Poseidon Nickel (POS.AX) released the results of the new feasibility study on its Black Swan nickel project in November. The mine plan includes the processing of 5 million tonnes of mill feed for four years, using 3.6 million tonnes of ore from the reserves and 1.4 million tonnes from tailings and existing stockpiles. The average grade of the 5 million tonnes of rock is 0.9% nickel, resulting in a contained nickel content of 43,500 tonnes of nickel. That’s almost 100 million pounds.

The anticipated all-in sustaining cost per produced (and payable) pound of nickel (but before taking smelter deductions into account) is US$4.90 and the mine could be operational for a total initial capex of A$50M, of which about 75% is earmarked for the refurbishment of the Black Swan concentrator.

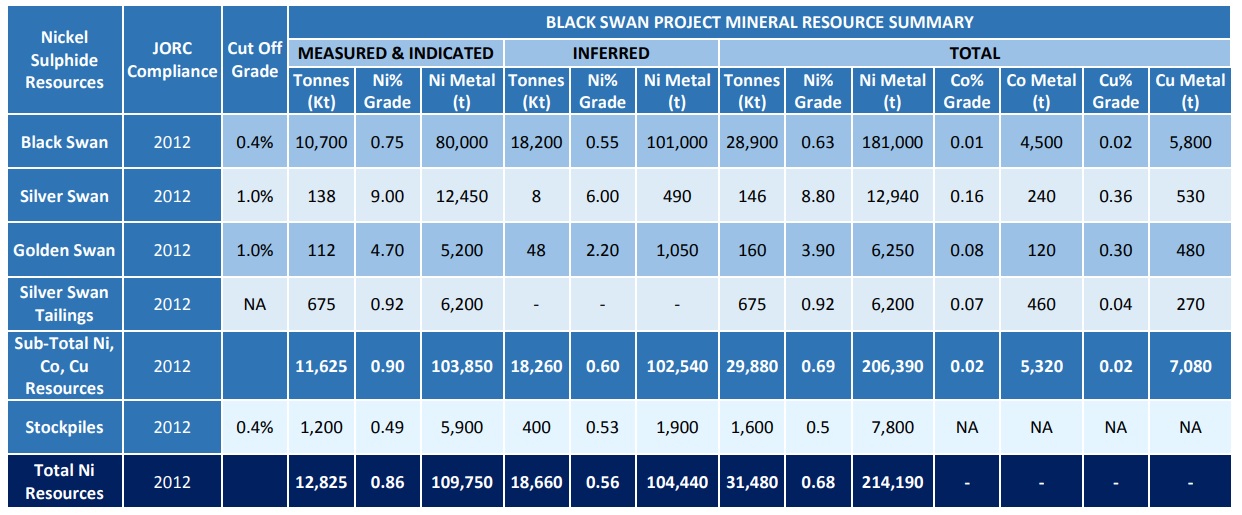

The 1.1 million tonne per annum plan is not set in stone yet: a drill program has started to check if it would be possible to further increase the annual throughput to 2.2 million tonnes of rock. Keep in mind the total resource at Black Swan stans at 31.5 million tonnes of rock at an average grade of 0.68% nickel for a total nickel content of almost 500 million pounds. Poseidon Nickel expects to make a production decision later this year and given the high nickel price right now, the company will likely be leaning towards the 2.2 million tonnes per annum scenario.

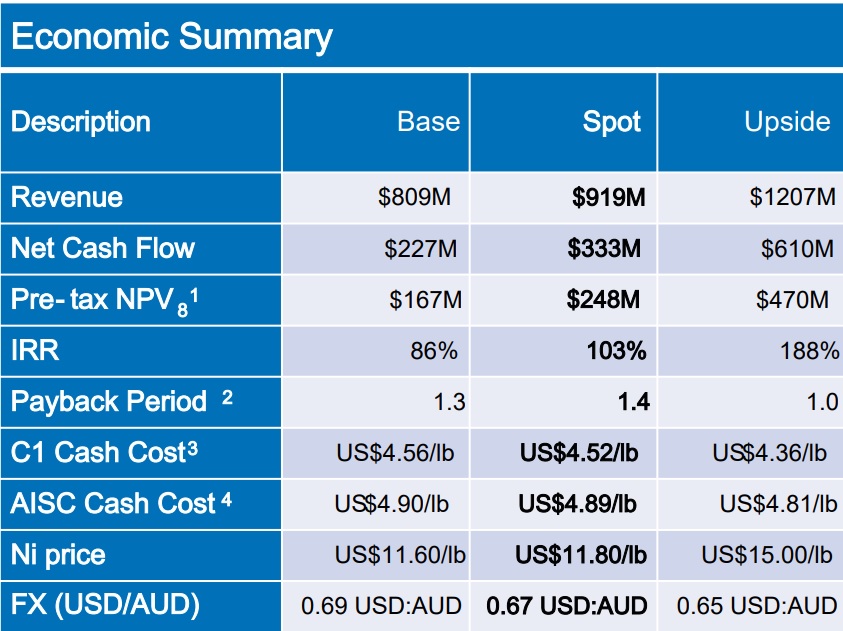

Using a nickel price of $11.6 per pound, the pre-tax NPV8% comes in at A$167M with an IRR of 86%. These numbers will likely still change, depending on the outcome of the new studies and mine plan.

Disclosure: The author has no position in Poseidon Nickel. Please read our disclaimer.