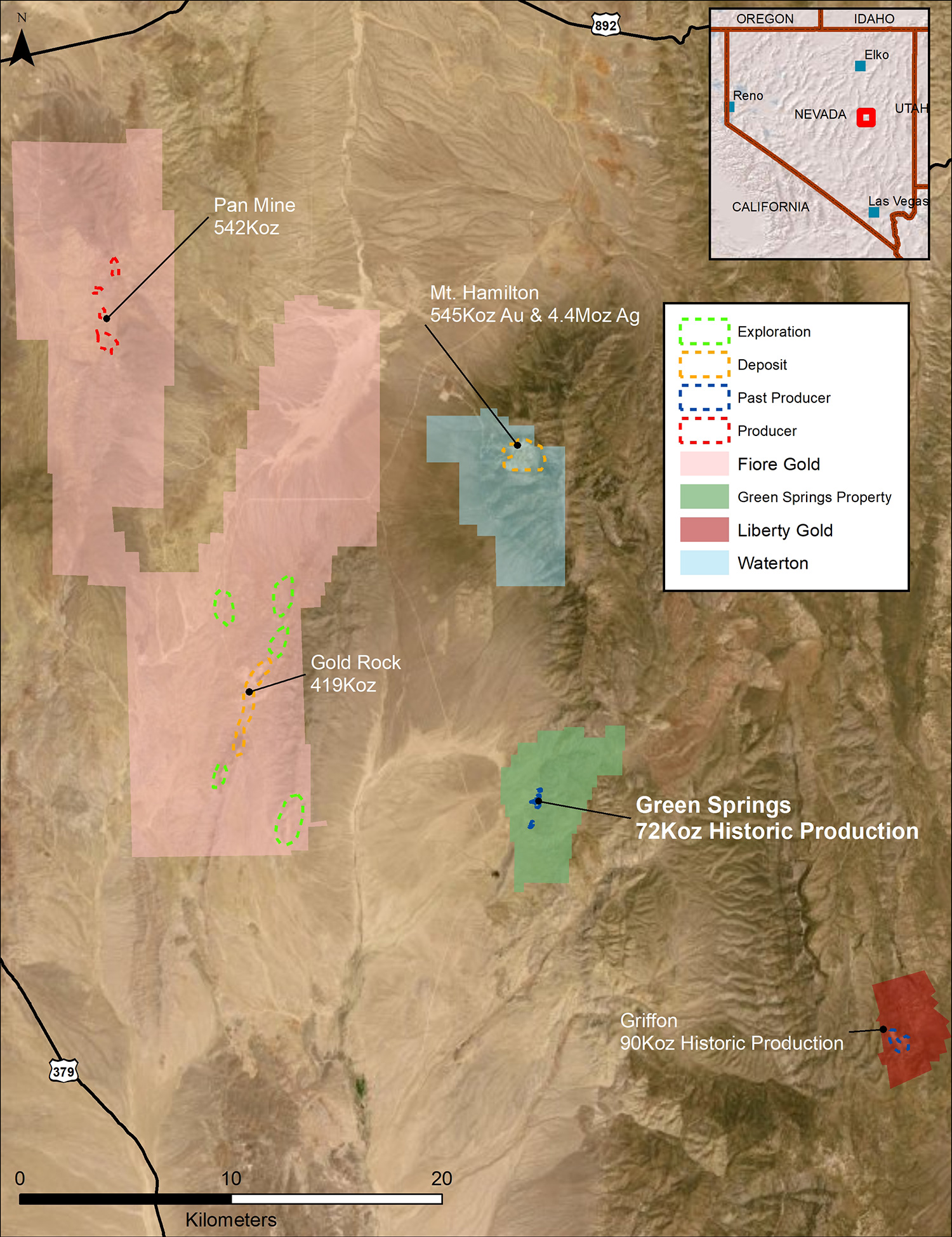

As the winter season is about to hit the area in Nevada where the Pony Creek project is located, Contact Gold (C.V) will increase its focus on the Green Springs gold project, which it is acquiring from Ely Gold & Royalties (ELY.V). The company is awaiting the approval of the plan of operations for Pony Creek – which will allow for additional exploration flexibility.

Contact appears to be very keen to drill-test some of the high-priority targets at Green Springs where historical drilling indicated the presence of very high-grade oxide mineralization. While Contact is still chasing the higher grade zones at Pony Creek, historical data from Green Springs already allows it to zoom in at the most interesting zones.

Getting ready to drill Green Springs

Contact has already received the drill permits for its Green Springs gold project in Nevada and plans to start drilling the high-priority exploration targets soon. Contact entered into an agreement to acquire Green Springs from Ely Gold in July (see later for the definitive terms), and its team on the ground hasn’t wasted any time to figure out which drill targets appear to be the most promising.

The interesting thing is that there appears to be an abundance of drill targets as Ely’s previous partner on the project, Colorado Resources (CXO.V), dropped the project due to its renewed focus without actually exploring the project to a full extent. When you see some of the historical drill results, it’s absolutely remarkable Colorado didn’t follow up on some very promising drill results before relinquishing its earn-in option.

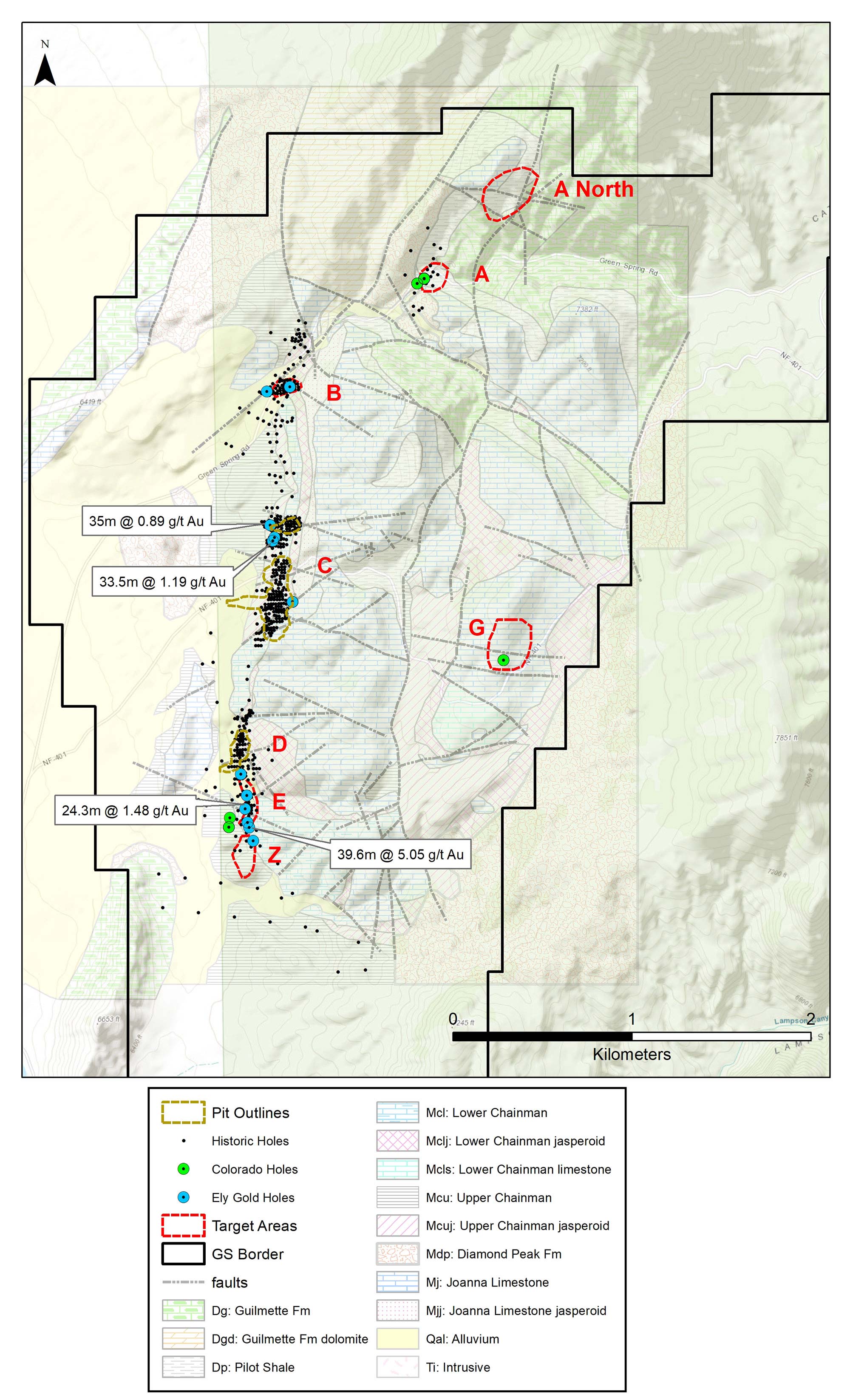

With intervals that are consistently around 40 meters in the A and E zones (whereby the A-zone has a lower average grade but where the mineralization occurs much closer to surface, while the E-zone contains thick mouth-watering intervals of 3.2-4.6 g/t), there seems to be some low-hanging fruit that could be picked from Green Springs. The next image shows some of the higher grade intervals:

Contact Gold has identified five high priority drill targets (in decreasing priority: E-A-C-B-Z), and has earmarked a budget for 2,000 meters of drilling on those targets, which could perhaps be further finetuned based on re-assaying the recently found RC sample splits from the project. Not only is double-checking the grades a good idea, re-assaying the material will also help Contact in further defining the type of mineralization (oxide/sulfide/transitional).

Drilling Green Springs doesn’t necessarily mean Contact Gold is giving up on Pony Creek (although we would love to see some more grade-meat on the bones there), but unlike Pony Creek, Green Springs should be drillable on a year-round basis while the winter season makes things a bit tougher at Pony. Additionally, Contact Gold is awaiting the approval of its Plan of Operations application for Pony Creek. This application should be approved by the end of this year and will allow Contact Gold to construct drill pads on a 150-acre disturbance area (compared to the areas of just 5 acres it has been able to work from in the past three drill campaigns during 2017-2019.

Re-assaying old chips yielded interesting results

Just to make sure Contact knows very well what it’s getting into, it decided to assay four holes that were drilled in 2015 to figure out if the encountered gold mineralization was hosted in oxide, transitional or sulfide rock. Contact Gold did have the chips from the 2015 drill campaign and although the type of mineralization should have been pretty clear, at least now it can say so with certainty.

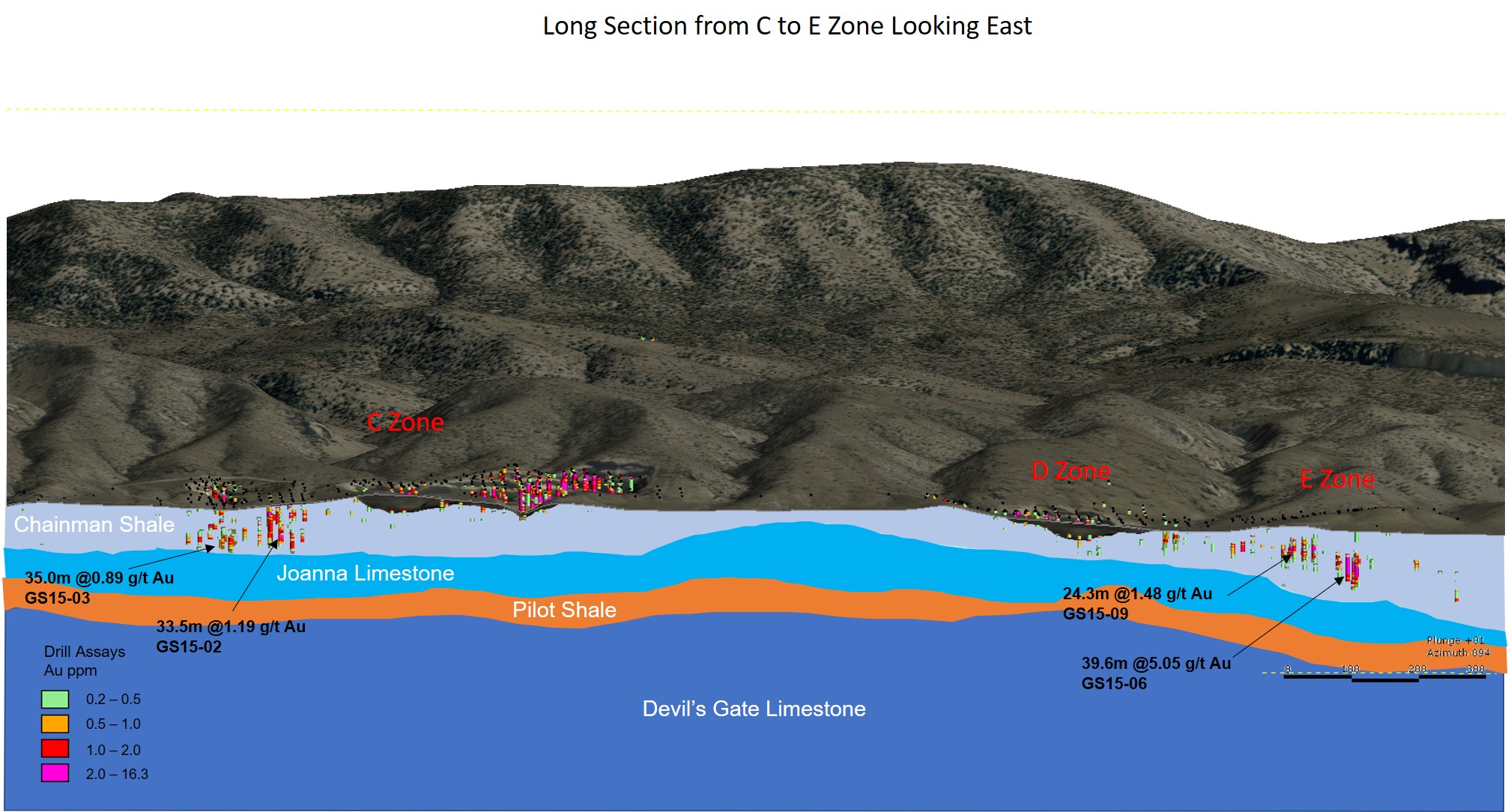

The four holes which were assayed showed solubility percentages ranging between 96% and 100%, confirming the intervals (which were quite thick and relatively deep in some places) are completely oxidized. And this puts the historical drill results in a whole new perspective as most of the historical drill results (35 meters at 0.89 g/t gold, 33.5 meters at 1.19 g/t gold) are excellent for an oxide deposit, but what was really surprising was to see the almost 40 meters with an average grade of 5.05 g/t gold as that grade is phenomenal for an oxide deposit. This immediately makes the E-zone a top priority for the upcoming drill program as both the E and C zones (all four holes that were tested for the oxidation state of the mineralization were from these two zones) are hosted in the contact zone between the Joanna Limestone and Chainman formation.

The C zone has been mined in the past (that’s where the 72,000 ounces of gold were recovered from two small and shallow pits), and Contact Gold has now confirmed there’s additional oxide mineralization between those two older pits.

Contact Gold is also keen on drill-testing the A zone of Green Springs, where the targeted mineralization is hosted in the contact zone between the Devil’s Gate Limestone and Pilot Shale rocks. A hole that was drilled on the western end of the C pit went quite deep and effectively intersected (low-grade) gold mineralization at a depth of around 200 meters which validates the exploration theory to search for gold in the Devil’s Gate & Pilot contact.

The E zone has never been mined and if we would extrapolate the current mineralized footprint of 350 meters by 100 meters and apply an average thickness of 50 meters (for now) and a specific gravity of 2.55, this specific target already contains approximately 4.5 million tonnes of rock. Just to put things into perspective: at 1 g/t gold that’s about 150,000 ounces. At 2 g/t gold we’re already talking about 300,000 ounces.

The earn-in terms

Contact Gold signed an agreement with Ely which allows Contact to earn a 100% stake in the Green Springs project, and the earn-in requirements appear to be quite favorable.

Upon signing the deal, Contact Gold issued 2 million shares and paid US$25,000 to Ely, and will be required to make payments of US$50,000 per year upon the first, second and third anniversary of the agreement followed by a final payment of US$100,000 on the fourth anniversary of the agreement (in 2023). The annual payments can be made in either cash or stock, and Contact has the option to immediately make all payments, thereby immediately securing full ownership of the project. Ely added a 1%NSR to the core claims which brings the total Net Smelter Royalty on those core claims (which cover the target areas and historic pits) to 3%.

Sitting down with the CEO

We also asked Matt Lennox-King, Contact Gold’s CEO to quickly discuss Green Springs, Pony Creek and the overhang of the preferred shares that were issued to Waterton as part of the acquisition of the Nevada properties in 2017.

About Green Springs

Some interpret your move to acquire Green Springs as an indication the Pony Creek project isn’t delivering the results you were expecting. But given the location of Green Springs, we mainly interpret your move as an attempt to make sure Contact will be able to explore on a year-round basis as the winter weather at Green Springs should be more favorable than at Pony Creek.

It certainly is more favorable to drill at Green Springs year-round as the roads are all upgraded to support mining activities and regional snowfalls are much lower. In addition, Green Springs already has a Plan of Operations in place making start-up drilling quick.

Pony has been very successful from an exploration standpoint, but while we wait for the Plan of Ops, Green Springs looks like an excellent opportunity not dissimilar to Pony Creek but with a higher-grade profile.

Since you published the solubility results for the 4 previously untested holes at Green Springs, your confidence level in finding a substantial amount of oxide/transitional mineralization must have grown. Can you elaborate on the near-term exploration plans at Green Springs? Are you in the process of securing a drill rig, and when will you start drilling?

We would like to start drilling in two weeks time (late October) and have already secured a drill rig. The exploration plan will be to drill outside of the previously mined areas in the A, E and in between the pits at the C Zone to offset some of the historical intercepts and test down to Pilot/Devil’s Gate contact where we believe gold mineralization may also occur. The Pilot-Devil’s gate has been intercepted by ~5 drill holes in previous drilling on the mine trend with gold in all cases. We believe this represents an excellent opportunity for new discoveries at GS.

Our exploration thesis at Green Springs is that there are strong gold grades and mineralization left unmined from the ‘80s that could connect between zones at the upper Chainman/Joanna contact, but there are also areas of gold mineralization (like at the A Zone) where gold is hosted at the lower contact (Pilot/Devil’s Gate), which presents a similar opportunity to Pony where historical operators did not explore for gold mineralization in a previously unloved part of the stratigraphy.

That is where we see the blue sky and we intend to test it with this first pass of drilling.

About Pony Creek

What’s the status of your application for the ‘Plan of Operations’ for Pony Creek?

The Plan is now entering the public consultation period, which lasts up to 60 days. With the 60 day timeline bringing us close to the holidays we should have this in hand early in the new year. We were delayed in getting the Plan in the original timeline thanks to the contracted wildlife survey group, which missed surveying for blue butterflies during Spring 2018 so we had to wait a full year for the Buckwheat bloom to conduct the survey. No Butterflies were found, as expected, and the BLM admitted it wouldn’t have made a difference to their decision. It was a frustrating delay but is now complete.

This is a typical timeline to complete a plan of operations in Nevada.

Could you briefly elaborate why this Plan of Operations is important, and how it will make your exploration activities at Pony Creek more efficient?

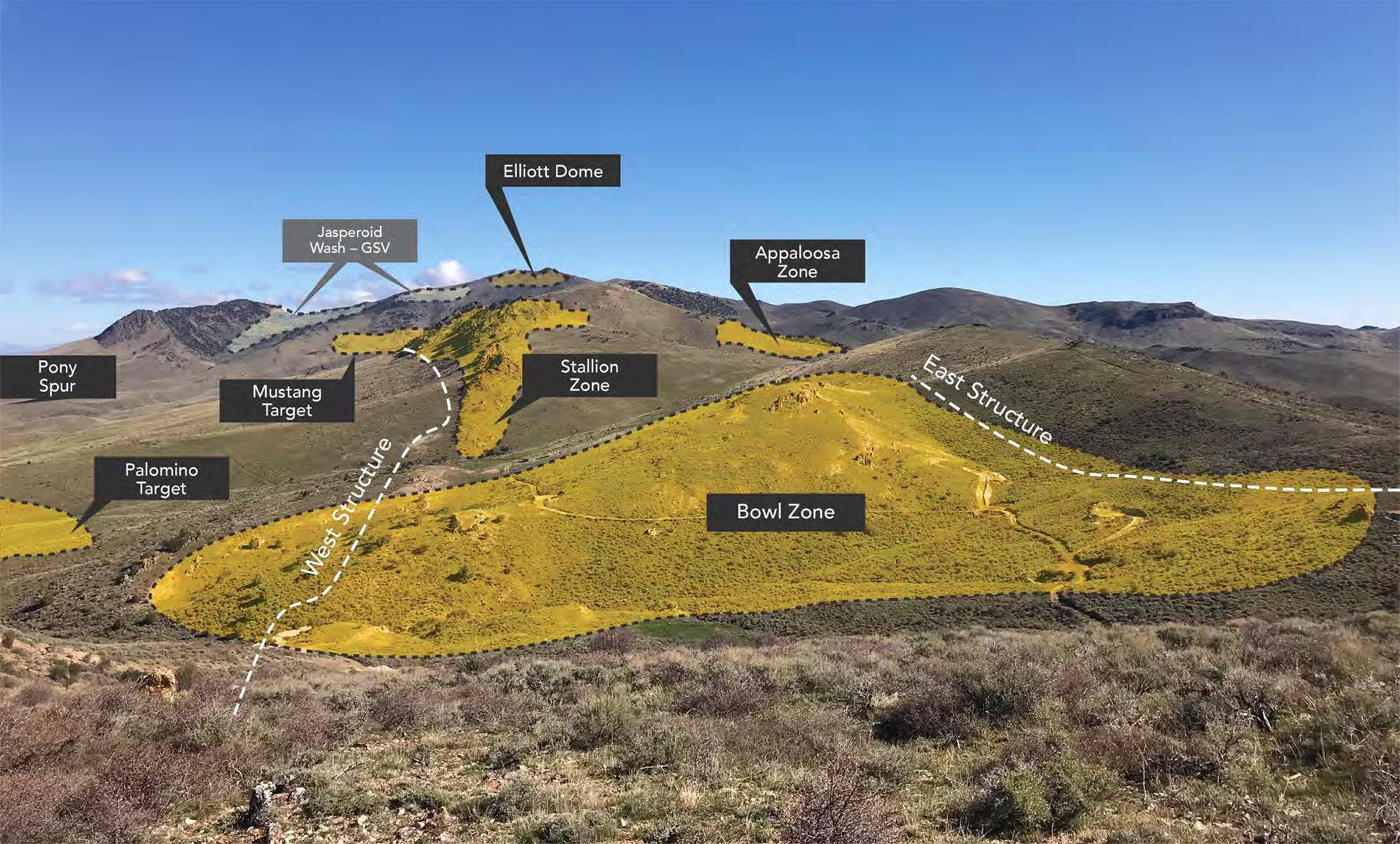

Up until now we have been limited to drilling on 5 acre Notice of Intent permits. This was sufficient for drilling the Bowl Zone and building roads to and ultimately making new discoveries at the Stallion Zone, but we are now maxed out on disturbance.

A lot of our large scale or Stallion sized undrilled targets (as well as substantial step out targets at Bowl and Appaloosa Zones) cannot be drilled until we have the Plan. The Plan will therefore be a turning point for Pony Creek as we will be able to step out and increase the size of the known gold zones and make new discoveries at Pony.

This year’s exploration program is over, so assuming your plan of operations is approved, what would you like to do at Pony Creek in 2020?

We would like to complete 10,000 meters of drilling, half split on the new, never before drilled, targets and the other half on the meterage focused on step-out targets at the Bowl and Appaloosa zone. The aim is to prove the historic resource areas can be expanded significantly and that Stallion is not a one-off discovery.

Corporate

One of the comments that’s popping up quite often is how Contact will ‘defend’ itself in case you are unable to repay the Waterton preferred shares in June 2022? That’s still a long way out and you have plenty of time to deal with those preferred shares, but is Contact able to ‘shield’ itself against the risk of Waterton taking all assets (including Green Springs)?

Waterton has no interest in getting these assets back. It is not their model. We are currently working with them to find a solve.

You currently still have around C$2.5M in cash, how long will this last you?

Currently closer to $2M. This could last us well into the new year if we do nothing. However, we are excited to get out and drill Green Springs in the coming weeks.

Conclusion

Now the winter will hit the Pony Creek project, Contact Gold will be shifting gears and will start to focus on the Green Springs gold project which should be explorable on a year-round basis. While the attention will temporarily be shifting to Green Springs, Contact Gold’s Plan of Operations application should be approved so it can drill its high-priority Pony Creek targets in 2020 when the weather and treasury allow Contact to do so.

But for now, all eyes will be on Green Springs where the excellent grades for gold oxide mineralization could draw quite a bit of attention to the story.

Disclosure: The author holds a long position in Contact Gold. Contact Gold is a sponsor of the website.