Avrupa Minerals (AVU.V) has been silent for a very long period. Initially, because the company was still trying to close a previously announced joint venture agreement with a ‘large North American mining company’ which was interested in working on the company’s three main projects while providing roughly C$20M in exploration expenditures to earn a majority stake.

This fell through, and Avrupa started to search for a new joint venture partner, which has now been found and announced.

No longer ‘waiting for Godot’: a new joint venture agreement on Alvalade

After going back and forth for a few months (the summer holidays weren’t particularly helpful), Avrupa Minerals has now finally entered the final negotiation stages of a new joint venture agreement after it signed a Letter of Intent with Minas de Aguas Teñidas (MATSA), a privately-owned Spanish company which produces copper from three existing mines on the Spanish side of the Iberian Pyrite Belt. MATSA actually is a joint venture between Trafigura and Mubadala Investment Company which manages Abu Dhabi money.

Initially, MATSA will be allowed to earn a 51% stake in a new holding company that will be created which will solely own the Alvalade VMS asset. MATSA is required to make an initial 400,000 EUR payment to Avrupa Minerals (which will give Avrupa some room to breathe – see later), while it will also have to deposit the 240,000 EUR work commitment guarantee to the Portuguese government. Additionally, MATSA will be required to spend at least 1.2M EUR in exploration in the first year of the agreement, followed by the requirement to spend a second tranche of 1.2M EUR in years 2-3.

Ideally, MATSA will need the entire three years to complete its earn-in agreement, as Avrupa will be paid an operator fee of 100,000 EUR per year.

Once the initial 51% stake has been established by MATSA, the company can further increase its ownership to 85% by completing a bankable feasibility study on at least one zone within the Alvalade project license and making all relevant payments to Antofagasta as MATSA will subrogate Avrupa’s previous commitments.

Once the 85/15 joint venture is established, Avrupa will have the option to either contribute pro-rata to its 15% stake, or sell its interest to MATSA for 10M EUR. But let’s cross that bridge when we get there, as this choice is still at least 5 years out.

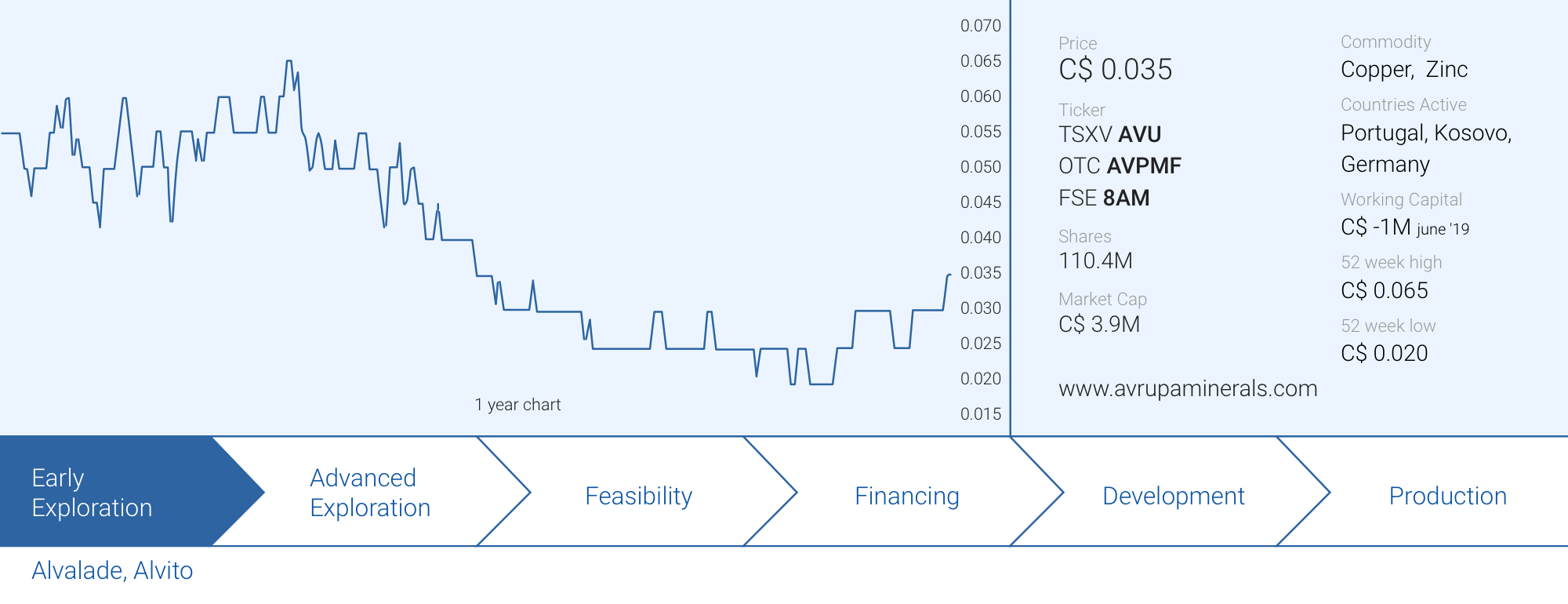

While we are generally positive about finding a new joint venture partner as this means Avrupa can continue to work on defining a resource at Alvalade, the earn-in terms are clearly not as favorable as the proposed earn-in schedule that was announced in 2018 (which also required the previously intended optionor to complete a feasibility study, but would end up with just 75% of the property, compared to 85% for MATSA now). However, Avrupa didn’t have a choice as its share price was too low to try to raise the money themselves: not only is the appetite for early-stage copper exploration quite low, raising the C$3.5M (2.4M EUR) MATSA is required to spend would have more than doubled the current 110M share count.

Avrupa Minerals didn’t have many options left on the table (except for a rollback and a 100% dilution). Something is still better than nothing and by teaming up with a company that lives, breathes and understands the Pyrite Belt, we hope the additional technical expertise that MATSA will bring to the table will speed up the exploration process at Alvalade.

The upcoming exploration plans

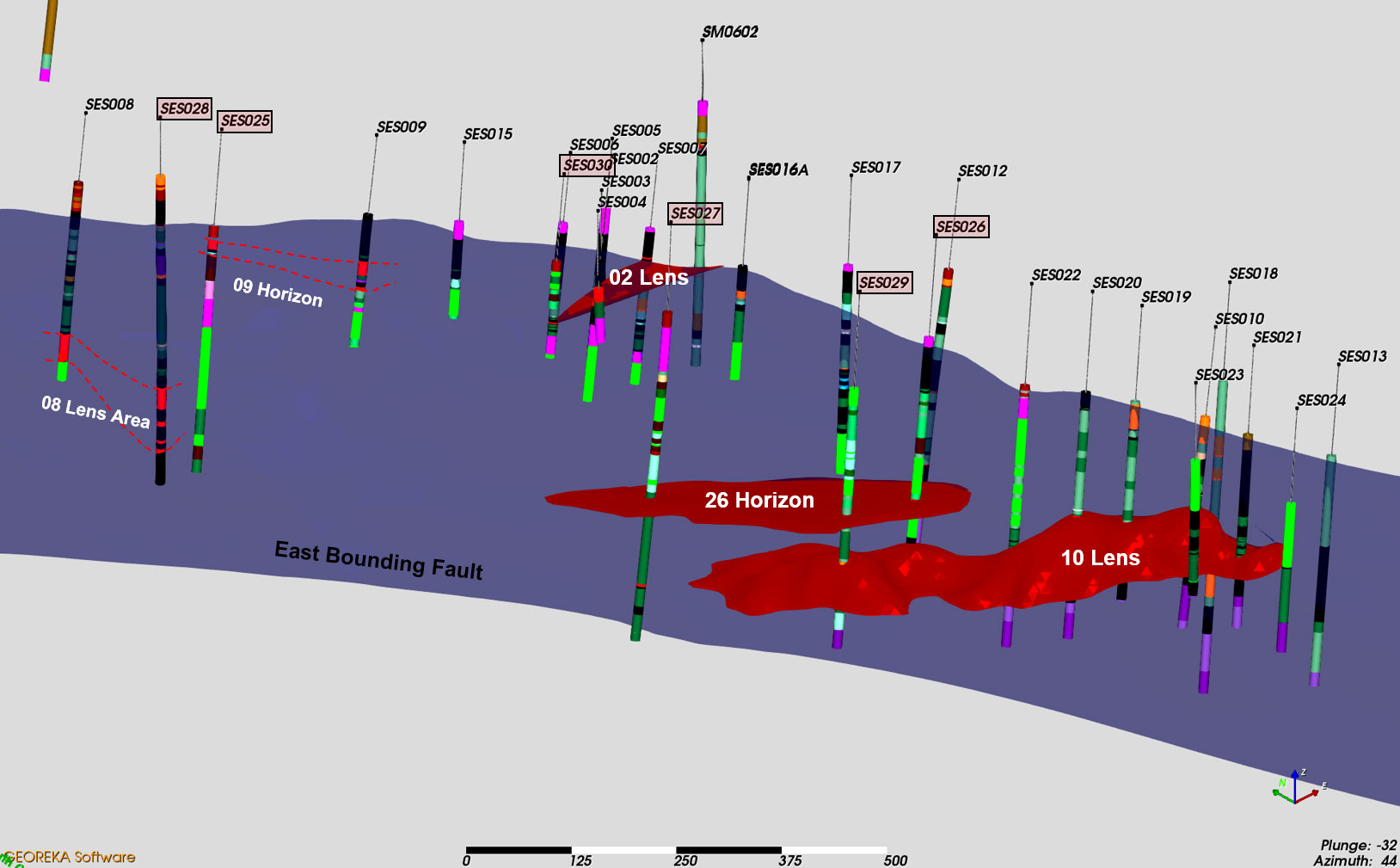

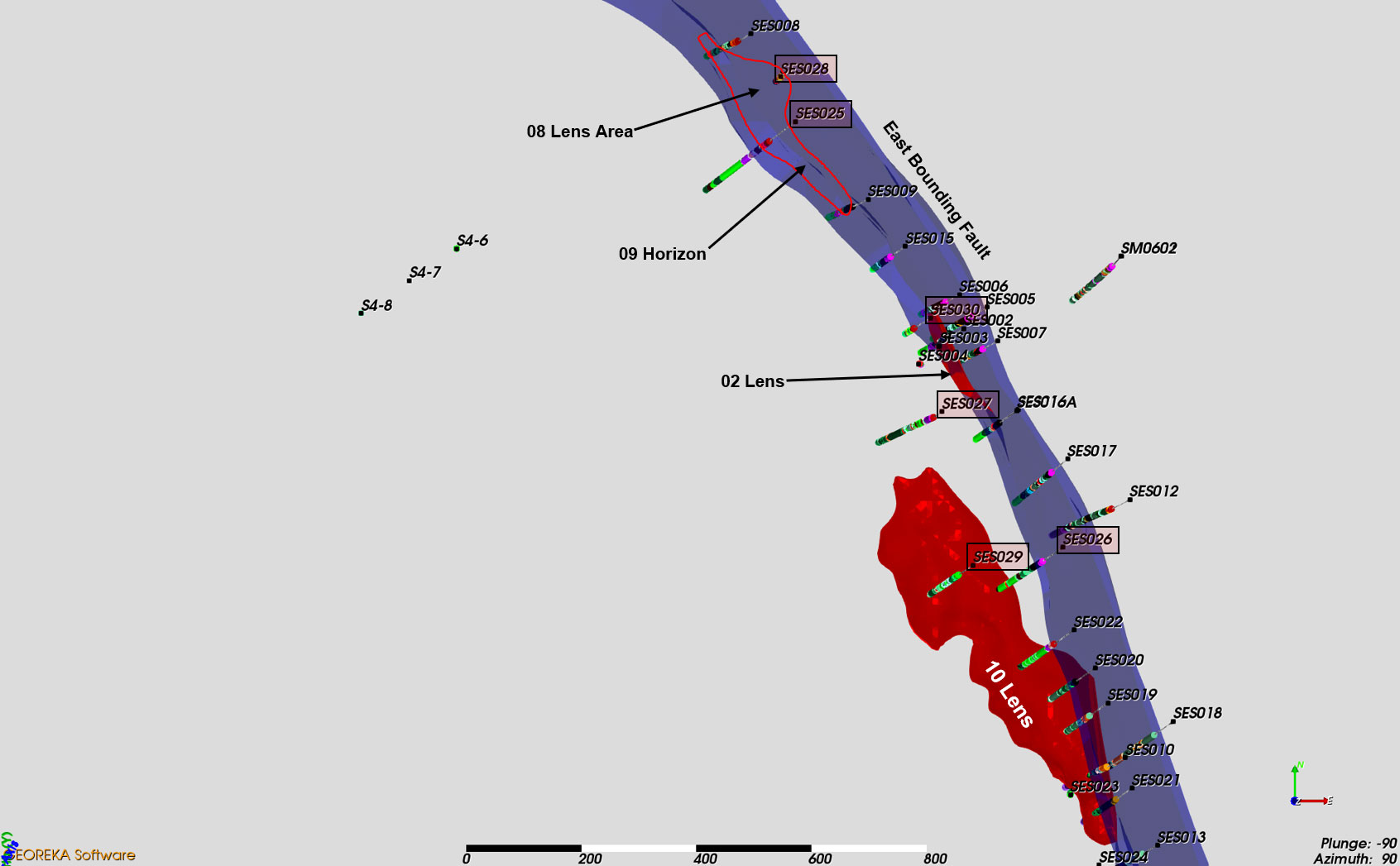

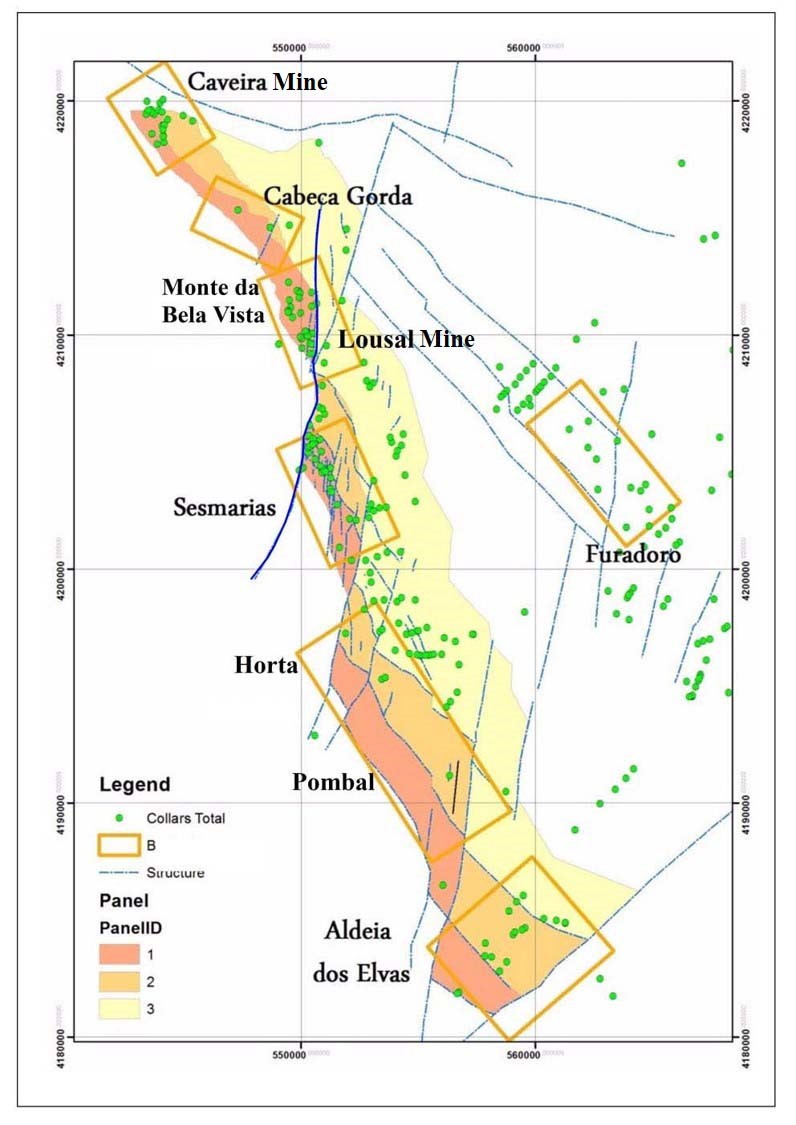

MATSA has three years to complete the initial earn-in phase to earn a 51% stake in the Alvalade VMS project. The low-hanging fruit will undoubtedly be the Sesmarias zone where the 10 Lens could be a very appealing target.

In a drill update earlier this year confirmed it encountered more mineralization at Sesmarias, and the drill data has now confirmed the size of the lens to be 600 by 300 by 25 meters. This doesn’t sound very big, but a target of this size actually represents 18 million tonnes of rock.

As a reminder, the holes Avrupa reported on earlier this year were an important achievement as the company did encounter good grades over decent widths. Hole 26 confirmed the 10 lens appears to be much larger than originally thought, and interestingly, the hole seems to contain two adjacent zones of mineralization with the upper layer containing higher copper values, while the lower zone saw a bump in the average gold grade to just over 1 g/t. Combining both zones, Avrupa hit 28.95 meters of 0.48% copper, 0.52% lead, 1.31% zinc, 15.7 g/t silver and 0.77 g/t gold. Using $1300 gold, $1.20 zinc, $0.95 lead, $2.80 copper and $15 silver, this results in a gross rock value of $115/t, which is very decent. Of course, a gross rock value is meaningless without knowing the metallurgical recoveries, but at least it gives you an indication of the value of Avrupa’s intercept.

Once the joint venture agreement will be finalized, we expect CEO Kuhn to provide a more detailed exploration plan. The immediate focus will very likely be on Sesmarias, but keep in mind that’s just one zone at Alvalade, and we expect MATSA to spend some time and money on the previously producing Lousal mine as well.

Avrupa’s treasury is probably running on fumes again

The new joint venture agreement is great news for Avrupa’s treasury. Looking at the most recent financial statements filed by the company, the working capital position was a negative C$1M as of the end of June as Avrupa’s balance sheet contained C$850,000 of payables with an additional C$342,000 owed to related parties. The majority of that amount (almost C$235,000) is due to Pacific Opportunity Capital, which is headed by Mark Brown, the chairman of the company.

Although a large chunk of the payables is due to related parties, the initial 400,000 EUR cash payment will be very welcome as it will allow Avrupa Minerals to inject almost C$600,000 in working capital. This won’t solve the entire deficit, but it allows the company to buy some time to get its financial ducks in a row.

Looking at the balance sheet as of June 30, Avrupa wasn’t really in a position to refuse the MATSA deal as the initial cash payment plugs a working capital deficit hole.

Conclusion

While the other deal that was originally announced in March last year envisaged 10M EUR to be spent on Alvalade, Avrupa’s management did what it could to secure a new partner for the Portuguese project. And even more important than the money that will be spent on the project is the name of the partner. With MATSA, Avrupa attracted a company that knows the intricacies of the Iberian Pyrite Belt very well. Not only from a production point of view, but also from an exploration point of view as MATSA’s geological team has been credited with several finds that either have been or will be fast-tracked towards production.

CEO Kuhn and his team are undoubtedly very keen on hitting the ground running. Rigs could be turning before the end of the year, but everything will depend on the weather in southern Portugal as drilling in wet circumstances wouldn’t be very efficient.

En avant, marche!

Disclosure: The author holds a long position in Avrupa Minerals. Avrupa Minerals is a sponsor of the website.