Kutcho Copper (KC.V) has been silent throughout the summer but that doesn’t mean no work was getting done. Kutcho has just released updated metallurgical test results on two different composites that were taken from the Kutcho copper project during the 2018 drill program. Composite A appears to be the most representative composite for the project as the lower recovery rates of Composite B (which was taken from high-sulphur zones) will only apply on a small part of the deposit. Kutcho Copper is still doing additional met work which will include a global composite, and we hope to see additional test results in the next few weeks and months.

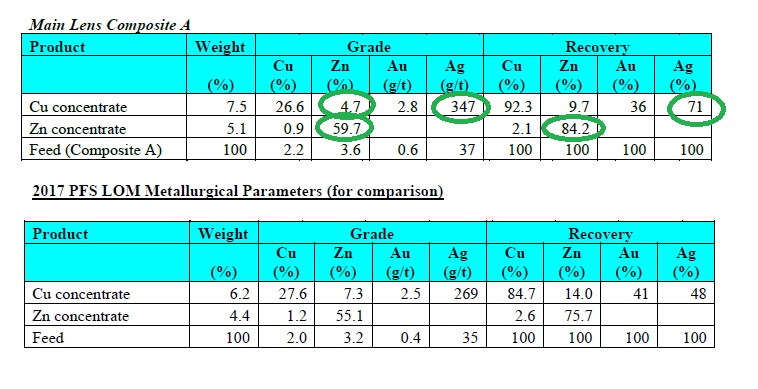

Compared to the parameters used in the 2017 pre-feasibility study, the updated test work is clearly better. The copper recovery rate increased from 84.7% to 92.3% and while the average grade of the copper in the copper concentrate decreased by approximately 1% to 26.6% (still within offtake specs), the gold grade increased by 10% while the silver grade increased to 347 g per tonne of copper concentrate. So despite the 1% decrease of the copper grade in the concentrate, the concentrate value (per tonne) should remain unchanged thanks to the slightly higher silver and gold grades.

While most investors will only look at the headline result with the increased copper and zinc recovery rates, the Kutcho update is so much more important on so many levels.

First of all, the total silver recovery rate increased from 48% to 71%. And while silver is just a small part of the metal distribution, every additional percent of the silver that gets recovered will add value, especially as the higher recovery has a direct impact on the silver grade in the copper concentrate. A clear positive as the payability for silver in the copper concentrate is much higher than in a zinc concentrate (where smelters don’t pay a single cent on the first three ounces of silver in a zinc con). The more payable silver ounces will be recovered, the faster Kutcho Copper will deliver the 5.6 million ounces to Wheaton Precious Metals (WPM, WPM.TO) under the streaming agreement. Once the initial 5.6 million ounces will be delivered, Kutcho will be allowed to retain 1/3rd of the silver production and the sooner that moment arrives, the more value will be left on the table for the Kutcho shareholders.

Secondly, the higher zinc recovery rate (a combined recovery increase from 89.7% to 93.9%) is also positive, but even more important is that the recovery rate of the zinc into the zinc concentrate increased from 75.7% to 84.2% which didn’t just boost the grade of the zinc concentrate from 55.1% to 59.7% (which will warrant a small pricing premium as the zinc grade comfortably exceeds the usual 48-52% zinc grade requirement), but the concentrate grade increase is directly connected to a decrease of the zinc grade in the copper concentrate (from 7.3% to 4.7%). That’s an important step forward for Kutcho Copper as zinc that ends up in a copper concentrate is usually worthless: smelters usually won’t pay for the zinc credit in a copper concentrate. So the more zinc that gets rejected from the copper concentrate and ends up in the zinc concentrate, the better.

So not only did Kutcho Copper make excellent progress by boosting the recovery rates of the two main metals, but even more importantly, a higher percentage of the metals ends up in the right concentrate now. A double boost for Kutcho as both the higher recovery rates and higher payability ratio of the zinc (from 64.35% (85% payability and 75.7% of the zinc recovered into the zinc concentrate) to 71.6% (85% payability on 84.2% of the zinc recovered into the zinc concentrate) will have a positive impact on the economics in the feasibility study.

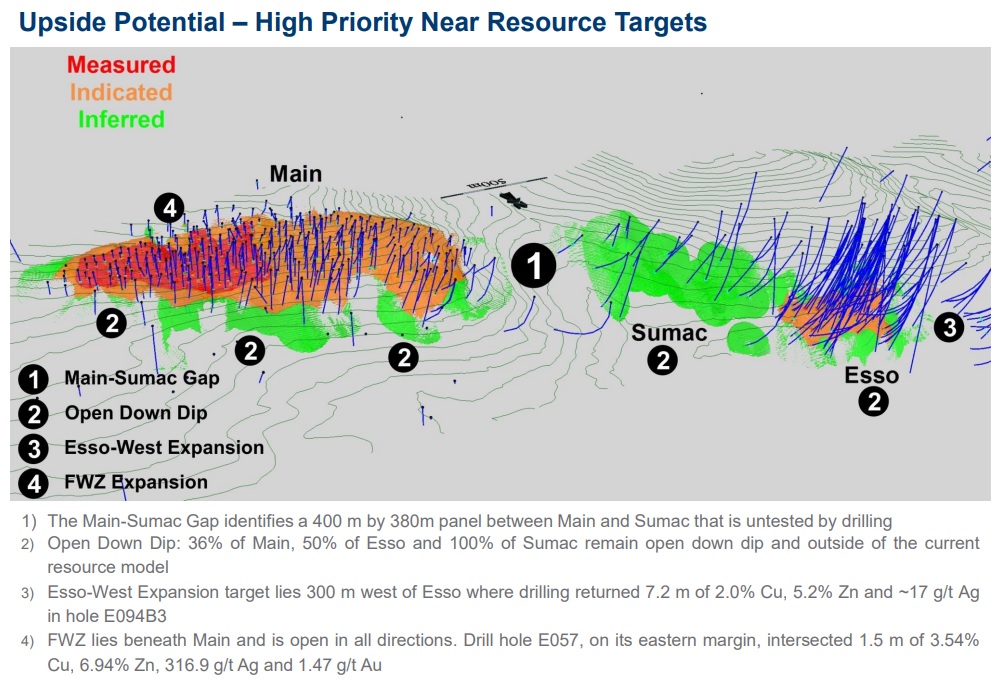

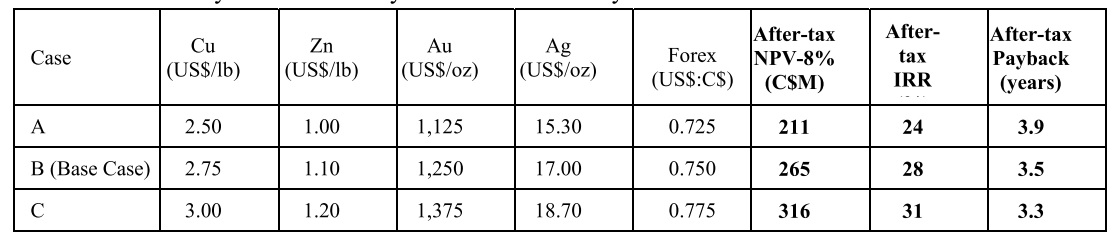

As a reminder; the pre-feasibility used a copper price pf $2.75 in its base case scenario which resulted in an after-tax NPV8% of C$265M and an IRR of 28% (and a LOM undiscounted free cash flow of C$533M). Considering Kutcho has now successfully expanded its resource base and its metallurgical test results indicate approximately 10% more copper and zinc will be recovered versus the assumptions in the pre-feasibiity study, the NPV should now comfortably exceed C$300M keeping all other parameters equal, and even including the impact of the gold and silver stream.

Disclosure: The author has a substantial long position in Kutcho Copper. Kutcho is a sponsor of the website.