Polymetal International (POLY.L) has released an updated reserve and resource estimate for its Nezhda project in Russia. The open pit reserves now contain 2 million ounces gold-equivalent at an average grade of 4 g/t, whilst the total resources now contain 8.9 million ounces of gold-equivalent, using an average grade of 5 g/t.

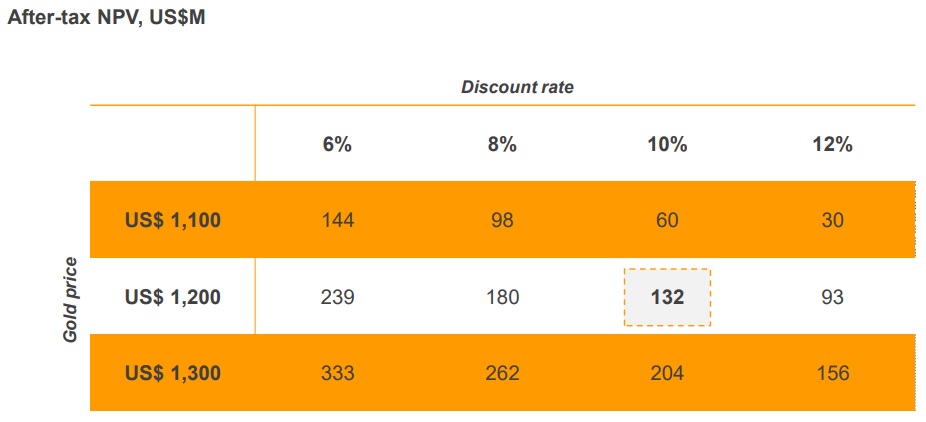

Despite the high average grade, the relatively low initial capex of $249M and the expected AISC of just $650-710/oz, the NPV10% of the project is estimated to be just $132M whilst the internal rate of return will be a very disappointing 20% (based on $1200 god and $16 silver). The NPV will obviously increase as Polymetal will continue to drill Nezhda to convert more resources into reserves, whilst using a lower discount rate than the 10% will obviously also have a large impact on the net present value as the cash flows in Y6 (when the initial capex + cost of capital will be repaid) are discounted by 41%, whilst the cash flow in Y9 is already discounted by 57%. Using an 8% discount rate, the total discount would be more benign at 34% and 49%, resulting in an after-tax NPV8% of $180M at $1200 gold and $262M at $1300 gold.

Go to Polymetal’s website

The author has no position in Polymetal International. Please read the disclaimer