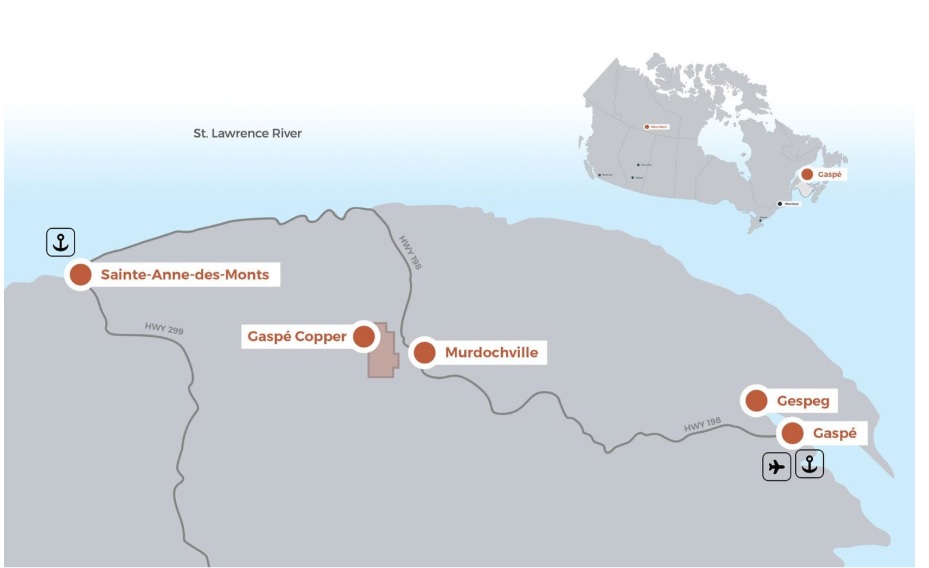

Osisko Metals (OM.V) continues to advance its Gaspé copper project in Quebec and in order to ensure a low-grade project like Gaspé could work, ensuring the copper can be recovered is a key element and that’s why Osisko Metals commissioned a metallurgical test program on eighteen composite samples of its 2023 drill program at Copper Mountain.

The company reported an average recovery rate for the copper of 91.9% from 19 bulk copper-moly locked-cycle flotation tests and 94.2% from three locked-cycle separation tests. This seems to indicate we may expect the copper recovery rates to exceed 90% while the copper will report to a copper concentrate with average grades between 24% and 28% copper.

The recovery rate for the molybdenum was approximately 65% on a combined basis, while the average recovery rate for the silver was in the low-70% range. This indicates there may be an interesting silver credit available to Osisko Metals although the average grade of the silver at Gaspé is just 1.75 g/t. This means that, applying a 72% recovery rate, the net recoverable silver represents a dollar value of 1 dollar per tonne using $25 silver.

Osisko Metals also published an updated resource calculation and the Gaspé project currently consists of 495 million tonnes in the indicated resource category at an average grade of 0.30% copper, 0.016% molybdenum and 1.75 g/t silver for a total copper-equivalent grade of 0.37%. It contains around 3.2 billion pounds of copper, 180 million pounds of molybdenum and roughly 28 million ounces of silver.

It will be interesting to see if the company can grab more attention now copper is trading at $4.8/pound and zinc is trading at $1.4 per pound. The zinc price is important for the company’s Pine Point zinc project where Appian is currently funding the on-the-ground activities.

Disclosure: The author has a long position in Osisko Metals. Please read the disclaimer.