Red Eagle Mining (RD.V) has announced the outcome of its feasibility study, and the result is much better than we anticipated. First of all, the initial capital expenditures decreased from $91M in the PEA to just $74M in the feasibility study. Additionally, the sustaining capital expenditures decreased sharply from $51M to $33M. This obviously has a direct impact on the all-in sustaining production cost per ounce of gold which decreased by almost 10% from $818/oz to just $754/oz.

Investors might be surprised that according to the feasibility study only 388,000 ounces of gold will be recovered, compared to the 514,000 ounces in the PEA, but we consider this merely to be a technicality, as the consultants who compiled the feasibility study aren’t allowed to use inferred resources in the proposed mine plan. So it’s not like 125,000 ounces of gold have simply disappeared, the gold is still there but will need to be upgraded before it can be added into the mine plan. The resources used in this feasibility study are a starting point, and we are very confident the mine life will be extended and we wouldn’t even be surprised if the company would decide to increase its mill throughput in a later stage.

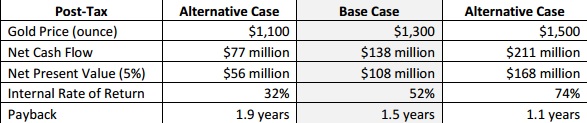

The after-tax NPV5% using a gold price of $1300/oz is approximately $108M with an IRR of 52% which is just great. As the company’s payback period is just 1.5 years, Red Eagle should have absolutely no difficulties to raise the funds needed for the construction of the San Ramon project. We were a bit surprised to see the share price remain stable after this excellent news, but Red Eagle is getting all of its ducks in a row. Most permits have been received and there’s only one more permit which needs to be signed off on, and we expect the final approval by the end of this year or early in Q1 2015, where after the construction of the project can commence immediately.

> Click here to read the press release

Disclosure: The author holds a long position in Red Eagle Mining. Please see our disclaimer for current positions.