When the gold price started its move during the summer, someone asked us ‘do you know any ‘old and forgotten’ projects that aren’t very appealing at $1250 gold but have a lot of leverage on the gold price that would make it viable at $1500 gold?’. An interesting question.

As a lot of projects get recycled during good years in the mining sector, you tend to see the same projects again and again and again. Sometimes the projects have a different name, sometimes the focus is on a different commodity, sometimes there is a new management team with a genuine desire to look at something with a different perspective (like Integra Resources (ITR.V) does with DeLamar) but quite often projects get recycled for a quick promotion tour and subsequent pump to offload paper into the hands of unsophisticated shareholders.

But sometimes projects are just gathering dust on the shelves. Forgotten by investors and placed on the backburner by management teams while waiting for better market conditions. One of those projects that is ‘okay but not appealing’ at $1250 gold is the Wind Mountain project in northwestern Nevada owned by Bravada Gold (BVA.V).

The drill program at the SF property: confirming the theory, no headline grade results yet

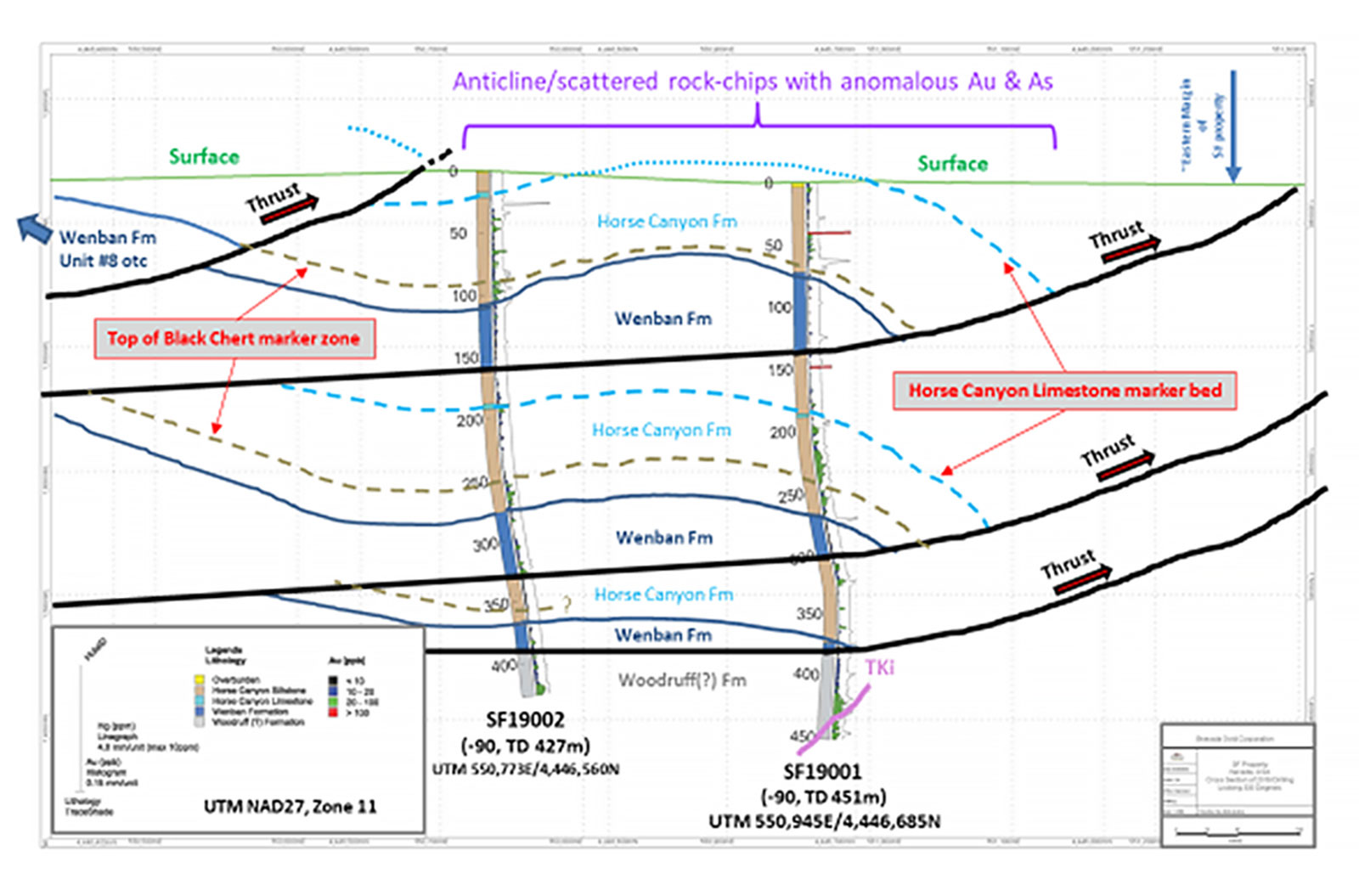

But first this. During the summer, Bravada Gold drilled two relatively deep “proof-of-concept” holes on its SF property in Nevada’s Cortez Hills gold district. Bravada wanted to drill-test the Wenban formation in a zone underneath a hanging wall anticline in the Horse Canyon formation where a previous exploration program encountered anomalous gold and arsenic (a pathfinder element to look for gold) values in their surface samples.

The results of the SF drill program are theoretically interesting as both holes intersected the Horse Canyon and Wenban formations three consecutive times. The repetition is due to a type of fault called a thrust fault which resulted in a stack of ‘layered’ sheets of the two prospective formations.

And Bravada did the right thing when it announced the results of its drill program: it reported it ‘detected anomalous values’ and didn’t even try to trick the market into thinking the encountered grades were economically good. No table with assay results was provided and in the exploration update, Bravada actually downplayed the assay results by just calling them ‘anomalous’ while calling the intervals that exceeded the 0.1 g/t a ‘rare spike’. Most junior exploration companies would have thought encountering long intervals of sub-economic grades like 0.10 g/t gold would be the best thing they have seen since sliced bread, but for Bravada the exploration theory was (and still is) more important than trying to pull the wool over the eyes of the market.

According to the current interpretation of the two holes and the anomalous gold and base metal values, the holes have been drilled close to an intrusion-related mineralized system. Interestingly, the correlation between the gold grade and the copper grade in the assay results suggests the main gold system should be located away from the intrusion. Bravada’s first task now will be to actually find that causative intrusion as it hasn’t been located at surface yet.

In order to identify the hidden (buried) intrusions, Bravada will very likely (have to) execute on a magnetics and IP survey to actually find the buried intrusions.

Revisiting the Wind Mountain project at $1500 gold and $17 silver

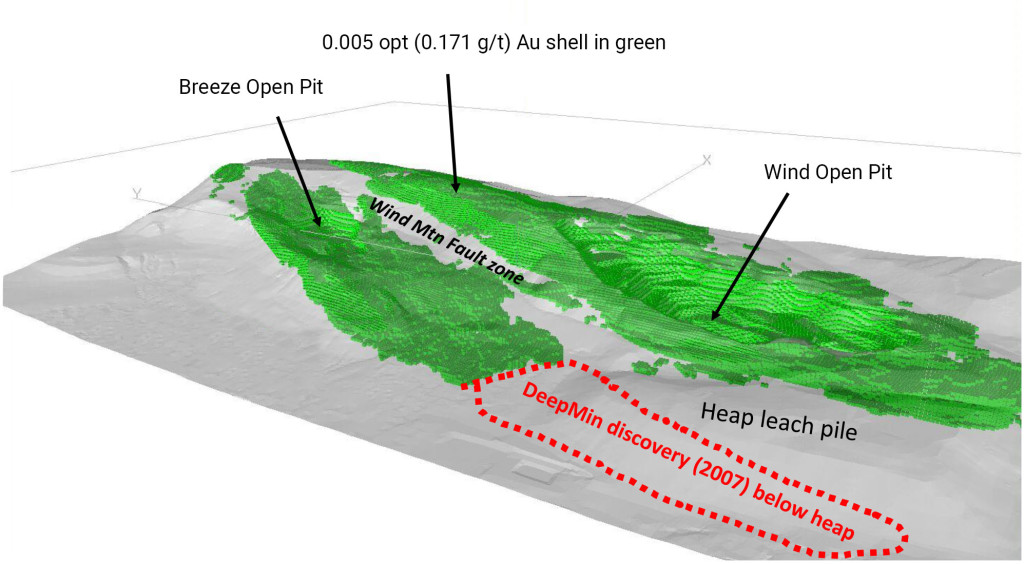

As the market still isn’t too keen on funding pure exploration stories, perhaps Bravada Gold could also revisit its Wind Mountain project, a relatively small past-producing silver-gold project in Nevada. There is an existing NI43-compliant resource (containing a total of 900,000+ ounces gold and 25 million ounces of silver divided into 570,000 ounces Au and almost 15Moz Ag in the indicated resource category and 355,000 ounces gold and 10.1Moz Ag in the inferred resource category). Of the total resource, approximately 450,000 ounces of gold and just over 11 million ounces of silver are deemed to be pit-constrained.

More work needs to be done to bring in more ounces in an in-pit mineable resource and although the project is already decently sized, it could use a few additional hundred thousand ounces in a mine plan to make it a well-sought-after heap leach project. Perhaps using a lower cut-off grade (compared to the 0.155 g/t used in the 2012 mine plan) could help to add a few ounces to the mine plan, but this should only be considered if the current low strip ratio of 0.71:1 could be maintained.

We think it’s time to take the dust off the Wind Mountain project. The Preliminary Economic Assessment was completed in 2012 and is definitely outdated by now, but as we were curious to figure out the economics at the current gold and silver price we decided to build our own economic model using the currently appropriate mining and processing costs.

Tabula rasa, indeed.

We prefer the 20,000 tonnes per day operation as this would unlock the economies of scale necessary to make the project successful (thanks to these economies of scale the mining cost is 15% lower and the processing cost is 35% lower than in a 5,000 tpd scenario). Looking at the pit optimization results in the original technical report we see that the optimized open pit would contain around 50 million tonnes of rock at an average grade of 0.30 g/t gold and 7.9 g/t silver. Those 50 million tonnes would represent a 7-year mine life, and we will use this in our base case scenario.

Note: the 7-year mine life which could potentially be increased by an additional 1.5 years should Bravada decide to process the historical waste dumps (see later). For now, we are not taking that into consideration at all.

The average recovery rate of the gold is around 60% (which is lower than the 69% recovery rate when Amex was operating the project so it’s not impossible Bravada could see a boost of a few percent in the recovery rate) while only 15% of the silver is being recovered. This is one of the negative features of running a heap leach operation: leaching the gold works well but it’s pretty useless for silver as the recovery rates tend to be just 10-40%. We will apply a recovery rate of 63% for the gold and 17% for the silver.

Since the PEA was completed in 2012, the USA has completed a reform of the tax structure. The normal corporate tax rate has decreased to 21% (which should definitely help a US-based mining operation). There also is a specific Nevada mining tax of 5% on the operating profit (which we will assume is the EBITDA) if a mining operation generates in excess of $4M in operating profit. Additionally, there is a 2% NSR on the property, which could be reduced to 1%.

We will assume a normalized corporate tax rate of 25% (consisting of 21% federal corporate taxes with the balance related to the Nevada mining tax). The ‘real’ tax pressure should be slightly lower (around 23.5-24%) but we will be using 25% to err on the safe side.

We borrowed the operating expenses from the Integra Resources PEA. These are the inputs we will be using:

The miscellaneous cost per tonne includes the reclamation and haulage costs per tonne. We will also use an average annual sustaining capex of $3M which will help us to calculate the taxable income. We also used a processing cost of $1.50/t which is lower than the $2.80 used by Integra Resources. Considering Fiore Gold (F.V) has a processing cost of $1.24/t and SSR Mining’s (SSRM, SSR.TO) Marigold mine has a processing cost of $1.22/t, we feel the processing cost may be exaggerated in the old Bravada Gold PEA and the recent Integra Resources PEA. By using $1.50/t we are already applying a 20% higher cost estimate than Fiore Gold which is operating a very similar project.

Step 1: calculating the operating cost and revenue per tonne

Applying a strip ratio of 0.7:1, Wind Mountain requires 1.7 tonnes of rock to be mined for every 1 tonne of paydirt. This means that the operating cost per tonne of rock is $3.4 + $1.50 + $0.55 + $0.60 = $6.05. That’s indeed quite low and that’s predominantly due to the low strip ratio. Adding the $0.41/t in sustaining capex increases the net operating cost to $6.46/t.

Now we have established the production cost per tonne of paydirt, we should also figure out the recoverable rock value. Applying a 63% recovery rate to the 0.30 g/t gold grade results in a recoverable rock value of $9.12/ at $1515 gold (the $9.12 net revenue already includes the 1% NSR). Using the aforementioned recovery rates for the silver and a silver price of $18/oz, the recoverable value of the silver is approximately $0.78/t resulting in a recoverable rock value of $9.90/t. This means the margin per tonne of rock processed at Wind Mountain is approximately $3.44/t.

Step 2: Applying the taxes

The initial capex of the project was estimated at $45M. We will apply a cost inflation of 2% per year and assume an initial capex of $52M. We will assume a linear depreciation over the 7-year mine life. This means the annual depreciation charges will be around $7.5M per year.

At a processing rate of 7.3 million tonnes per year (20,000 tonnes per day), the depreciation charges represent approximately $1.03/t which means the taxable operating margin will be $2.41/t. Applying the 25% total tax rate means the total tax cost will be around $0.60/t.

This means the total net cash flow per processed tonne of rock will be approximately $2.84/t using the current tax situation as base case scenario.

Step 3: a discounted cash flow model

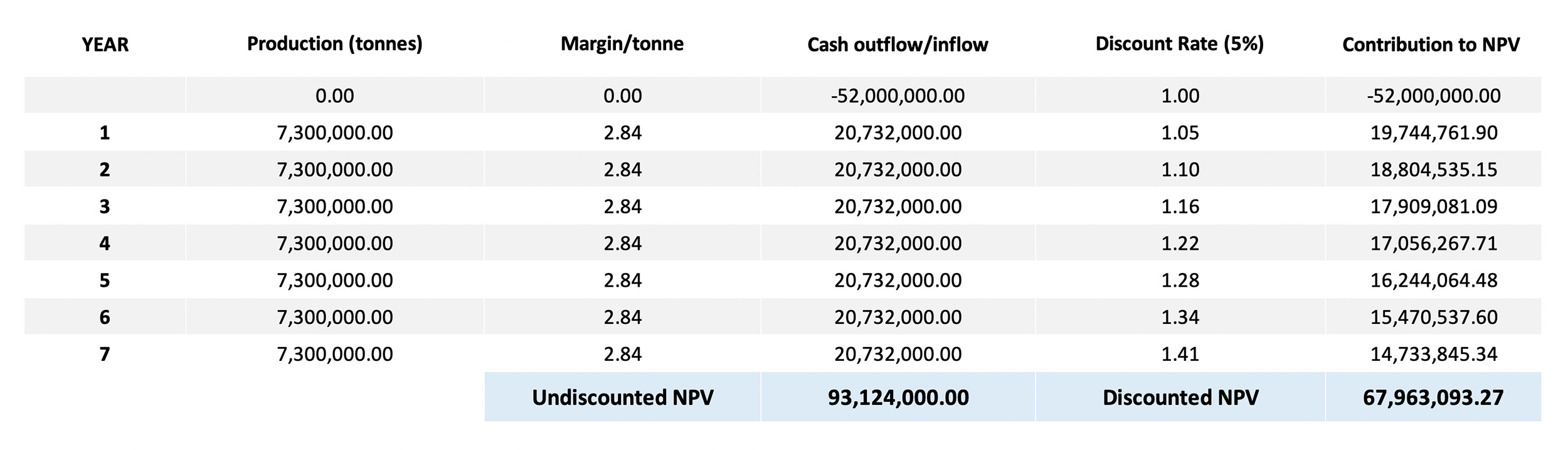

Now we have established all the parameters above, we can put everything into a simplified DCF model. We will apply a 5% discount rate which is pretty standard for gold projects in Tier-1 mining jurisdictions. The following table shows the after-tax NPV5%.

As you can see, the after-tax NPV5% of Wind Mountain would be approximately US$68M at a gold price of $1515/oz.

We also ran the numbers on a pre-tax basis (as both Bravada and a potential acquirer of the project may have a pool of tax losses it could apply). The next table summarizes the post-tax and pre-tax NPV5% and Internal Rate of Return of Wind Mountain, based on a gold price of $1515/oz.

There’s also some hidden value on the Wind Mountain project. Most of the historic production was not crushed (called “run-of-mine”) and historical production records and Bravada’s limited test work on the heap leases indicate the existing 25 million tonnes leach pad has a residual gold grade of approximately 0.2 g/t. Some of the material could be crushed and re-leached. Additionally, the 10.6 million tonnes of waste material are estimated to have an average grade of 0.22 g/t as well. This would be too low to get exciting about if that’s the stuff that has to be drilled, blasted and pulled out of the ground, but considering the strip ratio for the waste dump will be zero and much of it needs to be removed anyway as part of the open pit there may be some additional margin of safety when running the numbers on this.

Processing the waste dump wouldn’t move the needle too much but it would result in an additional 75,000 ounces added to the mine plan of which roughly 45-50,000 ounces could be recovered. So it would add value, but won’t really change the scope of the project.

According to our back of the envelope calculations, the incremental after-tax 5% would increase by US$8-9M using a similar recovery rate. A noticeable increase, but it won’t move the needle and would only be viable option at $1500 gold (or higher).

The silver could be key in redeveloping Wind Mountain

Although the Wind Mountain project contains quite a bit of silver, the metal isn’t important to the economics due to the relatively low grade and very low recovery rates. Even in the expanded production scenario based on the 50 million tonnes in the pit-optimized resource, the cumulative silver production would be just 1.9 million ounces, contributing just US$32M in cash flow (assuming a 100% payability) to the overall Wind Mountain economics.

We wouldn’t say that’s negligible, but it certainly won’t move the needle for Wind Mountain which really is a heap leach gold project with a small silver credit of a few hundred thousand ounces per year.

But the silver could be an important part of the financing puzzle: considering the total initial capex of US$45M would be too high for a company with a current market cap of just around C$7-10M, it could actually make sense to enter into an agreement with a streaming company to pre-sell the silver output as part of a streaming agreement.

Pre-selling the 1.9 million ounces of silver could easily bring $18-20M in the till which would take care of the equity portion of the capex.

Keep in mind all our calculations and ‘daydreaming’ about a silver stream are 100% conceptual in nature based on the parameters we think are acceptable for this type of project.

Bravada raised C$900,000 but isn’t out of the woods yet

About three months ago, Bravada Gold completed a C$900,000 private placement by issuing 12.86 million units at C$0.07 per unit with each unit consisting of one share and a full warrant with an exercise price of C$0.12 valid for a period of 4 years (until the summer of 2023).

The first tranche of this financing (for a total of C$567,000) already closed on May 13th and as this tranche became tradeable in September after the traditional 4 months +1 day hold period, it very likely is one of the main culprits for the weaker share price since the summer. On the one hand, it’s impossible to blame investors for taking money off the table, on the other hand, it is a pity the C$0.12 warrants are now again out of the money. And that’s too bad as the gradual and continuous exercise of those warrants (if they would have remained in the money) would have helped Bravada Gold to keep its treasury healthy while waiting for the royalty payments from the Shoshone pediment barite deposit, which now is being planned for production early in 2020.

Unfortunately that’s not the case and as the previous financing merely plugged the working capital deficit (which stood at approximately C$800,000 as of the end of April), Bravada may have to raise more cash sooner rather than later and hopefully it can do so on the back of positive exploration results from the JV with OceanaGold or by putting the Wind Mountain project back in the picture again.

There still are a bunch of 5 cent warrants outstanding (4.5M expiring in September 2020 and 2.25M expiring in October 2020) and those are the only warrants that are currently still in the money. But the expiry date of these warrants is still about a year away and as the total cash inflow upon the complete exercise of the warrants would be less than C$350,000.

Q&A with Joe Kizis, CEO

What are the next plans for the SF exploration target?

We are showing the SF property to potential JV partners now that we have confirmed the favorable geologic setting and verified that gold-bearing fluids passed through these attractive host rocks and structures. The next obvious work would be geophysical surveys because rock exposure is very poor at SF. A magnetics survey should identify intrusions, which we feel were the ultimate source of the gold and base metals. An IP or CSAMT survey should identify covered areas with pyrite accumulation and silica flooding, both features that should be associated with higher grades of gold. These surveys should be relatively inexpensive, but sometimes it is better to let a partner do that inexpensive work because it can give them “ownership” of the resulting targets and confidence to conduct an aggressive drilling program to test them.

Now the financing window appears to be closed for ‘pure’ exploration activities, is Bravada looking at the Wind Mountain project to drum up investor interest?

It is interesting that with the run-up in gold prices, several junior mining companies have resurfaced, asking to review Wind Mountain. These smaller operators could bring the experience and a skill set to turn the existing resource into a profitable mine; however, the exploration studies we’ve completed since our last drilling program at Wind Mountain in early 2018 has narrowed the search area for the feeder zone to a very compelling target. Feeder zones at similar Nevada “low grade gold deposits” contain grades that are up to 10 times higher than the disseminated portions of the deposits and, should such a high-grade deposit exist in the feeder at Wind Mountain, the existing oxide mineralization would make a very attractive starter operation while developing a much more substantial gold deposit. We are willing to consider a partner that will test the “big prize” in addition to advancing the known-resource asset.

Could you elaborate on the current status of the joint venture with OceanaGold? What’s going on behind the scenes and when can we expect an exploration update?

We recently had a Technical Committee Meeting with OceanaGold regarding work completed to date at Highland and their proposed plans for 2020. This year OceanaGold budgeted US$400,000+ and completed approximately 35 line-km of CSAMT geophysics and 1,400 soil samples. They plan to complete additional geologic mapping and permitting during the rest of 2019. Significant faults were identified by the geophysics and the soil geochemistry, and several areas have been identified for core drilling during 2020. The CSAMT was so successful in identifying structures in poorly exposed regions that additional lines are planned for 2020 over gravel-covered regions that are on-projection with drill holes that intersected narrow high-grade intercepts of gold and silver. We will announce a planned budget once OceanaGold approves their 2020 budget, expected sometime in January.

Conclusion

Bravada Gold is still focusing on its exploration activities but at $1500 gold and $18 silver, it may be an interesting idea to take the dust off the PEA-stage Wind Mountain project again. It won’t be a big moneymaker due to the current limited size of the project, but with an after-tax IRR of 35% at $1515 gold it could make sense to give Wind Mountain another look as the current heap leach operating scenario combined with the search for the feeder zone could make Wind Mountain appealing again.

Disclosure: The author holds a long position in Bravada Gold. Bravada Gold is a sponsor of the website.