Osisko Metals (OM.V) announced last month it has entered into a binding term sheet with Karst Investments, which owns a 3% Net Smelter Royalty on the production of the Pine Point zinc project, which Osisko acquired when it purchased Pine Point Zinc in an all-stock transaction while spinning off Generation Mining (GENM.C) which is now earning an 80% stake in what probably is one of the most exciting PGM projects in North America these days.

Osisko has agreed to pay the shareholders of Karst US$8.5M (just over C$11M) and issue 2 million shares of Osisko Metals to acquire Karst which will effectively eliminate the 3% NSR on the project. An expensive deal, but a good move, indicating Osisko appears to be serious about developing the asset. Removing a 3% royalty that comes straight off the top line will add a multiple of the C$12M in cash and stock Osisko is currently paying to the Net Present Value of Pine Point. And for the Karst shareholders it’s an easy way to monetize the NSR while retaining some exposure through the 2 million shares Osisko Metals will be issuing. Osisko Metals immediately turned around and sold a 1.5% NSR to Osisko Gold Royalties for C$6.5M (which means it’s selling the royalty at a marginal higher value) and just raised C$7M in a non-brokered private placement priced at C$0.50 per share to fund this transaction. This entire placement was taken up by Osisko Gold Royalties which seems to be adamant to continue to support Osisko Metals throughout its development process.

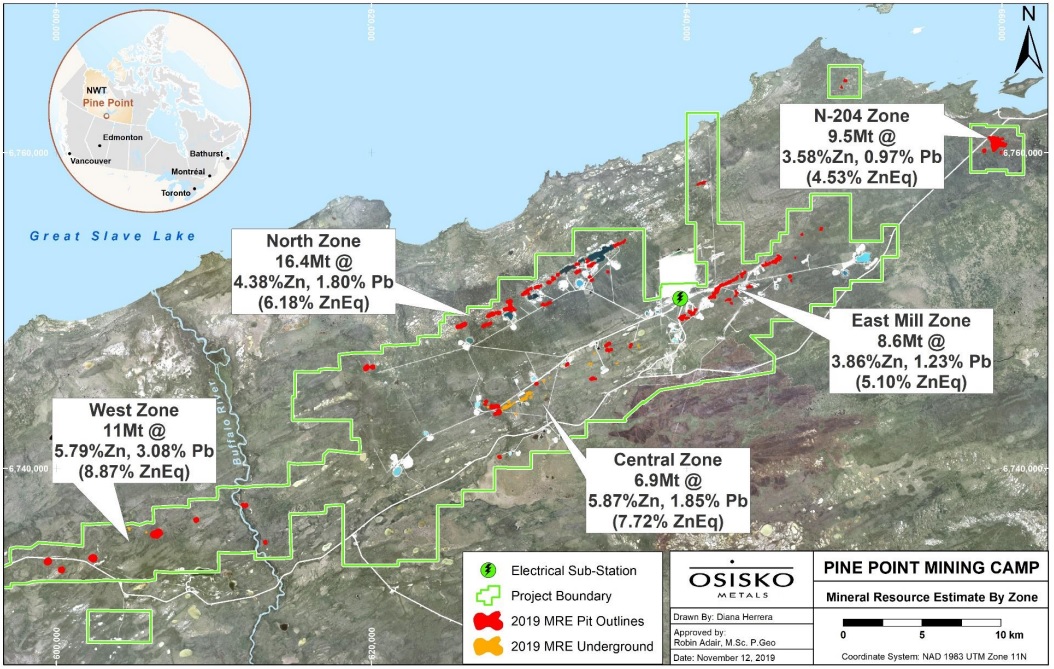

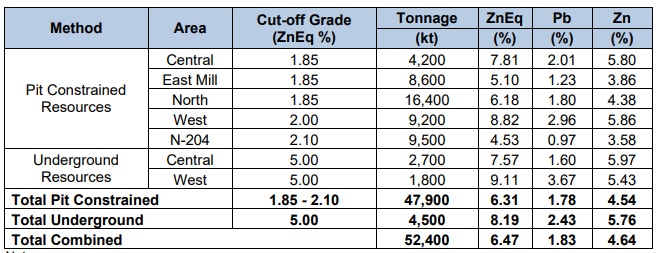

Osisko has now also updated the resource estimate at Pine Point which now contains 52.4 million tonnes of rock of which just over 90% are pit constrained. Osisko Metals was able to increase the tonnage by in excess of a third while seeing just a 0.11% drop in the zinc-equivalent grade. The 47.9 million tonnes of rock in the open pit will be the main focus for Osisko Metals and with an average grade of 4.54% zinc and 1.78% lead, Osisko now thinks Pine Point could be (re)developed as a top-10 producer in the world given the large resource (containing 5.3 billion pounds of zinc and 2.1 billion pounds of lead of which approximately 3.92 billion pounds of zinc and 1.8 billion pounds of zinc will be payable using the previously published recovery rates and assuming a 85% payability for zinc and 95% for lead) and decent grades.

Disclosure: The author has a long position in Osisko Metals.