It has been a while since Almonty Industries (AII.TO) started the financing process to secure debt funding for its massive Sangdong tungsten project in South Korea. After almost 3.5 years of talking, discussing and negotiating with the KfW Ipex bank and Austria’s export credit agency – which both completed rigourous checks during their due diligence process, the company has now finally signed a binding term sheet granting Almonty access to very cheap debt to fund the construction of the Sangdong project.

Over the past several years, Almonty has diligently worked towards securing the best possible outcome for its shareholders. Almost half of the tungsten will be sold into an offtake agreement with the Plansee Group which has guaranteed Almonty a minimum floor price for its tungsten concentrate. The project is now substantially derisked and on its way to regain the status as largest tungsten mine in the world.

Tungsten: a critical metal

Tungsten isn’t exactly one of the best-known metals, so it’s perhaps a good idea to provide a brief overview of the applications for tungsten, the tungsten market, and why it’s an important element for both western and eastern countries.

Tungsten rock gets processed into a variety of end-products, of which ferrotungsten, APT and tungsten concentrate are the best-known variants. Both of the latter could then be used for alloys, carbides and metal, to improve the qualities of the metals they are being blended with. The most important use of all aforementioned applications would be the use of tungsten carbide which hardens a material to ensure it’s possible to drill or press steel. As it’s also used to protect military equipment, the range of applications is enormous. It’s not surprising to see 60% of all tungsten used in the United States is going to those carbide-based applications.

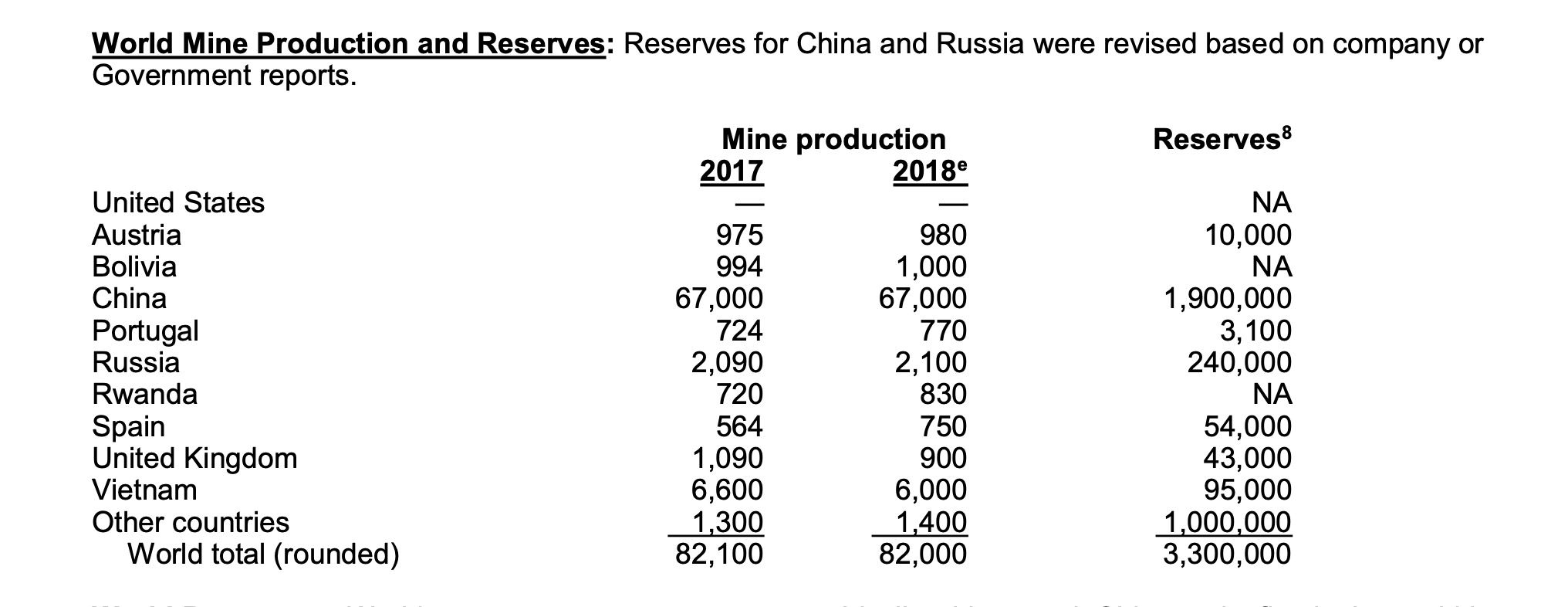

It’s an important metal for numerous industries. But there’s one big issue: supply chain risk. Looking at the 2018 production numbers assembled by the United States Geological Survey (the 2019 numbers aren’t out yet), the total mine production was 82,000 tonnes. China took care of the bulk of this number, as in excess of 81% (!) of the world’s tungsten supply is coming from China. Throw in an additional 2,100 tonnes (2.6%) from Russia, 1,000 tonnes (1.1%) from Bolivia and a few hundred tonnes from Rwanda, Mongolia and other second-tier countries, and you soon realize approximately 90% of the world supply on the tungsten market is coming from countries that don’t have to do the western world any favors.

Those western countries realized the potential risks to see a disruption on the tungsten supply side, and the European Union reacted by putting tungsten on the list of ‘critical raw elements’ with a substantial supply risk. As you can see in the next image, tungsten scores really high on the list of ‘economic importance and is a metal with a relatively high supply risk.

And just a quick note on the price-setting mechanism for tungsten: although benchmark prices are expressed in mtu (one metric tonne unit is 10 kilograms), it’s important to realize these usually are the prices for APT (Ammonium Para-Tungsten), a ‘finished product’. What’s really interesting is that the concentrate producers (like Almonty) which are producing a WO3 concentrate are paid based on the APT price, but at a 19-23% discount (Almonty applies a concentrate price which is 78% of the APT benchmark price). Just to explain this clearer: if the APT price is $300/mtu, concentrate producers will receive just $234 per mtu of concentrate. At the current APT price of $240/mtu, the concentrate price is approximately $187/mtu.

The final missing piece of the puzzle has been found: dirt-cheap financing

Blood, sweat and tears. That is probably the best way to describe the lengthy process in the past 3.5 years wherein Almonty was able to convince both the KfW Ipex bank and the Austrian Credit Agency the Sangdong mine makes sense from an economic and environmental point of view. The financial institutions engaged Hatch to leave no proverbial stone unturned and every single piece of the feasibility study was checked and double-checked as these national institutions obviously would like to avoid egg on their faces in case something would go wrong.

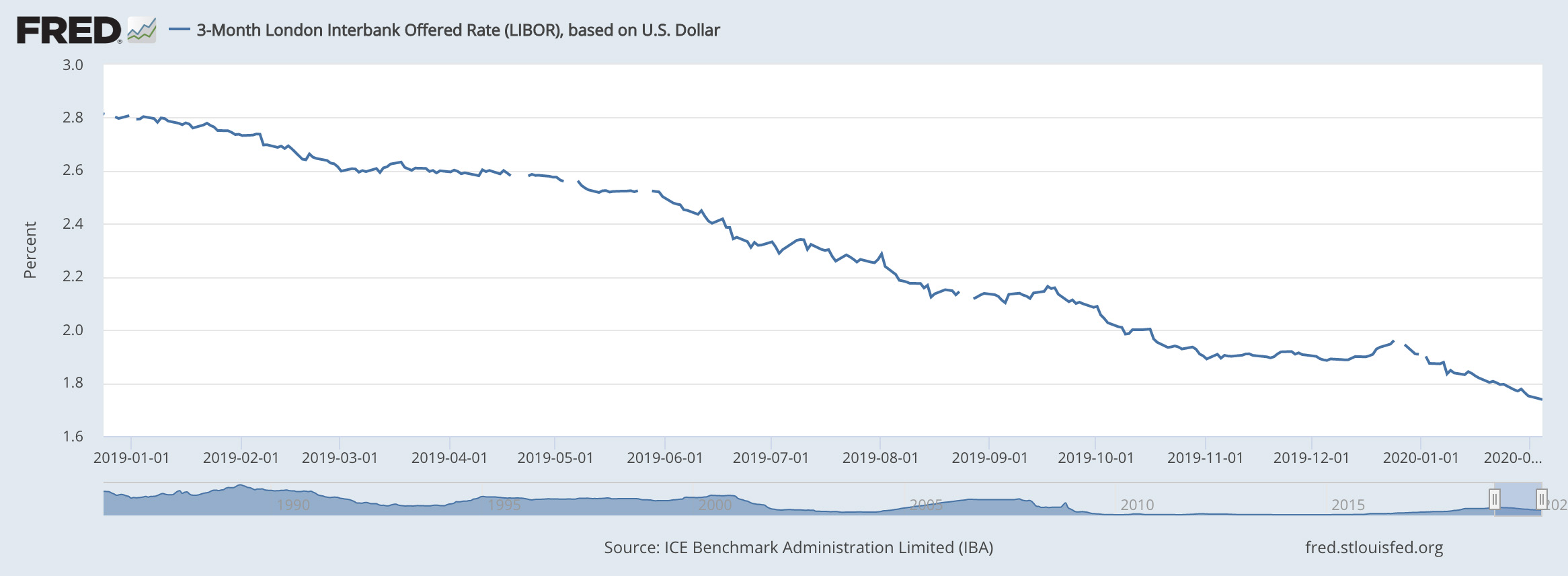

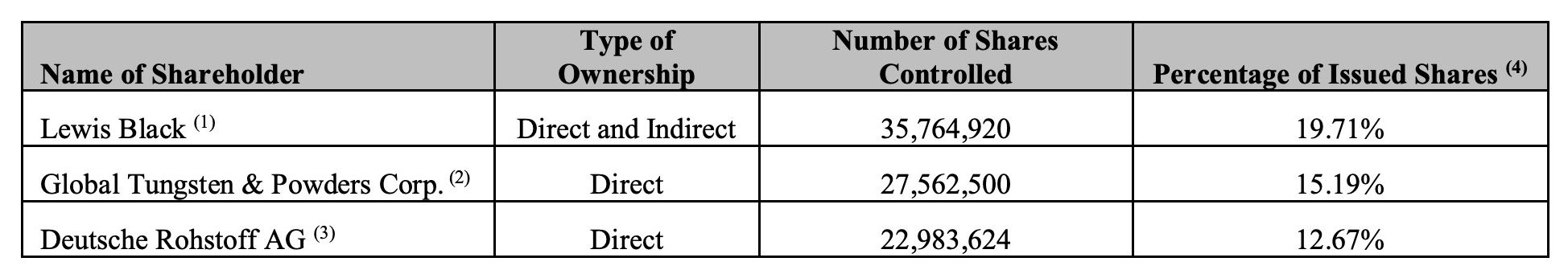

But the juice was worth the squeeze. In the end, Almonty Industries secured an extremely advantageous financing package with a cost of debt that’s jaw-droppingly low. The US$76M loan will be made available based on a variable interest rate consisting of the 3 month LIBOR rate and a mark-up of 2.5%. Considering the LIBOR rate is currently just around 1.75%, the effective cost of financing is just 4.25% which is already low, but CEO Lewis Black appears to be quite confident he can reduce the interest rate even further. He is motivated to do so as the largest shareholder, owning almost 20% of Almonty’s shares.

Could Almonty have secured funding for Sangdong sooner? Sure. But what’s the point of paying 8-12% on debt provided by private equity funds if you can get it much cheaper? Certainly, the time value of making decisions is important but using a straight line repayment over 6 years, a $76M facility would have been US$12M more expensive over that six-year repayment period. And we obviously would like to see money ending up in the pockets of Almonty shareholders instead of in bankers/private equity pockets. At the current USD/CAD exchange rate, the C$16M equals almost C$0.09/share in value-added to the Almonty share price.

Not only will Almonty save close to US$15M in interest expenses (assuming CEO Black is correct about his assumption he can further reduce the cost of debt) over that same six year period, the simple fact two respected financial institutions have signed off on the development plans of Sangdong is incredibly important as a third-party validation for Almonty’s approach, mine plan, and expected economics.

And although the debt is cheap, there don’t appear to be any penalties for early repayment of the debt. Depending on how the 3 month LIBOR interest rate will evolve over time, Almonty could easily decide to accelerate the repayment of the debt if it wants to considering there are no repercussions at all. And should the LIBOR remain at its current 2-year low (or drop even further), we can imagine the KfW bank would be glad to extend the maturity date of the loan to keep the money invested.

The economics should be superior, even at the current tungsten price

Most mining companies encounter some negative surprises when they move from a PEA stage to feasibility and subsequently the production stage: it’s very rare to see the production costs and capital expenditures effectively come in line with the expectations.

Almonty tried to eliminate this risk by entering into a fixed-price construction contract to POSCO E&C which is a subsidiary of the POSCO conglomerate, a very credible and well-respected company. So on the capex-level, we are quite certain the construction of Sangdong will come in at or below estimates.

What was perhaps more interesting to see was that the banks (!) claimed Almonty was too conservative. In its previous economic studies and its internal scenarios, Almonty used a production cost of $125 per mtu in the concentrate which typically has a grade of 65% WO3. Much to our surprise, the banks (which tend to be more conservative than the mining companies pitching them) have revised the expected cash cost down to just $106/mtu. With the current concentrate price trading at approximately $185/mtu, the operating margin could thus easily increase from $60/mtu to $77/mtu, an increase of in excess of 25%.

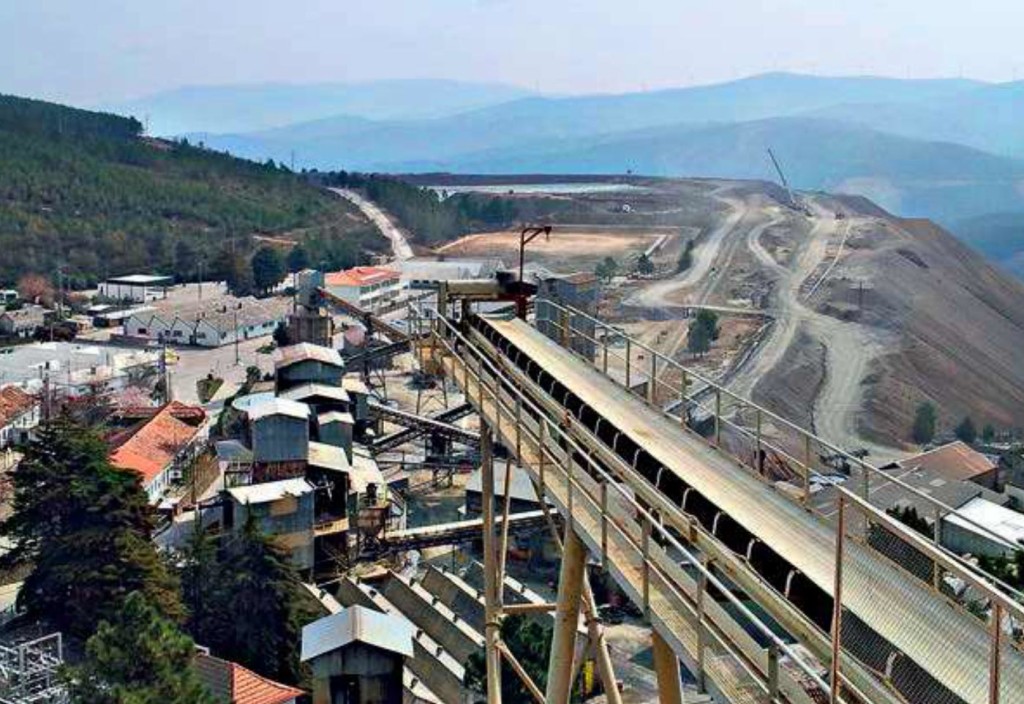

So on the operating and construction cost side, we don’t really expect any negative surprises, especially considering this essentially is a brownfields asset.

On the revenue-side, it’s important to emphasize the offtake agreement Almonty recently signed with Plansee. Plansee has committed to acquiring the entire initial production which is 45% of the design output capacity of the mine. The concentrate will have a floor price of US$183/mtu, which is approximately the current spot price. So there clearly is some downside protection on the revenue side as well.

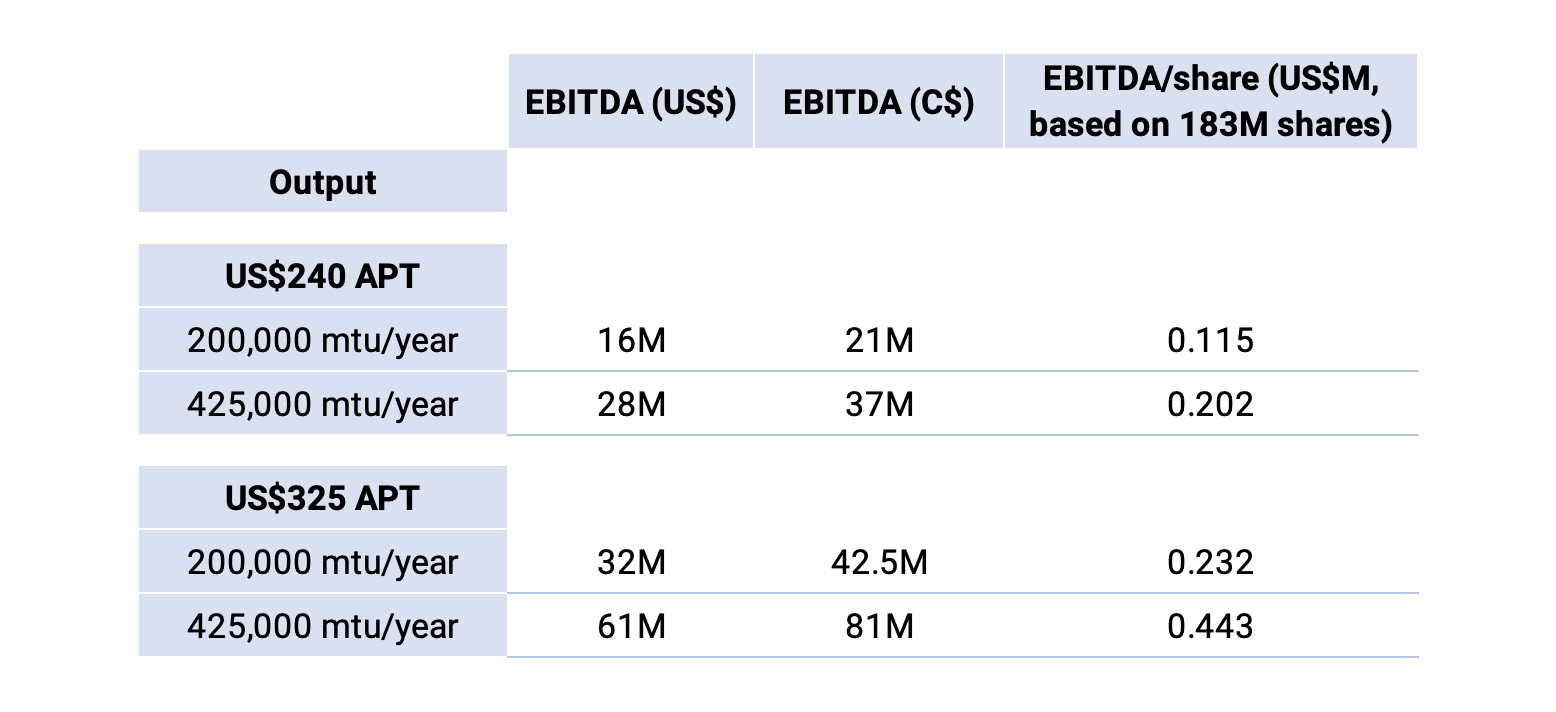

At a production rate of 210,000 mtu per year, the EBITDA will be around US$16M per year. Should Almonty indeed be able to increase its production rate to 425,000 mtu per year (see later), we are talking about an EBITDA of US$35M (or roughly C$50M) per year

Potential value-add initiatives

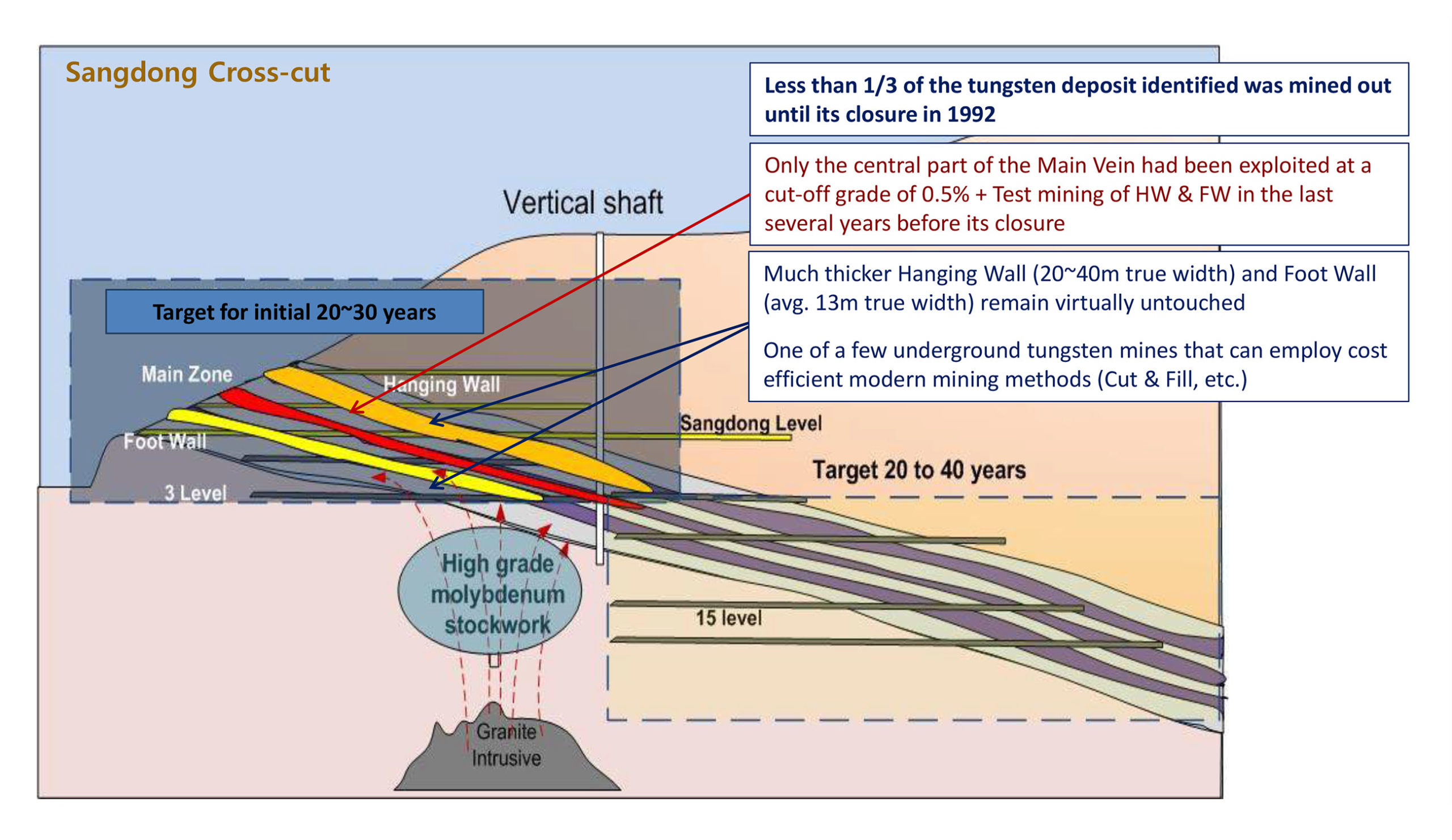

Indeed, the currently planned 600-650,000 tonne per year production scenario is just the first step to get the Sangdong Mine going again. We expect the demand for tungsten concentrate produced in a safe country like South Korea to be high and wouldn’t be surprised to see Almonty executing on its plans to boost the throughput to 1.2 million tonnes per year within the first 18 months after reaching commercial production.

That’s just one example of a potential initiative to add value. Not only will Almonty unlock economies of scale on the processing front (for instance, the salaries of the processing plant staff can now be spread out over a higher tonnage), increasing the throughput and mine production will allow Almonty to optimize its blending of ore before it goes into the mill. Additionally, the mine dilution percentage should decrease and preliminary indications point towards a production rate of 400,000-450,000 mtu in concentrate using a throughput rate of 1.2 million tonnes per year. And if the banks are estimating the Phase I production cost to be $106/mtu, it wouldn’t be too unrealistic to aim for a sub-$100/mtu production cost in the 1.2M tpa scenario. But of course, Almonty will only make the decision to expand on the current production scenario once the Sangdong mine is up and running.

And should Almonty be looking into a potential expansion scenario, it’s not entirely unthinkable the company will have a serious look at producing value-add tungsten products like ferro-tungsten (which currently sells for around $32/kilo – roughly $320 per mtu-equivalent which is a 65% premium over the current concentrate price). Discussions with Almonty’s management indicated the additional equipment to upgrade the concentrate to a ferro-tungsten product would cost a high single-digit or low double-digit amount making it worthwile to explore this option.

Even if Almonty would only produce 1,000 tonnes of ferrotungsten per year (in several batches throughout the year – the upgrade plant wouldn’t even have to be running 24/7), we estimate it would generate an additional US$10M in EBITDA – but that remains to be confirmed in additional studies.

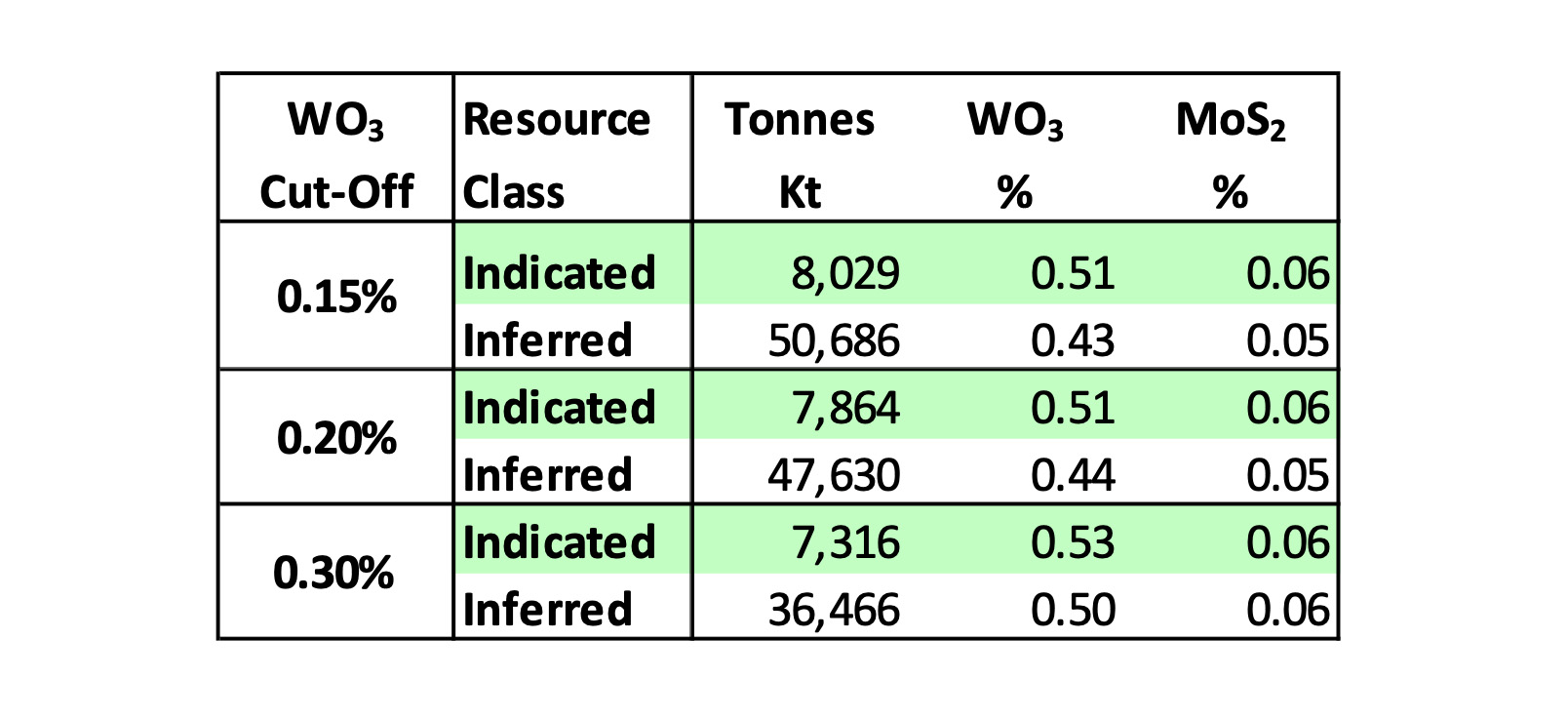

And finally, although the current reserves ‘only’ suffice for a 12-year mine life as the NI43-101 compliant resource estimate contains 7.9 million tonnes of rock in the reserve categories, there is an additional 50+ million tonnes at an average grade of 0.43% WO3. At the initial throughput of 640,000 tonnes per year this should be sufficient for an additional 80 (!) years – assuming all inferred resources can be converted into mineable reserves. But even if we would assume a conversion rate of 60% (31 million tonnes) and an increased throughput of 1.2 Million tonnes per year, the mine life would be an additional 25 years on top of the current 12.5 years based on the reserves.

As soon as the Sangdong mine is cash flow positive, Almonty should earmark a few million dollars per year to convert inferred resources into measured & indicated resources to get it into the official mine plan. This will allow the company to front-run any depletion (converting 1 million tonnes per year from inferred to M&I would more than offset the initial depletion rate of 640,000 tonnes per year) and could be very helpful to strike a new refinancing deal with the current lenders by for instance updating the repayment schedule to reflect the increased mine life.

The cash flow potential

At the initial production rate of just over 210,000 mtu/year Sangdong will generate a nice (but not overly impressive) EBITDA of around US$16M per year. This is based on just the hard floor price. If the tungsten price would increase to US$325/mtu, the EBITDA will increase to US$28M per year. Note, we will be using 200,000 mtu/year in our base case scenario, just to be conservative.

Should Almonty pull the trigger on increasing the production rate to 425,000 mtu/year (using a 1.2M tpa throughput in the expanded scenario), the mine would generate an EBITDA of US$32M per year at the current tungsten price, and an EBITDA of $61M at $325/mtu APT. In the next table, we have summarized these results and provided a conversion into CAD and C$ per share (this will change subject to the future share count).

Of course, this is just a back of the envelope calculation of how important Sangdong will be for Almonty’s future. The proof will be in the pudding and the initial free cash flow will be lower than the EBITDA (as there will be some sustaining capex and the initial interest payments will cost the company approximately US$3M per year). But the EBITDA to FCF conversion rate should be quite high in the first decade or so, as Almonty has issued intercompany loans to its South Korean subsidiary which means the initial tax payments in South Korea will be very low.

The current enterprise value of Almonty (based on a C$0.58 share price is C$109M market cap + C$47M net debt = C$156M. Adding C$100M in net debt (upon drawing down the Sangdong financing facility would increase the enterprise value to around C$255M, but this should then subsequently decrease fast once the Sangdong cash flow hits the balance sheet.

This means the upside potential is quite interesting. Even if the tungsten price doesn’t move, Almonty will be trading at just 7 times its EBITDA (and this is just the Sangdong EBITDA. The Panasqueira and Valtreixal EBITDA are bonus) assuming the company will execute on its expansion plans and boost the throughput to 1.2 million tonnes per year.

But should we see another improvement in the tungsten sector with prices going higher than US$325/mtu for APT, the EV/EBITDA ratio would be just 3 (again, this just includes Sangdong and completely ignores the contribution from the other mines and the potential to produce ferro-tungsten). In the optimistic scenario of 425,000 mtu/year at an APT price of US$325/mtu, the free cash flow from Sangdong will very likely be around C$60-65M per year as long as Almonty can repatriate the cash under the intercompany loan structure, and probably around C$50-53M including the standard 25% corporate tax rate in South Korea.

Again, these are preliminary back of the envelope calculations and the proof will be in the pudding. But any slight bump in the tungsten price will catapult Almonty’s EBITDA and free cash flow exponentially higher.

The other assets of Almonty Industries

Although Sangdong clearly is the company’s flagship asset, it’s perhaps important to emphasize Almonty Industries isn’t a one-trick pony. It has a producing asset in Portugal while the Los Santos mine in Spain is currently processing stockpiles to keep the equipment up and running before Almonty moves the processing plant to its Valtreixal tungsten project in Spain. We will keep this section of the report relatively short as Sangdong is what really matters now.

Panasqueira isn’t just a tungsten mine in Portugal, as it’s the main project that made Primary Metals big (Primary Metals was a tungsten-focused company that several members of Almonty’s team helped to build up including Lewis Black who was the CEO, President and Chairman of PMI too). That company listed on the TSX Venture Exchange at C$0.15 but was sold to Sojitz for C$3.65 after drilling out the Panasqueira project, and making it appealing enough for a suitor. Primary Metals wasn’t the first company to detect tungsten at this location, as the district has been known for its tungsten occurrences (and production) since 1896.

The project has been switched hands several times, and is now owned again by Almonty Industries, which owns 100% of the property. Panasqueira is located pretty much right in between major cities Porto and Lisbon in the Serra da Estrela mountain range. The total size of the concession is almost 2,000 hectares, and could easily be reached by the excellent road infrastructure. A nicely paved highway takes you to approximately 40 kilometers from the property where after normal secondary (but paved) roads pretty much take you all the way up to the mine gate. The Panasqueira mine is currently hooked up to the electrical power network, and Almonty is paying just 0.05EUR/kWh for its energy needs.

Not only is the power price relatively low (for European standards), the Panasqueira mine doesn’t need as much power as comparable projects: there’s no need to grind the ore whilst there also is a high level of ‘natural’ ventilation in the underground mine.

Contrary to what you might think, it’s not necessary to have a very high tungsten grade to be a successful underground mine. The average grade of the resources (including reserves) at Panasqueira is just 0.23%, and Almonty Industries has been able to make that work as the quartz veins are a ‘pleasure’ to work on: there’s very little ‘support’ needed to ensure the safety of the stopes.

The tungsten concentrate from Panasqueira is highly sought after, as even the official technical report calls it ‘a very high-grade concentrate, almost pure wolframite’. The process is pretty straightforward: crushing, screening and sand tables are pretty much the only elements needed to get from ‘run of mine’ ore to a high-grade concentrate. This concentrate is currently being sold at a substantial premium above the current spot price of $187/t for tungsten concentrate to their buyers.

The resources at Valtreixal are pretty small: the previously filed technical report discussed a 2.55 million tonne reserve. The average grade isn’t particularly high (0.25% WO3 and 0.12% tin), but what’s really interesting is the existence of a large inferred resource (15 Mt at a lower WO3 grade, but a stable tin-grade) and the fact that this deposit could be amenable to a simple gravity method (as long as the rock gets crushed to a size smaller than 1 millimeter). According to the study (which was completed on a PFS-level), the recovery of the tungsten is expected to be 55% whilst 65% of the tin will be recovered.

Just like all other projects in Almonty’s portfolio, Valtreixal isn’t a ‘new’ project, and although legend has it the Romans were mining there, the first clear evidence of mining goes back to 1883 (open pit) and 1920 (underground).

The potential start-up date of the Valtreixal project coincides with the potential end of the open-pit mine life at Los Santos. It’s not unlikely Almonty will be able to move equipment and plant (and some parts of its labor force) to Valtreixal, which would drastically reduce the initial capex. We expect Almonty to make some decisions and putting a timeline together for the development of Valtreixal within the next 12 months.

Conclusion

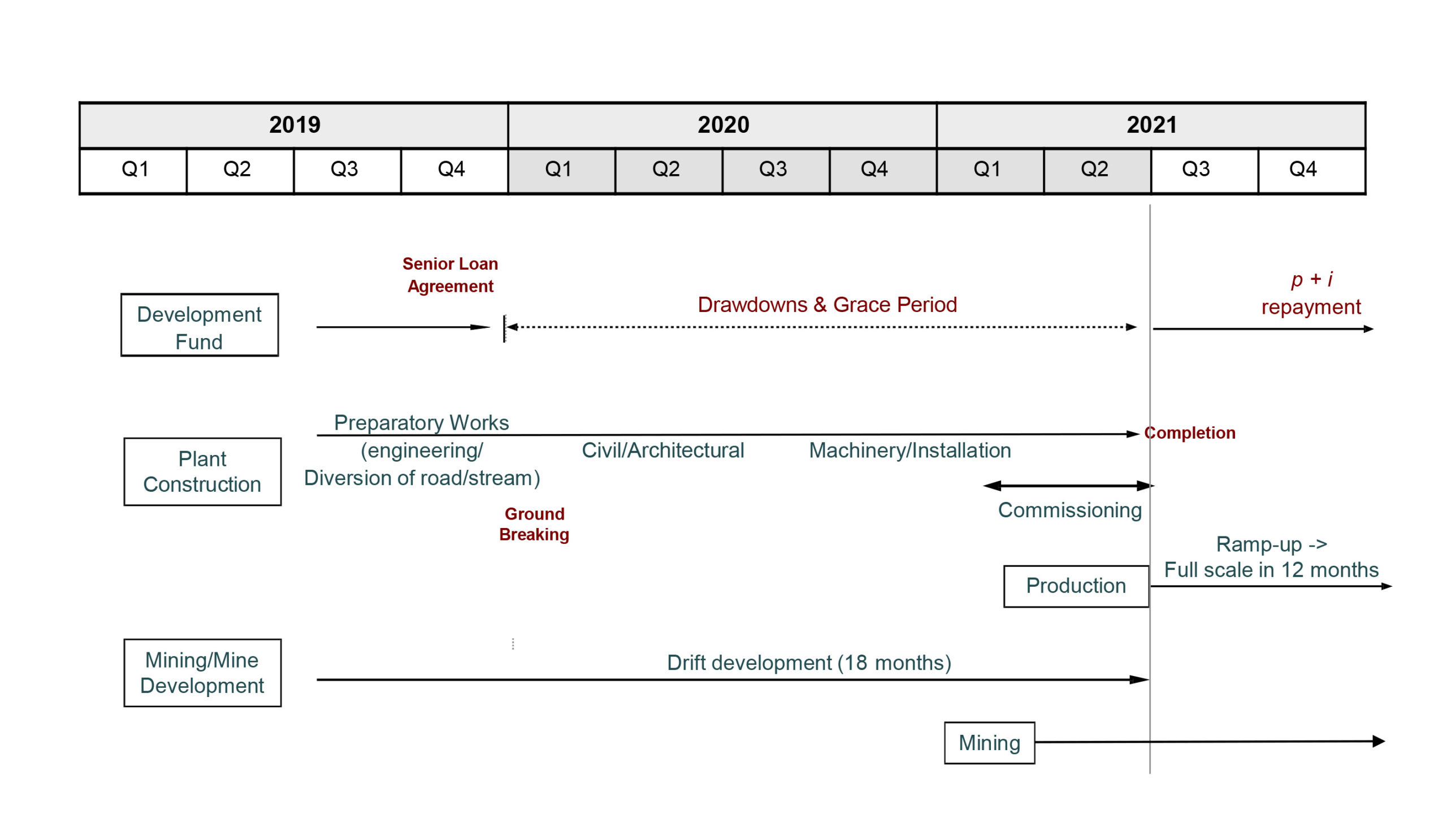

It took Almonty about 3.5 years but it now finally has a binding agreement to fund the Sangdong tungsten mine in South Korea. Expect all documents to be signed by the end of the first quarter where after Almonty will hit the ground running with first concentrate production to be expected in the summer of 2021 with commercial production shortly thereafter (we are aiming for commercial production in Q4 2021). Once the cash flow is coming in, we expect Almonty to simultaneously investigate the expansion of the Sangdong Mine to 425,000 mtu/year (for an EBITDA of around US$30M per year using an operating margin of US$75/mtu based on a current APT price of $240/mtu) while going ahead with the development of the Valtreixal mine in Spain where the equipment (and human capital) of Los Santos will be put to good use.

The leverage to the tungsten price is enormous. The Sangdong mine alone will see its EBITDA more than double upon a 35% tungsten price increase (irrelevant of the 200k mtu or 425k mtu production rate). Sangdong will generate a decent amount of free cash flow at the current (relatively low) tungsten price and initial throughput, but the free cash flow result could be catapulted into the stratosphere using a higher tungsten price and upon completing its expansion plans.

Now it’s up to Almonty’s management team to execute on its plans and continue to kick the can of the existing debt further down the road until the Sangdong cash flows could be used to gradually decrease the net debt. CEO Lewis Black owns almost 20% of the shares so his interests are aligned with the interests of smaller shareholders. Although his cash compensation (C$433,000 in FY 2018 including a C$128,000 bonus) is relatively high, he clearly stands to lose/gain more from his equity position which has a current value of in excess of C$20M. Also, keep in mind he invested in excess of C$6M of his cash in Almonty in the 2018 capital raise, putting his money where his mouth is.

Disclosure: Almonty is not a direct sponsor of the website, but a third party has entered into a short-term sponsorship. The author has initiated a long position in Almonty Industries last week.