Riverside Resources (RRI.V) has been working to update existing shareholders and attract new shareholders for a little while now with news flow during December and outlining plans in January 2020 for this coming year. The company remains focused on programs in Canada and Mexico. In Mexico, Riverside entered into an exploration funding agreement with BHP (BHP) over the summer, searching for large copper discoveries that could lead to new deposits. Last year as well, the company entered Canada where it staked claims on an interesting greenstone belt that has been underexplored in the past few decades and management in Riverside knew of as prospective and near past-producing high-grade gold operations.

But no matter what Riverside tried, the market simply didn’t seem to care for the early-stage exploration, the additional diversification into Canada and copper where the world’s largest mining company fully funding and partnering for exploration by working with Riverside. Now perhaps that will change once the word about the SpinCo gets spread. Riverside is planning to spin off the subsidiary that holds the Penoles gold-silver project (currently 100% owned by Riverside) into a completely new and independent company that will become publicly traded, whereby existing Riverside shareholders will end up owning shares of the SpinCo.

Exploration success at Los Cuarentas

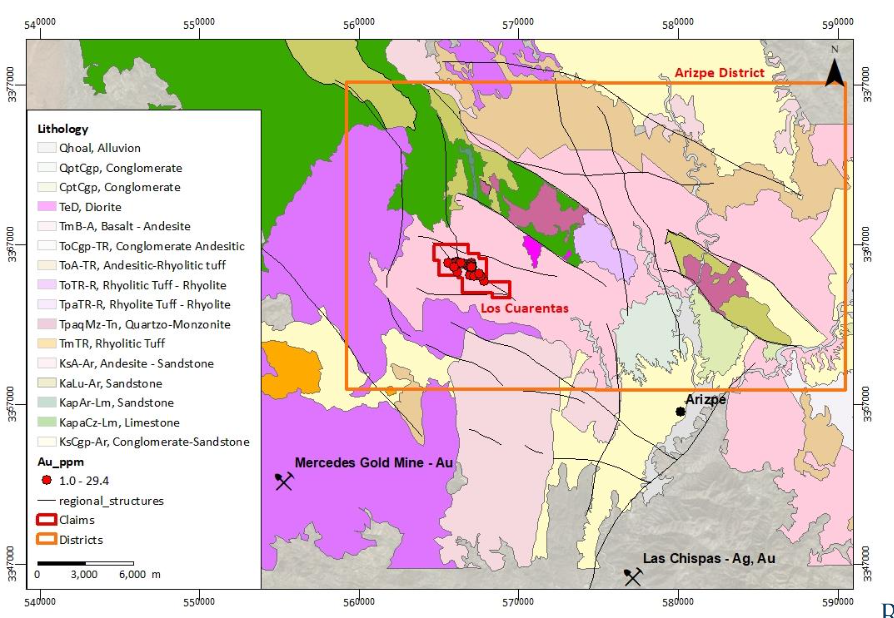

As Los Cuarentas Mining Area is located in the shadow of several other high-impact mines and projects with well-known properties like Silvercrest’s (SIL.V) Los Chispas project which contains over 100 million ounces silver-equivalent (predominantly in gold-silver mineralization) in the most recent resource estimate and the operating Mercedes mine owned by Premier Gold (PG.TO), it is an ideal spot to go look for additional mineralization at Los Cuarentas.

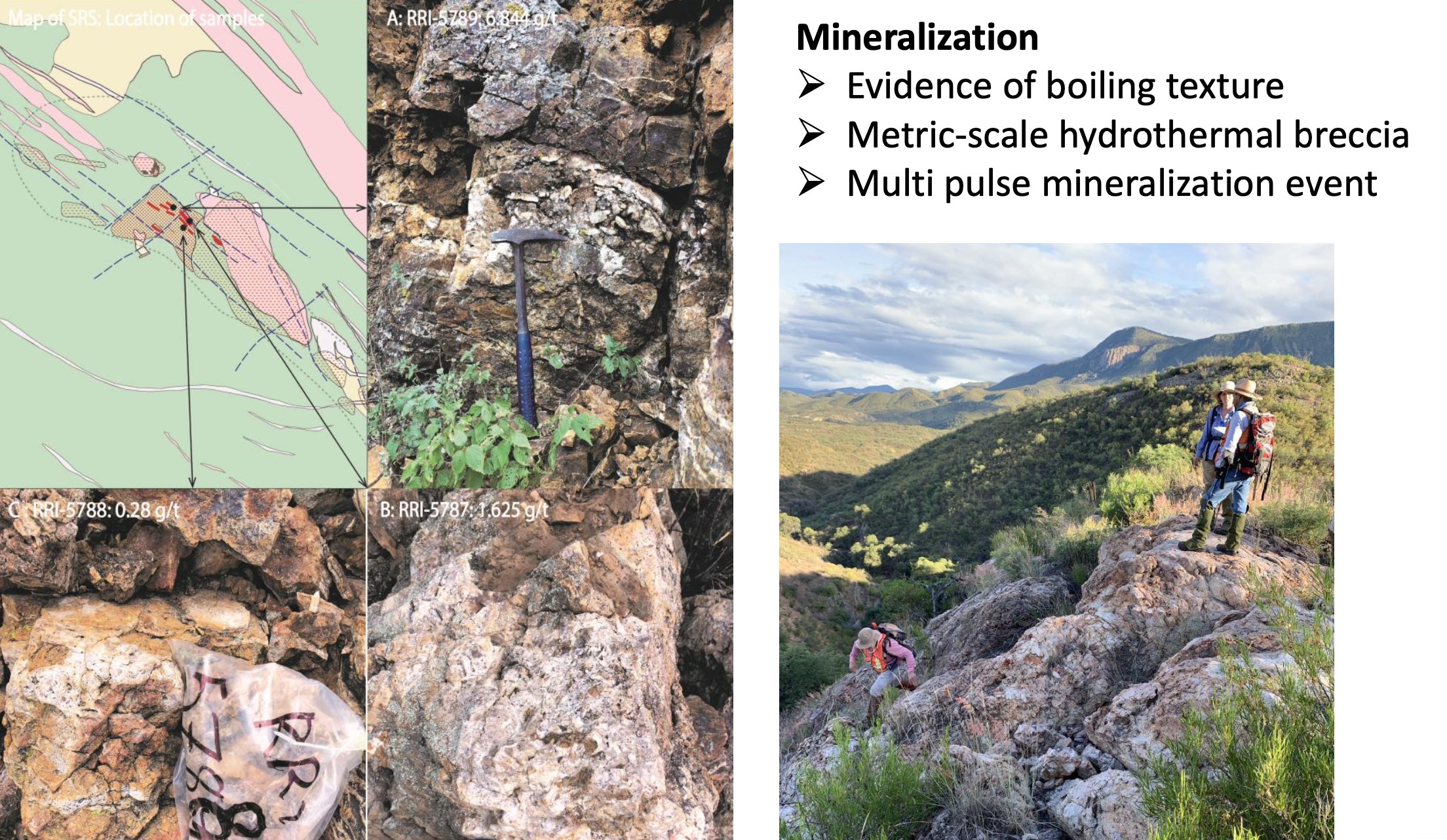

The mineralization at Los Cuarentas is similar to the other two projects as being epithermal of interpreted similar age and styles. New work at Los Cuarentas is being undertaken to study the relationship of some of the alterations to possible proximal heat and maybe interpreting a porphyry at depth which could make Los Cuarentas perhaps one the main centers in this large metal endowed region so geologists are excited but further work is first needed on this possibility. Los Cuarentas is definitely an epithermal vein system at the mine centers of Santa Rosalia and Santa Rosalia Sur. There are also large alteration zones that show possible zones of lithocap. And just a little bit to the southeast is Las Chispas which is a vein area north of the Santa Elena Mine which made Silvercrest 1.0 so successful that it was bought out by First Majestic Silver (AG, FR.TO). So far at Cuarentas the historic mining of the epithermal veins was largely for gold and upcoming drilling either by Riverside or a partner will further test the veins that Riverside now controls.

Another important aspect to Cuarentas is the infrastructure is already in place for the Arizpe district is well-endowed with well-maintained paved highways and an existing powerline could be accessed just a few kilometers away from the primary targets. Arizpe has been a mining center for over 200 years and previously was a mining capital city for Sonora State and had a mint where silver coins were made for the government of Mexico. Arizpe is along the river and had an old mission that Jesuit priests built with the local people as this was a mining center with the Spanish arrived to this region of Sonora.

Riverside acquired the property as part of its deal with Millrock Resources (MRO.V) which sold its project portfolio, and Riverside always seemed to have been quite charmed by the Los Cuarentas property. Millrock had done work at Cuarentas with Centerra Gold including soils, rocks, IP geophysics but did not at the time have signed agreement with the key internal claim during the time with Centerra. Only after Centerra left was Millrock able to finalize all the paperwork and Riverside has taken over the option to control the internal claim and main Santa Rosalia mine area targets.

The Santa Rosalia mine is a past-producing mine with a total output of estimated over 50,000 ounces of gold before mining activities ceased in 1958. Very little work has been done on the property in the past 60 odd years and Riverside has worked to collect some of the old records showing historic production levels as a guide to better understanding the system at depth.

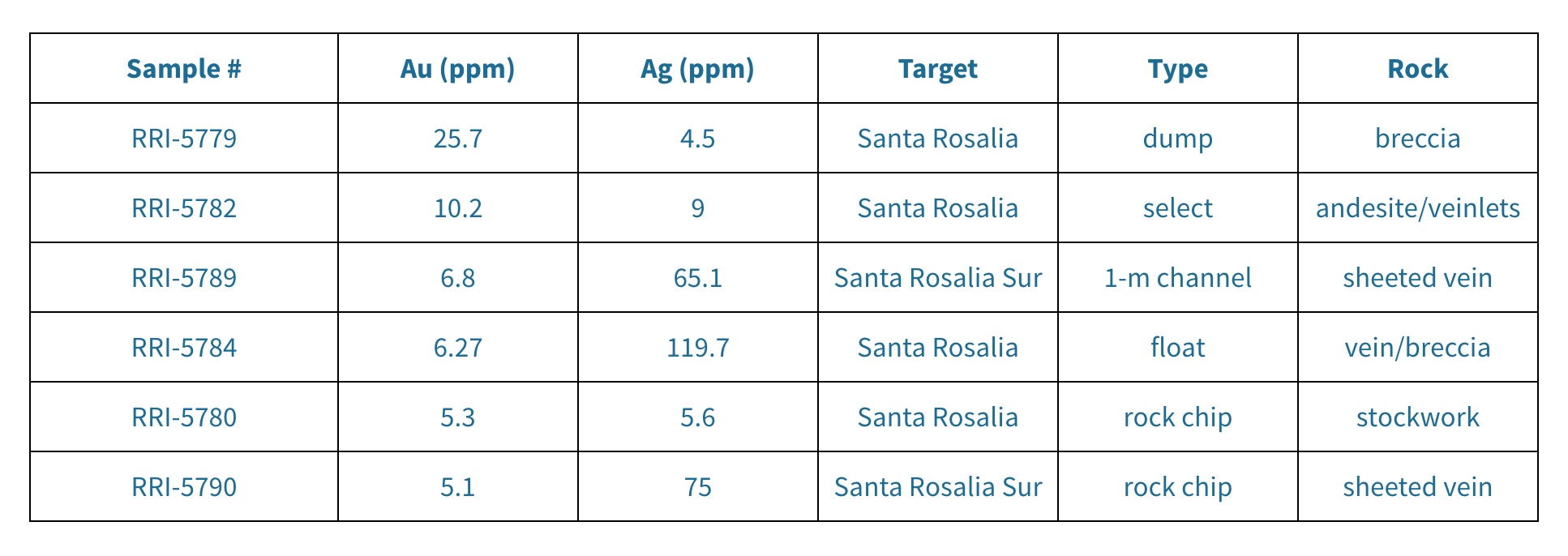

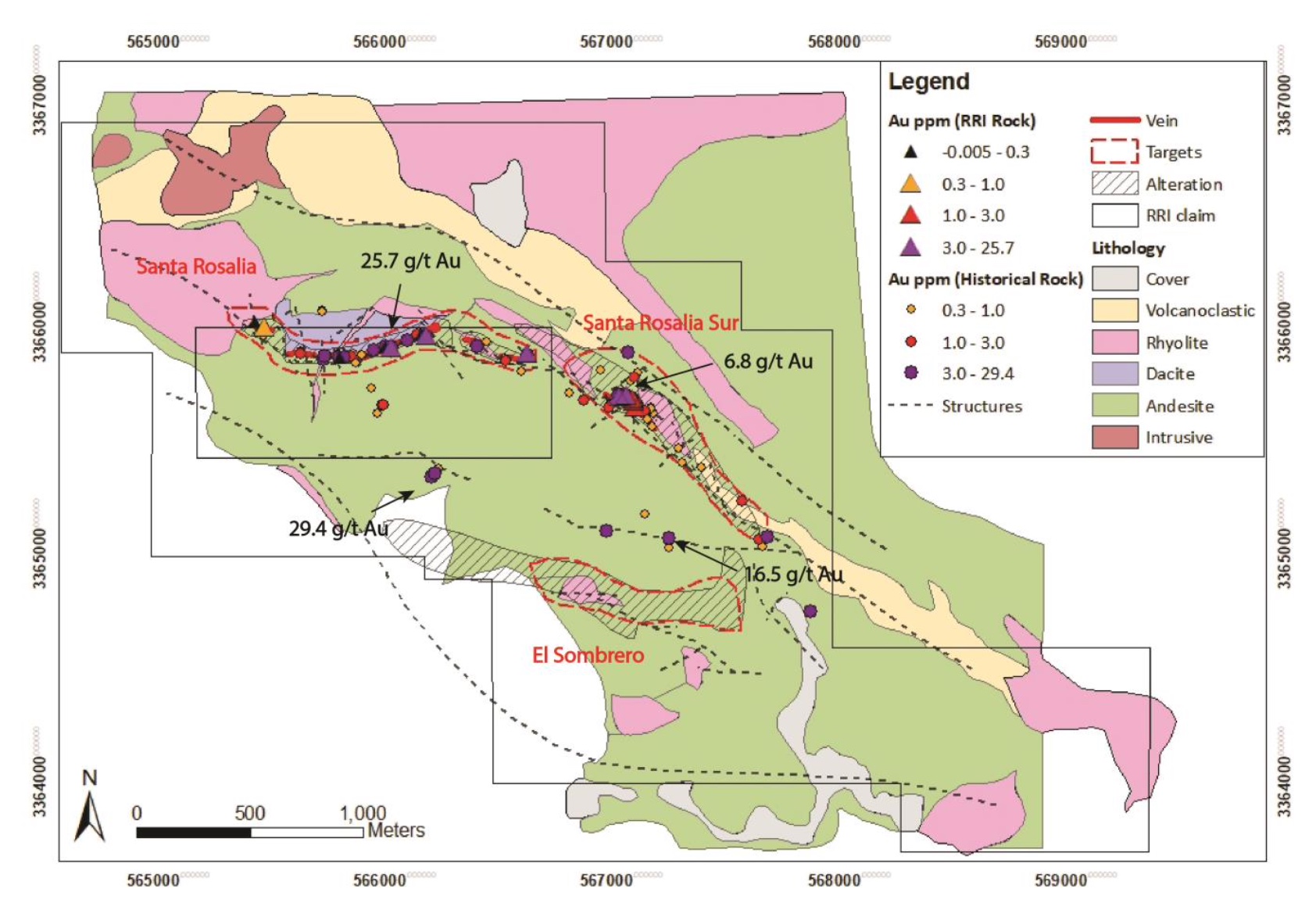

Los Cuarentas district is an early-stage project as no resource on Riverside’s tenure so it was important for Riverside to not try to run before they can walk, and the results of a first dedicated exploration program have recently been published. The field team took 16 rock samples from the two main targets (Santa Rosalia and Santa Rosalia Sur) and several of them returned high-grade gold and silver values. Riverside used the 25.7 g/t gold assay for the headline of its press release and although one high-grade gold sample could have been a coincidence, finding a bunch of those no longer is, and indicates the existence of a strongly mineralized system as several of the assays returned a gold grade of in excess of 5 g/t.

Those are great results to come out of the gate with, and during our most recent visit to Vancouver, we spent almost two hours with Erika Sweeney, Riverside’s project geologist who is clearly passionate about the project.

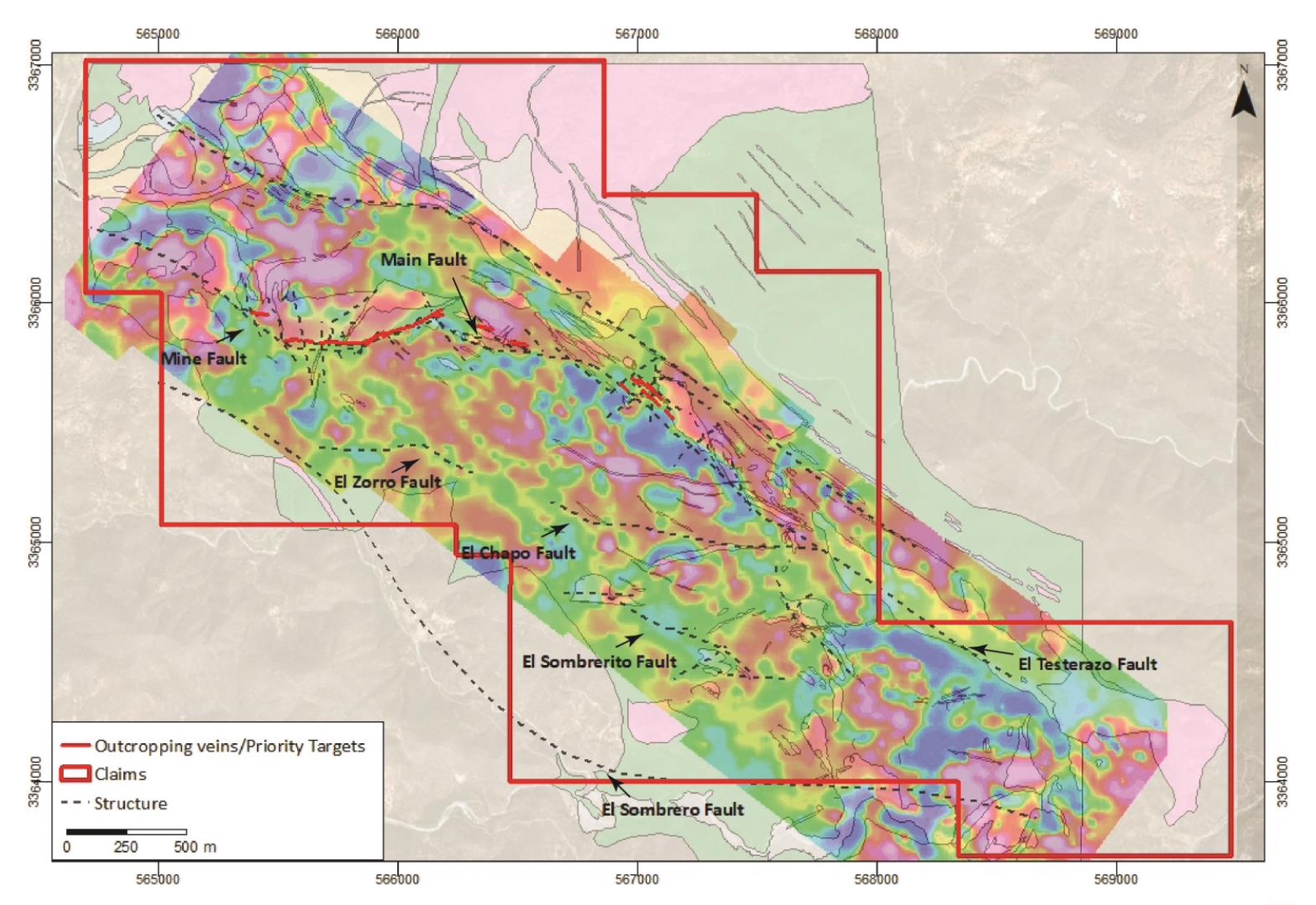

Riverside already has access to the results of the magnetic survey conducted by Millrock and Centerra Gold, but its own team has now also completed a mapping program at surface and the results of that mapping program line up remarkably well with the magnetics.

The interpretation of the magnetic survey and the mapping results has resulted in Riverside generating three primary targets: Santa Rosalia (where the sample grading 25.7 g/t gold was found at an old mine dump), Santa Rosalia Sur and El Sombrero. There are other target areas as well including parallel structures which will be further enhanced during the Q1 field program that is beginning this week. Riverside can focus its efforts on the main zones which contain a mixture of sheeted quartz veins, stockwork and breccia zones as is typical of high-level epithermal systems. RRI will study the alteration styles to better interpret possible proximity to a source for the potential deposits.

The Breccia zone at Santa Rosalia Sur which, according to Sweeney has a large outcrop at surface (see the photo below), returned a gold grade of roughly 2 g/t or more in most of the samples.

Of course, a sampling program doesn’t necessarily have to mean much and drilling the primary targets will be what will decide if the project gets the thumbs up or thumbs down. Sweeney and the technical team at Los Cuarentas expect to be in a position to provide a more comprehensive update on the Cuarentas project and the future exploration plans by the end of February as this is a priority project for Riverside to quickly progress.

Sitting down with CEO Staude to discuss Los Cuarentas

The location of Los Cuarentas is quite impressive, doesn’t it surprise you that any of the neighbors (Silvercrest Mines, Premier Gold,…) made a run for it while it was still owned by Millrock?

Millrock was working to consolidate the property with local owners and we were lucky that we came at the right time. We were discussing with Millrock as the internal concession deal was finalized after the Centerra program had ended. I think our neighbors are busy with their hectic mine drilling and weren’t able to focus on this adjacent property as we knew if from our Riverside database and had visited the area in the 1990’s.

Previously Cominco had held the large 400 km sq block for porphyry Cu targeting and the overall district is nicely endowed yet has not seen much drilling.

Since you acquired the project from Millrock you have completed some ground based exploration programs including a lot of remapping and sampling and the results speak for themselves. What additional work would you have to do to get your first few targets drill-ready?

We have completed initial reconnaissance check sampling program and I am actually heading back to Hermosillo this week to meet with our geology team as we will now do detailed mapping over the surface for where we are planning the first drill holes. The sampling has been good and we will do more detailed outcrop specific clay and geochemistry to determine the hottest zones of fluids for targeting along structures. The program is going well and we still have time to refine and improve plus of course much to expand as there are wider targets and more targets on the property.

Riverside is currently working on spinning of the Penoles property into a new entity. Would Los Cuarentas be strong/good enough to be the next candidate for a spinoff given its history, location, and encouraging first pass exploration results?

Cuarentas is a discovery to be made based on the data we gathered from a mining operation in the 1950s with good potential and previous work from Centerra and others. Yes, over time we will obviously try to further advance the asset but now we are initially looking for a partner to either fund an initial drill program or expand our own drill program should we decide to first start drilling it ourselves.

What we know for Cuarentas is that it is a large district system, we know we have mineralization in the area and will joint venture the property if we find a valuable deal with a great partner. Riverside maintains our focus on value creation and giving shareholders the upside with limiting the downside risks.

We know it’s still early days for 2020, but would it be fair to assume Los Cuarentas will be where the focus will be at this year?

Cuarentas is a big focus for us now but we are also pleased with our first steps into Canada and will continue to work using our local teams, strong data and are looking forward to be very busy throughout the year on several fronts in Canada, Los Cuarentas and spinning off the Penoles property.

Spinning out the Penoles project in a new company could be a good move

As Riverside Resources had and has a number of properties in its portfolio it was quite obvious that some projects were valued at absolutely zero by the market. In an attempt to create some value (and to advance projects on a standalone basis), Riverside is now in an advanced stage to spin off its Penoles gold-silver asset in Mexico into a new publicly listed exploration company, Capitan Mining.

Riverside’s team is currently marketing the idea to potential new shareholders eyeing to raise enough money to make sure the new company has no issue to get through the first 18 months after its initial listing. The current plan is to raise approximately C$2M at a valuation of roughly C$5M. Riverside is intending to distribute the premoney portion of the Capitan Mining shares to its own shareholder base and Riverside will retain an NSR. The funds raised for Capitan will be focused on the progression of the Penoles asset and creating continued value growth for the Capitan shareholders. Riverside shareholders will be the initial Capitan shareholders through a Plan of Arrangement approach which aims to limit tax liabilities on the share distribution and is most effective for unlocking the value inside of Riverside to its shareholders.

There are still a lot of variables in this deal (including the distribution rate of how many shares of Capitan Mining the Riverside shareholders will own) but we like the fact that Capitan will be run by a separate CEO (Alberto Orozco, whom we met at the most recent Vancouver conferences) and will be cashed up. An ideal scenario to unlock value for Riverside shareholders as well and if Riverside is indeed able to make this spinoff as painless as possible (from a tax perspective), then we would actually hope the company would consider doing the same thing in the future when projects are advanced enough.

About the Penoles asset

Perhaps a brief recap of the Penoles gold-silver project and why the creation of Capital Mining could unlock value for the Riverside shareholders.

The Penoles project in Durango was returned to Riverside Resources after Morro Bay Resources was unable to complete its earn-in commitments in 2016. The project has an existing resource estimate containing just over 330,000 ounces gold and 17 million ounces of silver. The project is located approximately 170 kilometers west of Torreon, and the land situation at this project is very intriguing. Riverside Resources owns four land claims which are surrounded by Fresnillo (FRES.L), but those Fresnillo claims are once again surrounded by additional Riverside claims. Fresnillo is very well aware of these properties as it actually used to mine the Jesus Maria mine back in the late 1800’s. The Penoles properties remained unexplored during the entire 20th century and the only activity-related reports on the project were discussing a small 100 tonnes per day operation which processed the San Rafael mine dumps at an average grade of 11-13 ounces of silver per tonne.

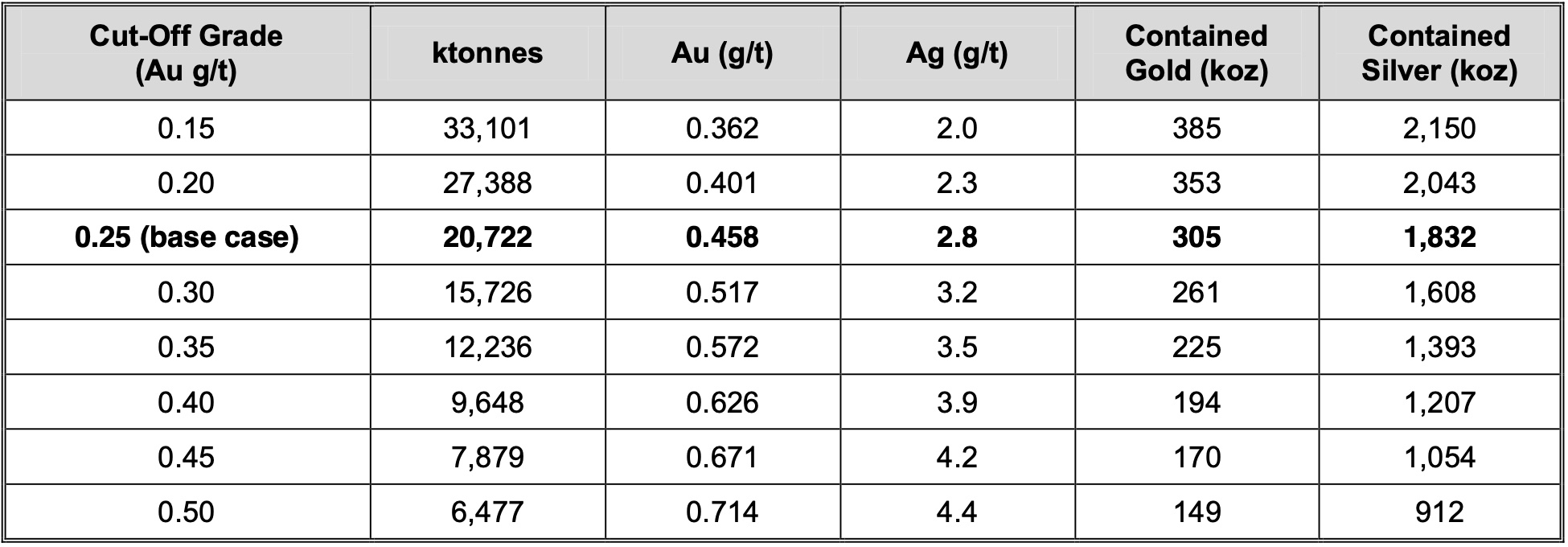

The Penoles project could be sub-divided into the El Capitan Zone which is gold-rich and as you can see here below, lowering the cutoff grade to 0.2 g/t (which would be reasonable and realistic given the current gold price), the El Capitan resource would increase to 353,000 ounces gold and 2.04 million ounces of silver.

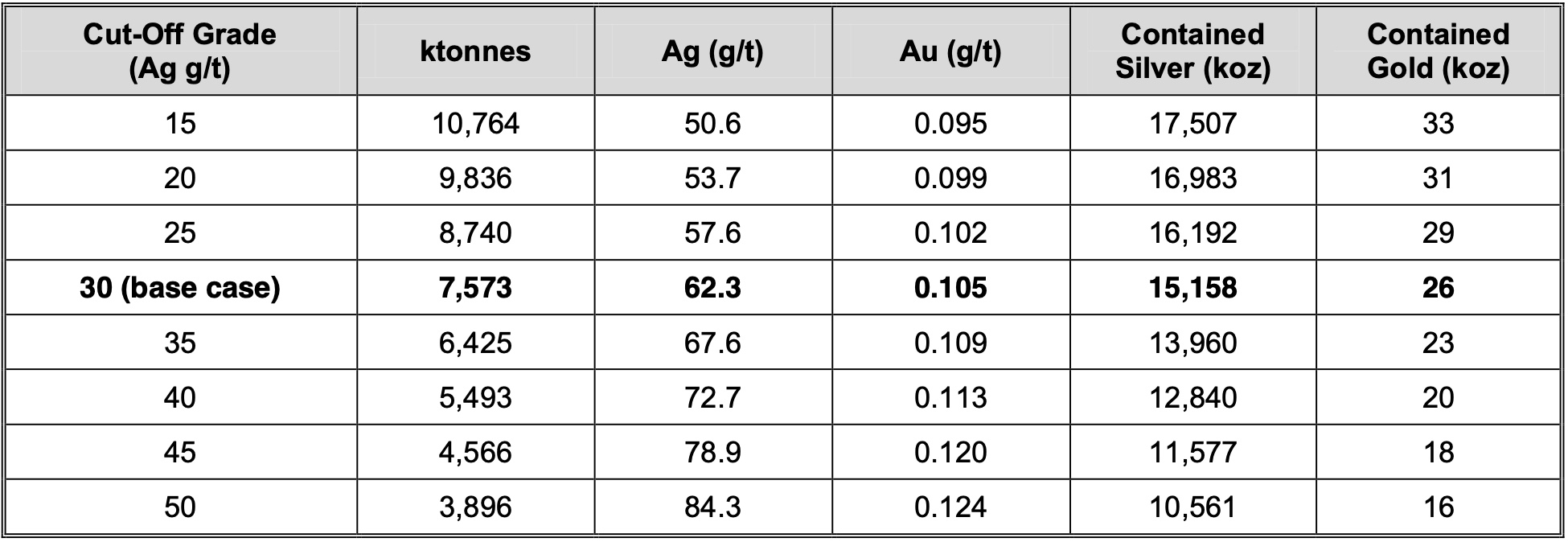

The second zone of Penoles is the Jesus Maria zone which is silver-dominant: the resource contains 15.2 million ounces of silver and 26,000 ounces gold. Lowering the cutoff grade won’t have a noticeable difference as the cutoff grade of 25 g/t silver would add just 1 million ounces of silver and a few thousand ounces of gold to the current resources.

The grade appears to be low, but bottle roll tests have indicated the recovery rate to be favorable for gold and silver extraction from preliminary indications. The existing resource, as well as Fresnillo’s continuous presence in the area, make Penoles an attractive exploration project, and spinning the project out in a new company with a dedicated CEO (Alberto Orozco) and field team should help to create value.

Conclusion

Although Riverside Resources’ most important business model remains to find joint venture partners to jointly develop existing projects, it could perhaps be the smarter decision to spin-off advanced assets into new companies if the right deal simply doesn’t come along. We support the decision to spin off the Penoles project in Capitan Mining and consider this to be a test case and potential blueprint for future deals on other projects. We agree with the approach and strategy, but the main uncertainty will be the liquidity on the market for Capitan in the first few weeks and months after its listing as Riverside will need to convince the shareholders that will receive Capitan shares to remain on board.

At Riverside, all eyes now appear to be on the Los Cuarentas project which is currently being prepared for the next phase of exploration. Discussions with potential partners that showed an interest in the property are still ongoing so we’ll see in the next few months if this will lead to a potential joint venture deal with a larger company, but Riverside could be strong enough to go at it alone.

Disclosure: The author has a long position in Riverside Resources Inc. Riverside Resources Inc. is a sponsor of the website.