Osisko Metals (OM.V), the zinc and copper development company has closed a substantial capital raise by issuing two sets of flow through units. Osisko issued 4.6 million flow through units at C$0.54 and an additional 19.2 million units at C$0.54 per unit. Each unit consisted of one common share and half a warrant with each full warrant allowing the warrant holder to acquire an additional share of Osisko Metals at C$0.57 for a period of five years. The back end of this financing was priced at C$0.36 per unit.

The funds will be used to continue to work on the Pine Point zinc project and the newly acquired Gaspé Copper project where Osisko committed to spend C$5M in drilling before the end of this month as part of the acquisition terms. As part of the agreement with Glencore (GLEN.L), the seller of the Gaspé project, Osisko Metals will also be required to complete C$55M in exploration and development expenditures over a four year time frame which means Osisko’s cash needs will be very high over the next few years.

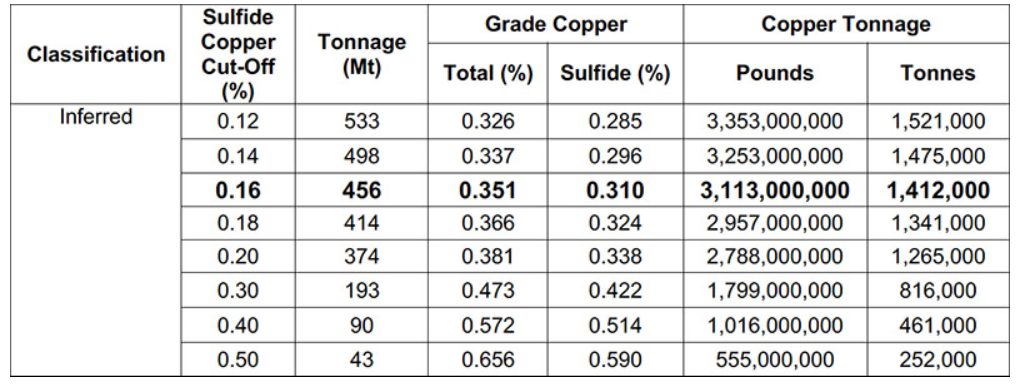

The maiden resource at Gaspé was interesting with 456 million tonnes at 0.31% copper, but the grade is too low to get very excited right now. 0.31% copper represents a gross rock value of US$27/t. Applying the 85% recovery rate used by the company, the net recoverable rock value decreases to US$23/t using $4 copper while the operating expenses are estimated at $14/t (consisting of $6/t mining cost, $7.10 processing, smelter & transportation costs and $1/t in G&A expenses).

The current 30,000 meter drill program will help to reduce the strip ratio (calculated at 1.98 right now) while it could also provide valuable information on adding silver and molybdenum to a future resource update as by-products could have a noticeable impact on the potential economics at Gaspé.

Disclosure: The author has a long position in Osisko Metals and participated in the recent financing. Please read our disclaimer.