While we usually comment on company-specific news in the hard commodities sector, it’s impossible to ignore the oil and gas sector appears to be one of the very few sectors in the entire commodity space where investors are actually able to book profits these days.

Just 18 months ago, almost the entire sector was on the verge of a wipe-out as banks were cutting lines of credit left and right but the comeback of the sector since those lows is nothing short of phenomenal. And it’s not just oil and the oil price fueling this resurrection, as the natural gas price has gained some momentum and remains very strong as well. While AECO gas (the traditional Canadian gas price) is trading firmly above C$3, the Henry Hub natgas price for immediate delivery is trading above US$5. Happy faces all around as every single producer in the oil and gas sector is currently printing cash. Some companies are still held back by historical hedges and let’s hope the management teams of those producers are smart enough to continue to hedge a portion of their output going forward.

Because that’s our main fear right now. We see a very similar evolution develop as we saw and see in the hard commodities markets. When prices are low in for instance the copper sectors, companies proudly announce they locked in some fixed prices by hedging a portion of their production. But as soon as things get better ‘hedging’ is a dirty word again. And that’s strange. If an oil company was happy to hedge at much lower prices, it should continue to do so at the current prices but only a handful of oil and gas companies has a consistent hedging policy (NuVista Energy comes to mind as it applies a rolling hedging program).

The past two weeks the headlines were dominated by the European gas crisis. Gas prices for delivery this winter have fourfolded and the gas prices on a TTF basis in the Netherlands have increased to almost 100 EUR per MWh. This represents an AECO-equivalent gas price of approximately C$40 which is more than 10 times higher than the current AECO gas price in Canada. Another example of how Canada has shot itself in the foot by not investing in LNG facilities. The operators of the US-based and Australia-based LNG facilities are printing cash by buying cheap domestic gas, converting it into LNG and ship it off to a market where the gas prices are 2-3 (and now 5-8) times higher. Meanwhile, Canadian gas remains subject to transportation capacity constraints. And that’s why the Canadian gas price is currently trading 50% lower than the Henry Hub price, and about 90% lower than the prices in Europe.

The image above shows the evolution of the natural gas prices for delivery in December. Trading at less than 20 EUR per MWh (approximately C$8.8 AECO-equivalent) about six months ago, the natural gas price has fourfolded. Mainly because European buyers are now in direct competition with Asian buyers to secure enough LNG and natural gas to get through the winter.

And that’s about as much as the mainstream media reports on the case as it’s presented as a case of ‘shit happens’. But we have yet to see any investigative journalism as to WHY the current issue is happening and it looks like the energy crisis may be a case of gross negligence.

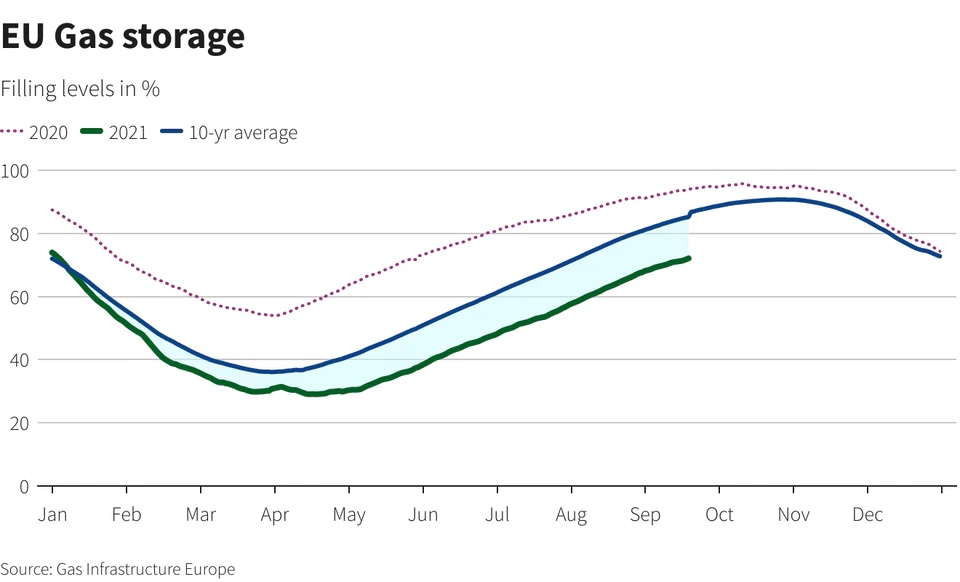

A Reuters article published a few weeks ago contained an excellent chart showing how the gas reserves in Europe were much lower than average going into the winter months. Not only were the reserves much lower than the 10-year average, they were also much lower than the 2020 reserves. That’s perhaps understandable as the collapse of the economy in 2020 resulted in higher than average gas reserves as the demand for natural gas was lower than budgeted.

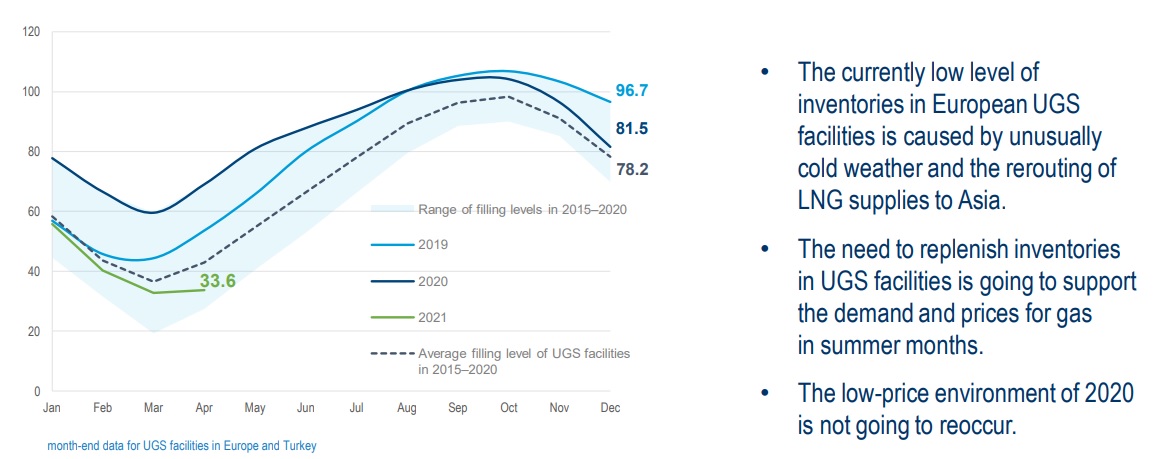

We have the impression some people were asleep at the wheel. Sure there was an excess supply in 2020 and reserves were higher than the 10-year average. But it has been clear for months the European economies are rapidly reopening in 2021 and although the demand for natural gas sharply increased, the strategic reserves were not built up again. And that’s something Gazprom already pointed out in its May corporate presentation where it highlighted the alarmingly low natural gas storage levels in Europe.

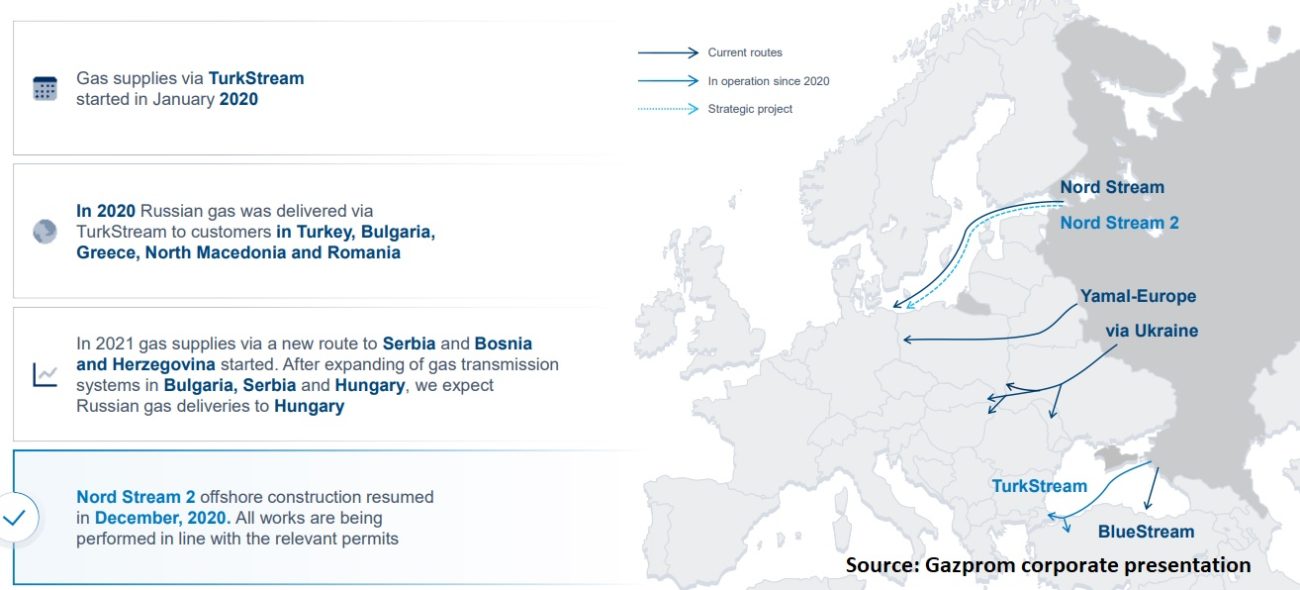

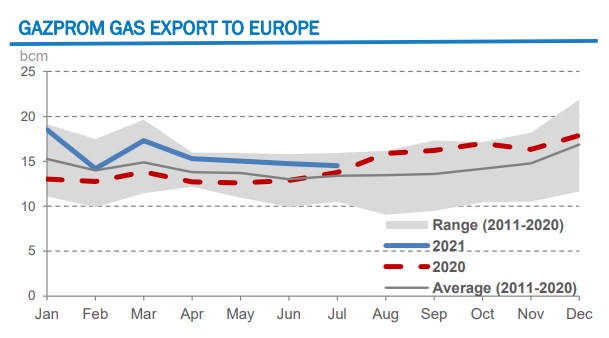

In some media, fingers are being pointed at Russia which reduced its gas exports in August as Gazprom first had to boost the Russian reserves, and of course, there also was a political game as reducing gas flows was an excellent way to increase the pressure on completing and opening the new Nord Stream 2 natural gas pipeline which bypasses Ukraine.

But as you can see on the image above, it’s too easy to point fingers at Russia as the reserves had been trending much lower than the 10 year average in the months leading up to August and the gap didn’t get wider since August. Additionally, the image below clearly shows Gazprom’s gas deliveries to Europe were trending higher than the 10-year average and 2020 deliveries in the first half of the year.

The European reserves have been lower than average since February (despite the higher imports from Russia on a year-on-year basis) and rather than solving the issue during the summer period by proactively securing additional supply, no additional actions were taken to rapidly fill up the natural gas storage capacity.

It’s just too easy to blame external factors for the high natural gas price. Someone was asleep at the switch. And that’s pure negligence.

The data on the futures markets are backing up the ‘asleep at the switch’ theory. As you can see below, the futures markets are clearly indicating a massive collapse of the natural gas prices in May next year, after the winter period. The gas price for delivery in May is trading at 44 EUR/MWh (53% below the December futures) while the gas price for delivery in the winter of 2023 is less than a third of the current spot price (the market is likely also taking a successful start-up of the Nord Stream 2 pipeline into account).

The futures market indicates the natural gas crisis in Europe is not a fundamental crisis but a horrific and historical error of judgment.

Disclosure: The author has a long position in Gazprom and in a variety of North American oil and gas producers (but no position in NuVista Energy). Please read our disclaimer.