Riverside Resources (RRI.V) will be able to further increase its already strong cash position as the company announced it entered into an agreement with Fresnillo (FRES.L) to sell its Tajitos project to the London-listed mining company.

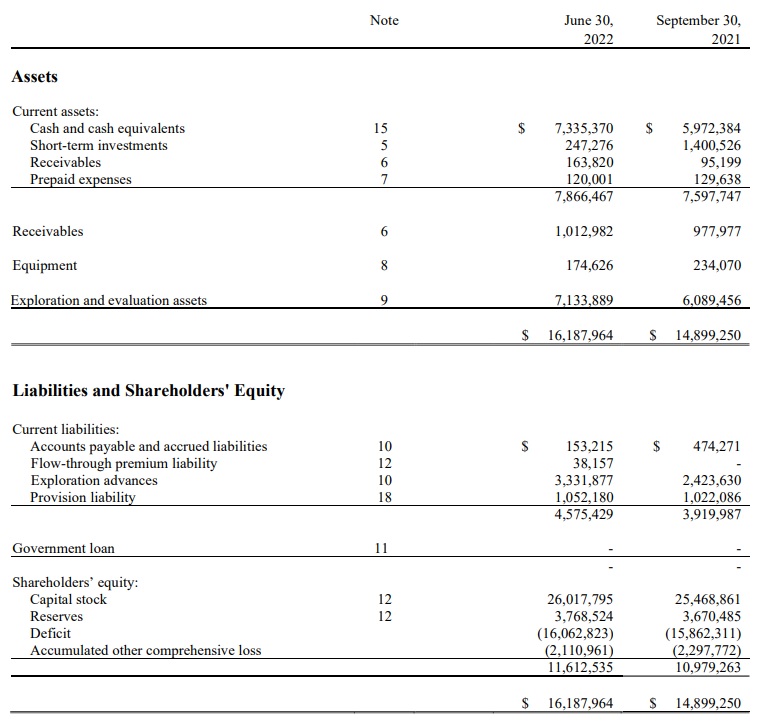

Riverside will receive US$2.5M in cash (which is approximately C$3.35M at the current exchange rate) and will retain a 2% Net Smelter Royalty on the property. The cash inflow will boost Riverside’s cash position and working capital position. As of the end of June, Riverside had a positive working capital position of approximately C$3.3M, including in excess of C$7.5M in cash and short term investments, and in the accompanying press release, CEO Staude mentions the cash position will increase to in excess of C$8M once the proceeds of the sale will have been received. As there are currently less than 75 million shares outstanding, it is clear the cash and net working capital position represent a substantial portion of the current share price.

And perhaps Riverside will receive more cash from Fresnillo further down the road. Fresnillo can repurchase half of the NSR for US$1.5M and has a second option to also repurchase the final tranche of the NSR for another US$1.5M. In order to do this, Fresnillo needs to formally notify Riverside it wants to repurchase the first half within four years after closing the purchase agreement.

Disclosure: The author has a small long position in Riverside Resources. Please read our disclaimer.