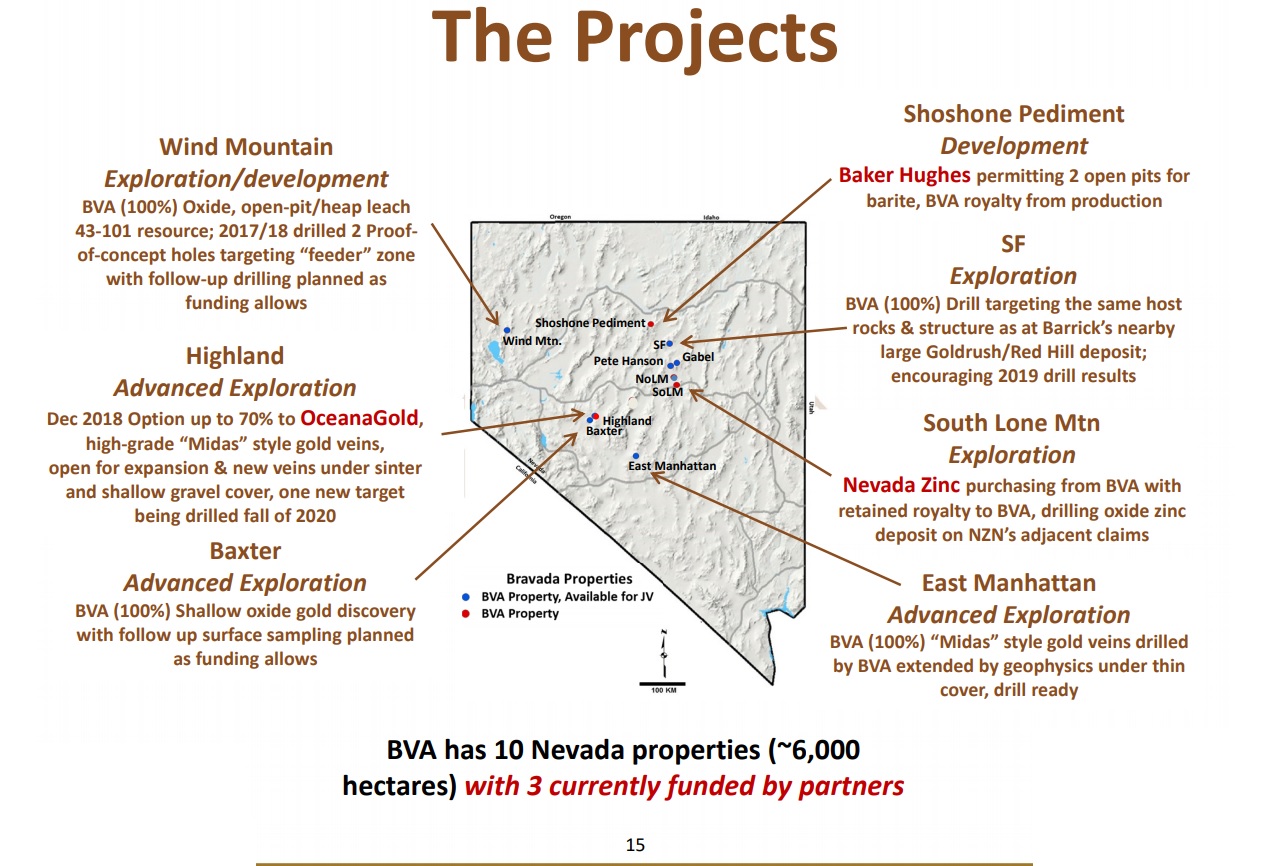

- You finally received the drill permits for the Highland project in Nevada. How tough is it to navigate through the bureaucratic system? Has COVID-19 resulted in substantial delays?

Actually, the process with the BLM went quickly except for an error I discovered in their approval letter, which took extra time to correct. The BLM permit is called a Notice and allows for up to 5 acres of disturbance with an appropriate reclamation bond. Once a company submits a request, the BLM has 15 working days to either accept the requested disturbance plan and bond amount or request specific additional information.

Our Highland Notice was accepted in 10 working days, but the BLM Decision Letter made an error by naming Bravada’s subsidiary as the operator instead of OceanaGold. Bravada’s subsidiary is the claim owner and agent for OceanaGold, which is responsible for the disturbance. That error required some paperwork and several signatures to correct, which added a couple of weeks. However, our planned start-date for disturbance was August 1st, and the delay did not affect our plans. We chose August 1st because we completed additional sampling in the target area and wanted to be sure that we received our data for the geochemical and clay mineralogy studies before drilling began. This data was received in the expected time frame and resulted in minor “tweaking” of the planned core holes.

- How were your proposed drill sites established? Can you elaborate on the ground work you did to finetune and refine the targets?

We have identified many valid drill targets at Highland. One of the reasons that we have been persistent in exploring Highland is that these high-grade low-sulfidation gold deposits worldwide have certain characteristics, which we see at Highland. One important characteristic is widespread quartz veins with local high-grade gold values. The mineralized quartz veins at successful gold mines are highly variable in gold content and usually only portions, called ore shoots, are economic to mine. A large number and distribution of quartz veins, and many significant gold assays, say 2 to +10 g/t Au, indicate a mineral system is worth exploring for the relatively small ore shoots.

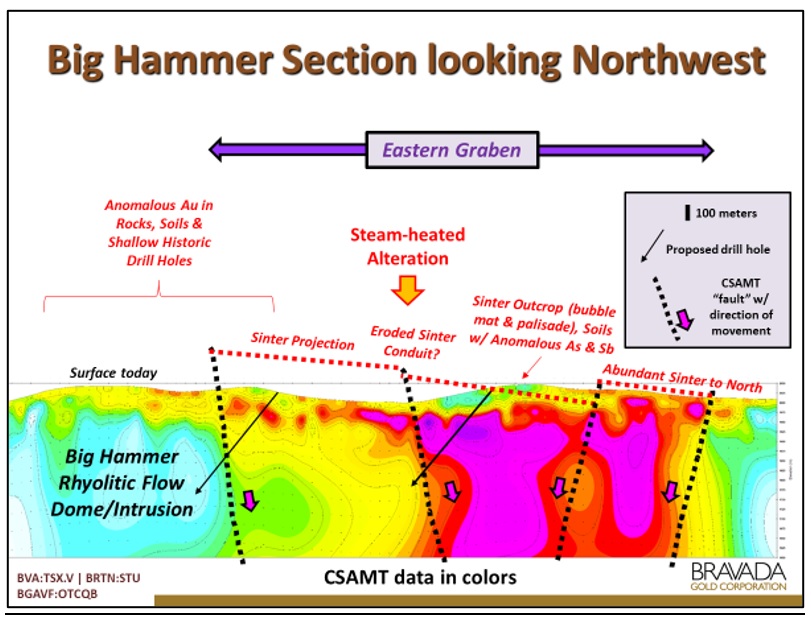

Our early work focused on the western portion of the Highland claims where many veins contain such gold values. We have several targets in the western area that remain untested by drilling, but the eastern portion of the property caught the attention of OceanaGold because of similarities to their New Zealand properties. The eastern area is less eroded than the western area at Highland, and the widespread veins and exposed mineralization is generally less robust, although grab samples do contain anomalous gold of less than 1g/t Au to a high value of +15g/t Au. Sinter is extensive in the eastern area, but is completely eroded from the western area. Sinter is the surface expression of hot springs, which may overlie high-grade, low-sulfidation gold/silver deposits. However, sinter is generally barren of precious metals (metals were deposited along fluid pathways deeper below the paleosurface). Targeting for relatively small, but rich, ore shoots is difficult when the veins are not exposed, but recent work in New Zealand has provided some guidance with both sinter mapping and geophysics. We used those techniques in combination with our previous mapping and sampling to choose the two sites at the Big Hammer target.

We have a second target, the Geyser target, that we are working to refine for drilling in 2021. We have permitted several drill sites at Geyser but will need to complete additional targeting work before designing a drilling program. By permitting the sites and arranging the bond now, we can speed up the permitting process for next year. It is relatively easy to modify existing sites compared to applying for a new Notice.

- OceanaGold will fund the drill program as part of its US$10M earn-in to acquire a 75% stake in Highland. How much has OceanaGold already spent to date?

OceanaGold spent US$330,000 in 2019. Expected expenditures for the two core holes in 2020 should be around $250,000.

- In your Highland announcement, you mentioned you are also looking at drilling a bunch of holes at Wind Mountain, can you elaborate on that?

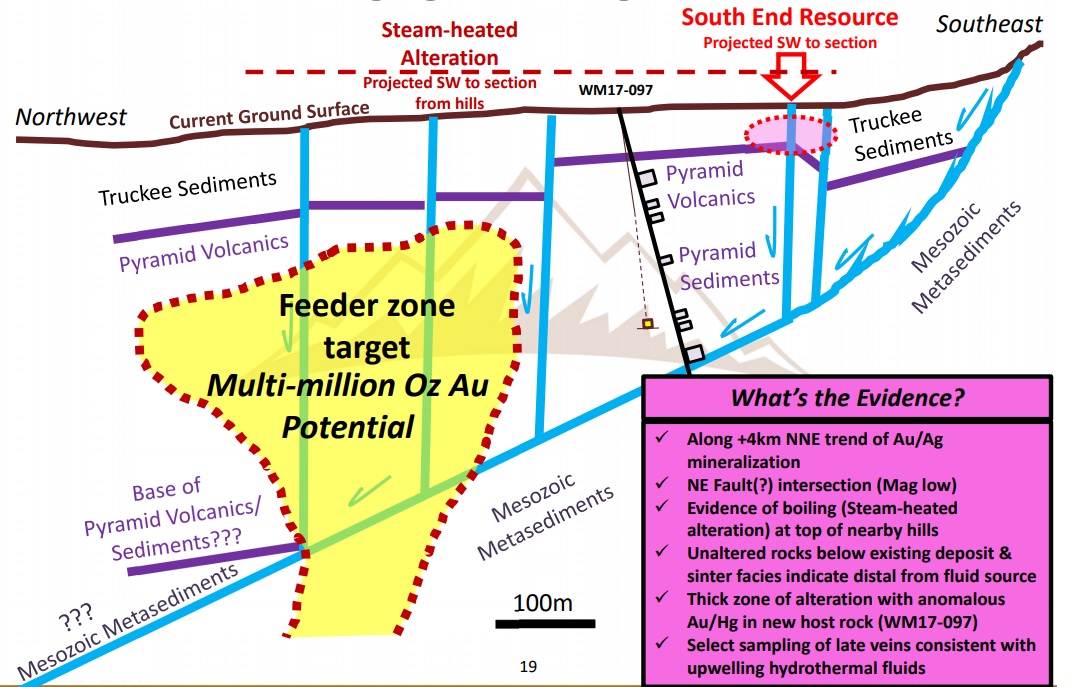

As you know, we have been searching for the feeder zone that was responsible for the existing near-surface gold resource and previously mined ore at Wind Mtn. Our work has led us to a relatively small area south of the existing open pits. We have investigated several geophysical tools that we had hoped could further focus the drill target, but our opinion is that none will confidently reduce the number of drill holes needed to test the area. We are currently modeling the locations for 3 or 4 relatively inexpensive reverse-circulation drill holes that will form a fence of holes across the target. With encouragement, we will follow up with core holes.

- Your share price is enjoying the strong gold environment. You tapped the market for C$664,000 in a placement which closed in June. May we assume you are also seeing participants in previous financings exercise their in-the-money warrants which further boosts your cash position and working capital?

Yes, we already have had warrants exercised, and we are putting the funds to good use at Wind Mountain.

- How has the collapse in the oil price and reduced demand for services of Baker Hughes impacted the production schedule at the Shoshone Pediment project, where you have a NSR? Can we reasonably assume the development to be pushed back for a while?

Yes, barite production has been severely impacted by the drop in oil price. Most of Nevada’s barite is utilized in the oil business to increase the density of drilling fluids in order to protect against gas blow outs. Barite processing is relatively simple, allowing producers like Baker Hughes to quickly make changes to production rates, both up as well as down. Longer term, the outlook is positive as permitting times have increased significantly for new barite mines in Nevada, and very few new deposits have been discovered at shallow depths. Barite at Shoshone Pediment is shallow and permitting was well advanced; thus, Bravada’s royalty will become a lot more interesting when the price of oil recovers, as it eventually will.

Disclosure: The author has a long position in Bravada Gold. Bravada is a sponsor of the website.