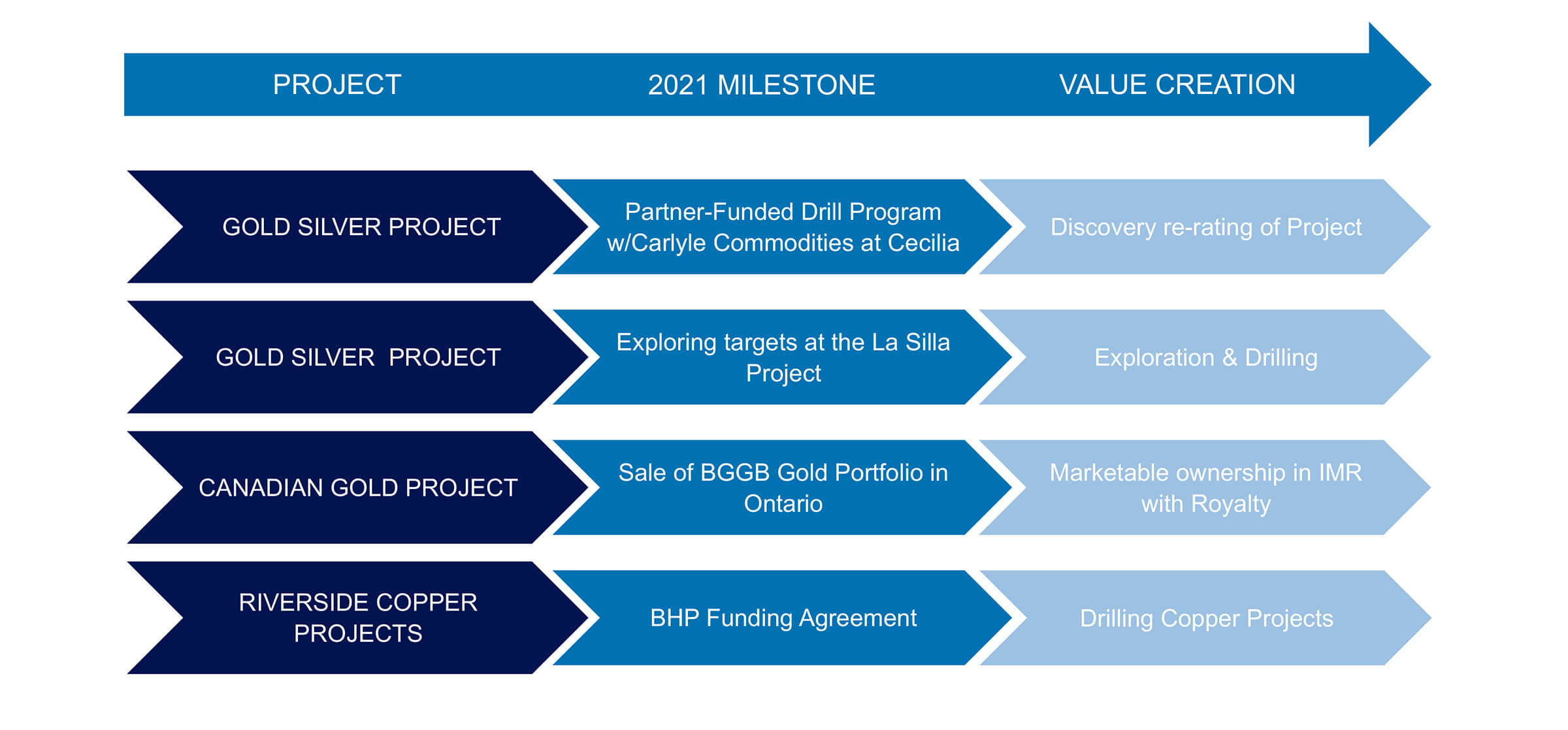

It has been a while since we last discussed Riverside Resources (RRI.V, RVSDF) and the project generator is firing on all cylinders these days. While the original focus of the company was on precious metals in Mexico, Riverside has been leveraging its knowledge, brainpower and artificial intelligence to explore for copper as well, and attracted world-famous BHP (BHP) as a joint venture partner.

The past few years, Riverside also spent some more time and effort in Canada where it was able to stake prospective land in Ontario. A first land package was recently optioned off to iMetal Resources (IMR.V), but the company is already working on the High Lake project area where it has outlined three projects of specific interest.

John-Mark Staude and his team have been very busy the past few months and quarters, and this is an ideal moment to catch up with him to keep our fingers on the pulse.

Discussing the Mexican Gold and Copper Properties

Mexico Gold

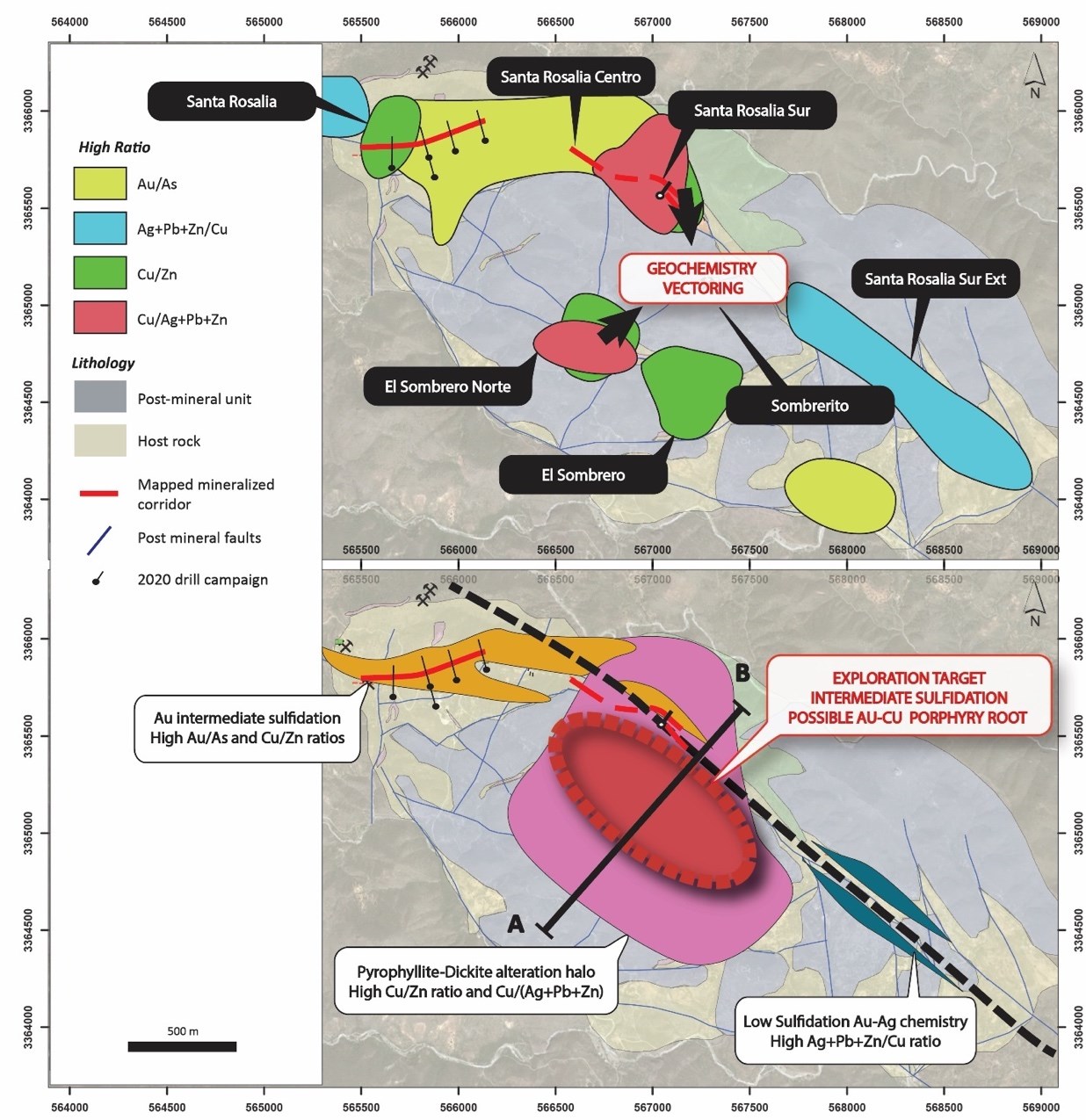

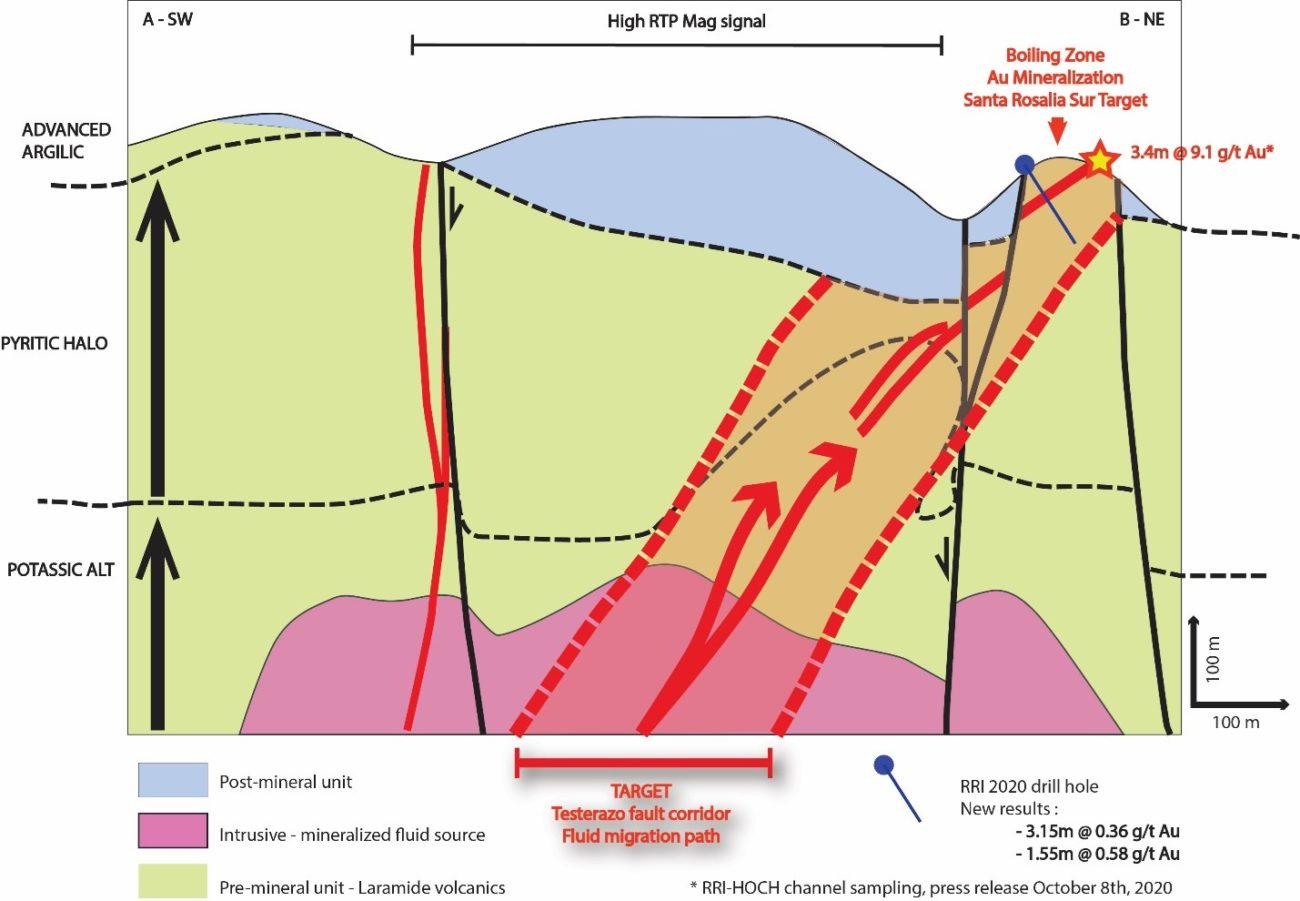

Riverside released drill results from a hole you drilled as a proof-of-concept hole at the Santa Rosalia Sur target on the Cuarentas project. Could you elaborate on why the assay results from this one hole are important, and how this changes your interpretation of foremost Santa Rosalia Sur, but perhaps also the entire Cuarentas project?

The Santa Rosalia Sur drilling is the first hole into a newly interpreted upper part of a porphyry copper system that has never been drilled. The intersection of gold in this vein with traces of base metals is a positive indicator along with the porphyry Cu style hydrothermal alteration mineralogy consistent with a new target that has large scale, favorable logistics, and potential for a possible new porphyry Cu find. The drilling shows the first ever drilled intermediate sulfidation gold-silver vein which fits in context with the interpretation of upper portions of a porphyry Cu system. This drilling really opens up the district and our property is a prime location for further drilling. Given that there are giant porphyry copper mines to the north and east of Cuarentas at Cananea and La Caridad in similar Laramide age volcanic host rocks this project is a priority for further follow up exploration that could lead toward a major new porphyry copper-gold discovery although it is still very early stages the district is large. This changes the Cuarentas project from just vein targets to now expand the potential for new finds here at depth.

We visited the Cecilia project with you a few years ago, and the project has now been optioned to Carlyle Commodities (CCC.C). How are the exploration activities going at Cecilia? Did Carlyle meet the required C$750,000 in exploration expenditures that it had to meet by July 15th?

Exploration activities at Cecilia are on track with Carlyle making required payments and investments in the ground which have been productive at a district scale while certain local zones have been drilled as well. From a district-scale point of view, the combination of Riverside operating and working with Carlyle funding has been able to complete geophysics with airborne magnetic survey as well as soil and rock and channel geochemistry which has developed at least 10 target areas with three now seeing initially drilling and all three warranting further drilling as positive results came from the first drilling on San Jose targets and nice intercepts were found from the breccia zones. We are looking forward to continuing work at Cecilia and are pleased to be shareholders in Carlyle thanks to certain share payments in combination with the cash payments.

Looking at the financial statements of Carlyle, the company was almost out of cash as of the end of May which means its earn-in schedule may be under pressure. Are you willing to be flexible on the earn-in requirements as Carlyle needs to make cash payments and continue to make certain minimum exploration expenditures?

Carlyle has made all payments and is looking to progress, we are pleased with the exploration results and believe there are quite a few large-scale targets that are valuable to go after.

Is there anything going on at the Tajitos and the La Silla projects these days?

Yes. At Tajitos, Fresnillo (FRES.L) is quite active with their pre-mine planning work and we are delighted to be well located inside of the areas that have mineralization. We have been in discussions and own the property outright such that a royalty and a transaction are ways to capture value from this area that Fresnillo is working readily on. Riverside has completed self funded exploration work and progressing targets at Tejo and Tajitos concession blocks in advance for potential future programs and transactions.

For La Silla, we have completed new field work and interpretative data synthesis. During the recent field program some rock chip gave results of 6.1 g/t gold as announced in news release and other work on the property. We identified over 2km of vein extensions from three vein systems on the property. This is important because we have identified two concession blocks which have two historical mines (El Roble and Ciruelos). The program as a whole is seeking to identify target extensions along strike using the two historic mines as anchor points. The high grade vein structures are west of Vizsla Silver (VZLA.V) and south of Prime Mining (PRYM.V) in a well endowed mineralized segment of the western foothills rising from the Pacific Ocean eastwardly toward the Sierra Madre. La Silla has been delivering new veins, good underground and surface results and we have been interacting with others in the area on the project.

La Silla Project in Sinaloa, Mexico

Mexico Copper

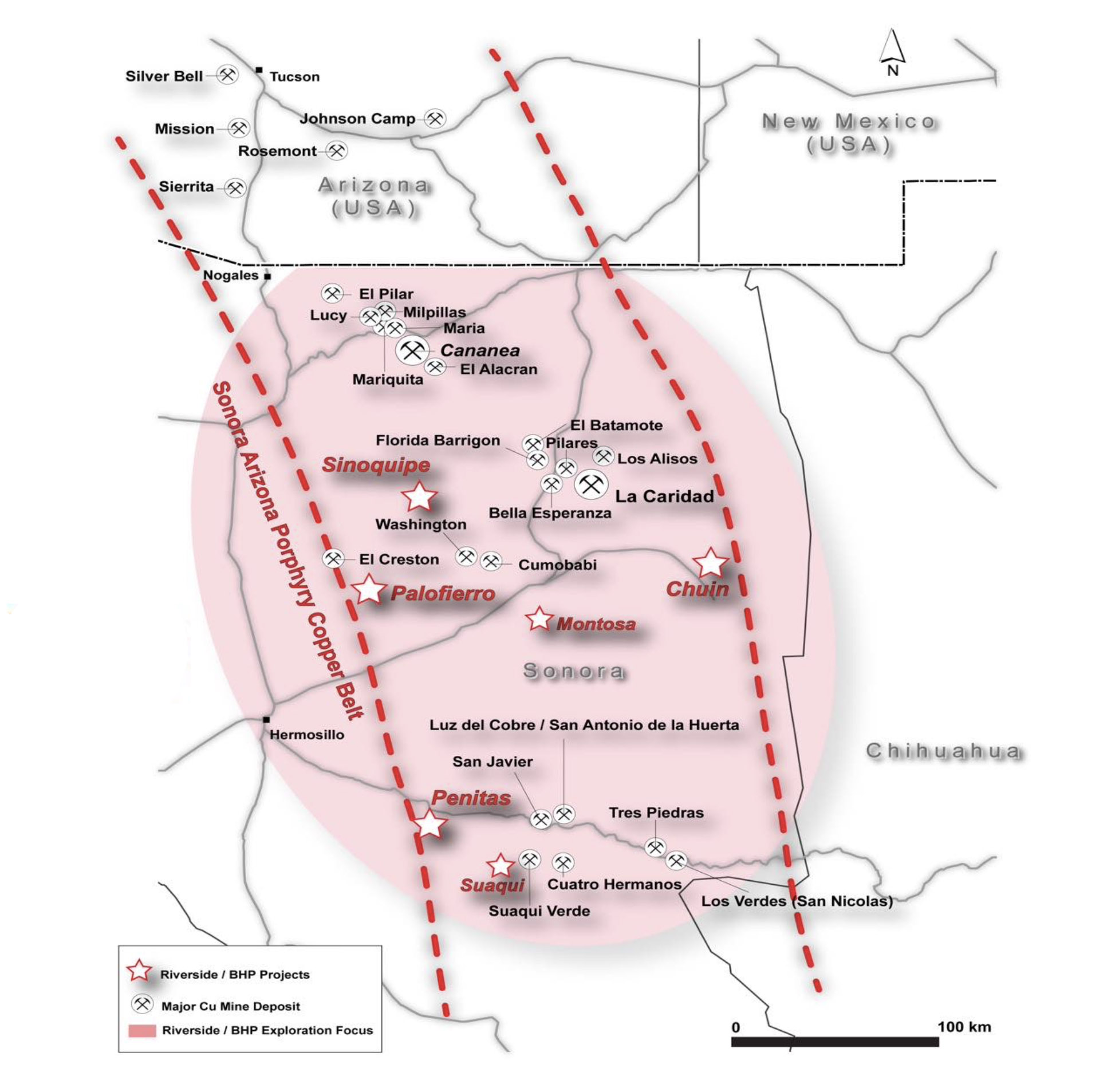

You recently had some good news from the copper front as BHP has increased its contribution to the copper exploration joint venture as US$5.4M will be spent on advancing four copper projects that are already part of the joint venture. This brings the total budget to almost US$7M considering an additional US$1.3M had already been earmarked for generative work. So two of your projects will be drilled soon for a total of 9,000 meters of drilling, could you elaborate a bit on the Chuin and the Palofierro projects? How did you find these projects and what made you decide to initially stake them?

Yes, the additional funding from BHP has been very helpful and during the COVID times Riverside was able to work with our local mineral exploration operating presence in Sonora, Mexico to progress quite a few projects along the discovery pipeline including those we had staked through using our machine learning, Mexico databases, integrated with BHP’s proprietary ‘fertility’ and prospectivity filters. Riverside has applied these filters now on over 100 project sites in Sonora and through this approach, a handful have risen to the top while a second group of projects now also shows promise. We see a long term pipeline and collection of identified areas for copper discoveries in Sonora shaping up well.

We have worked to validate some of the fertility factors and reprocessed our internal data coming up with stand out areas including Chuin which we then staked and Palofierro which we won the license rights from the Mexican government through their formal lottery and granting system.

The go forward programs also include Magneto Telluric geophysics for identifying large scale potential mineral systems beneath relatively shallow cover. We completed gravity surveys which helped us model the thickness of post mineral lowly consolidated gravel cover and this gives us focus now for potential drilling through these covers as well as through post-Laramide volcanic cover. Similar to discoveries being made in Arizona, here immediately to the south Riverside will be moving ahead with our programs during the rest of 2021 and through 2022.

When will drilling start on these two projects, and when do you anticipate to be in a position to publish assay results? As you are the operator, may we assume you will have immediate access to the assay results, and you won’t run into the problems other small companies partnering with majors have encountered?

We are delighted to work closely with our partner BHP and being the operator allows us to push things ahead and we have been able to share the results in a timely manner. Our shareholders will be updated about the drilling as we progress and no dates have been set although we see the steps coming along to make sure all is in place. We will have exploration results from the geophysics during 2021 and the drilling results will come and the planned drill programs are fairly robust which is exciting for Riverside.

You now have six copper prospects in your pipeline of which two are drill-ready. Are you still looking to add grassroots projects to the joint venture portfolio?

Yes we continue to upgrade, adding more projects and progressing those we have, some will be decided upon after we finish the well funded geophysics and we like the opportunities we have been working on as well as those we have and are moving forward on all fronts. The total budget from BHP plus other partner spending exceeds over >C$10,000,000 with most of that coming through BHP and with Riverside having a cash position of >C$4M and shares of other companies worth >C$1M we are in a great financial shape and will be able to do a lot of work. Also keep in mind Riverside receives management fees for operating the programs which lowers our burn rate as well. So there’s a lot of advantages when you partner up with a strong company.

At what point do the projects move to the ‘project operation’ phase which would trigger a US$200,000 bonus payment to Riverside?

The drilling currently as planned is target development stage and potentially could shift to target testing and trigger the US$200,000 budget on 4 properties in line right now with Chuin and Palofierro along with Sinoquipe and Penitas being the most likely candidates currently.

If you are making 10% as an operator fee on the US$6.7M budget this year, does this mean you may receive close to US$700,000 in operator fees this year? That would be a big help for your annual budget, wouldn’t it?

Yes we have had good success on the financial side this past year and will again as we wrap up our 2021 financial year this month (our financial year ends in September). We have been working hard to bring along the top opportunities and much of our staff time and focus is on the BHP copper program in Mexico thus the C$1,000,000 of income helps the balance sheet of Riverside as we are currently in a position where our market cap C$12,000,000 is less than our value of cash+shares+allocated funds ~C$15,000,000. So Riverside is in a prime position for success in the coming months and on-going.

Ontario

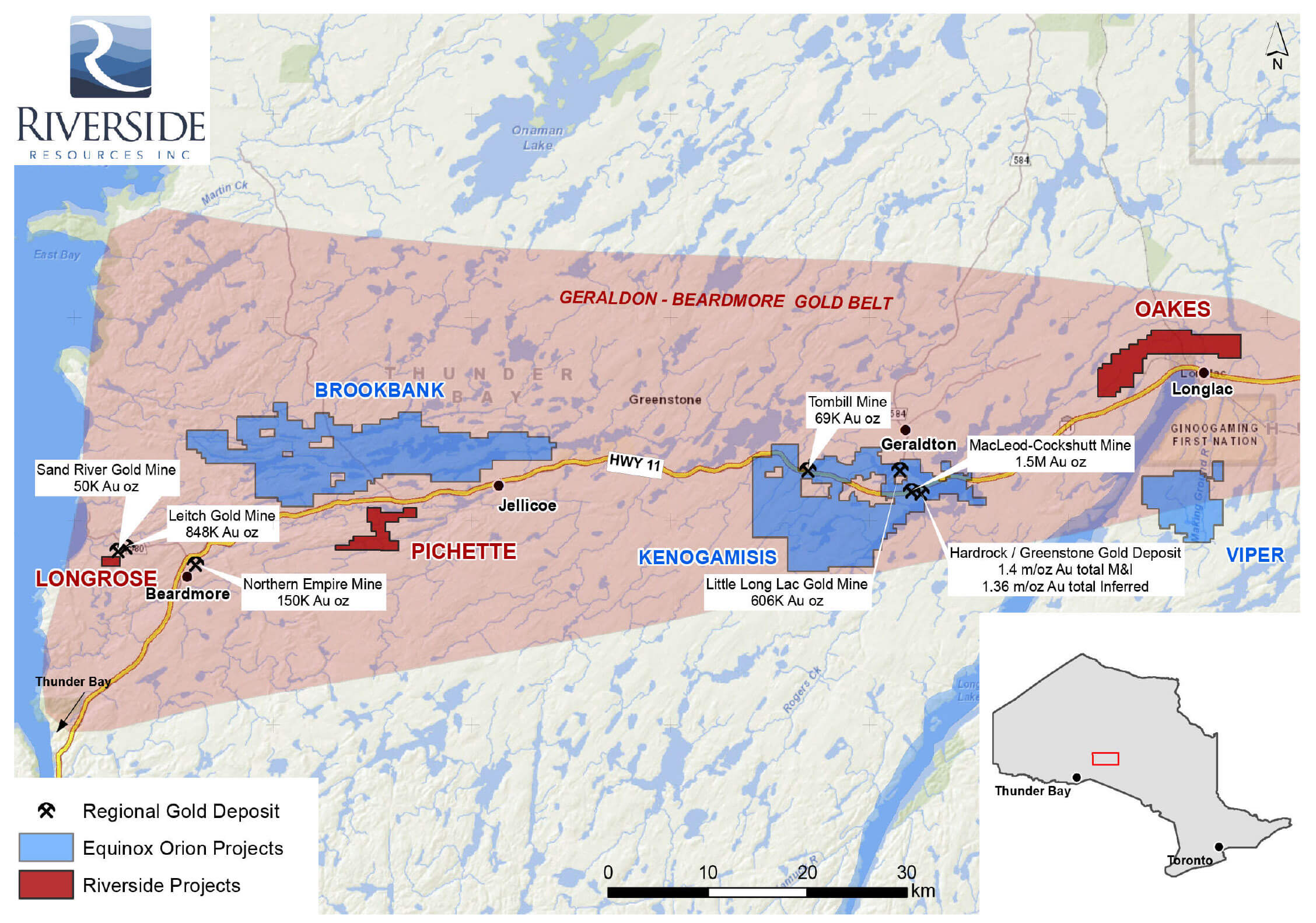

Let’s talk about your decision to accept iMetal Resources (IMR.V) as your partner on the initial three projects you staked and advanced in Ontario. What made you decide to partner up with them?

In a simple word, synergy. What we were looking for the three Ontario projects in the Beardmore Geraldton Greenstone Gold Belt near Equinox Gold’s (EQX.TO) Geraldton Gold Project was a dedicated focus. Additionally, Gowganda, south of Kirkland Lake where there are neighboring large gold resources controlled by other companies is an interesting exploration region and the mineralized structures come onto iMetal Resources concessions. So putting these portfolios together gives Riverside shareholders greater upside from both Riverside concessions and iMetal mineral properties as we received shares in iMetal as part of the consideration.

We were also prioritizing speeding up the activity on our Geraldton Belt projects and with the addition of the iMetal investment commitment the Oakes project has seen an infill and expanding Induced Polarity geophysical program. We are pleased with those results coming along and we choose iMetal through their positiveness to let us participate with them and bring our team and projects into the company.

How much did you spend on the projects during your tenure before entering into an agreement with iMetal?

Riverside completed work on all three projects with field programs and exceeded C$500,000 of investment which we are more than doubling in payments to us, plus having royalty that is uncapped and programs are progressing well.

Last year, you staked 230 square kilometers in the High Lake Greenstone Belt in Ontario and in a recent update you have defined three high priority target areas. Could you perhaps briefly elaborate on these three zones and how they grabbed your attention? How will you decide on prioritizing the targets, or will you be able to advance all three at the same time?

The High Lake Greenstone Belt has two drilled non-compliant gold resource bodies and quite a few occurrences such that Riverside was able to stake a large open ground portion with moderately good road access from the Trans Canada Highway which has allowed field work to progress over the past year leading to our technical field geologists focusing in on three property blocks which show good promise for further gold exploration. The combining of government data including magnetics, mapping, geochemistry and historic prospecting with Riverside’s own generative exploration continues to bear fruit and we see each of the now 3 targets having similar path forward with more detailed field work at all three being able to be progressed and the highest current priority being the Electrum area adjacent to one of the resources and Riverside having the structural geologic projection.

Do you still see more possibilities in Ontario to stake additional claims? Do you have a ‘secret sauce’ to find these unstaked prospects?

Yes we have been working on our data processing, integrating exploration layers and completing focused field work and are hopeful to work up additional target areas. The 3 High Lake Greenstone properties like our 3 Geraldton Greenstone Belt properties gives us 6 properties generated over the past two years and the team is moving ahead with continued Ontario exploration. We are pleased to have a strong local team and fine communication with our GIS and data processing team such that we are pleased to see the potential for continued generative and collaborations.

Corporate

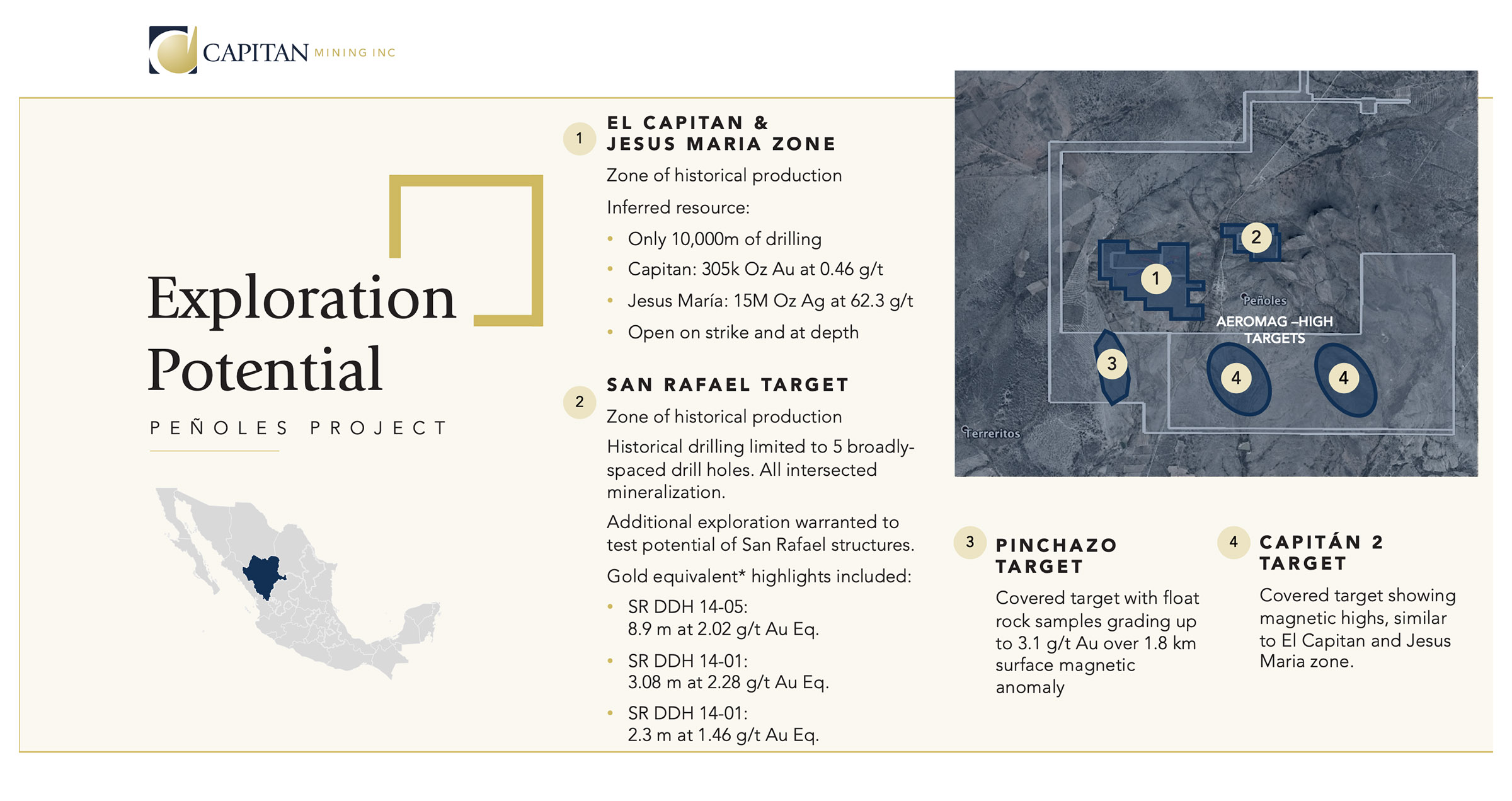

Last year (time flies!), you successfully spun out the Penoles project in Capitan Mining, which has now been operating as a separate entity. We have met CEO Alberto Orozco before and he appears to be a very knowledgeable man. But of course, Riverside team members still provide input on the exploration activities and targeting. How is the working relationship and symbiosis between Riverside and Capitan?

Alberto Orozco is doing an excellent job and as I am a large shareholder and the Chairman of the company I am pleased to see the shares well supported and the results from the Capitan team coming along as planned expanding and consistent drilling results. Capitan has an excellent field team with members who have worked with Alberto previously including at Argonaut Gold (AR.TO) in Durango, Mexico where they built the San Agustin Mine and also worked expanding the El Castillo Mine. This team of mine developers and builders is perfect for the stage of the Penoles Project and moving forward toward expanding the resources is the right direction for the asset. Riverside and Capitan use the same administration teams for Canada and Mexico but technically are working separately and have an open line of communication.

What are the next steps for Capitan? What news flow may we expect in the near future?

Capitan is progressing a second 6,000m drill program which is fully funded and we are pleased the drill results keep being announced. Using a single RC drill rig, the company can effectively move ahead with testing different areas and publishing drill results for a future updated resource, so we expect a continuous news flow.

As of the end of March, Riverside had about C$5M in working capital, including the short-term investments, which also includes share payments from optionees. The share price of Arizona Metals has recently gone through the roof adding about C$0.6M to the value of your marketable securities. May we assume you’ll be monetizing the remainder of this position soon?

Riverside is pleased to be a shareholder of Arizona Metals although we hold shares and are excited for the Kay Mine project and the Sugarloaf Peak gold project where we have a 2% NSR.

Oakes Gold Project

Longrose Gold Project

You had some bad luck with the La Silla project as within a 14-month time frame two optionees could not make the requirements and the La Silla agreement had to be terminated. Is there a project-specific problem? A Sinaloa-problem? Or just bad luck?

Riverside really likes the La Silla project and we want to make sure the project is moving ahead with the enthusiasm and potential that we see. We have been in the field as Riverside, see the success of some neighbors and are delighted to own the concessions with titles and ready to push things along. La Silla has good access and can be rapidly drilled and has high-grade gold right on surface including in small vein mines that outcrop and shallow excavations.

Conclusion

Riverside Resources is advancing the project portfolio on three fronts now and we are looking forward to seeing some actual drill results from the copper exploration program. Of course we shouldn’t expect Riverside to ‘strike it rich’ in the first few holes, but BHP providing more cash to accelerate the exploration activities is a very clear positive signal.

As Riverside and its partners are advancing several projects at the same time, we expect to see a continuous news flow over the next few months.

Disclosure: The author has a long position in Riverside Resources Inc. Riverside Resources Inc. is a sponsor of the website. Please read our disclaimer.