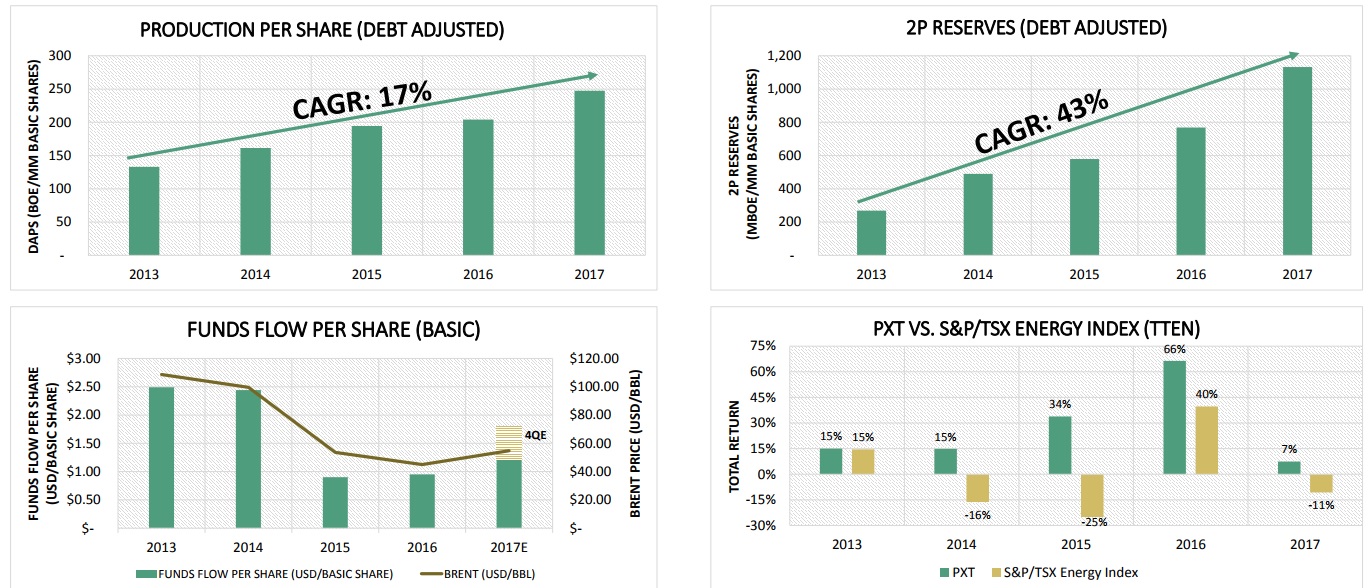

Parex Resources (PXT.TO), the Colombia-focused oil explorer and producer, has now released its updated oil reserve estimates. With a 2P replacement ratio of 488% (which means the company has added 5 times more oil to its reserves than it has produced) and a total 2P reserve basis of 162 million barrels and a 3P reserve of 241 million barrels, shareholders can definitely be happy with the results. Not only does this increase the reserve life index to 11.5 years based on the 2P reserves and approximately 17 years based on the 3P reserves, the after-tax NPV values are also pretty impressive.

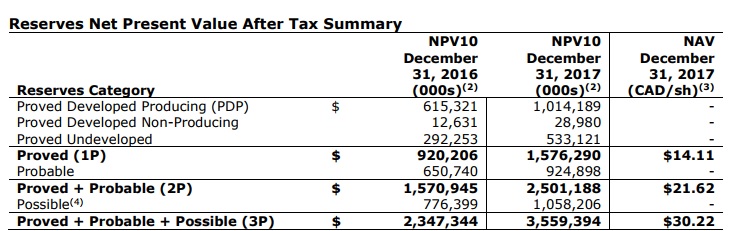

According to the official reserve report, the after-tax NPV10 of the 2P reserves is approximately $2.5B (which represents a NAV/share of C$21.62 if you include the US$160M net working capital position). Should you also add the possible reserves to the equation, the after-tax NPV10 increases by an additional 40% to US$3.56B, or C$30.22 per share. That’s an amazing result, considering the updated report uses lower oil prices compared to last year’s NPV calculations:

So despite using a 10% lower Brent oil price and having produced in excess of 10 million barrels of oil in 2017, Parex Resources was able to increase its 2P NPV10 by US$930M on an after-tax basis, whilst the value of the 3P reserves increased by in excess of US$1.2B. A great result for Parex which is now trading at a substantial discount to its NAV/share despite its strong cash flows and production growth projections.

Go to Parex’ website

The author has a long position in all stocks mentioned in this article. Please read the disclaimer