Although the gold price remains very strong, these aren’t fun times for exploration companies as despite the strong gold price the financing windows for exploration stage companies opens and shuts down without any advance notice.

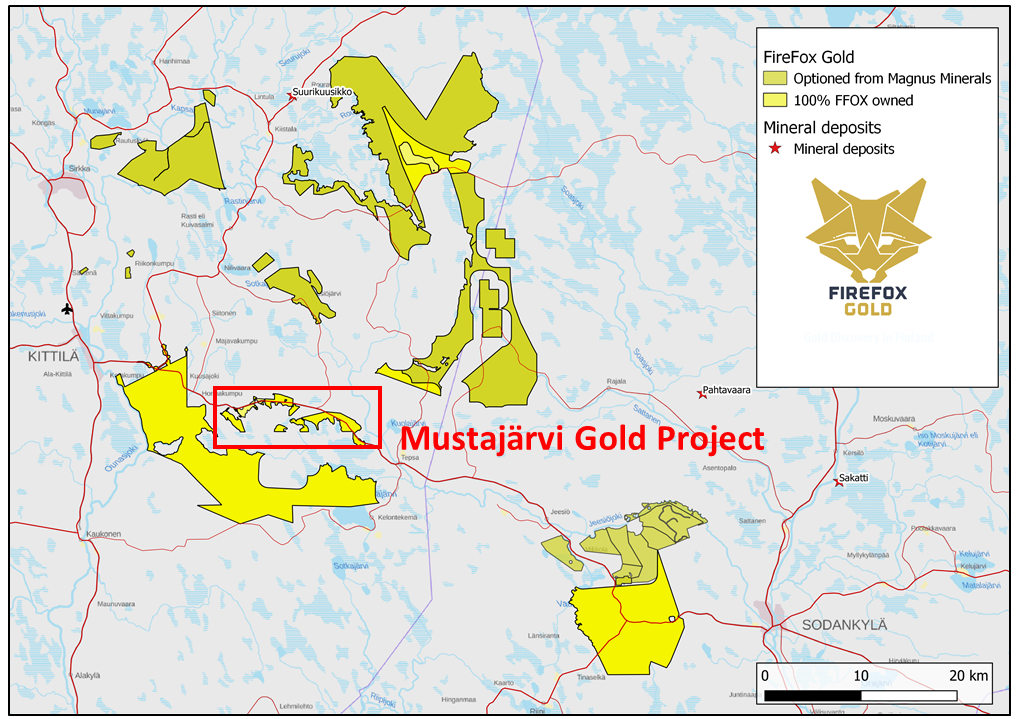

That makes it difficult for those companies to try to time capital raises as even discovering gold is no guarantee to attract funds. Firefox Gold (FFOX.V) is a Finland-focused exploration company with one of the lowest overhead expenses that we see in the sector. Notwithstanding this and despite having encountered more gold in the Mustajarvi drill program and more encouraging results from the Jeesio project, the share price of Firefox has been sliding. We will briefly discuss the recent exploration updates and have prepared a Q&A session with CEO Carl Löfberg.

Jeesio: sandwiched in between two land packages of Aurion

The market correctly interpreted the three hole drill program at Jeesio as a mixed bag: although the lithological structures appeared interesting, no significant gold values were intersected in the 446 meter drill program.

The program was focused on the Utsamo target, testing 180 meters of a 5 kilometer corridor of faults and shears that are part of the Sirkka shear zone, which is what controls most of the currently known gold deposits in Lapland. We were quite keen on this zone being drilled as the Utsamo target is located right in between the Risti and Launi East gold discoveries made by Aurion Resources (AU.V). There obviously never is any guarantee that gold-bearing mineralization continues between those two Aurion discoveries but it is self-evident the Utsamo target would be the first place one would go look for gold and that’s what Firefox Gold did.

Yes, the holes were empty and that’s underwhelming. But we also shouldn’t get overly pessimistic. These were just three holes drill-testing one specific zone that represents less than 4% of the encountered shear zone. Would we have loved to see gold mineralization in those holes? Sure. But these three holes don’t ‘kill’ the Utsamo target just yet. It provides the Firefox geologists with additional information on the geological structures at Utsamo and this will help them to refine and prioritize future drill targets.

As Petri Peltonen, the exploration manager of Firefox Gold mentioned, the three holes encountered and confirmed the targeted fault, and it remains possible the mineralized zones occur at a deeper level. This sounds like a reasonable explanation given the total amount of meters drilled in those three holes was less than 450 meters indicating an average depth of less than 150 meters per hole.

And the Jeesio project is much more than just the Utsamo target. Bordering the Launi discovery made by Aurion, the Katajaavara target is just two kilometers away from that discovery, and about 9 kilometers south of the Utsamo target.

Before the Katajavaara zone was covered by snow, the Firefox geologists have completed a bedrock mapping program which allowed them to identify several veins in several different locations at Katajavaara. Some of those vein zones were sampled and 11 of the 62 surface samples returned gold values exceeding 100 ppb and one of those eleven samples contained 6.4 g/t gold.

As the sampling program was completed right before the winter conditions covered Katajavaara with a layer of snow, there was no sufficient time for the geo’s to get back to follow up on these anomalous gold valued but the preliminary data based on the 2019 field season findings seem to indicate a 1.1 kilometer long trend of anomalous gold values along the Venejoki Shear zone, a thrust system on the southern end of the Sirkka Shear zone which was drill-tested by the three hole program.

These assay results appear to confirm the prospectivity of Katajavaara where previous exploration programs by Outokumpu in the eighties already confirmed the presence of gold-in-till anomalies on the south zone of the Katajavaara hill. Those historical till samples contained higher amounts of gold grains than what you would reasonably expect. According to Firefox several of the till samples contained over 50 grains which would be 10 times the default value of 5 grains for those sample sizes.

Mustajarvi’s drill results: there’s gold everywhere, and the focus should now be on grade and width

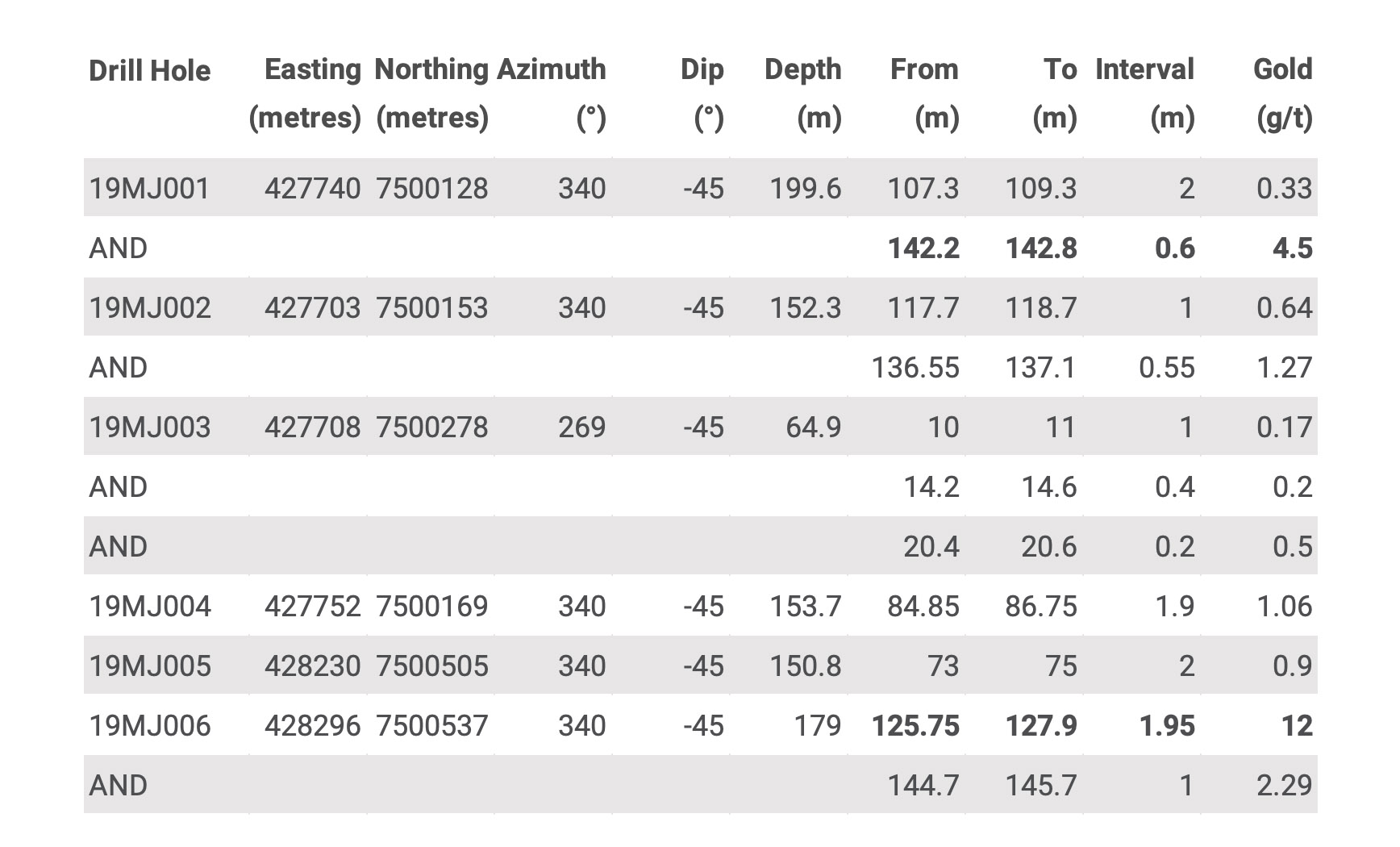

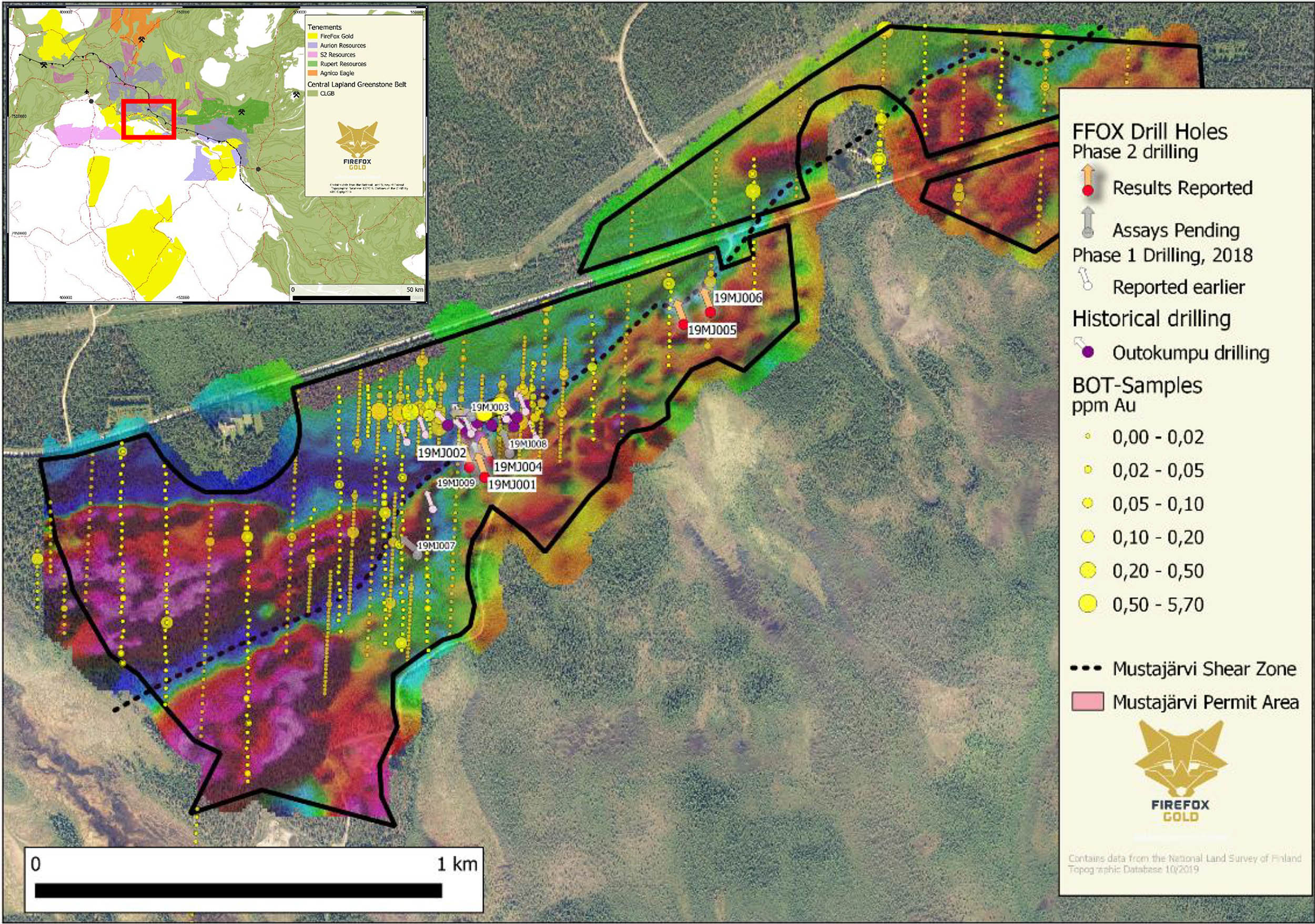

At the end of 2019, Firefox Gold has completed its Phase 2 drill program on the Mustajarvi gold project in Finland which consisted of nine holes. The results of the first five holes were already published in November, and the final four holes were announced in January.

Mustajarvi – Expansion potential at depth and along strike

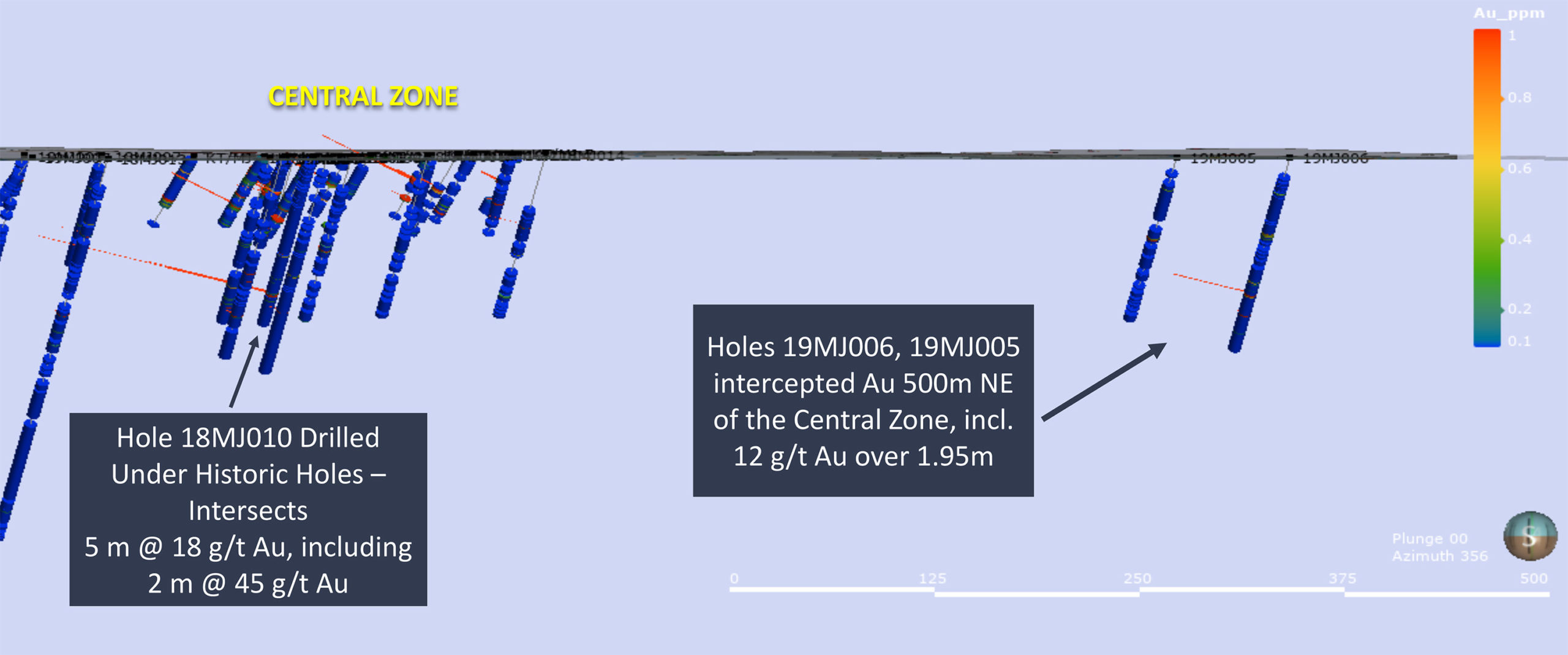

Perhaps a brief recap of the November assay results could be useful. Holes 1, 2 and 4 were designed to follow up on the high-grade result Firefox encountered last year (with the 2 meters of 45 g/t gold which was announced in January of this year) as the holes were aiming to follow the veins further down dip and along strike.

Hole 1 was drilled 25 meters down-dip and encountered 0.6 meters of 4.5 g/t gold (at about 142 meters down hole) on top of an anomalous but low-grade interval of 2 meters containing 0.33 g/t gold a little bit higher up in the hole. The second hole also intersected two distinct gold layers with 1 meter of 0.64 g/t gold and just over half a meter of 1.27 g/t gold 25 meters west of the high-grade discovery hole while hole 4, which was drilled 25 meters to the east, contained 1.9 meters of 1.06 g/t gold. So all three holes that were designed to follow up on the high-grade hit of last year did encounter gold mineralization but Firefox will have to chase the economic-grade mineralization.

The other two holes Firefox reported on are also very interesting as they were drilled approximately 500 meters towards the northeast of the Central Zone at Mustajarvi. The two holes were targeting the extent of the shear zone that does control the mineralization at the Central Zone and although hole 5 contained just 2 meters of 0.9 g/t gold, hole 6 appears to be another very interesting zone as the drill bit returned 1.95 meters of 12 g/t gold in what Firefox describes as ‘massive tourmaline-quartz-pyrite veining’.

Drill hole 8 targeted an area between the high-grade mineralization and the most eastern drill hole of the Mustajarvi Central Zone. It intersected anomalous gold grades (1 metre averaging 0.18 g/t Au). Drill hole 19MJ009 targeted the continuation of the high-grade mineralization of 18MJ010 about 50 metres to the southwest. It intersected three narrow intervals of mineralization: 1 metre averaging 1.07 g/t Au from 105–106m down hole; 0.5 metre averaging 2.36 g/t Au and 0.1% Co from 112.1–112.6m down hole; and 1 metre averaging 3.49 g/t Au between 145–146m down hole.

The leitmotiv at Mustajarvi is straightforward: there is gold on the property but the technical team still has a lot of work to try to tie everything together. As CEO Löfberg explained (see later), the main focus for 2020 will be on the Jeesio project.

Sitting down with CEO Carl Löfberg

Jeesio

Could you elaborate on the recent drill program at Jeesio and the subsequent announcement with the sampling results on the Katajavaara target? How will this influence your plans for 2020?

We will continue to focus on Utsamo and Jeesiö in 2020. The reconnaissance drilling in Jeesiö was the first pass over a much larger area altogether. I view the results as a technical success: Anomalous BOT samples. Interpreted near vertical fault zone based on Ground Mag and on IP. We hit a comparatively wide shear zone, and even though the BOT samples (‘bottom of till’ samples) were anomalous in gold, the about 25-metre thick fault gouge that was formed by extensive shearing, alteration and oxidation of both the arkosic quartzites and mafic-ultramafic rocks was not mineralized.

It did however contain abundant fragments of quartz-carbonate-sericite veins – similar to those associated with gold elsewhere in the region. This is exploration. We are in the early days.

As seen on the map in our presentation on slide 11. We hit 180m with 3 holes. The overall area is kilometers wide.

The current plan is that we will expand the ground magnetic surveys while completing a more detailed mapping program as soon as the snow melts, perhaps accompanied by an additional bottom of till sampling program to get an even better understanding of the Utsamo target. At this point we also can’t rule out doing some trenching in the most prospective areas in order to define and refine new drill targets that we could follow up on with a drill program either in 2020 or 2021.

Mustajarvi

In January you also announced the final drill results of the 9 hole drill program on the Mustajarvi zone. Although all nine holes did contain gold mineralization but there was no real ‘barnburner’ hole. How has this nine hole program helped your technical team to finetune its interpretation of the gold bearing structures at Mustajarvi?

We have gained more information and even though we hit gold, the current plan for 2020 is to concentrate on Utsamo and Jeesiö, to a minor part on other areas. With the current treasury, we have no plans of drilling Mustajärvi in 2020 and will focus our resources on Jeesiö.

Encountering gold in every single hole is encouraging though, and you have now expanded the strike length to 900 meters. What are your next steps to further refine your follow-up drill targets at Mustajarvi?

The interpretation of the 2019 data is still ongoing. With a larger land package, the current idea is to concentrate mainly on Utsamo and Jeesiö in 2020. Mustajärvi has all the permits in place and it will be easy enough to return there any time. We have now hit gold over 900m but the current interpreted trend is over 2 km long. It remains a good prospective area, but again, we currently have no plans to drill Mustajarvi in 2020.

The technical team & Background

Perhaps we should also highlight your team on the ground for a minute. You were able to announce the appointment of Timo Mäki to your board of directors last year, and he is a household name in the Finnish mining industry. But he is not the only hot-shot in your board as Petro Peltonen also has an excellent reputation. Could you perhaps explain why these gentlemen were so keen on joining the board of Firefox Gold and attach their name to a nanocap exploration company?

Everybody knows everybody. I have known Petri Peltonen for a number of years and I would think we have mutual respect for each other. It was Petri Peltonen’s company who sold Mustajärvi to FireFox. I have known him from the times when he managed “half of base metal exploration in Lapland” as the Exploration Manager for FQM in Europe. One thing lead to another and as entrepreneurs we joined forces and he has willing to take the position of exploration Manager in FireFox from the get go.

I have started Magnus Minerals 14 years ago with Alf and he is a close friend, a young entrepreneur in his 80s. For him not to be involved would be strange. He is a globally renowned geochemist and a fantastic human being. On a personal note I admire him and hope I could be a quarter of what he is and be in the business for as long as he has been.

As the Central Lapland Greenstone Belt is now one of the hotter exploration regions in a Tier-1 jurisdiction, how does Agnico-Eagle Mines react to the presence of several junior exploration companies in ‘their’ neighborhood? Are they keeping tabs on everyone and everything to keep their fingers on the pulse? Or isn’t Agnico’s exploration team too interested in the more greenfields exploration programs in the greater Kittila region?

Agnico’s recent purchase of 9.9% of Rupert Resources (RUP.V) for C$13M tells you quite a bit.

There are 4 gold majors in Finland now. (Agnico-Eagle is just one of them, Kinross Gold (KGC, K.TO), B2Gold (BTG, BTO.TO) and Newmont Mining (NEM) are also present in the Lapland Greenstone Belt). 5 years ago there was only 1. I would tend to think that all the majors are rather keen on following all the juniors (Aurion, Rupert, Firefox and S2 Resources) since the juniors have about 80% of the ground. I would tend to think that additional transactions between the majors and the juniors could happen in the not too distant future, just based recent activity in Finland. (Kinross bought 9.9% of Aurion in 2017 with 15M. Aurion has a JV with B2Gold and a JV with Kinross as well.)

Also, the Fraser study, published at the end of last month has put Finland back on it rightful place again as the country was ranked second overall in Investment Attractiveness and first in Policy Perception. The strong and reliable regulatory framework in Finland is an additional bonus for companies looking to secure prospective projects in safe jurisdictions.

The financial situation

As of the end of September you had a working capital position of just over C$0.5M but you have just completed a drill program so your cash and working capital position are probably getting quite low. Fortunately your drill contractor accepted shares in lieu of a cash payment for its drilling services to the tune of C$333,000 for 2.52M shares at a deemed price of C$0.132 per share. Could you elaborate on why your drill contractor has accepted payment in shares?

Our group has worked with Kati (our drill contractor) for decades. The company was established 40 years ago and they have drilled pretty much everything in Finland, from the Kittila mine with dozens of Canadian and Australian Juniors, with all the major mining companies etc. We are the first listed company ever where they wanted to have a stake. My feeling is that these gents are business smart. They know the potential. As said, they have drilled e.g the Kittilä mine pretty much from get go.

Do we need to fear those shares hitting the market once the final hold period expires later in March?

Based on the discussion I have had with the Kati managers, not at all. They have told me that they are longer term share holders.

How is the appetite for junior mining investment in Finland these days? Do you see an increased interest from asset managers now the gold price is trading firmly above $1500-1600 again? Or is there no real interest in exploration stage companies?

There is no risk capital for exploration in Finland and that is the main reason why the companies here are listed in Canada or Australia, sometimes London. We are slowly educating people (Petri Nousianen and myself mostly ) about this with a number or meeting with Fund managers and other pertinent people but it is rather new to all Finnish investors. It is a long term process and will very likely take a few years.

There has never been any institutional investors for exploration in Finland. We are rather proud that we have Finland’s and Scandinavia’s first Silver and Gold Fund as a shareholder (https://www.zenito.fi). 1.5 years ago they said that they are investing in Mid tiers and some majors as although they wanted exposure to precious metals, they had no expertise or knowledge of the exploration scene and thus stuck with larger companies. This changed in July 2019 when they participated in a private placement of a junior exploration company for the first time ever and in the fall in Sep they participated as well. They are the only fund who is in the space in Finland. We will keep on educating Fins about the exploration industry, but as said, it will be a long term process.

Conclusion

Finding more gold at Mustajarvi is very encouraging, but the market was disappointed by the lack of gold in the three-hole drill program at Utsamo, as that part of the Jeesio gold project is located right in between the two discoveries made by Aurion Resources.

Firefox Gold became a publicly traded company less than 18 months ago and has seen its share price slide by more than 80% from the C$0.40 the IPO was conducted at. Not only does this result in frustration and an even stronger desire of the entire team to prove the market wrong, the risk/reward ratio has improved. Even if you would discard the gold finds at Mustajarvi, Firefox’s current market capitalization of just around C$2.5M is perhaps one of the cheapest call options on extensive land packages in a hot exploration district you could find these days.

Disclosure: The author has a long position in Firefox Gold. Firefox Gold is a sponsor of the website.