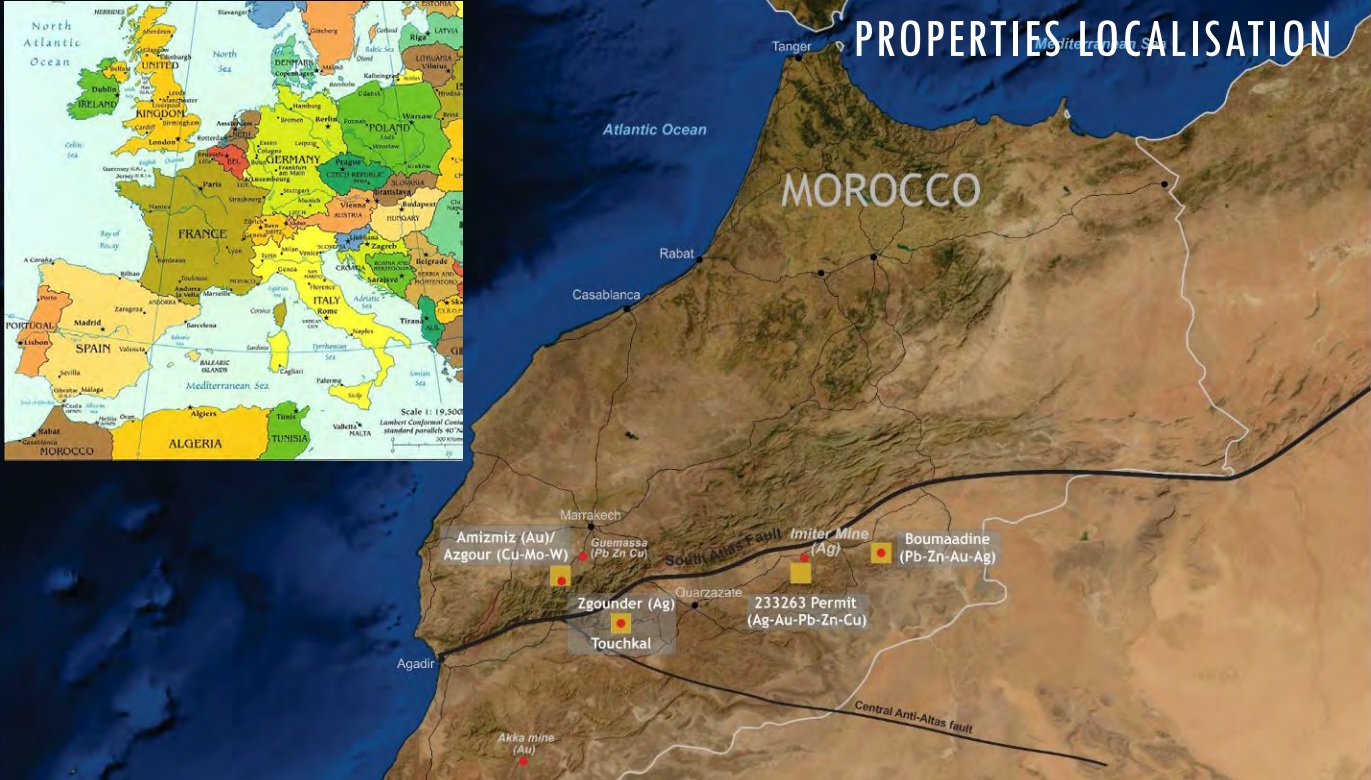

Maya Gold & Silver (MYA.TO) grabbed the headlines in April when the company announced the results of its Preliminary Economic Assessment on its Boumadine project, which shows an after-tax Internal Rate of Return of 53% and a NPV6.5% of almost US$498M.

Impressive numbers for pretty much any mining project in the world, and we don’t even mind using a 6.5% discount rate as Morocco is indeed perceived to be a safer jurisdiction compared to most other African countries. The mine plan calls for the mining of 7.6 million tonnes at an average grade of almost 102 g/t silver, 1.67 g/t gold, 4.03% ZnPb and 5.4 g/t germanium that will be processed at a rate of 1,500 tonnes per day, increasing to 2,000 tonnes per day after two years.

The grades are good, the initial capex of US$89M (total capex including sustaining capex is estimated to be US$120M) is very reasonable and the mining cut-off grade was based on a gold price of $1300/oz, a silver price of $15.5/oz, a zinc price of $1.30 per pound, a lead price of $0.91 per pound and a Germanium price of $2,200/kilo. The zinc price may appear to be a bit optimistic here, but overall, we have no objections against using these prices to determine the cutoff grade.

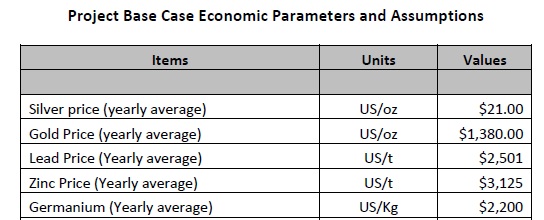

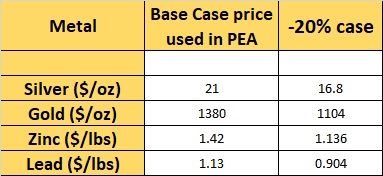

What we fundamentally disagree with is the optimistic price deck used for the economic assumptions. Let’s have a look:

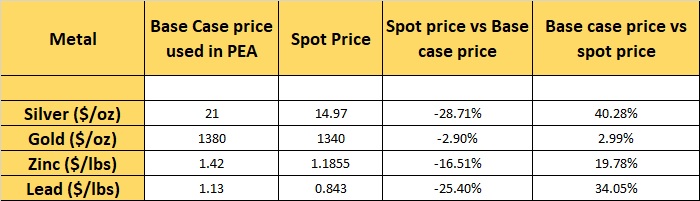

While we don’t doubt the accuracy of the production expenses (which are estimated at US$102/tonne and appears to be a very reasonable assumption), it looks like Maya (and Maya’s consultants) fell for the ‘over-optimistic’ trap by using metal prices that are too high to be a credible base case scenario. While we would obviously love for Maya Gold and Silver to be absolutely correct about its pricing projections, it’s perhaps not the best idea to use metal prices that are substantially higher than today’s spot prices. In the next table we are comparing the base case prices with the metals prices as of the closing bell of the metals markets yesterday, June 7th.

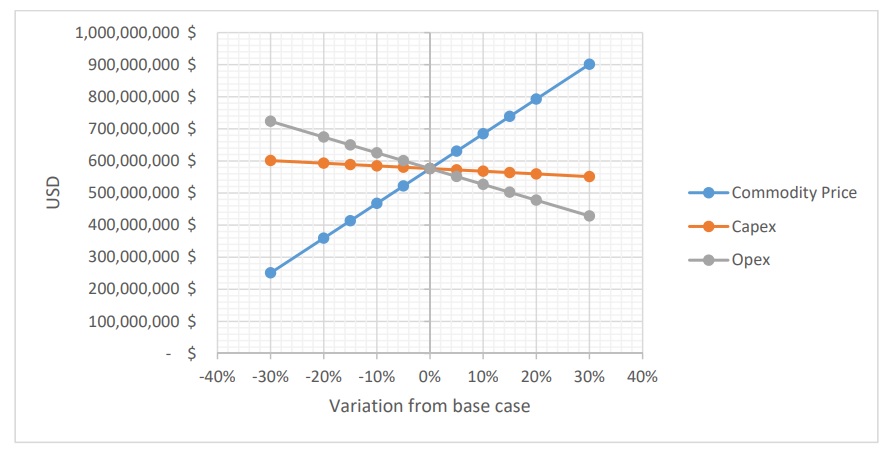

It’s clear that using an optimistic price deck is the main contributor to the high NPV and strong Internal Rate of Return. Fortunately the NI43-101 report also contains a sensitivity analysis, so we checked what the NPV and IRR would be using metal prices that are approximately 20% lower than the base case scenario.

According to the official sensitivity analysis, using a 20% lower metals price, the pre-tax NPV6.5% would still have been around US$360M (with an estimated post-tax NPV of around US$300-310M). And yes, that’s still absolutely excellent for a low-capex operation. Using March 29th spot prices ($1195 Au, $15.10 Ag, $0.92 lead and $1.36 zinc), the after-tax NPV6.5% was calculated at US$383M with an IRR of 47%.

As the project seems to remain quite valuable even after applying a 20% lower metal price, we don’t understand why Maya Gold and Silver was so determined to use a price deck that is way too optimistic for a maiden PEA. We think the company lost a lot of credibility on the market doing resulting in a lukewarm reaction to the PEA. If Maya would have applied more conservative metal prices, it probably would have resulted in a better value recognition by the market.

Because that’s all the market cares about these days: projects that make sense and stand out from the crowd at the CURRENT metal prices. And Maya should be proud the Boumadine project does seem to work at those prices and shouldn’t have been putting lipstick on the project by using premium metal prices.

Go to Maya’s website

The author has no position in Maya Gold & Silver at this time. Please read the disclaimer