A little while ago, Atalaya Mining (AYM.TO, LON:ATYM) reported its financial results of the first quarter of the year after it had already pre-published its production results (re-read them here).

The impact of the lower copper price ($2.80 per pound on average) was mitigated by an 8.2% production increase as Atalaya produced just over 10,200 tonnes of copper. The revenue remained relatively stable at 51.7M EUR but the EBITDA increased by 30% thanks to Atalaya’s operating cost reductions. As Atalaya also didn’t have to pay an interest expenses, the bottom line of the income statement showed a net income of 14.16M EUR, or 0.10 EUR per share (which is approximately C$0.155 per share).

Additionally, the cash flows also remained strong at 20.3M EUR, but this excludes any allocation for the taxes as Atalaya is still tapping into its accumulated losses from the past few years. It looks like that ‘tax shield’ should help Atalaya to avoid any tax-related payments until 2022, and helps its funding efforts.

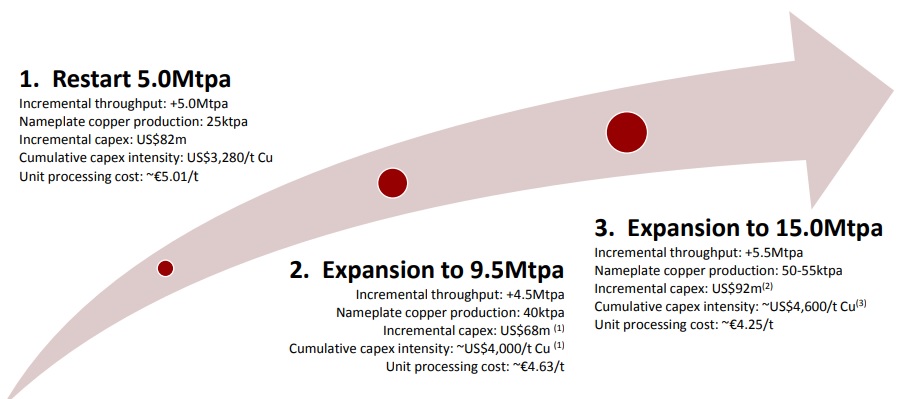

The 20.3M EUR in operating cash flow (before changes in Atalaya’s working capital position) were sufficient to cover the 17.1M EUR in capital expenditures. As you may remember, Atalaya is in the middle of a capacity expansion which ultimately should lift its copper output to 110-120 million pounds per year. The construction phase (of the final expansion to 15 million tonnes per year) reached a 72% completion rate at the end of Q1, and the mechanical completion is still scheduled for the end of this month.

For 2019, the company maintains its previously issued production and cost guidance. It plans to produce 45,000-46,500 tonnes of copper (99-103 million pounds) at an all-in sustaining cost of $2.25-2.45. This means the mine should remain profitable at the current copper price of $2.60/pound, but the operating expenses (estimated at US$1.80 per pound in Q1) should increase throughout the remainder of this year so we estimate an average operating cash flow of 11-13M EUR per quarter in the next few quarters.

This puts Atalaya Mining in a strong position to take advantage of the expected improvement of the copper fundamentals, but we hope the company can solve all legal issues sooner rather than later.

Go to Atalaya’s website

The author has no position in Atalaya Mining. Please read the disclaimer