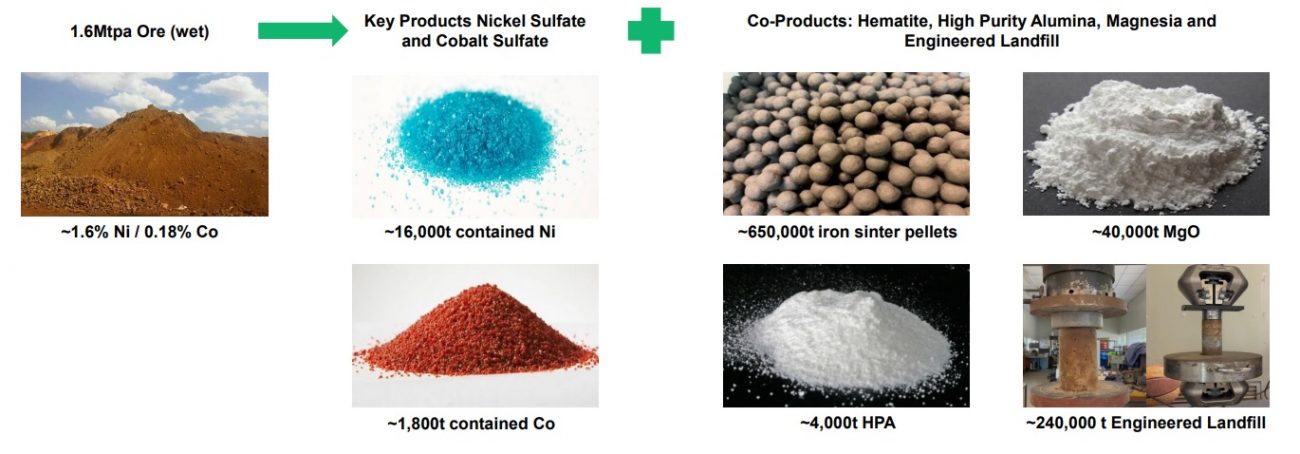

Queensland Pacific Metals (QPM.AX), which signed an offtake agreement with General Motors (GM) in the fourth quarter of last year, has released the results of the feasibility study on its flagship TECH project, a metals processing plant it aims tot build, supplied with feedstock coming from New Caledonia.

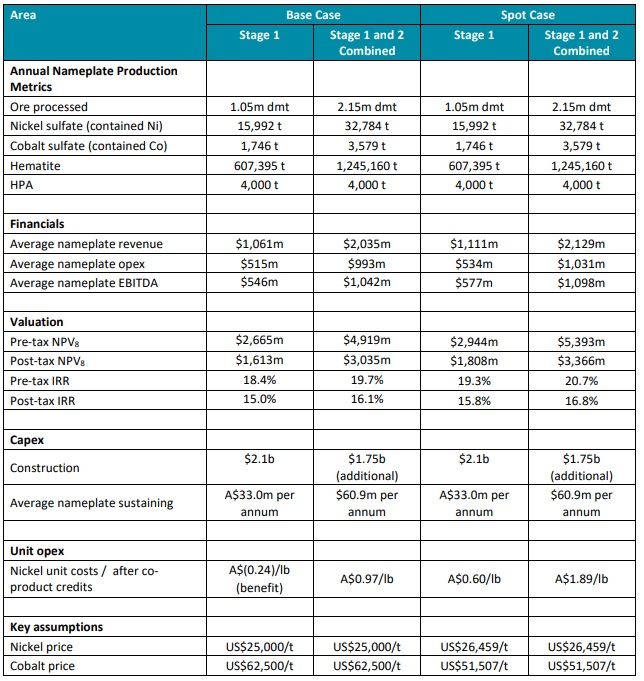

According to the study, the initial nameplate capacity will be 16,000 tonnes of nickel in nickel sulphate and about 1,750 tonnes of copper in copper sulphate. The net production cost for the nickel would be a negative A$0.24 per pound after taking the cobalt revenue and the other by-products into consideration. At a average nickel price of US$22,000/t (US$10 per pound), the anticipated EBITDA is approximately A$506M in the first stage, resulting in an after-tax NPV8% of A$1.35B. Assuming the second phase will be built as well, the after-tax NPV8% increases to A$2.55B. Applying a nickel price of US$12.7 per pound, the after-tax NPV8% increases to A$1.9B for stage 1 and A$3.56B for the two stages. The IRRs remain pretty low due to the hefty initial capex.

Queensland estimates the initial capex for the first stage of the project is approximately A$2B, followed by an additional required investment of A$1.75B to double the production capacity to 32,000 tonnes of nickel in nickel sulphate.

This project will never be a high-IRR project but as it is an industrial project not hindered by a limited mine life, this processing plant could be a valuable link in the supply chain for high quality nickel and cobalt sulphates.

Disclosure: The author has no position in Queensland Pacific Metals. Please read our disclaimer.