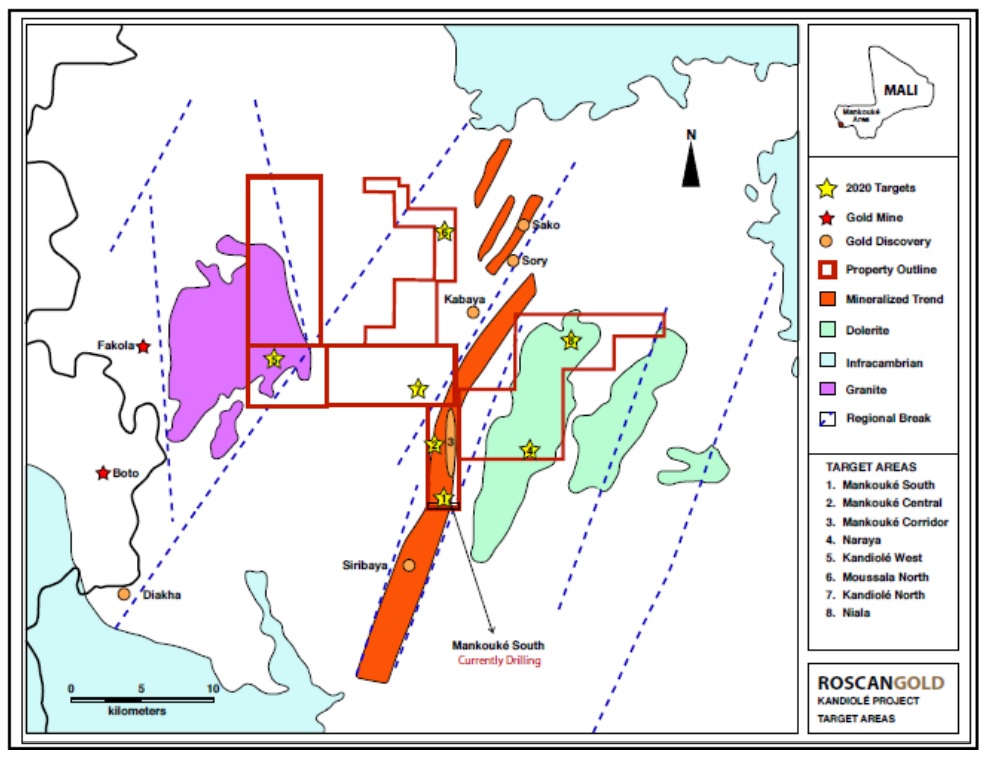

Roscan Gold (ROS.V) is currently working through a drill program on its Kandiole gold project in Mali, and some of the assay results that have just been released are truly jaw-dropping.

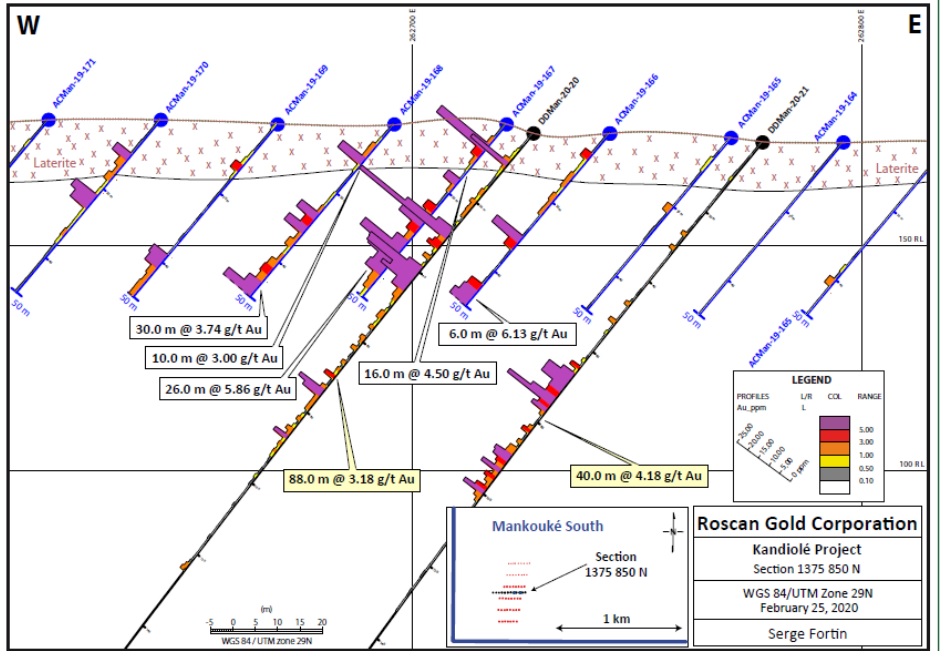

88 meters of 3.18 g/t gold, 39 meters at 8.68 g/t gold and 48 meters of 3.71 g/t gold are just three of the intervals but as they are starting at a depth of respectively 4.7 meters, 6 meters and 2 meters, it’s almost unimaginable to see these gold values basically at surface. And this is just a handful of selected intervals as even at slightly deeper zones (but still open pittable) encountering 20 meters of 12.1 g/t and 40 meters of 4.18 g/t is incredibly good for a gold project, and we are almost certain the Roscan team itself is quite surprised with these gold values.

Roscan is now adding a second drill rig and has tripled its drill program to 30,000 meters to aggressively follow up on these initial drill results. The share price is currently still trading below 20 cents and will probably stay there until all July warrants will have been exercised. As a reminder, the cap table contains 33.65 warrants with a strike price of C$0.12 that will expire on July 26. As we can imagine these warrants are now gradually being exercised, Roscan’s share price is probably held back by those exercises as the current market capitalization is still just C$28M. But on the flip side, if all C$0.12 warrants are being exercised, Roscan will be able to top up its treasury by C$4M which will allow it to keep the drill rigs turning.

Those drill results are phenomenal, and we hope the remaining 27,000+ meters of drilling will contain several more of these high-grade and near-surface gold values.

Disclosure: The author has a long position in Roscan Gold. Roscan is a sponsor of the website.