Pacific Ridge Exploration (PEX.V) recently closed a financing which will allow the company to continue its activities on its British Columbia based copper-focused exploration portfolio. Although the Kliyul copper-gold porphyry project remains the company’s flagship project, this does not mean the other projects will remain dormant.

At the end of last month, the company provided an update on its Chuchi copper-gold project, as it has identified a six kilometer long trend of copper-gold porphyry mineralization. This positive progress was made possible by the groundwork completed by the company in the past two years since it acquired the asset. Pacific Ridge completed an airborne and ground-based geophysics program, a soil sampling program and a mapping program at Chuchi. The data from these programs was then compared with the historical data which ultimately ended up in the identification of the six kilometer long trend.

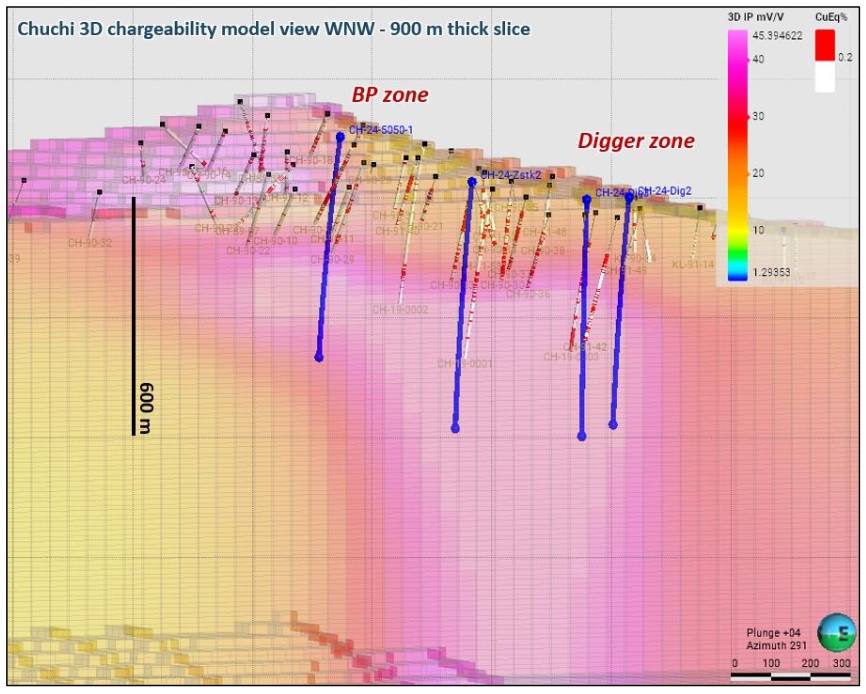

Within that trend, the BP Zone and Digger Zone have significant but yet untested potential for copper-gold mineralization at depth as the few holes drilled on those zones didn’t go deeper than 150 meters although the all ended in mineralization. The BP zone measures 550 by 450 by 650 meters (based on the interpreted size of the porphyry intrusive complex) but has never been adequately drilled. Despite the limited amount of historical data, there is a historical resource of 50 million tonnes with grades ranging from 0.21-0.40% copper and 0.21-0.44 g/t gold. While this historical resource is non-NI43 compliant, it provides a good starting point for the company to further work towards hopefully reaching critical mass at BP.

The Digger Zone, a smaller area measuring 500 by 250 by 200 meters (based on the size and extent of the IP anomaly) also needs additional work but historical drill data suggests the presence of a thick layer of mineralization with one hole intersecting 229 meters containing 0.1% copper and 0.61 g/t gold. At $4.25 copper and $2250 gold, this represents a gross metal value of approximately $53.5/t. While gross metal values don’t mean much without knowing the recovery rates, it does provide a good indication to see if a project has what it takes to host economical-grade rock.

And now it’s up to Pacific Ridge’s technical team to uncover the potential at Chuchi.

Disclosure: The author has a long position in Pacific Ridge Exploration. Pacific Ridge is a sponsor of the website. Please read the disclaimer.