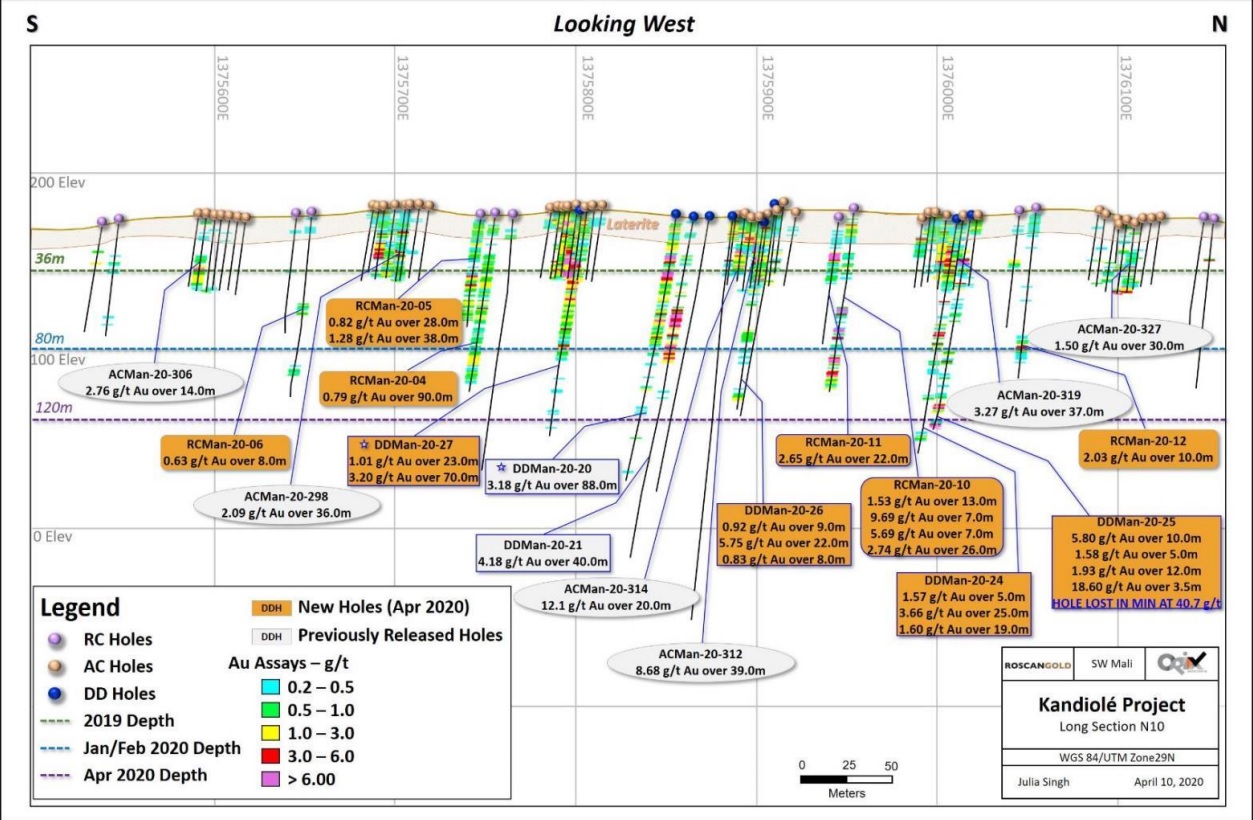

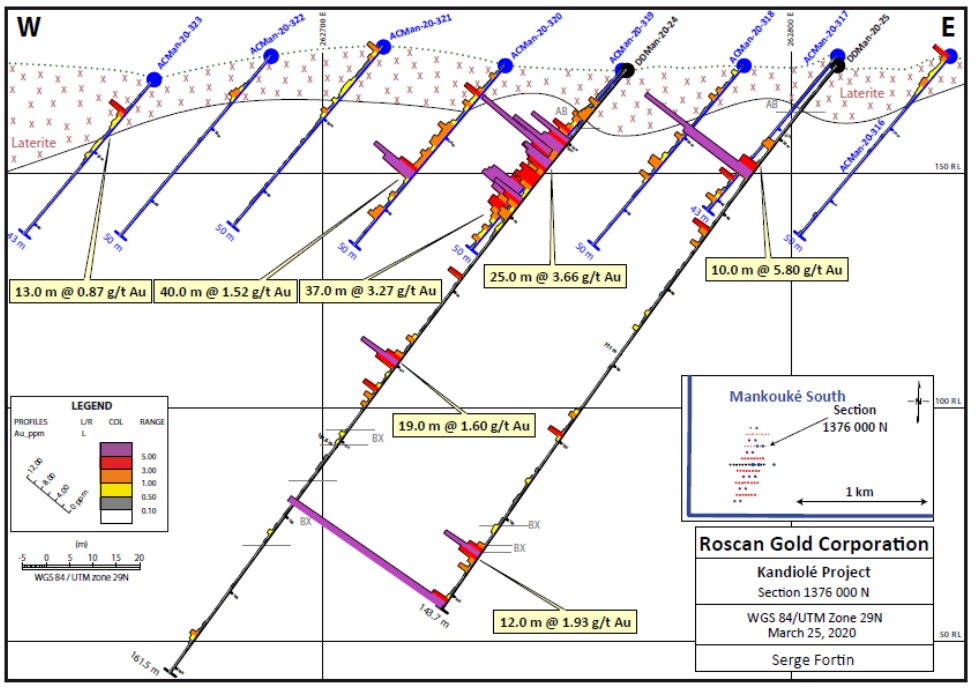

Roscan Gold (ROS.V) has released the assay results from an additional 20 drill holes earlier this month, and this combination of diamond and RC drill holes confirms the continuity of the gold-mineralized zones as the presence of gold has now been confirmed to a depth of 120 meters at Mankouke South while one of the diamond drill holes ended in mineralization about 144 meters down-hole.

Not only did that hole end in mineralization, the grade of the lower part of that hole is phenomenal as the final assays indicate 40.7 g/t gold over 1.5 meters before the hole had to be abandoned due to drilling issues so it will be interesting to see what else is down there. Needless to say Mankouke South remains open at depth and to the North, and Roscan will continue to focus on increasing tonnage in those two zones. All relevant assay results can be found in Roscan’s press release HERE.

Roscan also announced it recently received C$2.6M in cash proceeds from the exercise of 12 cent warrants that were issued as part of a previous placement. According to the April 24 press release, an additional 11.95M of these warrants remain outstanding and if all those warrants (which are now in the money with a margin of in excess of 100% given the current share price of C$0.25) will be exercised, Roscan will add an additional C$1.4M to its treasury. Those warrant holders still have about 3 months to exercise those warrants but we are impressed with how the company’s trading volumes have been able to absorb the selling volume related to the exercise of those warrants (it would be Utopia to imagine all warrant holders will just exercise and keep the stock, there will always be some sellers).

The orderly exercise of the C$0.12 warrants will confirm our expectation that Roscan Gold won’t ‘have’ to go back to the market to raise money as a chunk of the C$0.22 warrants will very likely be exercised as well given the current share price and the trading volumes. Assuming all C$0.12 warrants will be exercised, C$4M will be raised and this, in combination with the C$2.9M working capital position as of the end of January should be sufficient to cover the exploration expenses for the time being if those C$0.22 warrants are indeed being exercised. That being said, considering the previous raise happened at C$0.10 in December, it would make a lot of sense for Roscan to try to raise an additional C$4-5M at C$0.25 if the market appetite is there. That would put a new bottom under the stock and could result in all 28.5M of the C$0.22 warrants to be exercised (for gross proceeds of C$6.3M) which could then get Roscan through 2021 before the 33.7M C$0.16 warrants are expiring (for gross proceeds of C$5.4M).

Last year, we weren’t too impressed with the warrant structure of Roscan, but the recent exciting drill results have proven us wrong: good assay results have been sufficient to get the share price over the warrant exercise prices.

Disclosure: The author has a long position in Roscan Gold but has been exercising warrants. Roscan Gold is a sponsor of the website.