Pacton Gold (PAC.V) once again shows the company’s share price seems to be moving in accordance with big brother Novo Resources (NVO.V). Although Pacton hasn’t put a single drill hole in and hasn’t taken any samples yet, the share price collapsed on Thursday on the results of Novo’s bulk sample.

And although we are (and will be) the very first ones to say Novo seems to be very expensive, we do have to acknowledge the average grade of the first sample (7.14 tonnes) of 10.4 g/t gold is really good. The second sample seems to have rattled the market as the 6.85 tonnes yielded a gold grade of just 1.5 g/t. According to Novo, the second sample was taken from the zone directly beneath the first sample, and half of the sample was taken from rock that’s considered to be barren. If that’s correct, and the dolerite was indeed completely barren, the average grade of the second sample would be approximately 3 g/t.

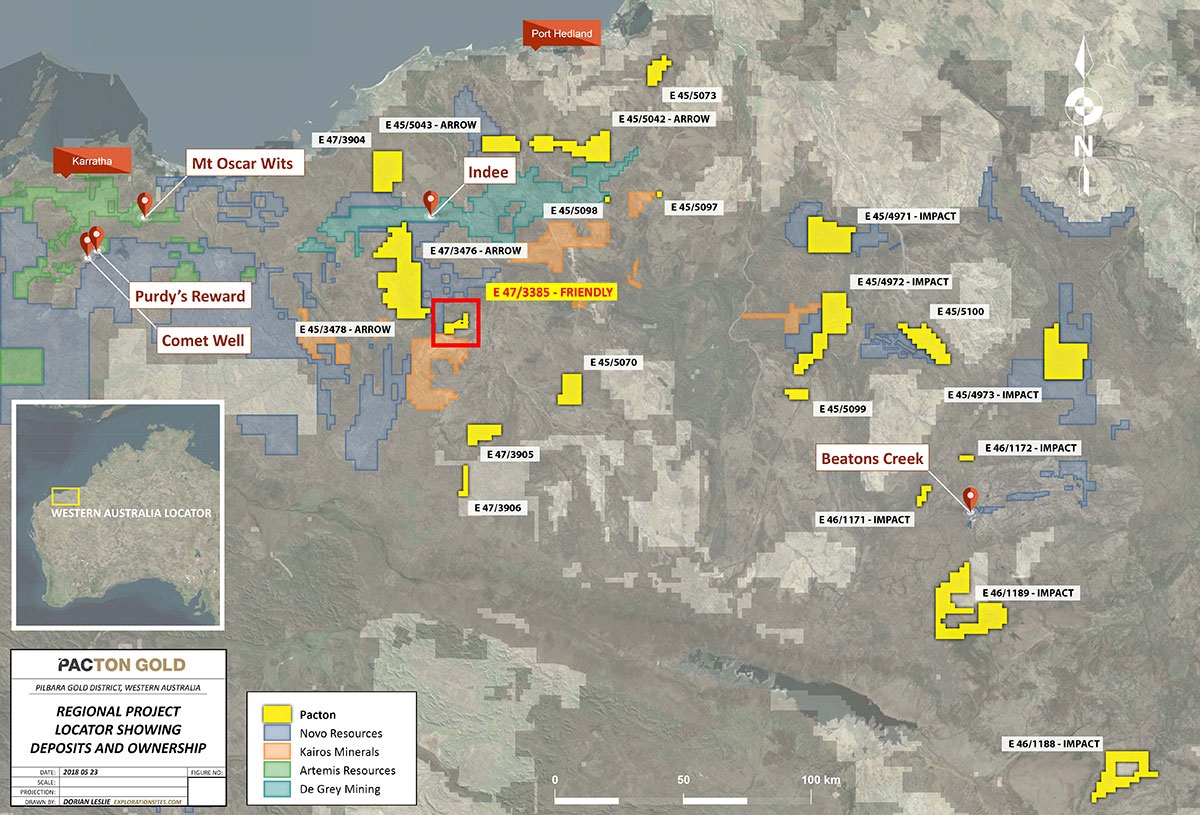

Still not mind-boggling, but pretty decent. After all, these types of operations will be open pits, and if you can’t make an open pit work at 3 g/t gold, you have a serious problem. Did Novo’s share price deserve to go down on the news? Perhaps. As we were never comfortable with a market capitalization reaching the C$1B mark. But Pacton hasn’t even done any work yet. Sure, its tenements could yield even worse results than Novo. But Pacton has just started to acquire its land position, and on a fundamental basis, nothing has changed in the past four days.

As you could read in the disclaimer in our initial report which was published on Monday, we didn’t own shares in Pacton. But we will be bidding for stock after yesterday’s crash as the risk/reward ratio seems to have improved.

Go to Pacton’s website

The author has no position in Pacton Gold, but will be bidding for stock today. Pacton is a sponsor of the website. Please read the disclaimer