The lack of interest in uranium stories isn’t really helping the exploration companies. Fortunately, Skyharbour Resources (SYH.V) has just been able to raise C$1.8M of which the majority was invested by family offices and institutional investors which means the company can go ahead with all of its planned exploration activities on the Moore uranium project. Meanwhile, its joint venture partners Orano and Azincourt Energy (AAZ.V) are also planning to complete quite a bit of work on their respective properties as well which means this winter season should once again provide Skyharbour with plenty of news flow.

The general weakness of the uranium market has made Skyharbour a victim of tax-loss selling and its share price has lost about 60% since the beginning of the year. It’s perhaps worth mentioning December 27th is the final day of the tax-loss selling season in Canada so let’s hope the exceptional weakness will be over soon.

Rekindled interest in the Uranium space?

The uranium market remains a little bit shaky but the fundamentals for recovery are present. The primary uranium production has now decreased to less than 140 million pounds per year while the annual demand continues to increase (albeit at a slower pace) to almost 200 million pounds per year. This difference of roughly 60 million pounds per year is currently being covered by existing inventories and secondary sources, but it’s clear this situation is unsustainable in the long run. There still is no incentive for new uranium production to come online as the breakeven price of most new uranium projects that actually have a chance of being developed (based on the financial and regulatory risks) would be around $55-60 per pound.

Some market spectators are seeing a ‘perfect storm’ lining up. The only issue is that there have been plenty of warnings for that perfect storm in the past few years, and every time the consensus was ‘this is going to happen very soon’, nothing really materialized so it’s perfectly understandable the market is using a ‘let’s see what happens first before we get over-excited’ approach.

For investors that do believe in the upcoming uranium crunch, this is the ideal time to start accumulating positions in companies that are in varying stages of the exploration and development cycle, preferably with projects in safe jurisdictions.

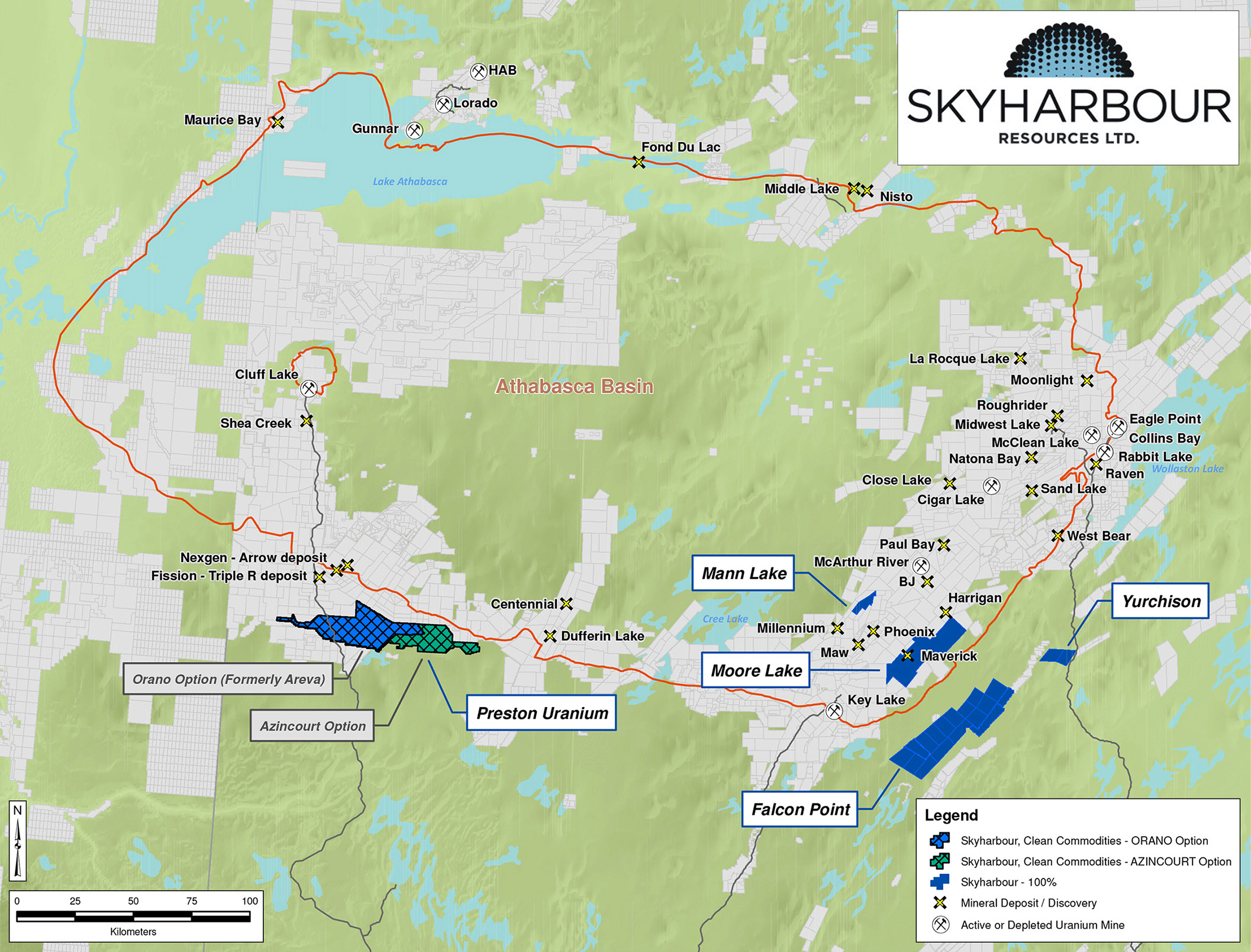

And Skyharbour’s assets are in the right location. Anyone who’s serious about exploring for uranium in Canada will be focusing on the Athabasca Basin in Saskatchewan. Yes, there are other uranium projects in other provinces, but those continuously hit walls with exploration and development moratoria and low grades (for instance, Paladin’s Michelin project in Newfoundland hasn’t gone anywhere in the past few years).

The situation is different in the Athabasca Basin, which has been known for its (high grade) uranium occurrences since the 1940’s and where the local Saskatchewan government has developed a good (legal) framework and is backing the uranium industry. Since the Rabbit Lake uranium deposit was discovered in the late-60’s, an additional 100 uranium discoveries have been made in the Athabasca Basin, with resources totaling in excess of 2 billion pounds of uranium. According to a recent keynote submitted to and published on the PDAC website, just 1/3rd of the discoveries have been brought into production.

The Basin heated up in 2010 and 2011 which culminated in Rio Tinto (RIO) winning a bidding war to acquire Hathor Exploration for C$650 million. This was followed by the huge discoveries made by Nexgen Energy (NXE, NXE.TO) and Fission Uranium (FCU.TO), which reconfirmed the Athabasca Basin as ‘the place to be’ for high-grade uranium exploration.

Skyharbour’s mix of own projects and JVs means a lot of work gets done

Skyharbour’s asset base consists of two types of projects and the company is directing its own focus on the Moore Uranium project. As Skyharbour is prioritizing its (human and capital) resources on the Moore project, it didn’t want to spread itself too thin. It decided to option out its other projects and has some sort of hybrid model: focusing on one own property while using the prospect generator model to keep the news flow going and advance other properties using other companies’ money.

Back in 2017, Skyharbour was able to attract AREVA (now: Orano), the large French nuclear power and uranium mining conglomerate as a joint venture partner on the Preston uranium project on the western end of the Athabasca Basin. Perhaps a surprising deal as AREVA had not done many deals with junior companies in recent history. But the fact it wanted to up its game in the Athabasca Basin and its mindset on the cusp of a restructuring was ‘yes, we really need this project’ says a lot about Preston. Fortunately, the French government stepped in and recapitalized the company to the tune of a few billion euros which allowed Orano to continue with its day-to-day operations.

The earn-in agreement is relatively straightforward. Orano can earn up to 70% after spending C$8M in cash payments and in exploration expenditures on the property. A first 51% will be acquired by spending C$2.8M on the property and making a C$200,000 cash payment to Skyharbour Resources and Dixie Gold (DG.V).

A second, separate agreement allowed Skyharbour to option the eastern end of Preston, conveniently called Preston East, to Azincourt Energy (AAZ.V). Azincourt will be able to acquire a 70% stake by making C$1M in cash payments and spending at least C$2.5M on exploration within a three-year period ending next year. Additionally, Azincourt issued 4.5M of its stock to both Skyharbour and Dixie Gold in a 50/50 ratio (so Skyharbour ended up with 2.25M shares, currently valued at just over C$200,000).

1. The developments at Moore

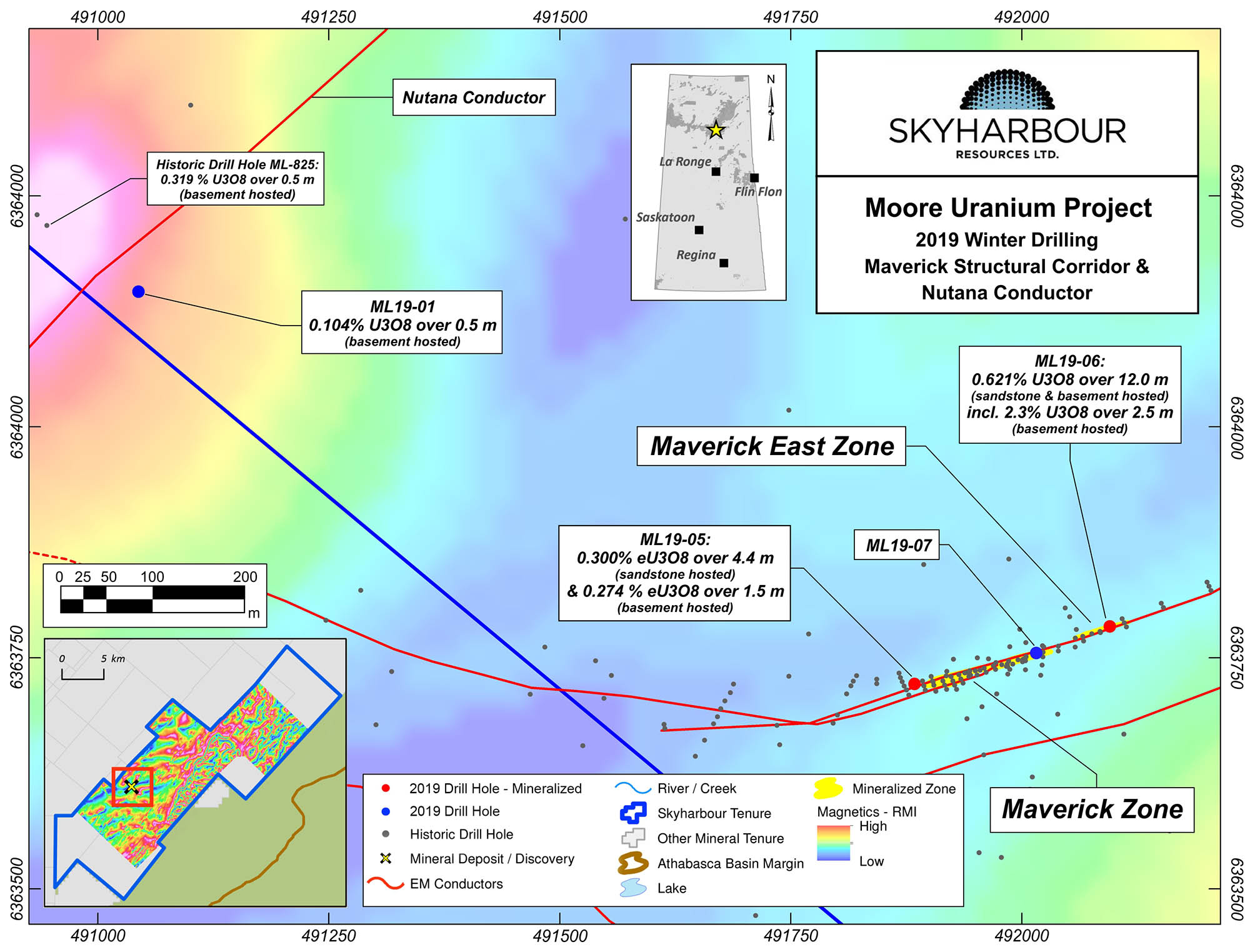

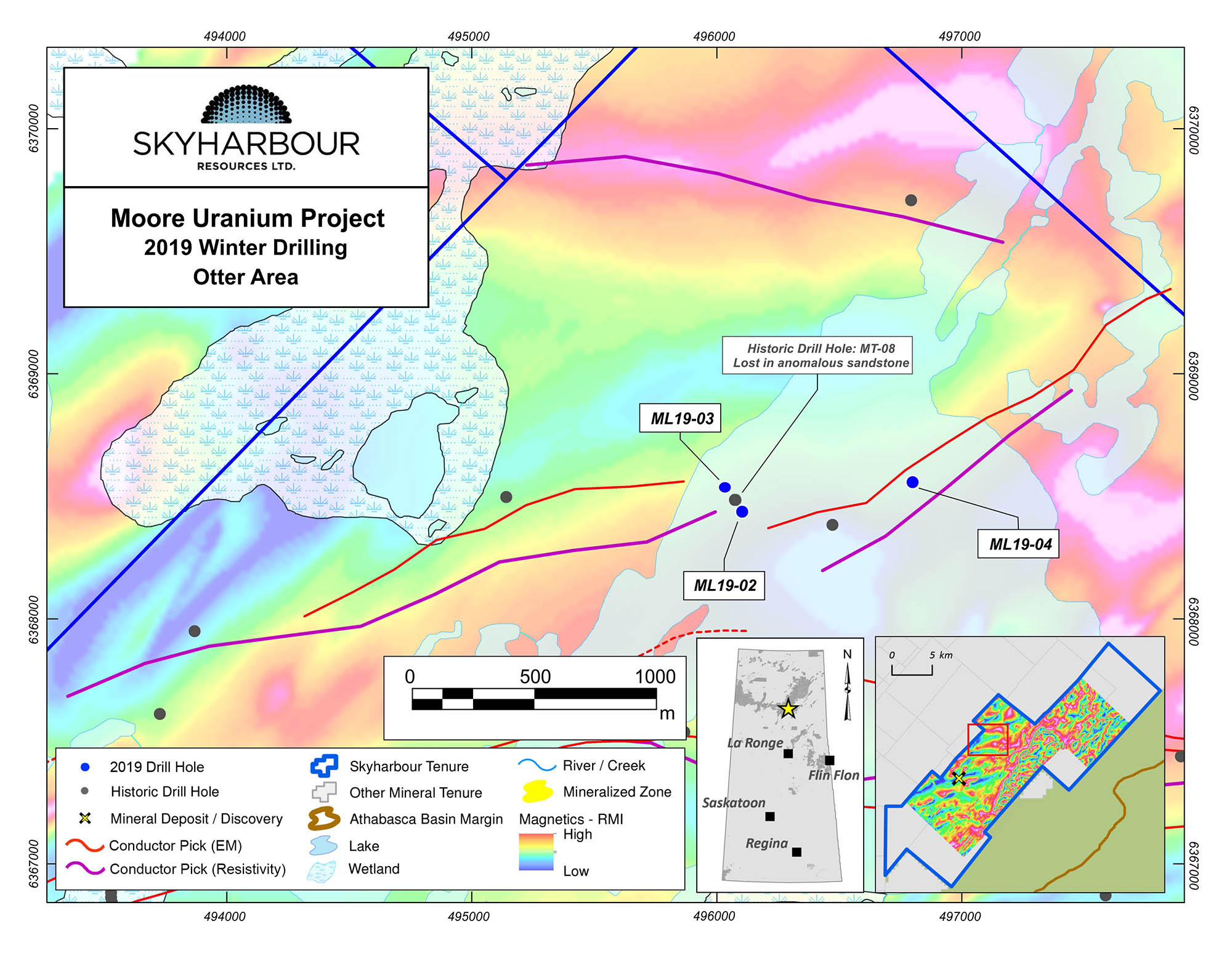

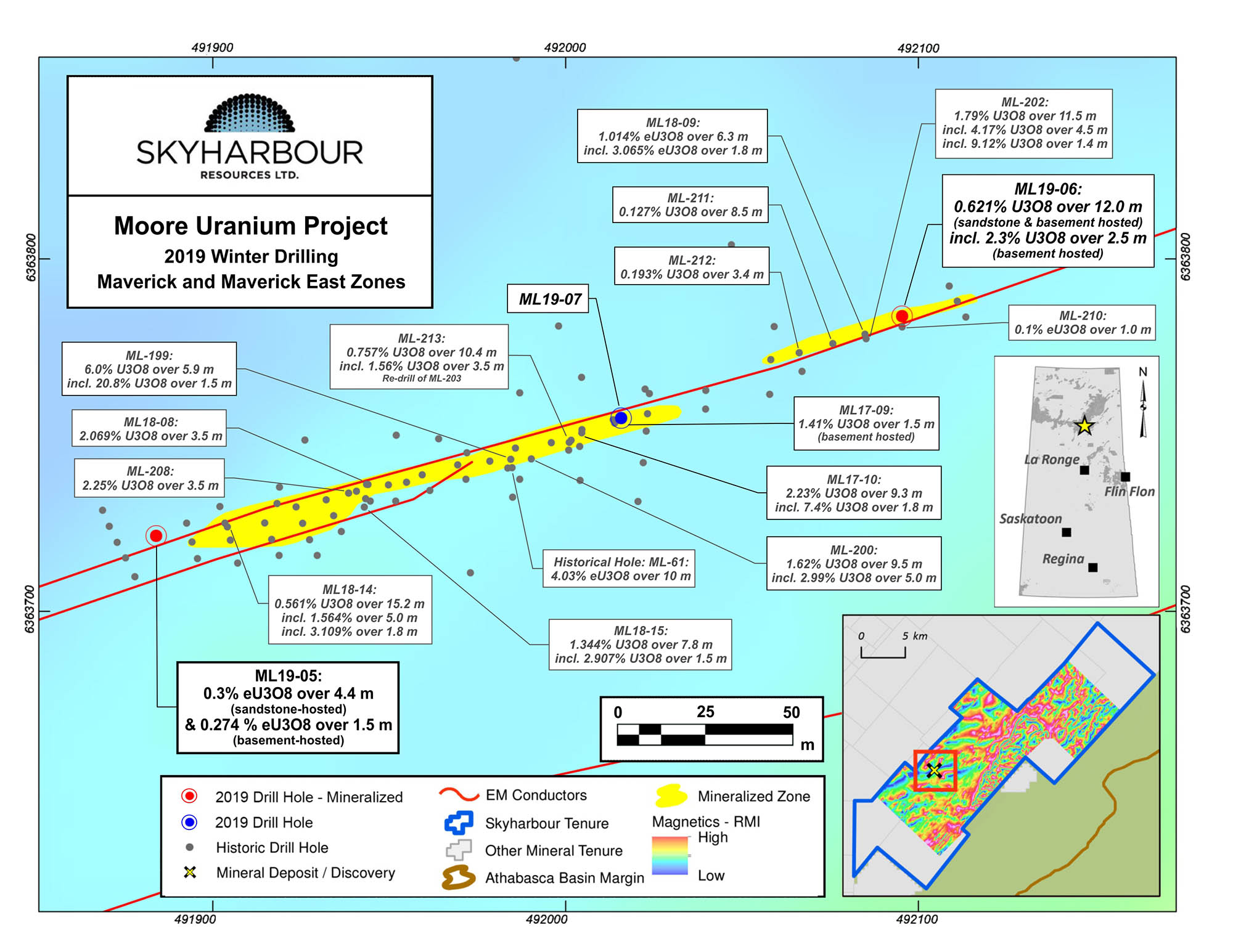

Skyharbour has been busy this year as the company has completed its spring drill program at Moore which consisted of almost 2,800 meters in 7 drill holes (one was drilled at Nutana (1), three were drilled at the newly discovered Otter Zone (holes 2-4), two were drilled on the main zone (holes 5 and 7) and one hole was drilled at the Maverick East zone).

The headline result was encountered in the one hole (hole 19-06) that was drilled on the Maverick East zone, towards the most eastern point of the exploration target. The drill bit encountered 12 meters containing 0.62% U3O8 including a higher grade zone of 2.31% U3O8 over a 2.5-meter interval (indicating the remaining 9.5 meters contained an average of 0.18% U3O8) starting at a depth of 273 meters.

Hole 1 at Nutana (which is directly west of the Maverick Main Zone) was an exploration hole and intersected 0.5 meters of 0.10% U3O8 approximately 75 meters below the basement rock unconformity.

Hole 2 and 3 on the Otter Zone both encountered clay altered pegmatites which resulted in the ‘discovery’ of up to 1.26% boron in hole 2 (no assay results were shared for hole 3), and according to Skyharbour, the boron values are indicative of a high level of prospectivity for additional uranium mineralization to be discovered, as Skyharbour is tying the results from these two holes to the general interpretation of the geological structures in the Athabasca Basin. Hole 4 was also drilled in the Otter zone and encountered 0.15% U3O8 over half a meter, and this hole also contained anomalous boron values which strengthens Skyharbour’s interpretation of the uranium-hosting structures.

Hole 5, which was drilled on the western part of the Main Maverick Zone, was also very interesting with 4.4 meters of 0.30% U3O8 followed by another 1.5 meters of 0.27% U3O8 just 5 meters deeper. And yes, the uranium values are lower than the headline result, but let’s not forget that 0.30% U3O8 still represents 6.6 pounds per tonne of rock. And if one believes in a future uranium price of $50/pound, that’s still US$330/tonne rock. So while 2.5 meters of 2.31% Uranium is exceptional, values of 0.3% are really good as well.

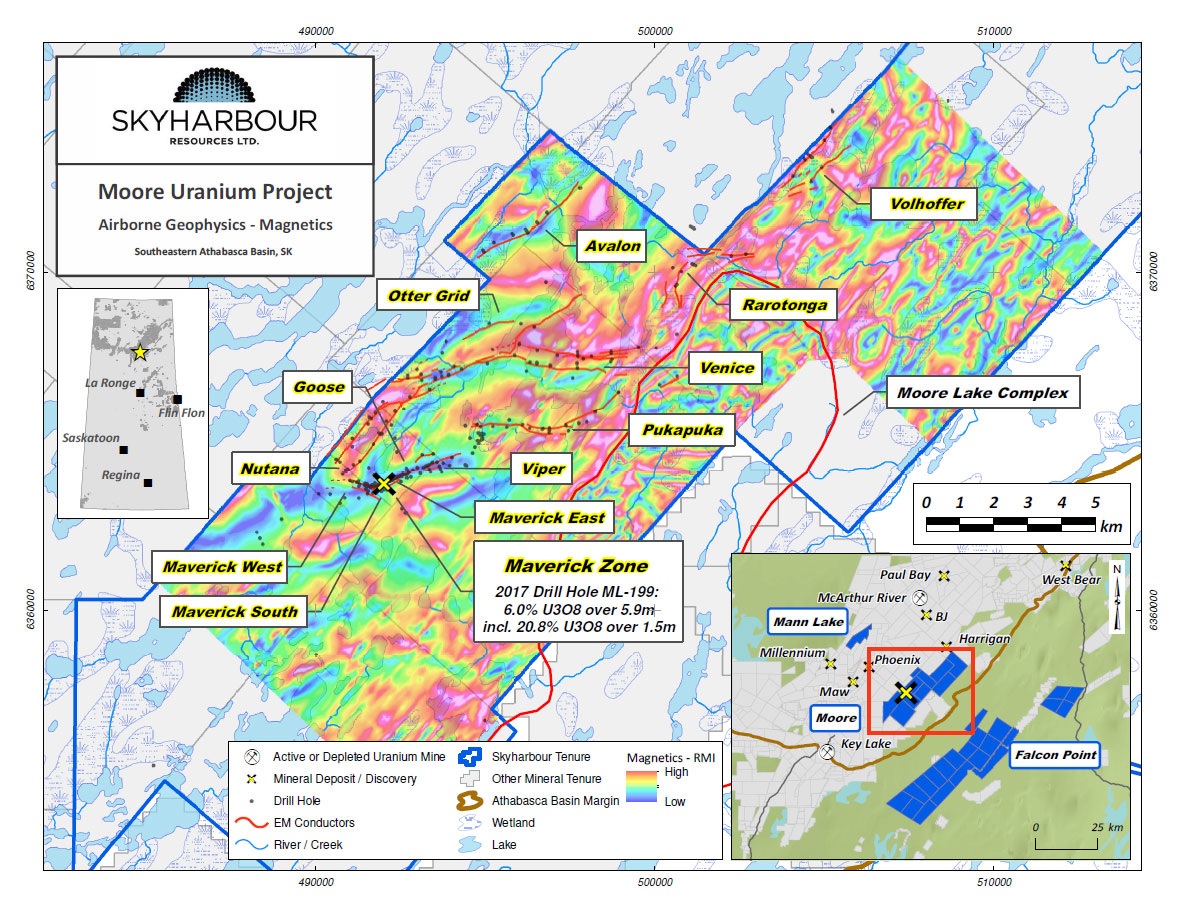

Subsequent to releasing and analyzing these drill results, Skyharbour completed the aerial survey over its Moore Uranium project in Canada’s Athabasca basin. The company was awaiting the final results of this survey before further refining its drill targets on the 357 square kilometer land package, and the results have now been interpreted.

The survey has identified several drill targets outside of the 2-kilometer strike length that has already been drilled to date, and some of these new targets will be drilled in the upcoming winter drill program. Skyharbour is aiming to drill 2,500 meters to test the basement targets as well as the unconformity targets at Moore, and the company has provided an extensive explanation of the three targets it would like to drill; Maverick East, the Northeast Extension of the Maverick structural corridor and the Otter target.

2. The Preston Joint Venture with Orano

Orano, the new name of AREVA, will start its winter exploration program at Preston early in the new year with another round of geophysical work to be completed which should result in generating new drill targets.

Orano could still be drill-ready by the end of 2020 and the upcoming winter exploration program could/should be the final preparatory exploration program where after Orano should have some high-priority drill targets it would like to drill-test.

But for now, Orano will be focusing on a DC resistivity ground geophysics program on the Canoe & JL grids and the B conductive area to further ‘characterize the EM conductors by providing information about possible clay, silicification or alteration in the vicinity of conductors. To keep the costs down, Orano will be using the existing JL and Canoe geophysical lines while the B conductive area will need almost 16 kilometers of line cutting for this geophysical program.

Skyharbour’s update press release does an excellent job in describing the upcoming work programs at the three respective zones:

The Orano joint venture will probably be the least exciting project this winter as there will be no drilling, but Orano’s dedicated and thorough method to discovering uranium mineralization could pay off later.

3. The East Preston Joint Venture with Azincourt Energy

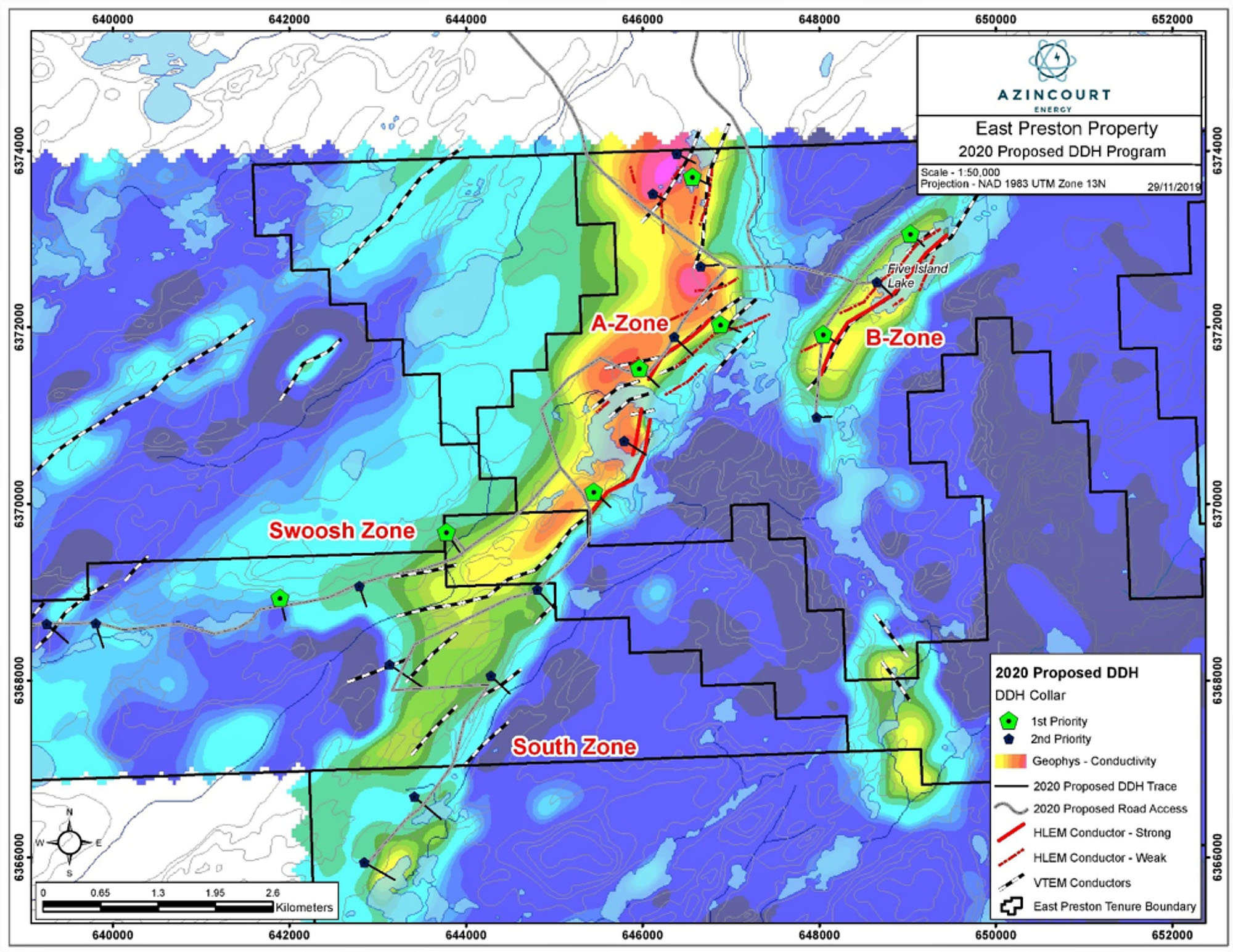

Azincourt Energy already drilled the East Preston uranium project in the previous winter and that initial drill campaign confirmed the prospectivity of the project as the drill bit intersected structures and rock types that appeared to be very similar to NexGen’s Arrow and Fission Uranium’s Patterson Lake South projects.

Azincourt is still very encouraged by the results of its most recent exploration programs and has provided an update on its plans for the winter. The past few exploration programs were predominantly focusing on generating drill targets based on gravity surveys, Electro-Magnetic Survey and VTEM surveys.

Azincourt now feels sufficiently confident in its high-priority drill targets that it has budgeted C$1.2M for a 2000-2,500 meter drill program. This should be sufficient to drill up to 15 holes from 8-10 different drill pad locations to test the subparallel EM conductors in what Azincourt describes as ‘an area of marked structural disruption’.

On top of these two EM conductors, Azincourt will also drill-test the Swoosh zone, which is a 7-kilometer long east-west lineament with geochemical anomalies. At Swoosh, only two holes are being planned and these will be drilled near the upstream terminus of these Geochem anomalies.

Despite the weak markets, Skyharbour successfully raised almost C$2M

It’s still not easy for uranium companies to attract fresh money for exploration, and that’s why Skyharbour’s ability to close a C$1.8M raise just two weeks after announcing it is a good achievement. Additionally, the majority of the placement was placed with institutional investors and family offices, indicating strong support from these parties.

Skyharbour raised C$1.1M by issuing 7.31 million hard dollar units priced at C$0.15 and an additional C$0.7M by issuing 4.04 million flow-through units priced at C$0.18. The flow-through units consist of a common share and ½ warrant, the hard dollar units have a full warrant that will allow the warrant holder to purchase an additional share of Skyharbour Resources at C$0.22 for a period of three years (until December 2022). A total of 9.5 million warrants were issued (including the finders warrants) and should these be exercised, Skyharbour will be able to top up its treasury with an additional C$2.2M. But we obviously aren’t there yet.

Insiders participated in the financing. CEO Trimble invested an additional C$75,000 in the hard dollar financing (which is almost 50% of his base salary in the preceding year, according to the management information circular. In fact, Trimble has also been active on the open market even before the private placement was announced) while directors Pettit, Kusmirski and Cates invested an additional C$24,000 in the financing with Cates participating in the flow-through financing round.

Skyharbour had a positive working capital position of almost C$450,000 as of the end of September and the cash injection should push the working capital to approximately C$2M again. A comfortable position to be in, and the cash will allow Skyharbour to be as flexible as it wants during this winter’s drill program.

VTEM Being Flown Over The Preston Lake Property

Conclusion

Although the market still doesn’t seem to care too much about Uranium, Skyharbour will continue to advance on three different fronts: its own Moore Uranium project and two projects (Preston and East Preston) where respectively Orano and Azincourt Energy are working towards a potential discovery of high-grade uranium.

With a current share count of 75.4M shares, Skyharbour’s market capitalization of around C$12M and enterprise value of around C$10M is intriguing considering the company and its partners are advancing three separate projects. And even if only one of the projects will turn out to be successful and even if that would be one of the JV projects where Skyharbour would only own a small minority stake, the fair value of the stake in a new uranium discovery could be much higher than the current market capitalization.

But of course, we aren’t there yet and it will ultimately come down to the drill bit to unveil what Mother Nature has hidden underneath the surface at Moore, Preston and Preston East.

Disclosure: The author has a long position in Skyharbour Resources. Skyharbour Resources is a sponsor of the website.