Pacific Ridge Exploration (PEX.V) is gearing up for what looks to be a busy 2023. Not only will the company drill its flagship Kliyul project and will partner Antofagasta (ANTO.L) drill the RDP project, Pacific is also planning to be pretty active on the Chuchi project in British Columbia.

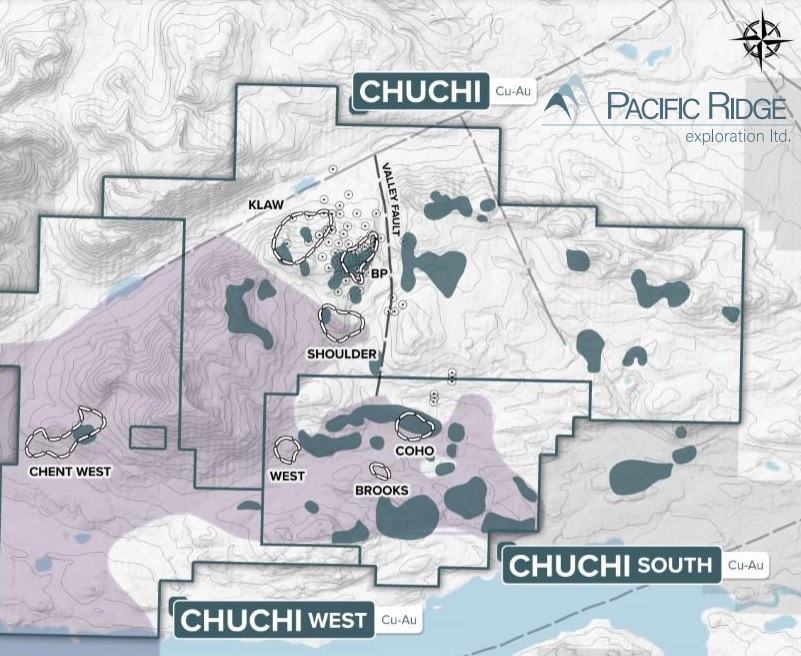

The company recently announced an agreement with a prospector and with American Copper Development (ACDX.V) to acquire their land position directly adjoining the Chuchi project. This boosts the total size of the project from just over 6,000 hectares to approximately 16,000 hectares which is almost three times as large. Pacific Ridge provided a rationale for the acquisition of both pieces of land.

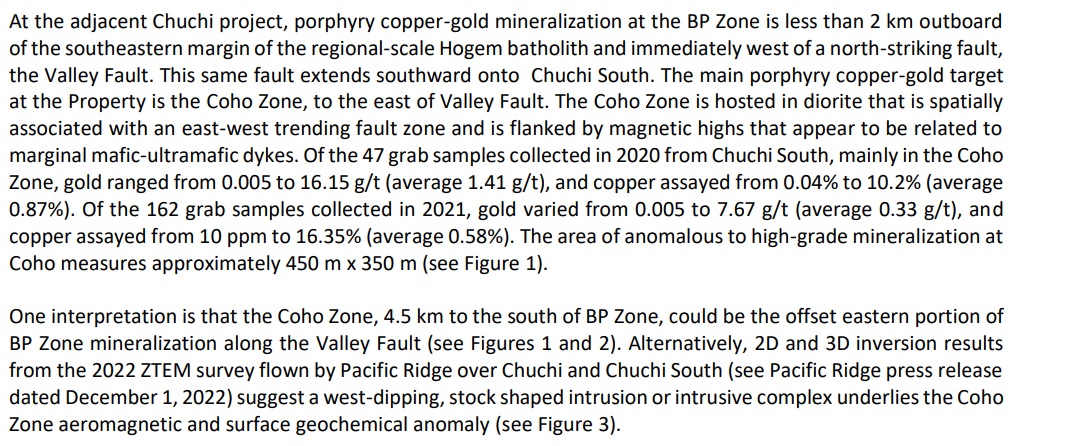

Pacific Ridge is acquiring Chuchi South from ACDX and prospector Ronal Bilquist. An initial 51% stake can be earned by making C$250,000 in cash payments to Biliquist and spending about C$4M on exploration by the end of 2025. Subsequent to meeting those conditions, Pacific Ridge can then further increase its stake to 75% by issuing C$250,000 in shares and making a C$150,000 cash payment to American Copper Development while incurring an additional C$4M in exploration expenditures.

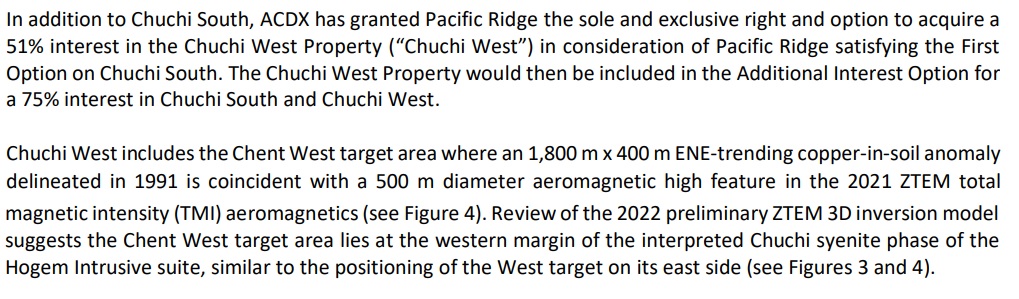

Pacific Ridge is also acquiring the Chuchi West property from ACDX. The terms are quite interesting as Pacific will be able to earn a 51% stake by completing the First Option on Chuchi South. If or when that happens, Pacific has the option to include the Chuchi West property in the Chuchi South agreement to end up with a 75% stake in both Chuchi South and Chuchi West.

It looks like Pacific Ridge is covering all bases in case of further exploration success at Chuchi. The terms to acquire the additional land packages are very reasonable and mainly consist of exploration expenditures.

Disclosure: The author has a long position in Pacific Ridge Exploration. Pacific Ridge is a sponsor of the website. Please read our disclaimer.