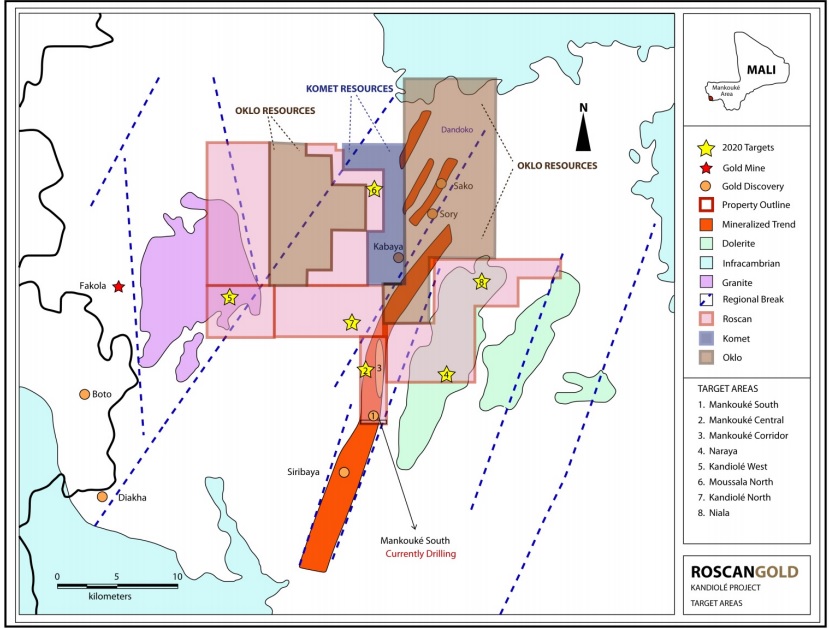

Roscan Gold (ROS.V) has entered into an agreement with publicly listed Komet Resources (KMT.V) whereby Roscan will purchase Komet’s Malian subsidiary which owns the Dabia Sud gold project, a 35 square kilometer land position squeezed into Roscan’s and Oklo’s land position on the prospective gold trend. Roscan will be paying C$1.6M in cash and C$1.6M in shares (the amount of shares to be issued to Komet Resource will depend on the 5 day VWAP before closing the deal).

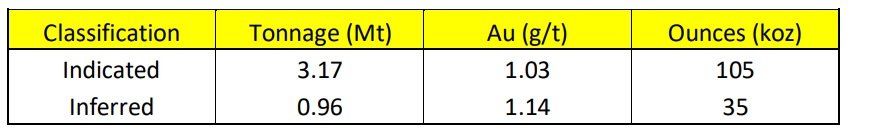

This acquisition makes a lot of sense for Roscan. Not only is it adding 140,000 ounces of gold (105,000 ounces indicated and 35,000 ounces in the inferred resource category) at an acquisition cost of around US$16/C$22 per ounce but what’s more important is the upside exploration potential. The Komet land package has barely been scratched at surface (Roscan’s press release mentions the average depth of the historical drill holes was just about 80 meters) and considering Roscan has been successful in adding ounces at depth on its own land package, it shouldn’t be too hard to rapidly expand the 140,000 ounces on the Komet lands.

With this acquisition, Roscan Gold is making itself more appealing for a prospective buyer.

Disclosure: The author has a long position in Roscan Gold. Roscan currently is not a sponsor of the website, but has been one in the preceding 12 months.