Roscan Gold (ROS.V) has provided the market with an extensive exploration update with assay results from its aircore drill program which focused on the termite anomalies and approximately half of all those anomalies have now been drill-tested.

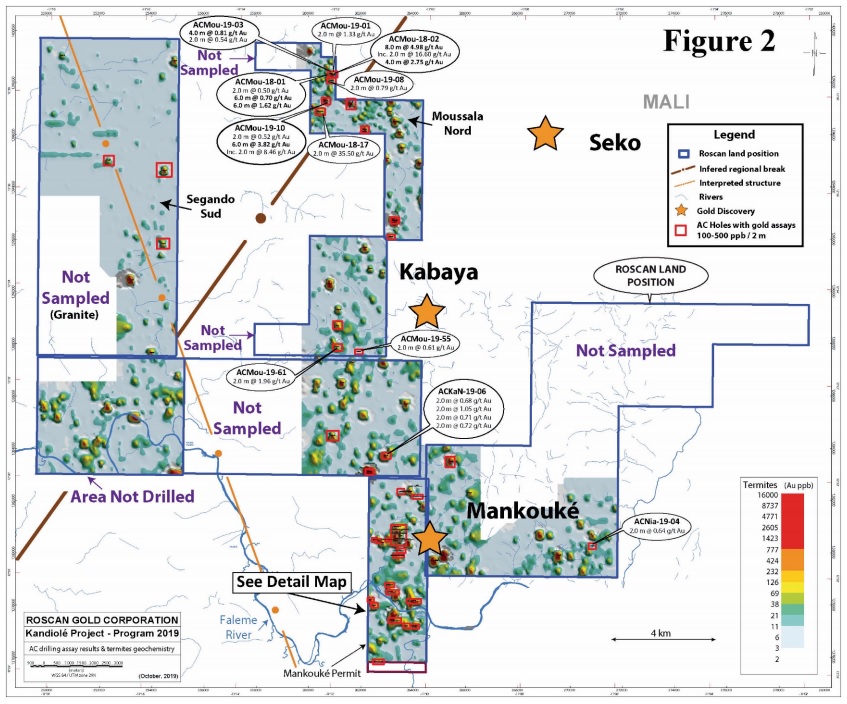

At Moussala Nord, Roscan has now identified a mineralized zone extending over two kilometers in a Northeast-Southwest trend and the most recent batch of assay results intersected 6 meters of 3.82 g/t gold starting from a depth of 38 meters, and this is quite consistent with previously encountered high grade mineralization of for instance 8 meters at 4.98 g/t gold) and it now looks like this trend links up with the Kandiole West zone in the Southwest and the Walia discover by Komet in the Northeast.

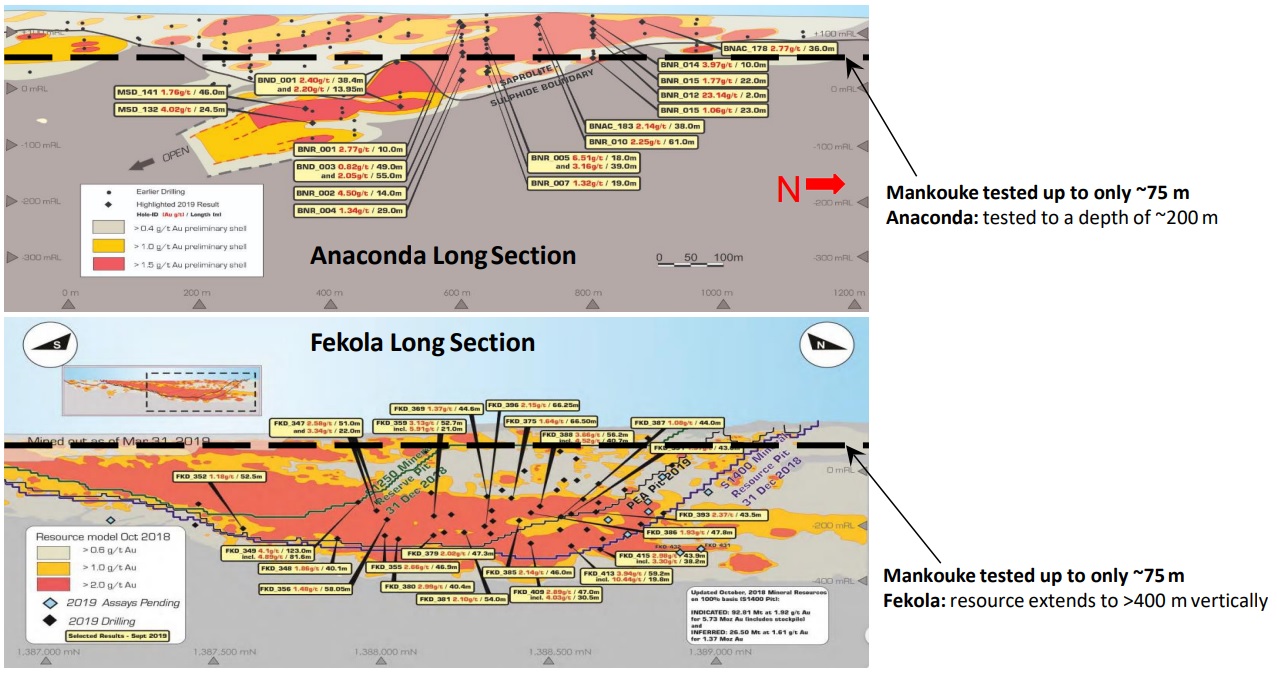

Roscan also drilled additional holes at Mankouke where it has now defined two important discoveries now called Central Mankouke and Southern Mankouke. Roscan appeas to be quite excited about Central Mankouke and CEO Greg Isenor wants to drill the northern part of the 500 meter trend as soon as feasible to add to the strike length (note: the 500 meter trend we just mentioned is just the strike length that has been drilled, the total strike length of the mineralized corridor at Mankouke is now at least 7 kilometers long).

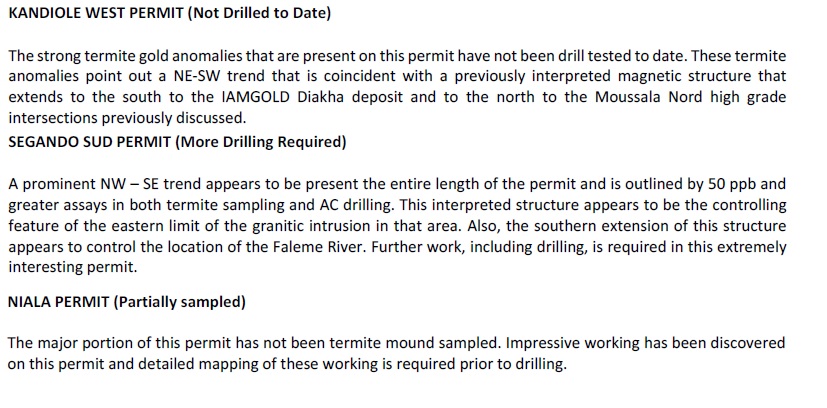

In addition to the Mankouke and Moussala Nord zones, Roscan also continued its greenfields exploration program at Kandiole West, Seganco Sud and Niala which currently are in different exploration stages.

The rainy season will end in a few weeks, and Roscan Gold appears to be ready to hit the ground running. Central Mankouke will be drilled, and the other land packages will be explored through a combination of air core drilling and (termite mound) sampling.

As of the end of July, Roscan Gold had a working capital position of C$650,000 after having spent in excess of C$2M on exploration in the third quarter. This means Roscan may have to raise more money sooner rather than later although we are still hoping some of the 33.7 million warrants with an exercise price of C$0.12 (expiring in July next year) will be exercised to keep the treasury at an acceptable level. As the current share price remains above the exercise price and the expiry date is now just 9 months away, this doesn’t appear to be an unrealistic assumption. Should all warrants be exercised, Roscan will be able to add C$4M to its bank account.

Disclosure: The author has a long position in Roscan Gold. Roscan Gold is a sponsor of the website.