Canterra Minerals (CTM.V) has been busy this summer. Not only is the company actively drilling the Buchans critical minerals project in Newfoundland, it also just announced a drill program on the Wilding gold project in the same province. Canterra recently closed a C$2M raise with the proceeds of that placement earmarked for gold exploration.

This means the company will be active on two fronts this fall, and we should see a continuous flow of drill results throughout this winter. We caught up with CEO Christopher Pennimpede to discuss the status of the flagship Buchans critical minerals project and its plans for the Wilding gold project as the company announced a new drill program earlier this week.

The recent exploration results at Buchans are encouraging

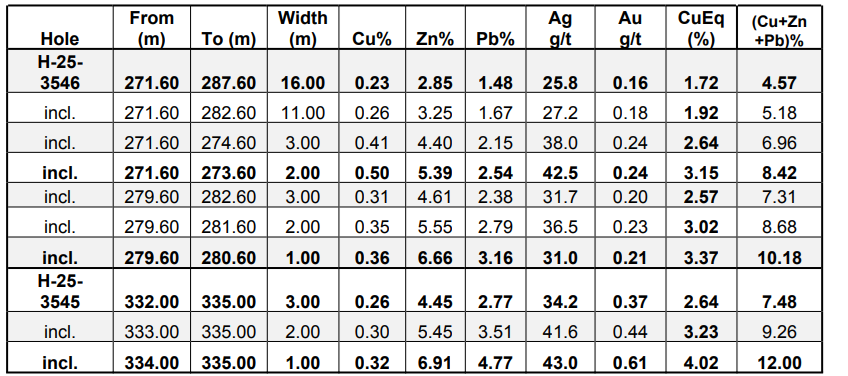

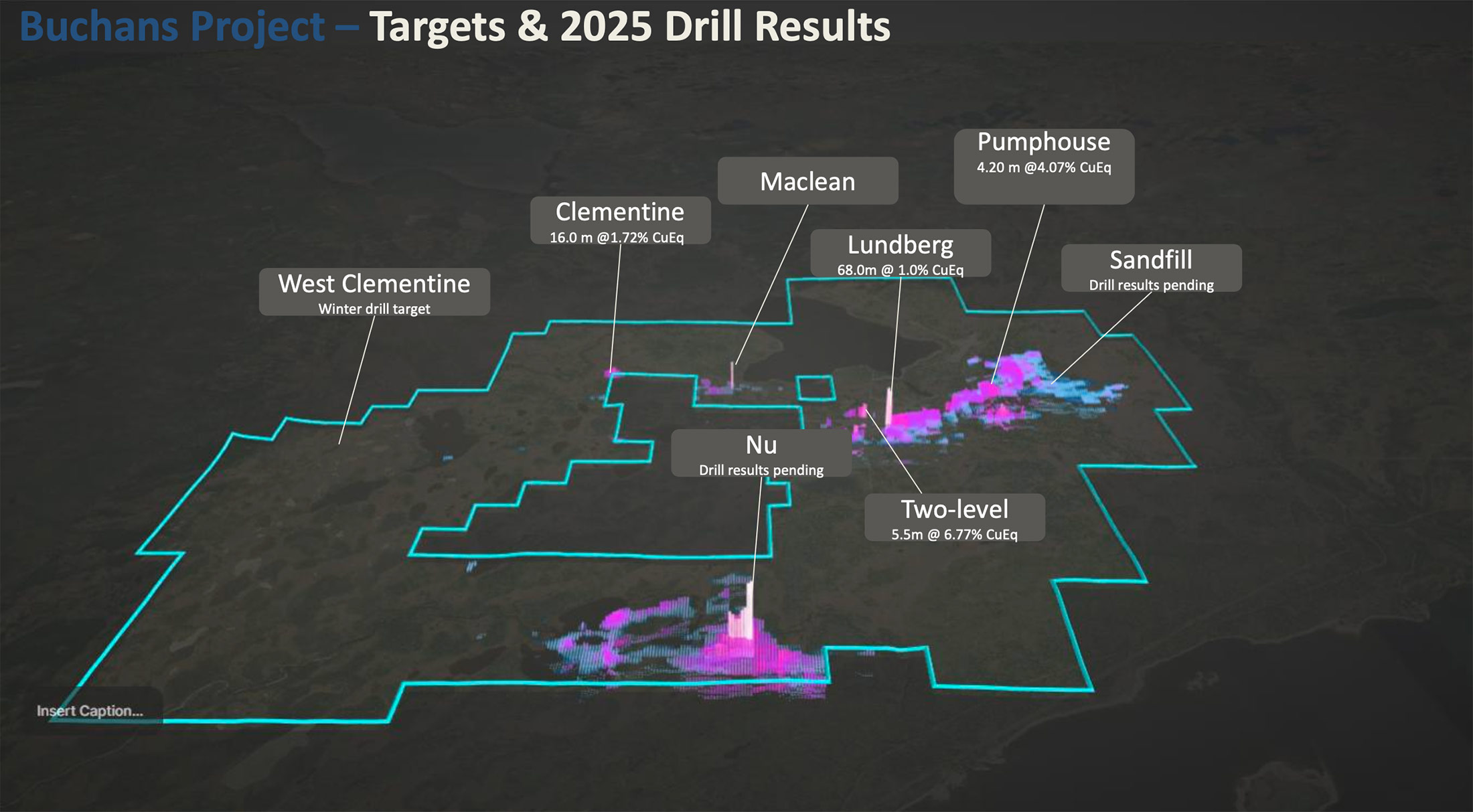

It has been a while since we saw some drill results from Canterra’s Buchans critical minerals project, but the exploration results definitely haven’t disappointed so far. In September, Canterra announced the first assay results from the Clementine prospect where the company drilled two holes to test the extensions of historical drilling. Hole H-25-3546 was clearly the best of the two holes as it intersected 16 meters of 0.23% copper, 2.85% zinc, 1.48% lead and just under 26 g/t silver. This represented a copper-equivalent grade of 1.72%.

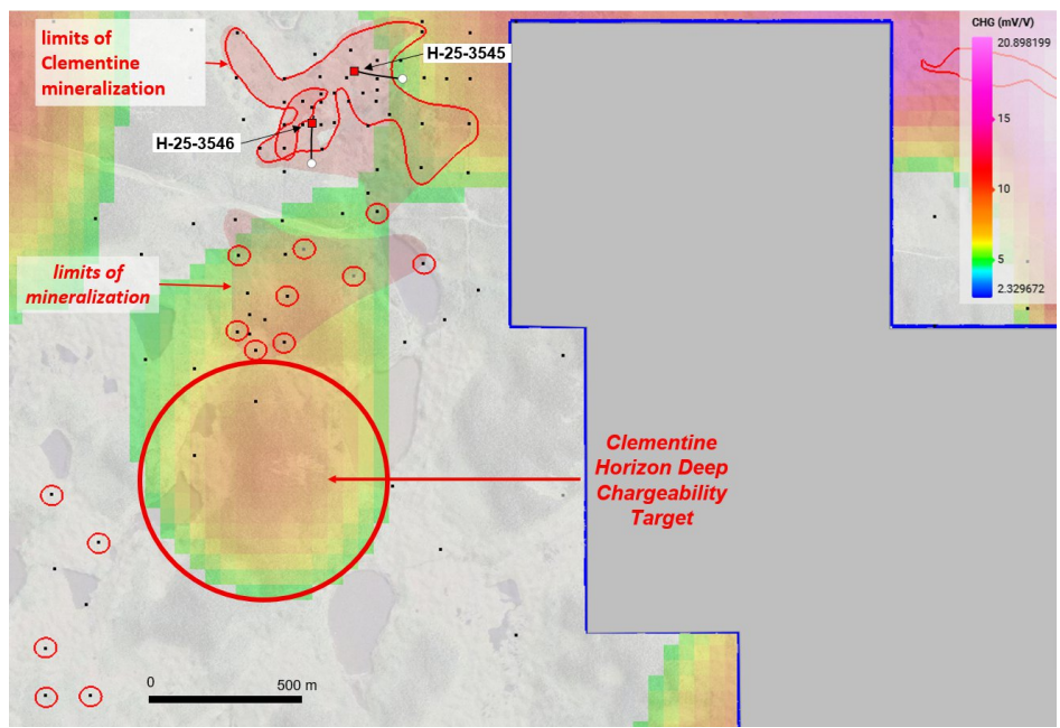

Hole 3545 was weaker, but the technical team is generally pleased with these first results from the Clementine target as the drill bit encountered high-grade Buchans-style mineralization at the edge of the known system. On top of that, the prospectivity of the target has now been extended towards the south where a large IP anomaly was detected. According to CEO Pennimpede, that anomaly provides the company a compelling large-scale target to test, making the Clementine target even more appealing to follow up on.

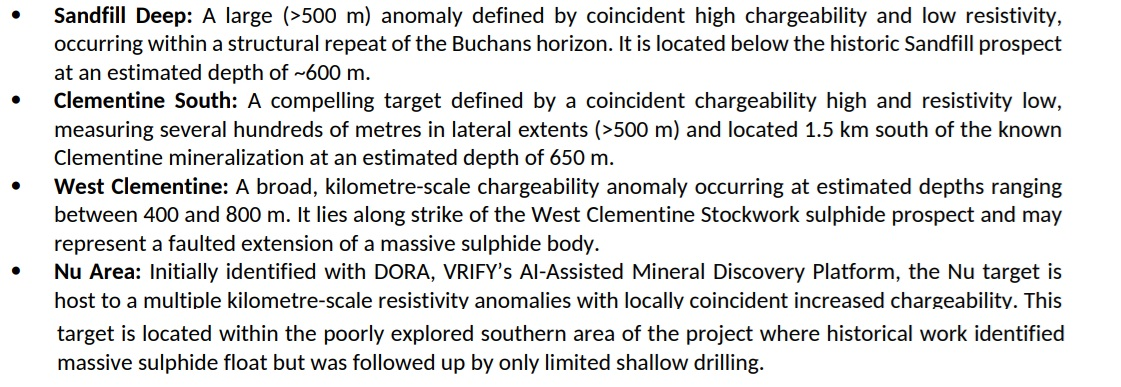

Additionally, the company has released the results of a property-wide 3D IP survey on its Buchans polymetallic project in Newfoundland. The survey was intended to look for large scale anomalies with geophysical signatures that mirror those of the historic high-grade Buchans orebodies. This survey was the largest and deepest geophysical survey ever conducted on the project and reached depths of up to 800 meters from surface, which is substantially lower than where most historical exploration activities occurred.

And the 3D IP survey didn’t disappoint: it highlighted five large scale anomalies that have never been drill-tested. All anomalies have similar geophysical signatures compared to the known mineralized zones, and all anomalies were found along the projected extension or structural repeats of the Buchans Mine host stratigraphy. The Nu target was already known (due to the VRify AI software), and the 3D IP survey has confirmed the validity of this exploration target.

Now these additional targets have been defined, Canterra Minerals has immediately kicked off Phase 3 of its 10,000 meter drill program. This phase will consist of 6,000 meters of drilling focusing on four of the highest priority targets.

More drill targets could be added later on, but Canterra will already have a busy fall with these initial four targets.

Sitting down with CEO Chris Pennimpede

We had a chat with CEO Chris Pennimpede to follow up on the recent events.

Buchans

It feels like your initial drill results have exceeded expectations. How happy are you with the first phases of the exploration program on this past producing project? What is your main take away so far?

We had three main goals for the maiden exploration focused drill program at Buchans:

1) show that the Lundberg resource could grow

2) make a new high-grade Buchan style massive sulfide mineralization discovery

3) drill pure exploration targets well outside the mine trend targeting a new discovery

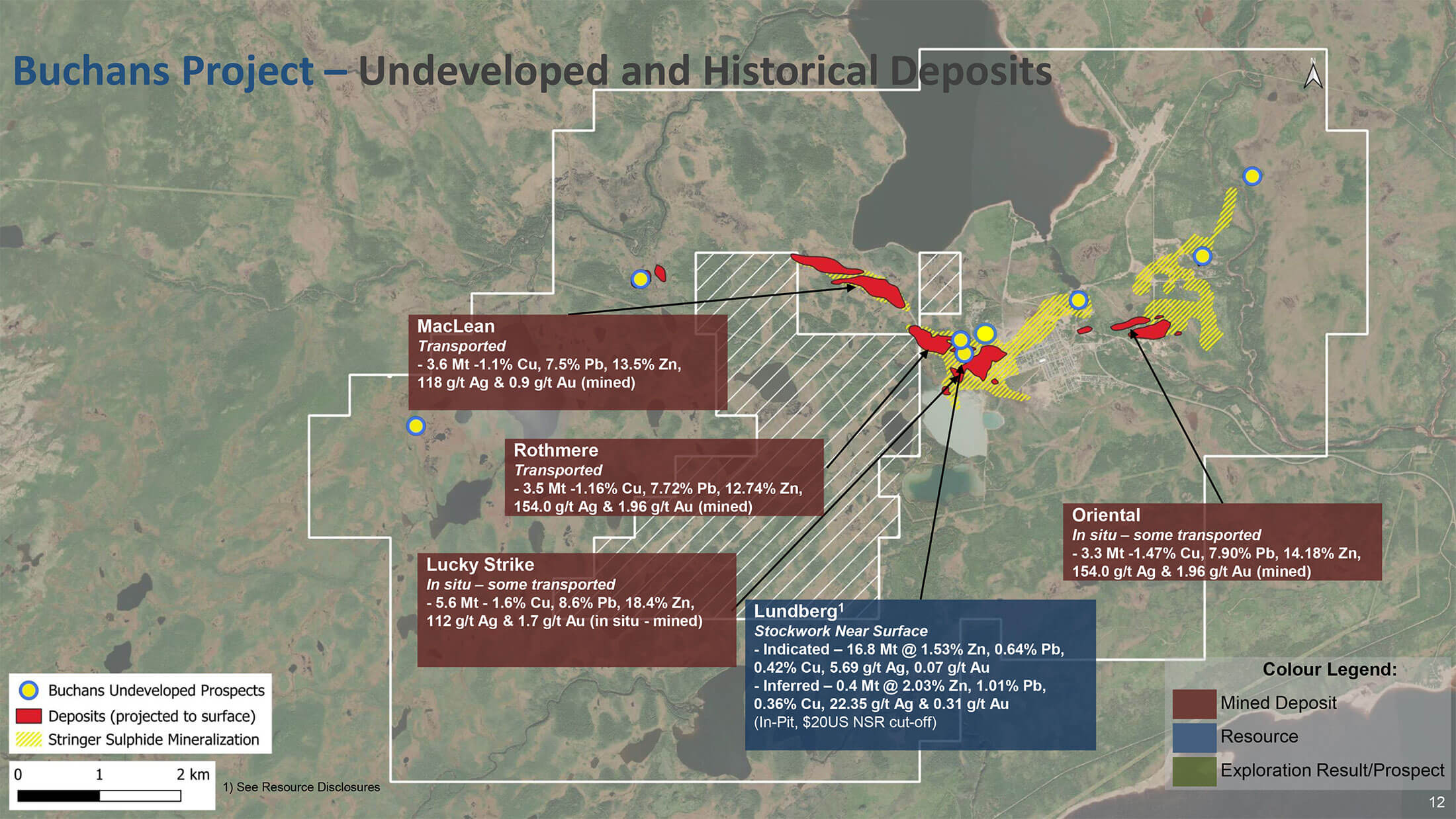

We are very happy with the results so far, as we have achieved all three goals demonstrating the Lundberg deposit can grow particularly at depth and laterally, discovering the two level zone outside the existing resource, which demonstrates the higher grades that made Buchan such a prolific mine. We also hit at the Clementine target which is approximately four kilometers west of the resource representing a new trend of the “right rocks” that will be the focus of our future exploration efforts. Pumphouse, located 800 meters away from the resource, was an encouraging success as we encountered classic Buchan-style massive sulfide mineralization (high-grade). Assays are now pending for the pure exploration holes targeting anomalies derived from the 3D geophysics survey.

How does the recent drilling impact the 2024 pit shell?

We’ve demonstrated with the deeper Lundberg holes that the stock work mineralization can certainly extend well beyond the current resource limits at depth. Additionally, the two level zone may also represent a lateral resource expansion opportunity at five times the grade, several two level drill holes are pending assay results.

Last year there was some excitement about the VRify-generated exploration targets on the Buchans critical minerals project. What have you done since to further validate the exploration targets?

The main take away from VRIFY’s Dora was the identification of several new areas where exploration work should be considered including the Nu target. At this stage, that’s the real power of AI-driven exploration techniques – it forces technical teams to look in areas that might not have been previously considered as prospective. This meant that for Canterra’s propertywide modern 3D geophysical survey that we covered over these new targets in hopes that the results of the geophysics would get them to the point where they were a valid exploration drill target. Happily, the results from Nu showed two targets, one multi-kilometre scale and the other approximately 1.5 kilometers. We have now drill-tested both and are awaiting assay results.

It’s still early of course, but at what point do you think you’d be ready to update the resource at Buchans?

We should have all the results back from our 10,000 m drill program at Buchans by the end of Q1 2026 and then be in a position to determine if we need more drilling in certain areas of the deposit or at the Two Level Horizon to work towards an updated resource estimate.

As the size of the mineralized envelope increases, metallurgy will likely become an increasingly important element of creating value at Buchans. How much data do you have from the historical activities, and is there something specific you’d like to improve on?

From the existing resource in 2019 and previous operators’ completed and internal economic study in the 2000s, there’s a lot of positive metallurgical data and even the samples used have been kept in cold storage in an off-site lab for future work if necessary.

So we have the requisite data, Buchans historically had very good metallurgy because of it’s “bluegray ores” devoid of pyrite which usually complicates metallurgy in VMS systems. We would really only be looking at optimization work where, depending on the metal it price environment at the time, you might want to look to optimize copper recovery in the copper concentrate if copper prices remain so strong. Or should for instance zinc go on a price run then you might look to do the opposite.

If we are successful in bringing in Two Level or one of the other identified zones (Pumphouse) which are much higher-grade in nature, particularly in precious metals (intervals from those zone averaged almost 1g/ton gold and 100g/t silver) then you may look to optimize the precious metal credit recovery rates.

Wilding Lake

It has been quiet for several years on the Wilding gold project as your efforts were obviously focusing on the Buchans critical minerals asset. Back in September you announced gold samples from the project and now you will start drilling again. Other than the higher gold price, is there any other reason why you I’ve decided to focus again on the gold project as well?

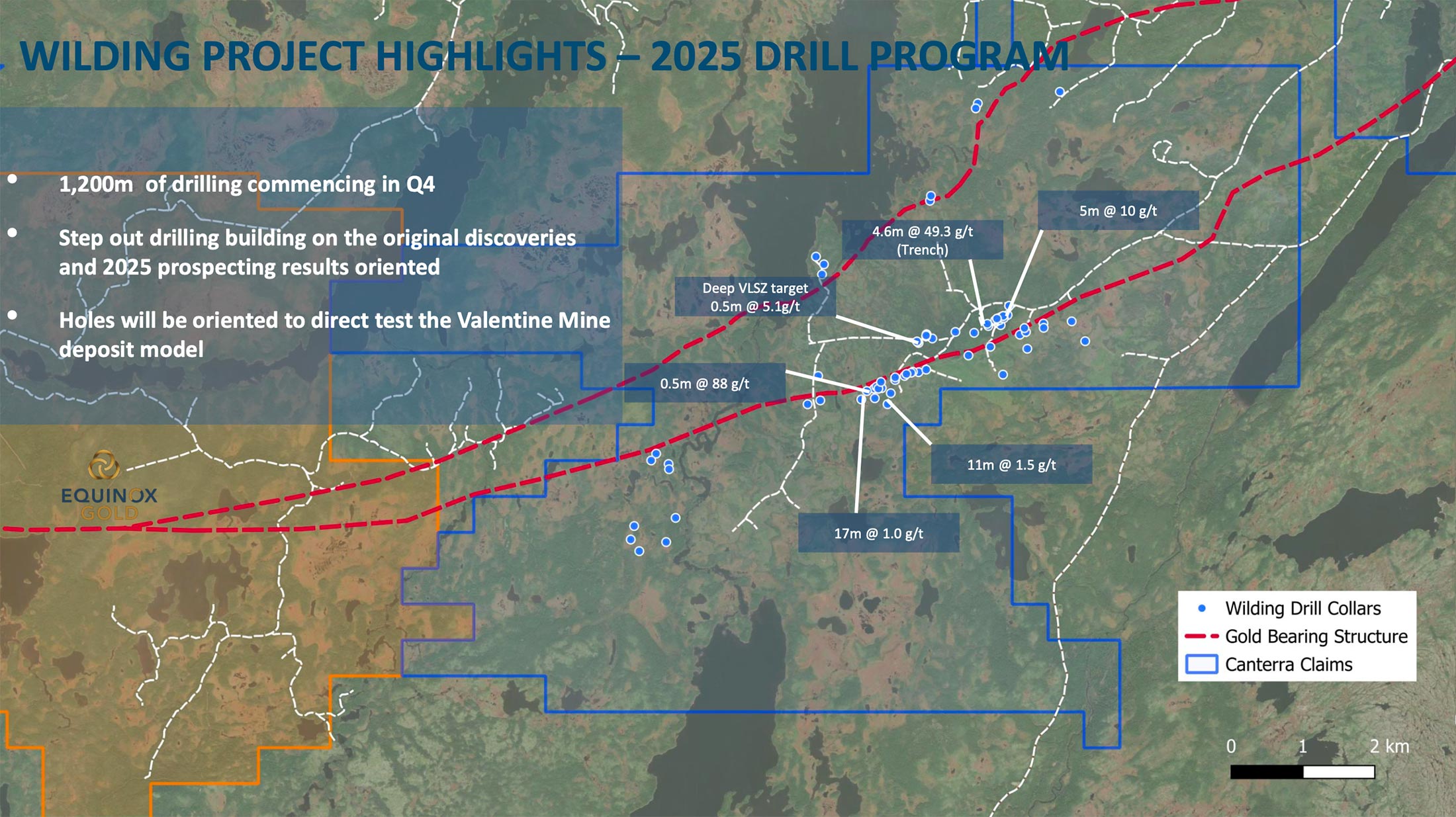

We’ve had more time to model the 2021 drilling at Wilding and now combined with the 2025 prospecting results, we feel we understand the gold mineralization much better. Particularly, having gone to the Valentine mine and seen that same mineralization style now exposed in the pit wall, you get an infinitely better sense on how to best orient a drill rig to target the mineralization seen on our side of the fence.We just never had the opportunity in 2021 to go back and drill in the “preferred orientation” to see the extensional vein sets that carry the bulk of the grade at Valentine, stack. That’s the key in these orogenic gold systems, your first holes you get an orientation of the main shear structure and shear veins, which gets you into the ballpark and then the key is to go back and drill once you understand those orientations much better so that you see the extensional vein sets stack at depth, which is exactly the process at Valentine.

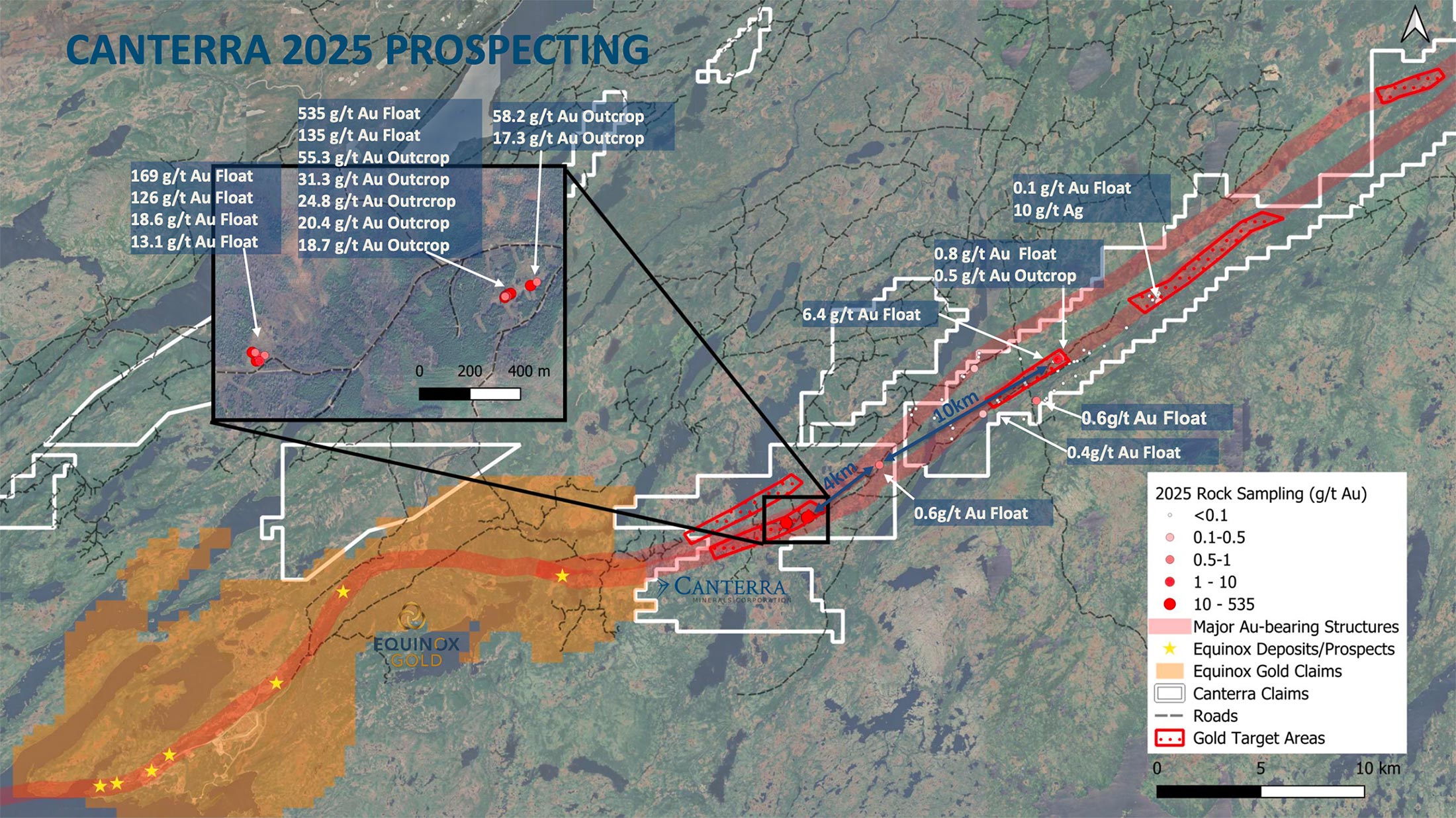

The September prospecting results or mainly grab samples. What was the main reason to focus on that specific part of the project given the substantial size of your land package there?

We brought in all of the existing public data from Valentine and the surrounding areas including our 55 km of the shear zone and did a targeting exercise and identified five discrete target areas along that 55 kilometer trend where we have all the same ingredients as Valentine. So the next step was to prospect them. We are focusing around the 2021 discoveries because they are further along as they were trenched and ultimately successfully drilled and now we get to go back and drill in the preferred orientation. The other discoveries 14 km to the northeast will still need to be trenched in 2026 to determine if they will become drill targets

Could you elaborate on the details of the recently announced drill program?

– 1,200 m of large diameter (HQ) core drilling is planned across 15 drill holes

– Drilling will test for Equinox Gold’s Valentine mine style gold mineralization in stacked extensional quartz-gold-tourmaline-pyrite vein packages along the known shear zones , testing geometries not previously drilled. The targets have been defined by summer 2025 field work and prospecting results (see September 8 news release) as well as targets derived from newly re-interpreted IP geophysics and historical work

– We are confident that from the culmination of work by the technical team we will deliver thicker intercepts of gold mineralization building on the 2021 successful gold drill results from Wilding

If all goes well, when could we expect the first essay results from Wilding?

We expect initial assay results in Q4, likely late November or in the first week of December.

Are there any efficiency benefits from drilling Buchans and Wilding at the same time?

There are some benefits, as our technical teams are already at site and at our field office so there some shared costs that will we reduce the per-meter rate.

Corporate

You recently announced closed a financing, raising C$2M at C$0.12 per unit, But it appears that money was earmarked for the exploration program on the gold project. How is the financial situation of Canterra in general? Are you planning to tap the flow through markets by the end of this year?

We really wanted to drill the Wilding gold project before 2025 was over especially given our prospecting results and actually visiting the Valentine mine in person. As a geologist you gain so much more understanding seeing the mineralized zone stripped in an active mine. Our largest shareholders also wanted to see Wilding drilled and so a four placee financing was designed to get drilling at Wilding and also give us some hard dollar runway into 2026. With this financing we are fully funded for the 1,200 m drill program and corporately until late Q2 2026 if not beyond. We’ll wait to see how the gold drill results are before making any further financing decisions.

At the end of June you had almost 21 million warrants outstanding at 7.5 cents and an additional 10 million warrants with an exercise price of 9 cents. Although we are still respectively 2.5 years and one year from their expiration dates, are you seeing any warrant exercises that help you to keep the treasury filled?

Yes we started to see some warrant exercises, which has brought in a bit of money, but if the warrants you outline get exercised, that would be a significant chunk of change (approximately $1 million)

You recently sold some shares in Star Diamond, was that in an orchestrated sale? Can we expect additional share sales from this non-core position?

We needed to augment our hard dollar position in the beginning of fall so we sold a portion, but still retain half our position. Going forward, we will always look to monetize non-core positions to generate hard dollars if it makes corporate sense to do so. Right now, Star Diamond’s share price is trading significantly below our cost basis and so at present it doesn’t make sense to sell more shares.

Conclusion

This will be a busy winter for Canterra Minerals as the company is simultaneously advancing Buchans and Wilding. Canterra’s news flow should be pretty continuous throughout this fall and winter.

Disclosure: Canterra Minerals is a sponsor of the website. The author has a long position in Canterra Minerals. This post is for educational purposes only; be mindful investing in junior mining stocks is risky and you may lose your entire investment if things go wrong. Please read our full disclosure.