Prime Mining (PRYM.V) announced a C$10M marketed offering after-hours on Friday. The units will be priced at C$0.50 and consist of one share and a full warrant valid for a period of 5 years and with an exercise price of C$1.10.

This financing is conducted at a deep discount to the share price at the Friday closing bell which seems to indicate Prime must have been granted price protection for this financing. A C$0.50 financing was perhaps not entirely unexpected as that was the price Minera Alamos (MAI.V) sold 3M shares at and it probably wouldn’t have gone over well if Prime would have announced a financing at a substantially higher share price shortly after arranging a block at C$0.50.

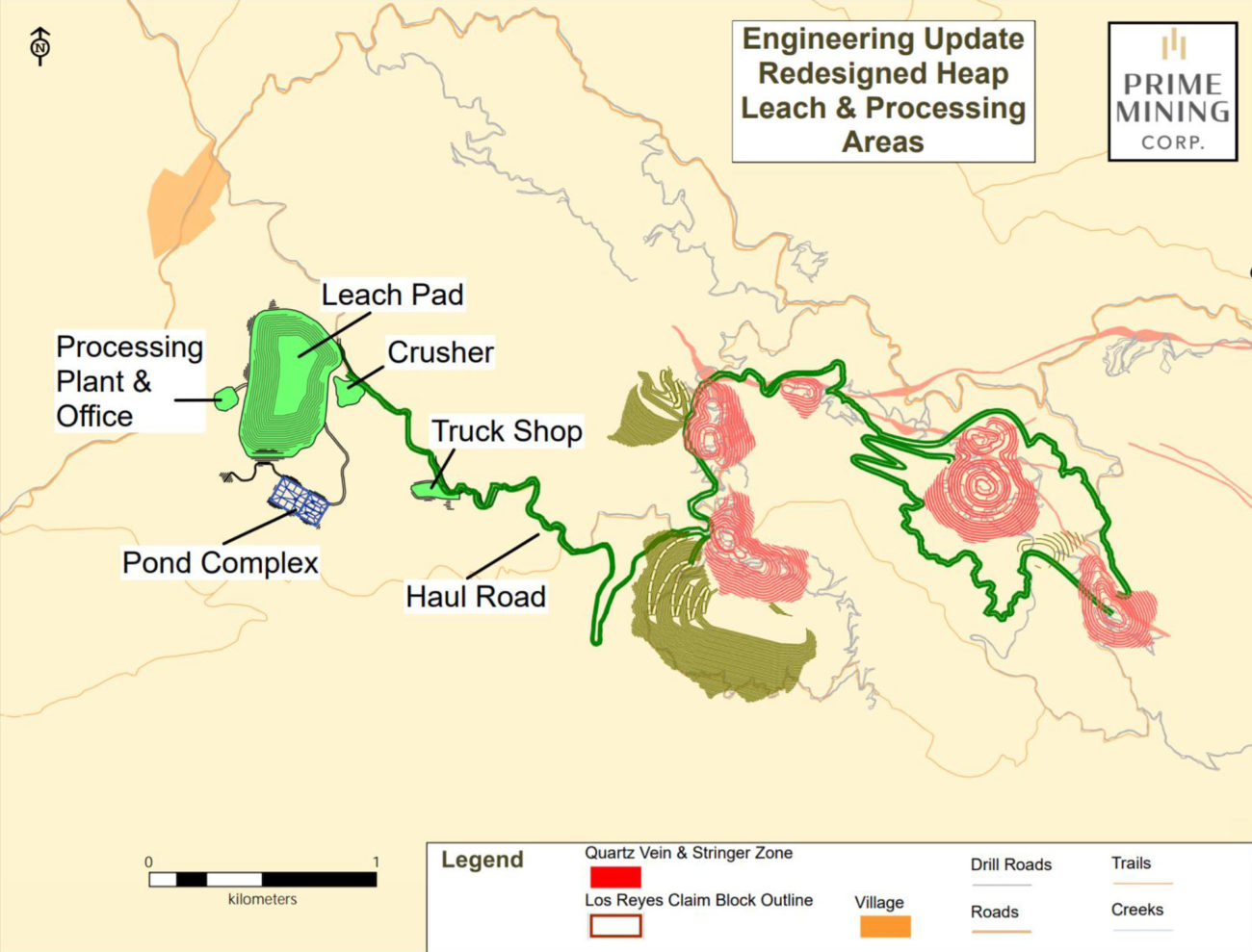

While a financing at the C$0.50 level is a little bit disappointing when the share price is trading above C$0.80 (although the market seems to have reacted well and Prime is trading over C$0.90 right now), there are also positive sides. Prime will fill its treasury with C$10M while we expect the outstanding C$0.50 warrants (19M warrants outstanding as of the end of January) to remain in the money which should ensure a continuous cash inflow from warrant exercises. This means Prime is now fully funded to make the final US$1.5M payment to Vista Gold (VGZ) ahead of schedule and to complete substantial exploration programs at Los Reyes.

There will be some short term pressure on the stock due to this financing, but in the end it very likely means Prime Mining won’t have to raise more money before the summer of 2021. And that’s a good thing as there’s no guarantee the financing window for exploration stage companies will remain open.

Disclosure: The author has a long position in Prime Mining but has recently taken some profits off the table and exercised warrants. Prime Mining is a sponsor of the website.