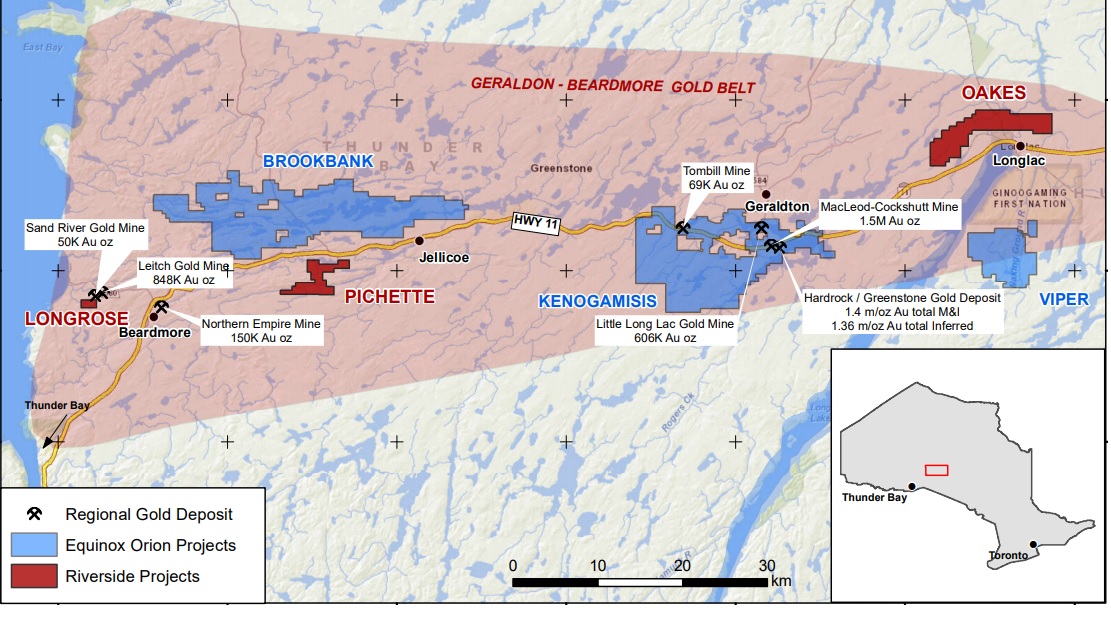

Riverside Resources (RRI.V) has entered into an agreement with iMetal Resources (IMR.V) whereby the latter will acquire full ownership of Riverside’s portfolio of assets located in the Geraldton Greenstone Belt in Ontario. This means all three projects; Oakes, Pichette and Longrose will be transferred to iMetal Resources for a total consideration of 8 million shares of iMetal Resources (valued at almost C$1.3M using the recent closing price of C$0.16) as well as a 2.5% Net Smelter Royalty on all metals except for copper, lead and zinc, where the NSR rate will drop to 1.5%. Additionally, a one-time bonus of C$0.5M in cash or stock will be payable if a gold interval of in excess of 100 gram-meters is reported (for instance 200 meters of 0.5 g/t or 33 meters at 3.1 g/t), so Riverside could get a nice additional bonus out of the deal.

Considering this was a relatively early stage portfolio and Riverside invested around C$0.5M in staking, exploration and man-hours on these three assets, selling the portfolio at a valuation of almost C$1.3M and retaining a royalty seems like a good deal. iMetal Resources is also required to raise C$2.5M in cash for the deal to go through, so this means the assets will likely get some attention in the near future. The 8M shares gives Riverside a 15%+ stake in iMetal Resources, but this stake will be reduced when IMR raises the C$2.5M.

After selling the Geraldton portfolio, Riverside will be left with just one Canadian project, the High Lake district it staked. This 230 square kilometer district near Kenora, Ontario, remains available to be optioned out to interested parties.

Disclosure: The author has a long position in Riverside Resources but no position in iMetal Resources. Riverside is a sponsor of the website, iMetal Resources is not. Please read our disclaimer.