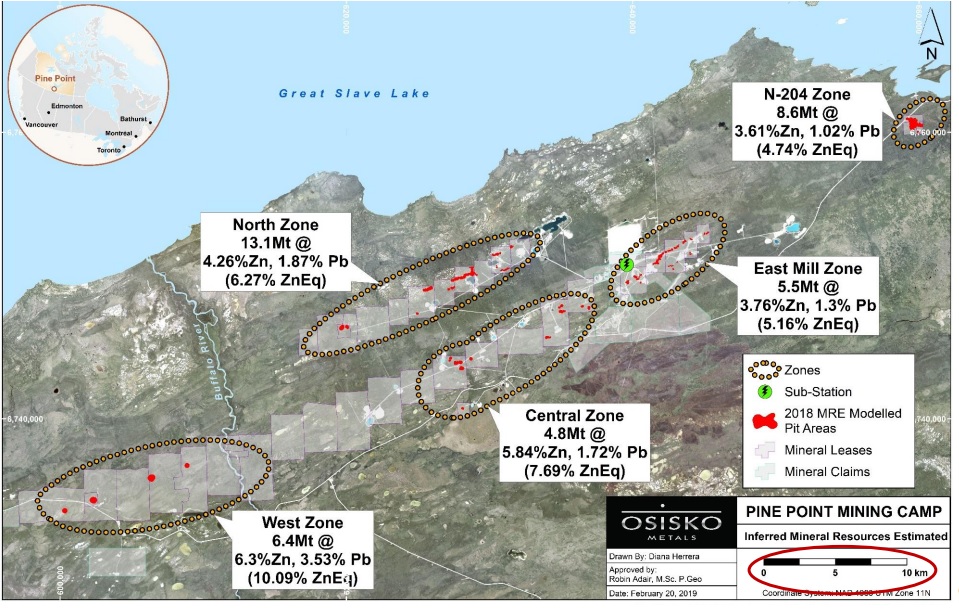

Osisko Metals (OM.V) has released the results of a preliminary flotation test phase it conducted on the zinc-bearing mineralization at Pine Point, the zinc project it acquired from Pine Point Zinc.

Osisko published the recovery results of both the rougher flotation test work as well as the cleaner flotation test work and we will focus on the latter. The initial zinc recovery was between 83.9% and 87.7% for the zinc and 92.2%-95.9% for the lead while the optimized recovery results showed a sinc recovery rate of 93.1-94.5% and 87.4-91.4% for the lead.

Those optimized flotation test results are very encouraging and Pine Point has now been able to produce a zinc concentrate with an average grade of 63.6-64.1% which exceeds the required zinc grade in a concentrate (48-52% Zn) by a great margin. Additionally, the lead concentrate has an average grade of 67.9-72.1% which means both the zinc and lead concentrates meet the minimum requirements of the smelters.

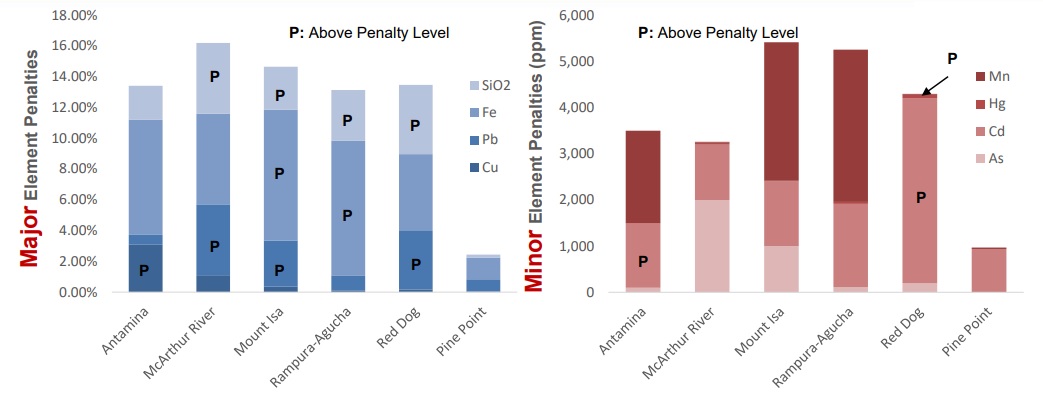

Additionally, Osisko Metals provided a breakdown of the potential deleterious elements in the zinc concentrate and only the magnesium values are slightly exceeding the smelter requirements (0.36% versus 0.35% MgO). Considering all other deleterious elements are well below the maximal values, we don’t see this as an issue.

Osisko also provided an update on its assets in New Brunswick where a 5,000 meter drill program will be kicked off any day now (in addition to a 8,000 meter drill program in Québec and a 5,000 meter drill program at Pine Point), focusing on expanding the Key Anacon Resources (which currently contains just 3.6 million tonnes in the indicated and inferred resource categories) while some additional targets in the Brunswick Belt and at Gilmour (2.26Mt containing 6.04% ZnPb, 0.19% copper and 44.3 g/t silver) will also be tested. Osisko has outlined 10 drill targets, and the currently announced 5,000 meters will very likely be immediately expanded to drill throughout the winter.

Osisko still had a working capital position of approximately C$4M as of the end of June but recently closed a C$10M placement to ensure it’s fully funded for the exploration activities. OM issued 6.4 million flow-through shares at C$0.78 as well as another batch of 7.14M flow-through shares at C$0.70M, decent premiums to the current share price. Insiders participated for C$1.13M in the financing, putting their money where their mouths are.

Disclosure: The author has a long position in Osisko Metals.