Contact Gold (C.V) has been able to attract some attention of the market by releasing excellent assay results from drilling the oxide zones at the newly acquired Green Springs project. The expectations were quite high after Contact re-assayed RC samples from a historic drill program, but it’s safe to say those expectations have been surpassed with the new drill campaign as Contact encountered thick layers of gold-bearing oxide mineralization.

The assay results of most of the holes have now been published and it’s time to give Green Springs another close look.

Shifting gears: focusing on Green Springs…

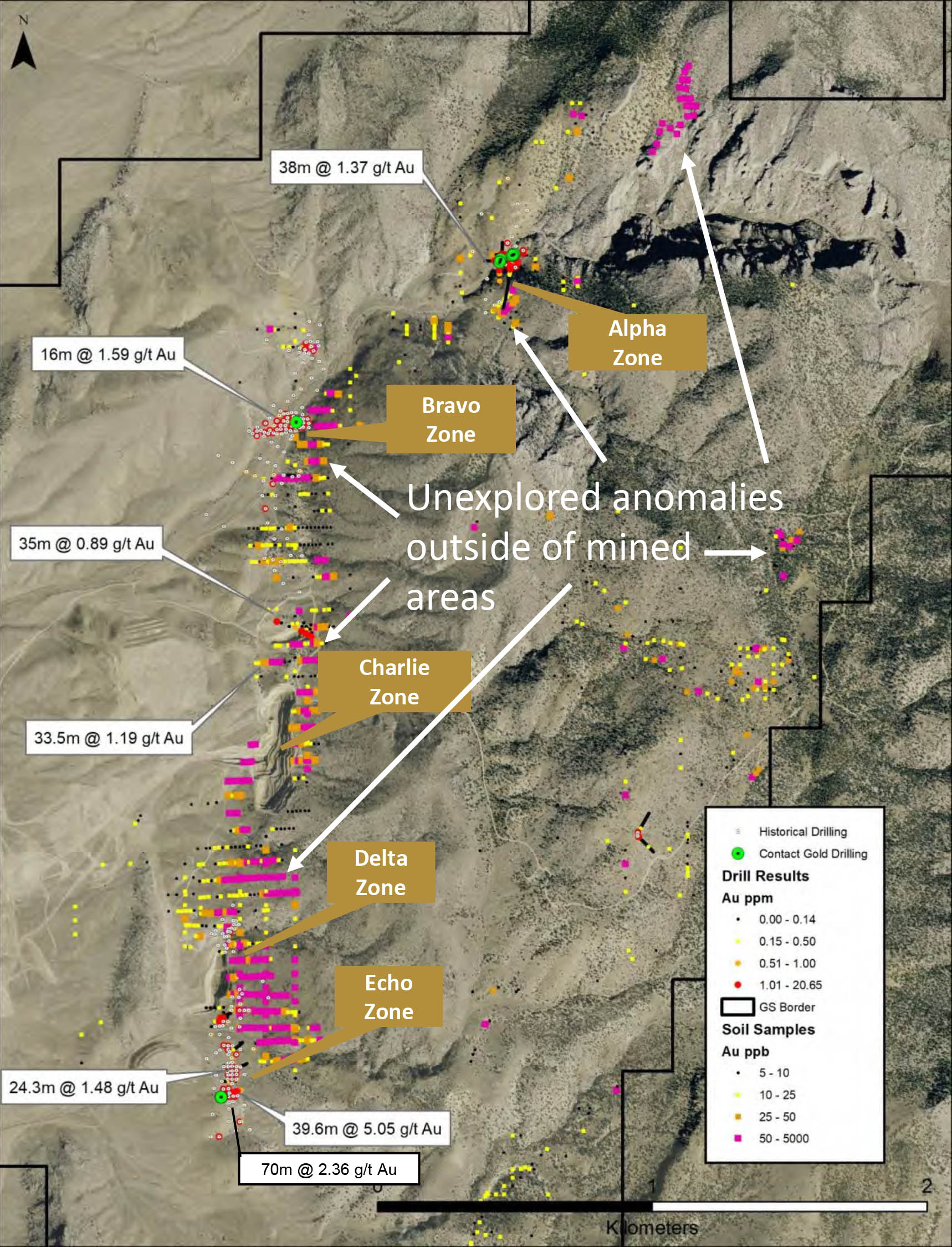

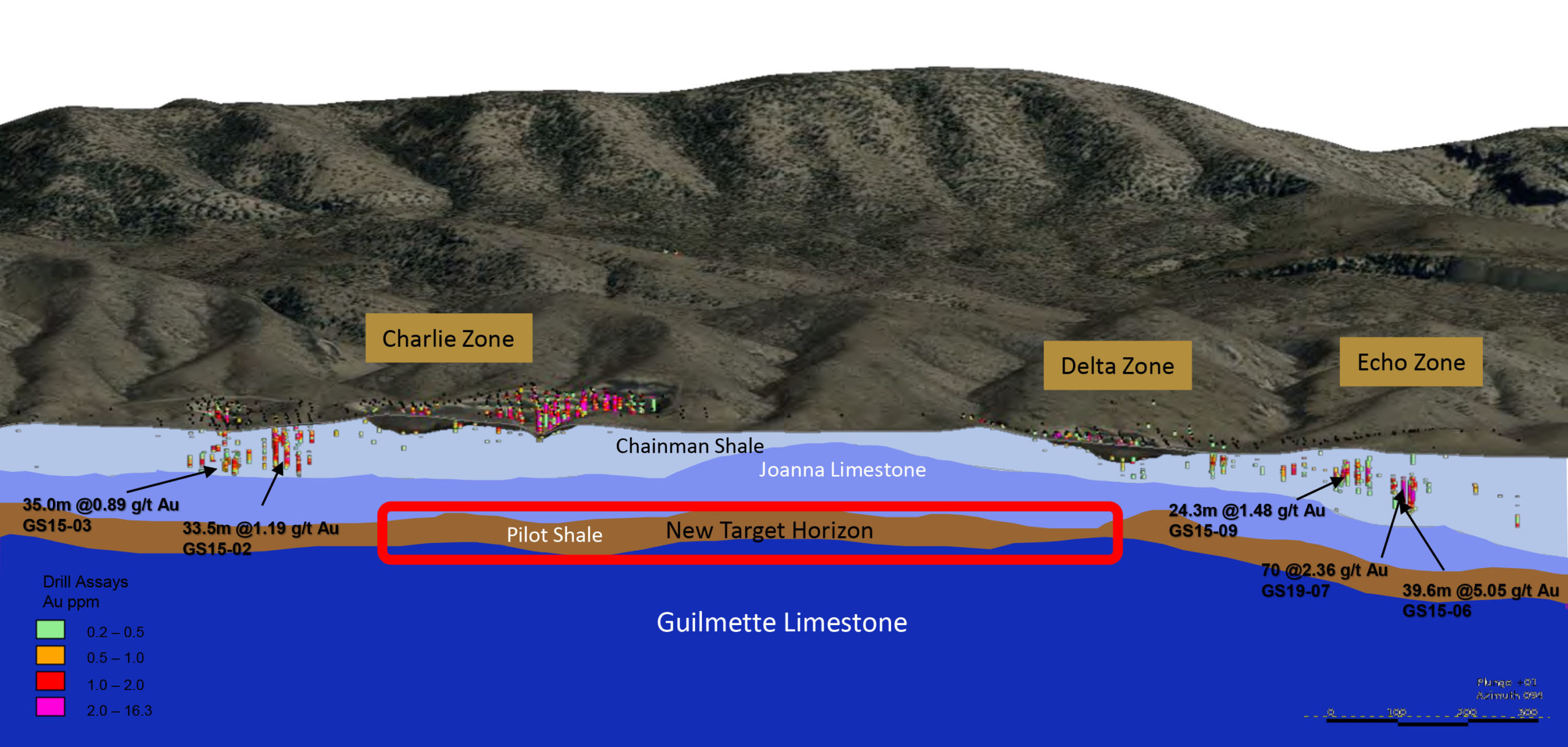

The Alpha Zone of Green Springs was discovered approximately 30 years ago and virtually all historical drilling was limited to very shallow holes and Contact’s theory is that there’s much more gold to be found at Green Springs along the lower contact of the Pilot Shale and the Guilmette limestone. Historical drilling at Green Springs was too shallow to effectively penetrate the Pilot Shale and Contact’s exploration plan was based on the theory of drilling deeper holes to find more gold.

A – The Alpha Zone

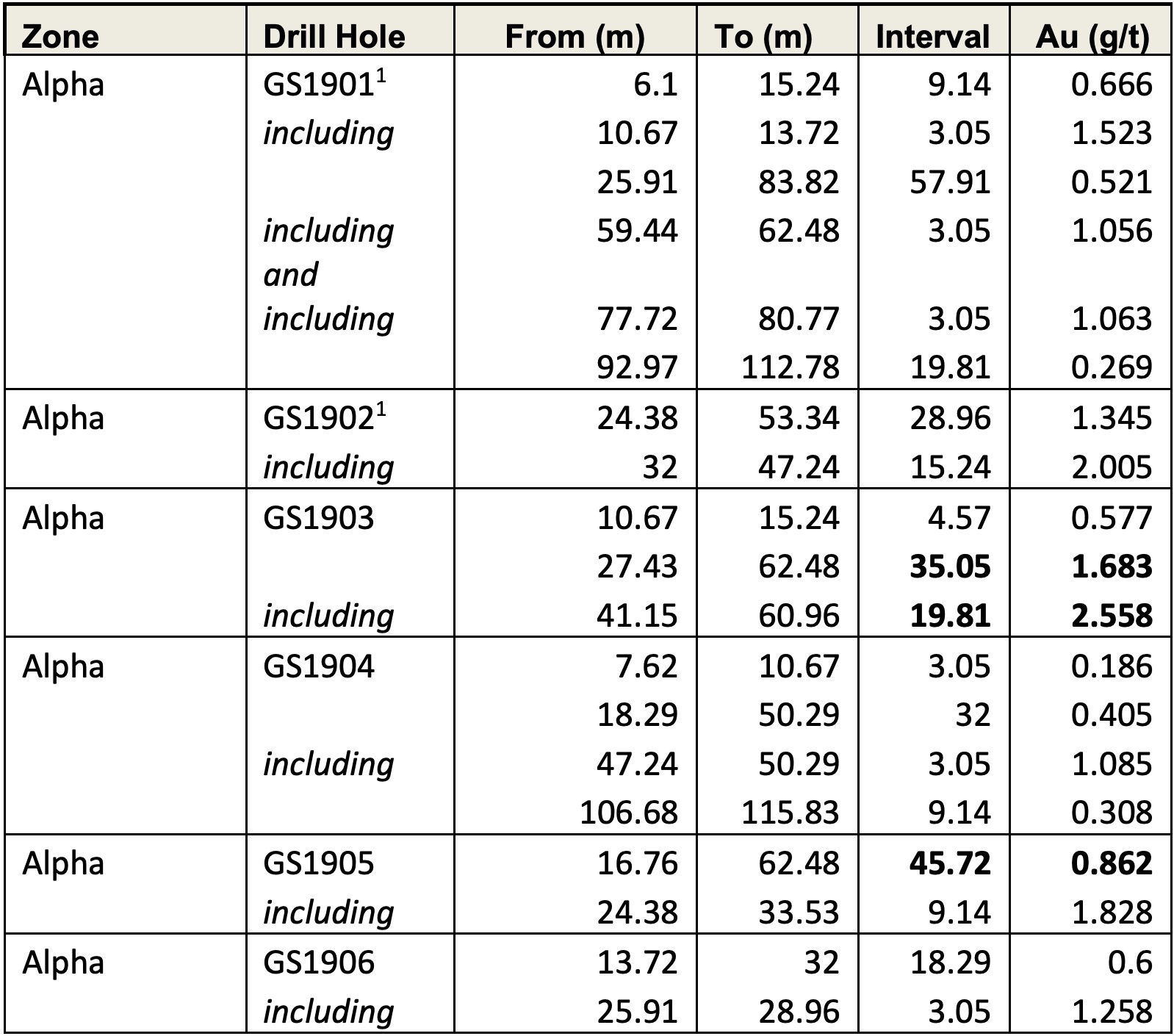

The first holes Contact Gold reported on were drilled at the Alpha Zone, the northernmost area of the Green Springs project.

Although the Alpha zone was generally expected to be just ‘okay-ish’ (the highest grade mineralization over thick intervals was found in the south at Echo), we are positively surprised by the assay results from the Alpha zone drilling.

The first batch was released in early January and the assay results from the first two holes from Alpha (as part of a six-hole campaign on that zone) are encouraging and perhaps the 0.52 g/t gold over 58 meters doesn’t look that appealing on a grade-basis although 0.52 g/t in oxides should definitely be viable in Nevada. Additionally, a continuous interval of 58 meters should have a very positive impact on the eventual strip ratio and on top of that, there also was a 9.14 meter interval containing almost 0.67 g/t gold almost starting at surface and ending just 10 meters above the start of the 58 meter interval. The real eye—catcher however was the 1.34 g/t gold over almost 29 meters as that hole combined a very reasonable thickness with a good gold grade for oxide mineralization.

The implications of both holes should not be underestimated: hole 1 (the 58 meters at 0.52 g/t) extended the gold mineralization further to the South of historic drilling while the second hole with the higher grade gold extended gold mineralization beneath a historic hole that didn’t reach its targeted depth. So both holes are actually good news.

The market appeared to have shrugged off these assay results and that is a pity as the second batch of four Alpha-holes was released just one week later and more excellent assay results.

All six holes at Alpha have encountered mineralization and hole 3 (with a highlight of 35 meters of 1.68 g/t gold starting just 27.4 meters downhole) was a successful infill hole providing more information on the gold-bearing structures between hole 2 (the aforementioned 20 meters of 1.34 g/t gold) and a historic drill hole. The implication of this is quite important as this confirms a 75 meter long zone with an average thickness of over 30 meters carrying grade of in excess of 1g/t gold. Assuming a width of 40 meters (just arbitrary, more drilling is needed to define this zone) you are already looking at 250,000 tonnes of rock which should have superior margins given the average grades.

Hole 4 was perhaps a little bit more disappointing but with 32 meters of 0.41 g/t gold starting just 18 meters down-hole including just over 3 meters carrying 1.09 g/t gold from 47.24 meters on the mineralization in this hole should meet the cut-off requirements as well (at $1550 gold, the gross rock value is just over $20/t).

Hole 5 was another hole with important implications as Contact Gold drilled this right in between two historic holes that were drilled in 2017. With almost 46 meters of 0.862 g/t (including 9.14 meters of 1.83 g/t) there’s almost zero doubt about the viability of this zone as the mineralization starts at less than 17 meters downhole. 0.86 g/t gold equals a gross rock value of almost $43/t so even after applying the recovery rates and deducting the operating expenses, the operating margin should be pretty good.

The final hole that was drilled at the Alpha zone, hole 6, contains 18.3 meters of 0.6 g/t gold. Essentially another excellent hole for a Nevada-based gold oxide project but not as jaw-dropping as the previous few holes.

The next table shows you all exact drill results (we rounded some intervals and grades) and the main takeaway is that the gold mineralization starts really close to surface so the strip ratio of an optimized pit shell should be quite low.

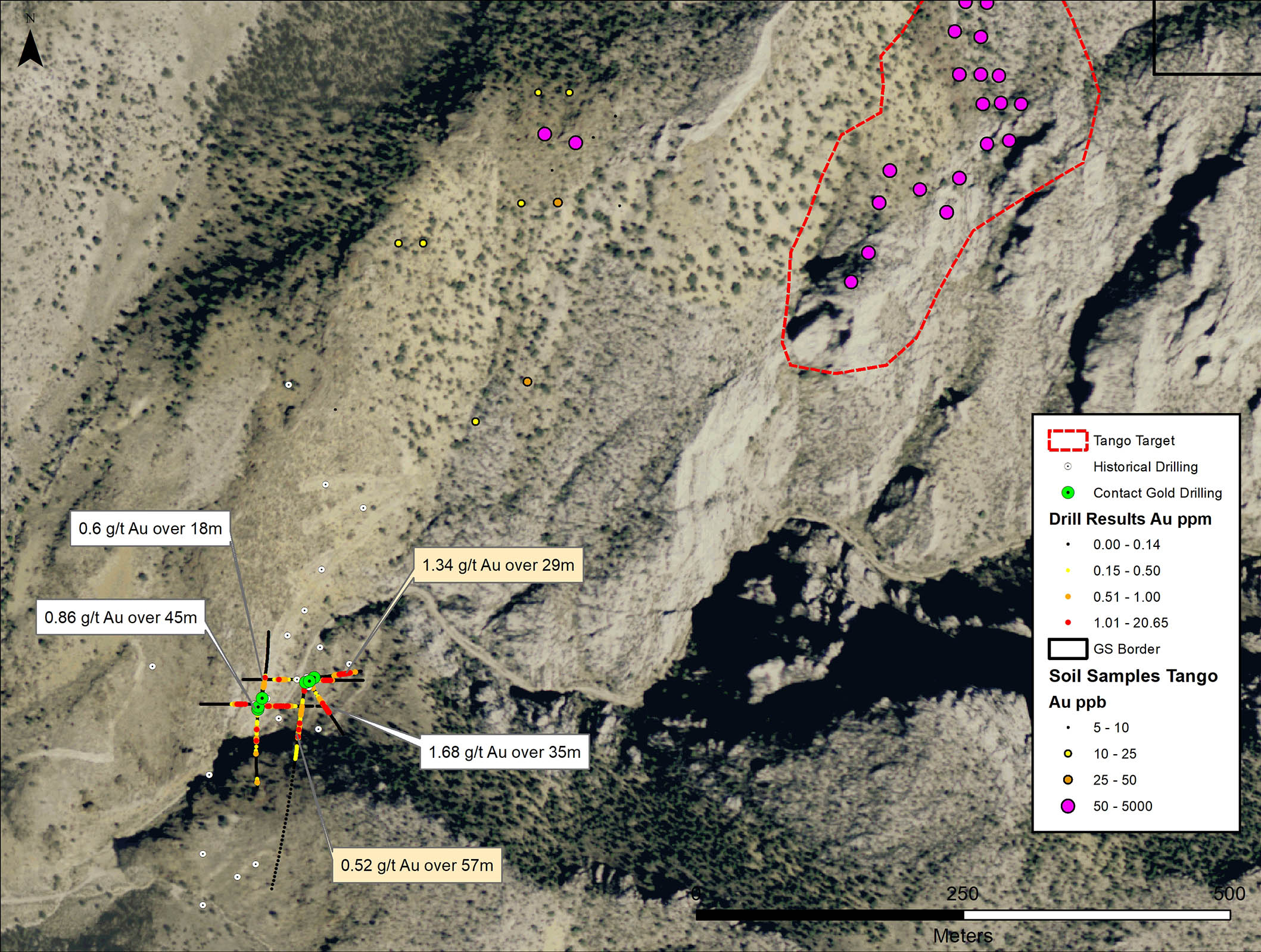

It is safe to say the first six holes Contact drilled at the Alpha zone have now proven the exploration theory, and this could allow Contact Gold to step up its aggressiveness. About half a kilometer north of the Alpha Zone is the new Tango target, which has never been drilled before. The target has a footprint of a 450 by 150 meter gold-in soil anomaly and based on the interpretation of the layers encountered, Contact’s geologists think this is the zone where the contact of the Pilot shale and Guilmette limestone reach the surface.

B – The Echo Zone

The assay results of the six holes drilled at the Alpha zone appeared to be building up towards releasing the results of the Echo Zone (which is where the company encountered the 5.05 g/t oxide gold in over almost 40 meters in old RC samples that hadn’t tested for cyanide solubility). The Alpha zone was just the warm-up zone, and everyone appeared to be waiting for the Echo zone to see if the high-grade intervals could be replicated.

And the drill bit didn’t disappoint. Hole 7 was drilled as a step-back hole about 40 meters from the aforementioned almost 40 meters of 5.05 g/t gold and also contained higher grade gold: an interval of 70.1 meters of 2.36 g/t gold including 12.2 meters of 8.05 g/t gold is excellent although it probably would have been more fair to report a 38.1 meter of 4.26 g/t gold as the residual 32 meters contain lower grade gold. We double-checked with the company and were told there was a 25+ meter long interval of .26 g/t gold and 4.5 meters of over 0.6 g/t in the residual intervals, and both zones would meet the required cutoff grade.

And that’s nothing short of amazing. While a lot of the heap leach open pit mines in Nevada are operating at an average grade of anywhere between 0.3 g/t gold and 0.8 g/t gold, finding almost 40 meters of in excess of 4.25 g/t gold is spectacular. It doesn’t even matter the main interval starts 85 meters downhole as the gross rock value of in excess of $200/t (resulting in a recoverable rock value of in excess of $150/t using a recovery rate of 75%) would mitigate the impact of a higher strip ratio.

… While waiting for the approval of Pony Creek’s plan of operations

Although Contact Gold continued to find gold almost everywhere it drilled on the Pony Creek project, its ability to freely move around was hindered by the lack of a plan of operations on the project. Contact has been exploring under a ‘notice of intent’ permit which only allowed Contact to drill from existing drill pads, thus limiting the ‘creativity’ of where to put fresh holes in.

The file for the plan of operations was submitted in 2019 and should be approved before the summer and this will give Contact Gold much more flexibility to effectively chase the gold on its high-priority zones.

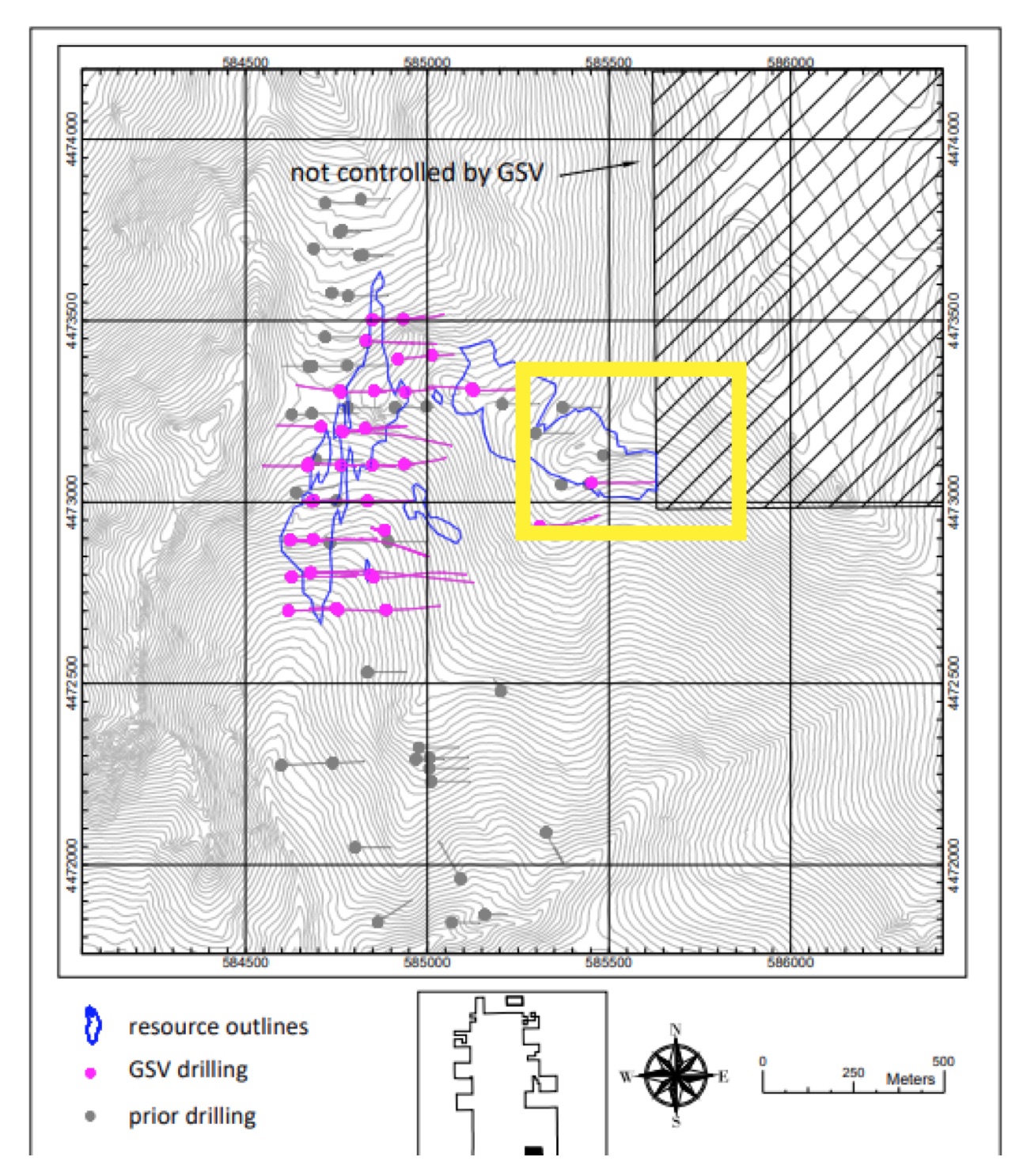

We still think neighbour Gold Standard Ventures (GSV, GSV.TO) is keeping tabs on Pony Creek as especially the Elliott Dome target could be very valuable for Gold Standard. Have a look at this image we found in the technical report of the Preliminary Economic Assessment of Gold Standard Ventures, where the Jasperoid Wash was included in the mine plan (page 286 of the technical report):

As you can see, the Jasperoid Wash open pit appears to be limited due to the constrained land package of Gold Standard Ventures (that blue resource doesn’t just stop at the border). That zone would probably produce much more gold in an optimized pit shell (which would include a layback agreement allowing Gold Standard to access the Elliott Dome zone) and although it is difficult to figure out the incremental value to Gold Standard Ventures, they would clearly benefit if the Jasperoid Wash and Elliott Dome claims would be put together.

This doesn’t mean Gold Standard needs Elliott Dome at any cost, but it would make sense for them to try to consolidate the entire district and pick the low-hanging fruit on the Pony Creek tenements. And now Contact Gold’s market capitalization has been sliding to less than C$20M, any potential deal should be manageable and digestible for Gold Standard).

Of course, this is all just speculation from our side, but if you look at GSV’s Jasperoid Wash resource and mine plan, a consolidation of at least Jasperoid Wash and Elliott Dome makes so much sense.

Contact’s financial situation

As of the end of September, Contact Gold’s working capital position had dropped to C$1.8M and this was even before the Green Springs drill program started. Although drilling at Green Springs remained limited to just 1,300 meters, the working capital position has very likely fallen below C$1M by now which means Contact Gold will probably have to go back to the market after publishing the assay results from the final 2 holes at Green Springs.

And it will be interesting to see what investors would like Contact Gold to do with the money. Although Contact definitely hasn’t written off Pony Creek, we have the impression Green Springs is slowly overtaking Pony Creek as the flagship asset and that is hardly a surprise given the thick mineralized zones and high grade oxide mineralization. We wouldn’t object at all to put Pony Creek on the backburner while continuing to drill-test the exploration theory at Green Springs. Green Springs is also more accessible year-round than Pony Creek with upgraded roads to support the historical mining and given the project is further south than Pony Creek means it sees less snowfall. Therefore Contact could be out drilling Green Springs as soon as they are cashed up again. Having both projects in the portfolio means the potential for year round drilling news flow.

Conclusion

As Contact Gold had a tough time convincing the market about Pony Creek last year, the acquisition of the Green Springs project may actually ‘save’ the company. Contact has been right about the potential of Green Springs and has now identified gold-bearing oxide zones which have been overlooked by the previous owners of the project. The initial exploration theory appears to be fully confirmed by the 10 hole drill program (assay results from two more holes are still pending), and Green Springs could (and probably should) overtake Pony Creek as Contact’s flagship project.

This doesn’t mean we are writing off Pony Creek as we do believe in better exploration results once the plan of operations is approved but meanwhile, Contact is getting a lot of bang for its buck at Green Springs where the oxide mineralization is hosting gold zones that have a much higher average grade than what Contact has found at Pony Creek.

As long as the Pony Creek plan of operations isn’t approved, there is very little doubt Green Springs should remain the company’s first priority. But even after getting Pony Creek sorted out, Contact’s technical team and CFO should think hard about where and how the money will be spent in 2020 as it still isn’t easy for exploration stage companies to raise money and some choices will have to be made.

Disclosure: The author holds a long position in Contact Gold. Contact Gold is a sponsor of the website.