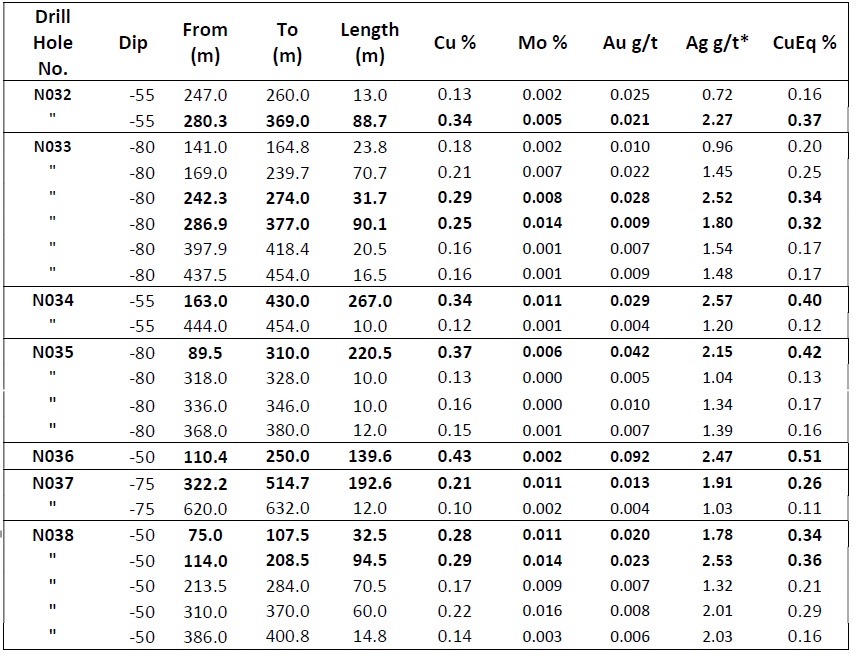

In a North Zone update, Oroco released the assay results rom holes N032-N038 which represented in excess of 4,000 meters of drilling (as per the latest update, Oroco had completed in excess of 28,000 meters of drilling in a total of 43 holes, which confirmed the presence of copper mineralization over a 1,700 meter strike length. In its exploration update, Oroco did a great job in explaining why and where the holes were drilled:

And as we already knew the continuity and consistency of Santo Tomas is pretty strong, and the assay results (below) confirm the average grade with a nice outlier in hole N036 which encountered almost 140 meters of 0.51% CuEq, of which 0.43% was actually copper.

And although the grade is still relatively low, the size of the mineralization at Santo Tomas is exactly what a Tier—1 copper company would be looking for. We always knew Santo Tomas should be seen as a very large tonnage low-grade deposit where economies of scale play an important role. And with the recent North Zone and South Zone drill results, we think Oroco is now getting pretty close to demonstrating a billion tonnes of mineralization containing what should be economic copper (equivalent) grades.

Disclosure: The author has a long position in Oroco Resource Corp. Oroco is a sponsor of the website. Please read our disclaimer.