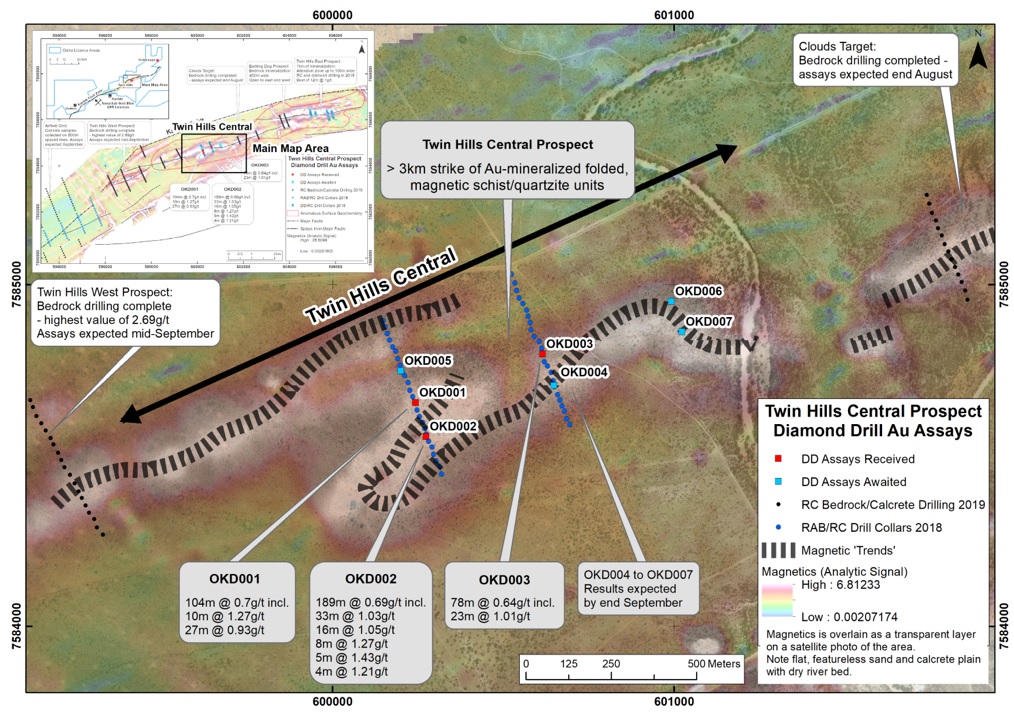

Osino Resources (OSI.V) reported on the assay results of the first three diamond drill holes that were completed at its Twin Hills Central zone. Considering all three holes intersected thick layers of gold mineralization (104 meters at 0.7 g/t gold, 189 meters at 0.69 g/t gold and 78 meters at 0.64 g/t gold), it’s very encouraging to indeed see the diamond drill program confirming the wide-spread presence of gold mineralization.

The thickest interval of 189 meters started at a depth of just 21 meters downhole while the 104 meter interval started approximately 115 meters down-hole and the 78 meters at 0.64 g/t gold started 91 meters down-hole. The true widths are still unknown at this point but it looks like all three mineralized zones started within 100 meters from surface. This is all very reasonable.

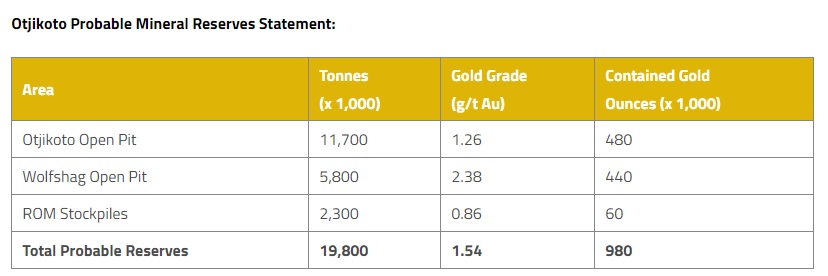

Considering the mineralization appears to be capped by a calcrete zone at surface, we aren’t expecting the mineralization to be oxide, but Osino has reassured us we shouldn’t be expecting the sulphides to be refractory, and Osino referred to the Otjikoto mine (operated by B2Gold (BTO, BTG.TO)) and its ultra-low production costs. While the average recovery rate at Otjikoto of 98.6% is indeed impressive, we still think it’s very early days to already point a finger to Otjikoto as the best comparison for Twin Hills, simpley because the grades of both projects is too different. B2Gold’s website shows an average weighted grade of 1.63 g/t gold for both the Otjikoto and Wolfshag open pits, and that’s more than twice as high as the grades encountered in the first three holes at Twin Hills.

So while we agree Otjikoto is perhaps the very best example of Namibia’s gold sector right now, the relatively low grade of the first three drill holes made us think if Twin Hills would be viable using the same parameters as used at Otjikoto.

Applying a similar 98.6% recovery rate on Osino’s 0.70 g/t would result in a recoverable grade of 0.69 g/t or US$33/tonne based on $1500 gold (and approximately $30/t using $1350 gold).

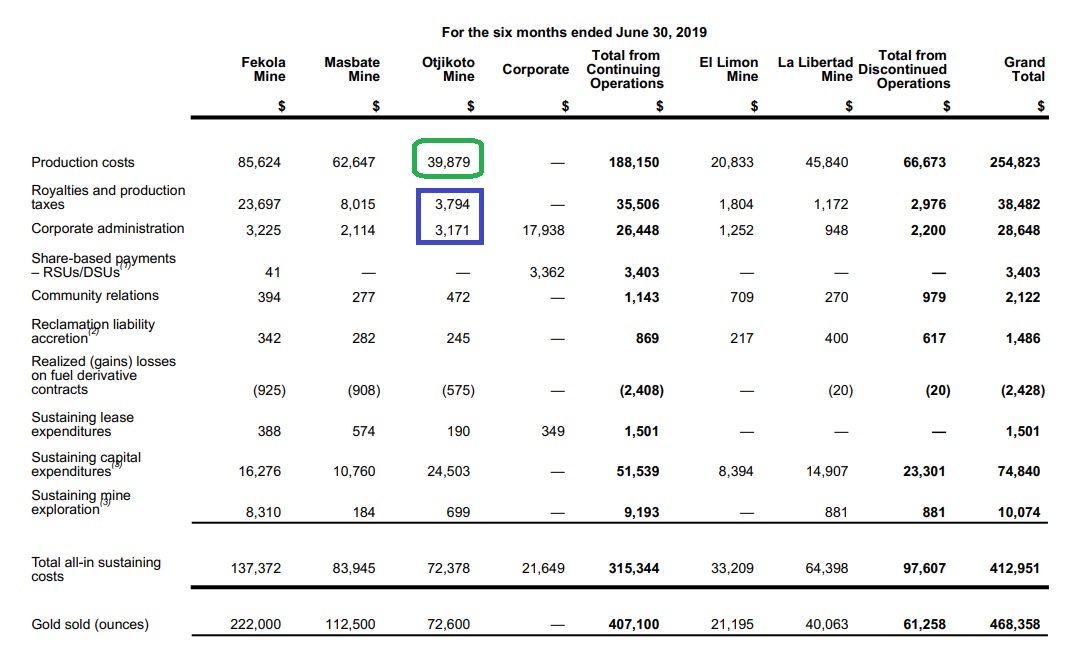

Otjikoto’s production expenses in H1 were $39.9M (excluding royalties and local G&A and of course excluding the $24.5M in sustaining capex). Considering 1.668 million tonnes were processed, the average cost per processed tonne is $23.92/tonne (We realize we are cutting a few corners here with for instance the strip ratio although the majority of the pre-stripping activities for the higher grade pit wasn’t expensed but (correctly) included in the $24.5M sustaining capex). The royalties & local G&A at Otjikoto were a combined $7M or $4.19/t in H1.

So if we would apply the Otjikoto production costs per tonne, we’d end up with approximately US$28/t (still excluding sustaining capex and the (relatively low) handling costs for the gold), indicating Osino’s current operating margin based on the first three holes would be just $5/t, even with the same exceptional recovery rates of 98.6%. Of course this just tells a part of a potential story. Selective mining always is an option, and could become a very realistic option once Osino has a better understanding of the size of the deposit.

It’s still very early days and we are encouraged by Osino encountering thick layers of mineralization (which basically confirms the exploration theory) while holes 6 and 7 that have been drilled towards the East-NorthEast have the potential to quickly increase the tonnage at Twin Hills. Additionally, hole 5 was drilled 100 meters further to the North-NorthWest from hole 1 and if hole 5 would be mineralized as well, the footprint at that specific zone would immediately double to 200 meters.

The encountered thicknesses are very impressive and the 4 remaining holes that are still pending have the potential to further confirm the geological and exploration model. But the sulphide grade of 0.7 g/t could use a boost.

Disclosure: The author has a small long position in Osino Resources.