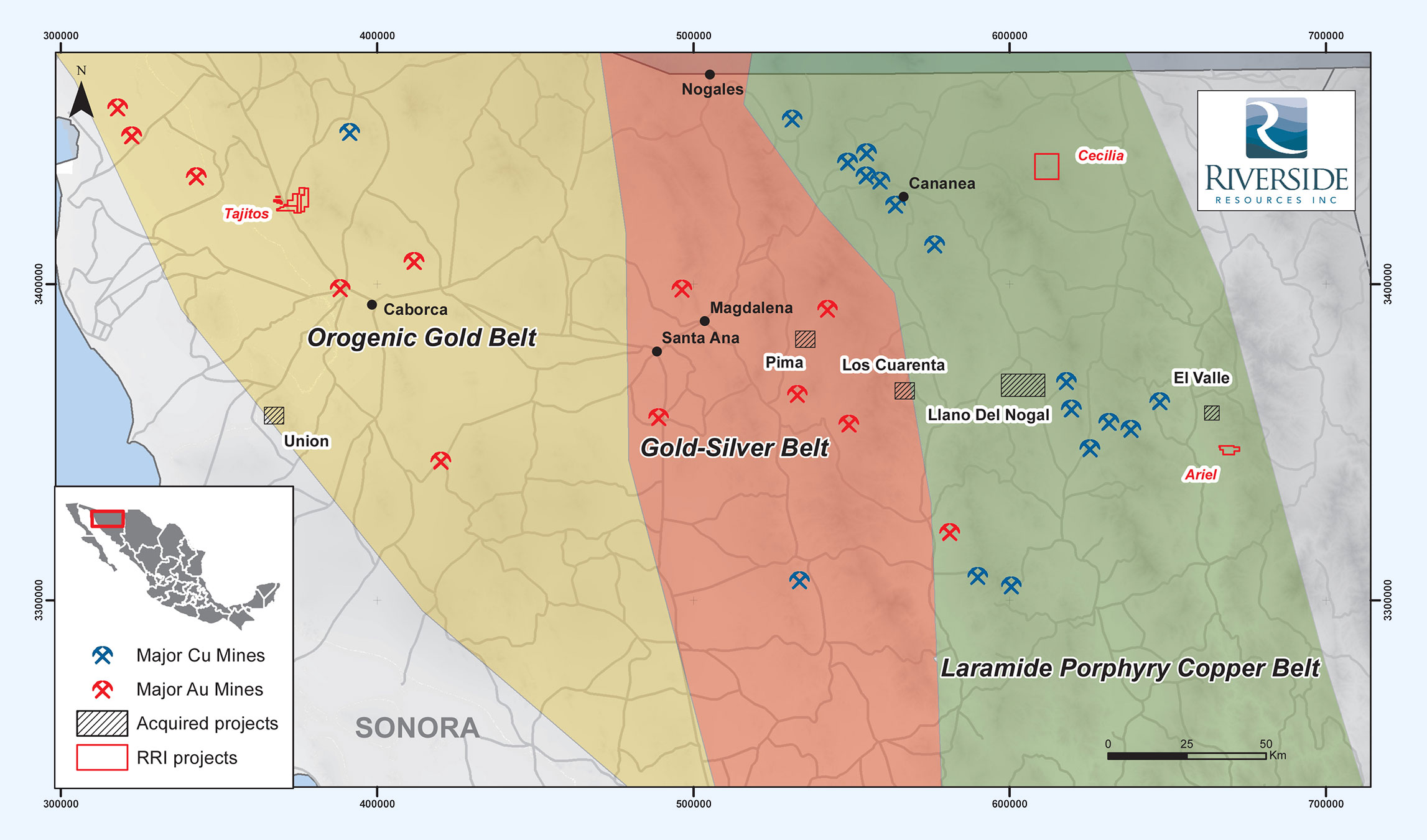

Riverside Resources (RRI.V) still hasn’t drilled its promising Cecilia project in Sonora, Mexico, but the company has made a lot of progress on the corporate front over the past six months as it expanded its portfolio with numerous projects. The company has made a lot of progress on the corporate front over the past six months. It signed an important joint exploration agreement with BHP (BHP) to explore for large copper porphyry deposits in Sonora (similar to the large copper mines across the border in Arizona), it acquired a portfolio of assets from Millrock Resources (MRO.V) and announced its entrance into the Canadian market after staking two gold projects in Ontario close to the Greenstone project, a feasibility stage gold project to be jointly developed by Premier Gold Mines (PG.TO) and Centerra Gold (CG.TO). It added a VP Corporate Development Alberto Orozco who is leading the BHP Program for Riverside and also working to help unlock the value at the Penoles Gold Silver Project in Durango Mexico which is 100% owned.

About the new Oakes gold project

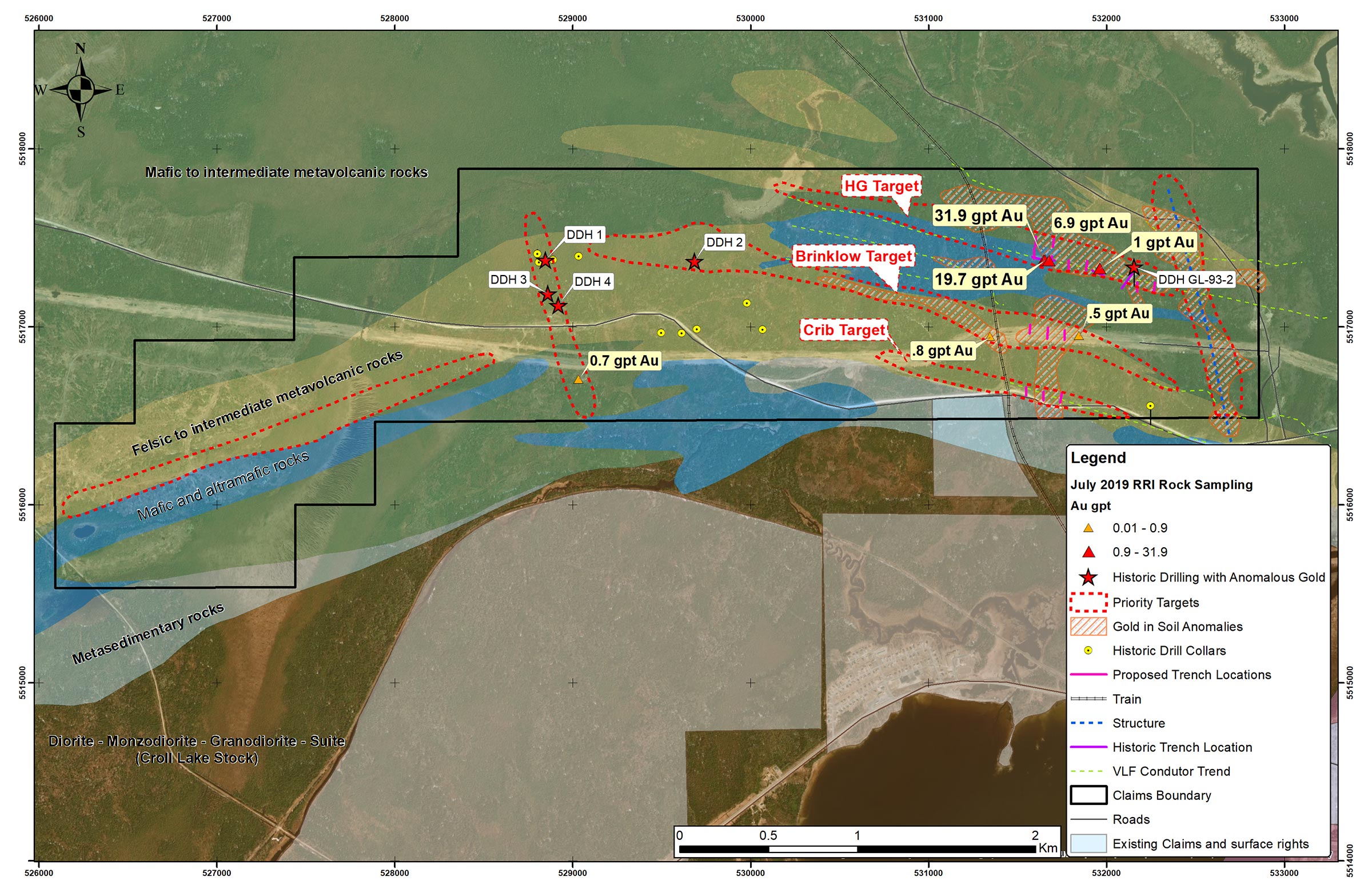

The company now no longer is a purely Mexico focused prospect and project generator as the company has staked its first claims in Ontario, Canada in July. Riverside calls its new project the Oakes Gold Project, and the claims are located in northwestern Ontario in the Geraldton region. Although the Geraldton region may not immediately ring a bell, there are some past producing mines in the area (including the MacLeod-Cockshutt mine which produced approximately 1.5 million ounces of gold) and the attention was recently drawn to the area when Premier Gold Mines (PG.TO) announced a joint venture with Centerra Gold (CG.TO) to jointly develop the so-called Greenstone gold project which currently contains 1.41 million ounces gold (at 2.15 g/t) in the measured and indicated categories and an additional 1.36 million ounces of gold at 3.09 g/t in the inferred resource category.

The majority of those ounces (1.08Moz in the M&I resource categories and 1.27Moz in the inferred resource categories) at the Greenstone gold project are classified as ‘underground’ ounces. Riverside’s initial exploration program at Oakes was (obviously) focusing on rock channel outcrop sampling, and the initial assay results taken from an area that was subject to a trenching program in 2010 returned high-grade gold values (up to 19.7 g/t gold). Definitely interesting enough to follow up on as although it’s still very early days, we would imagine the Greenstone joint venture between Premier and Centerra would be interested in potential (open pit) satellite deposits that could add value to the Greenstone project.

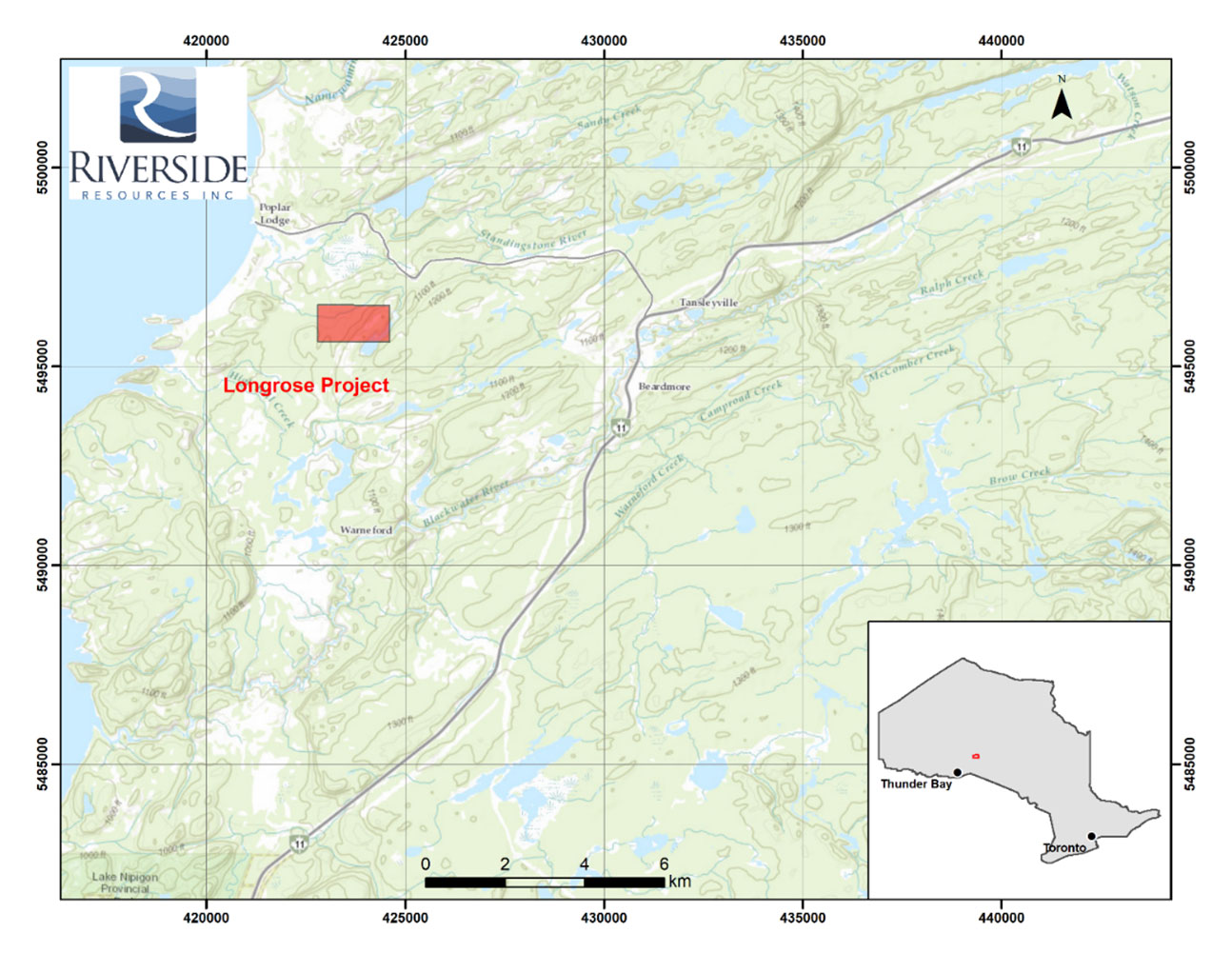

A second Canadian project has been added to the Riverside list of ‘properties available for joint venture’. The Longrose gold project in Ontario is a 320-hectare project in the same Geraldton greenstone belt, just 7 kilometers west of Beardmore town. Riverside was able to have a look at the historical exploration data for Longrose and the assay results from a 1947 (!) drill program returned a high grade gold interval in a narrow quartz vein, but there were wider intervals at a lower grade (quite similar to the Greenstone project owned by Premier Gold and Centerra Gold). In this region, in excess of 1 million ounces of gold were recovered from approximately 1 million tonnes of rock, thus indicating an average grade of in excess of 1 ounce per tonne.

Both the Oakes and Longrose projects are marketed to potential joint venture partners.

Canada

Riverside has always presented and positioned itself as a project and prospect generator focusing on Mexico where you have assembled an impressive project database and strong ‘human capital’. Could you elaborate on your move into Canada?

Riverside is a prospect generating company and focuses on value and opportunity. In 2009, we acquired a highly prospective gold-copper district in Arizona, as we recognized the potential value of the project. That project now is a key holding of Arizona Metals (AMC.V) and Riverside owns 7M shares of the public company as well as a 2% NSR on the project. Arizona Metals (the new name of Croesus Gold) is currently trading at 26 cents which means our stake in the company is currently worth C$1.8M and that’s almost C$0.03 per share of Riverside.

Subsequently, Riverside moved into British Columbia, Canada with the partner funding Strategic Copper Alliance with Antofagasta (ANTO.L) and developed four different projects to test for porphyry copper systems between 2011 and 2015. Riverside having a corporate base in Vancouver Canada and skilled Canadian geologists on our team, we saw the opportunity to leverage off of our knowledge of Canada to stake and consider strategic low cost, high potential margin acquisitions. We used Freeman Smith’s (our VP Exploration) 20-year knowledge in Ontario among other central and western Canada exploration experience plus the Riverside database processing GIS skills to locate and stake highly prospective areas.

In Canada, with the partners’ ability to use Flow Through funding which comes from the Canadian Federal and Provincial Governments looking to support mining industry growth and give discount on spending on new exploration initiatives, it is a perfect fit for Riverside. We have the technical skills, live in Canada, and can network with potential partners on a daily basis.

Can we expect Riverside to add more Canada-based projects to its asset portfolio? And would you only be interested in Canadian projects or will you also have a closer look at the USA?

We have been looking at both the USA and Canada. With the strong USD and generally fairly mature prospecting regions we have not yet found the perfect fit in the USA again as we did at Sugarloaf Peak (in 2009). This doesn’t mean we are ignoring prospects in the USA as we still have the USA subsidiary in good standing and ready to go for the right opportunities.

We are still doing our due diligence on some Canadian assets and we will have more news flow from these Canadian activities over the coming few months.

Some would argue the company is spreading itself too thin by having projects in two completely different jurisdictions. How would you reply?

We are using the same staff, same skills, and have a broader fit for potential partners. With the BHP Strategic Program we have our Mexico team active on that and we have good Mexican projects. Let it be clear we continue to have Mexico as a focus, but Canada is an opportunity, we live in the region and are working off of our historic knowledge and leveraging off the Canadian governments supportive efforts where we have fixed infrastructure that can use this well.

Let’s discuss the merits of the project itself now. How did you come across the property? And can you elaborate on the historical exploration programs by the previous owners?

The Oakes project is located along a major gold trend with past production of million-ounce gold operations and resources of > 1-4M Oz remaining in deposits along the belt. The specific area has good outcrops and our geological team had been to the area previously and was looking for the timing with it having open ground. We saw the opportunity and jumped on it.

The property has had successful drilling of structural orogenic greenstone style gold mineralization and we see the continued along strike potential plus past IP and magnetic geophysical data that indicates to us the likely geologic break which could host a major new gold discovery.

With outcrops of high-grade gold and potential continuity to the geophysical targets we saw the historic work now combined with our own program work as a really nice chance for a major Riverside shareholder win.

What are the next few steps to prove up the value of the Oakes project? And how far do you anticipate Riverside to have to go before finding a partner for the project?

The steps so far have progressed us nicely with field work, rocksaw cut channels perpendicular to the main structures which have given grades and thicknesses that excite us including over 10 g / t Au and shear zone areas greater than 20m wide. Further work could include geophysics and/or immediate drilling. We are looking now to prepare the property for partnerships as Riverside prefers the Prospect Generator model and welcomes this project into our portfolio.

Mexico

Riverside appears to be in ‘expansion mode’ as you also acquired the Mexican portfolio from Millrock Resources (MRO.V). Could you elaborate on the background of this transaction?

This was a great opportunity and fit for Riverside and Millrock. Millrock can focus on its main Alaska activities, Riverside has the partnership with BHP and immediately can take the porphyry style projects to partner BHP.

The epithermal gold silver properties may have porphyry at depth and also have undrilled targets and abundant data. We also purchased rights to all the company’s data and databases for the predecessors and current company. This we integrate with our on-going BHP generative program as we also have BHP’s data for Sonora. All this data continues to improve and leverage off of Millions of Dollars of Past work so Riverside can focus on great targets in Mexico.

We also got the physical assets including trucks, field equipment, office, core racks, and computers. We are selling back some computers and thus reducing our purchase cost immediately as well as most of the trucks as we have as through our BHP program we have been able to purchase new high quality vehicles as part of the capital asset spend with BHP to operate at highest safety standards. So in all this deal is a great win- win and we would do more of these anytime. Riverside has the team now presenting these projects to BHP and we will be in the field as well on the other 10’s of target areas we have going. It is very exciting and busy for Riverside in Mexico right now.

We are particularly interested in the Los Cuarentas project, close to Premier Gold’s Mercedes mine. What’s your opinion on the project and its potential?

Absolutely, we are very excited about this one as well. The Los Cuarentas has drill-ready wide near surface targets similar to Silvercrest Metals (SIL.V, SILV) – Las Chispas District immediately to the west as well as the Mercedes Mine and Santa Elena Mine operated by Premier Gold and First Majestic Silver (FR.TO, AG) respectively. So yes around three major mining and high quality districts with us now having title and good growth targets, this has immediately positively impacted our field plans and I am off in the field at Los Cuarentas this week. It is smart for us as shareholders to consider these new worked up targets with the rest of the portfolio and move toward self progressing or JV partnering.

With BHP as the immediate first order partner we are meeting and presenting to them our target ideas. We appreciate the vast past field and sampling work. Geophysics, geology, geochemistry which we leverage off with our knowledge of the regional significance makes these acquisitions exciting. We only took ½ the projects available, as we wished to focus on each one that has a strategic reason or we did not take it. The ones we took have strategic value reasons and now we work to unlock and make a major value generating discovery.

You will be working on projects close to Premier Gold in both Canada and Mexico and in both cases your projects have the potential to be seen as some sort of ‘satellite’ zone to their own operations. Has your relationship with Premier Gold changed? Are you now on their radar?

We have an open friendly relationship with our neighbors, we share insights, experience, and staff knows each other. We see a good potential fit with success to bolt on a discovery on our ground to the infrastructure potentially operating at the other sites. We will be having meetings in the coming months as well and have been working to get all our targets and information integrated as Riverside already had data from our databases for these projects as well.

Last year, Riverside was hesitating between finding a joint venture partner for the Cecilia project in Mexico’s Sonora province or to drill the project yourselves. What has happened at Cecilia in the past six months, and what are your plans for this year?

Most attention in the past few months was given to the opportunities like Millrock and BHP coming to us which brings a plethora of new quality projects and yet still had field work going and are now putting together an updated technical report on Cecilia. We really like the new Cecilia targets as well as having upgraded from field mapping, sampling, rock, soil and structural work some of the known targets.

We have three sets of targets now worked up at Cecilia and could various types of drill programs, some these are all permitted and ready to go. Now with the Millrock assets (particularly Los Cuarentas) and the gold market coming back -which is raising the JV interest levels rapidly and significantly- our management and board is looking at the best deployment of capital. Riverside still has over C$3M in cash plus over C$3M in other company’s equity so we are in a good position to pursue a drill program ourselves, and the Cecilia project would be a good contender for a drill program.

You also announced Alberto Orozco as new Vice President Corporate Development. Could you elaborate on why he appears to be a good fit for Riverside? And as he is based on Hermosillo, will this have any consequences for the current team that’s based there?

We are delighted and feel very lucky that Alberto Orozco joined us as he has over 15 years experience in Mexico with public companies, strong knowledge and his base in Hermosillo as he steps up to lead our BHP Exploration Program while also working on other corporate development initiatives. Alberto has experience with major discoveries and transactions in Mexico including Linear Gold and then Pediment Gold which was acquired for the gold resources and potential to put into production. He also is the President of the Sonora Mining Cluster and thus provides a good entry for Riverside into networking with the mining operators in Mexico and helps us to remainup to speed on the regulatory policies, while he also is in an excellent position to spot potential exploration opportunities.

You also announced an exploration agreement with BHP to look for large copper deposits in Sonora. A strategy that makes a lot of sense considering the vast amount of huge copper deposits in Arizona and considering the Laramide trend obviously doesn’t stop at the US-Mexico border but just continues into Mexico. Have you already done some work with/for BHP since the deal was announced?

Yes, Riverside has been very busy this spring and through the summer. Now we see the fruits of such labors as the BHP agreement took 18 months to finalize and we are delighted to have the world’s largest mining company choosing to fund and do business with Riverside. This deal whereby we benefit from BHP’s experience and its access to capital gives Riverside the fire power we need to pursue our own projects without highly diluting the company.

We have very good business terms with imbedded financial success bonuses and asset percentage ownership while BHP funds 100% of the work, acquisition and essentially de-risksthe projects. This agreement came out of years of knowing each other and many Riverside staff having worked for BHP in exploration in Mexico including the discoveries of the Cu resource moving toward a Cu mine at El Plomo and other discoveries. BHP knows Riverside has an idea of the giant scale, and big impact BHP needs with a discovery and is bringing targets to BHP for future drilling and expansion discovery.

The next steps

For Riverside we have hit on 4 key parallel tracks. They all have the same theme, DISCOVERY and value. We have assets at Tajitos and Penoles where we are working to unlock the value out of the portfolio. Both these properties have good potentials to build resources and expand upon past work. This fits Riverside’s business of owning and unlocking value. Share price should rise with a reranking as clarity over having many combined good assets in a small market cap company and we will work to get these different projects rolling with external funding where Riverside shareholders get the ride for the upside.

Next will be news from Canada and Mexico. Riverside is working to get drill targets refined and partners to complete agreements.

Conclusion

Riverside has now completed three major updates on the corporate level by closing a strategic exploration alliance with BHP, acquiring a portfolio of Mexican assets from Millrock Resources while it now re-entered Canada after staking claims in Ontario, a low-cost and efficient way to lock up ground the company expects to be potentially interesting.

With all corporate activities now being completed, we are looking forward to see Riverside’s planned field programs for the second half of the year, and will keep a close watch on the results.

Disclosure: Riverside Resources is a sponsoring company. The author has a long position in Riverside Resources