- In anticipation of a drill program, GSP Resource Corp. (GSPR.V) already completed a lot of desktop work on the Alwin project. You completed a 3D model of the unmined portion of the #4 North zone of the Alwin mine by incorporating all available data from the previous operators in the past few decades. Could you perhaps elaborate on how this 3D model was created and how this helps you towards drilling?

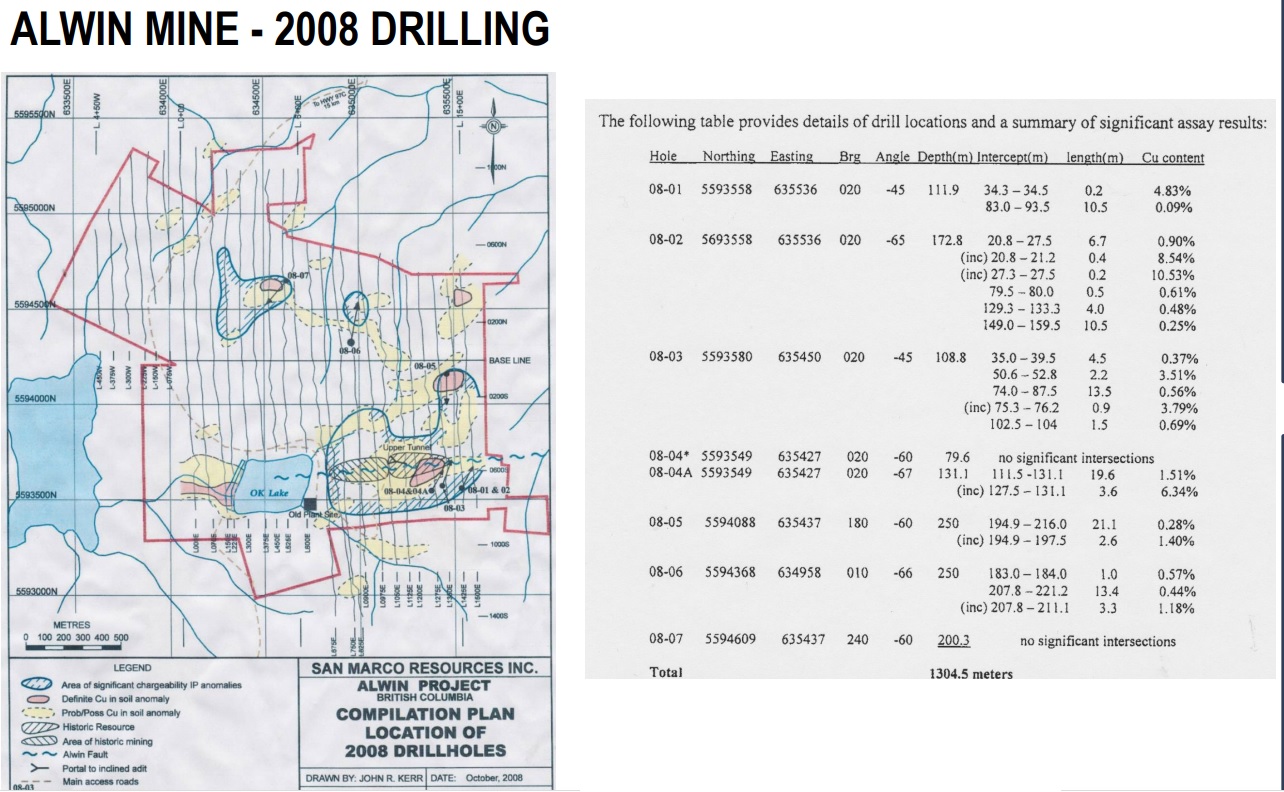

The last operator of this project drilled without a complete picture of the underground workings. We thought it prudent to invest time and effort to model pertinent information from historic operations to better guide our upcoming 2020 drill campaign. The modelled information allows us to better target known mineralization, as well as to test exploration targets with less chance of drilling into old workings. Drilling into old workings is costly and could inhibit us from gaining valuable information on the project. For example, San Marco’s hole 08-04a hit a nice intercept of 20m of 1.5% copper, but had to be terminated early as it hit an old tunnel.

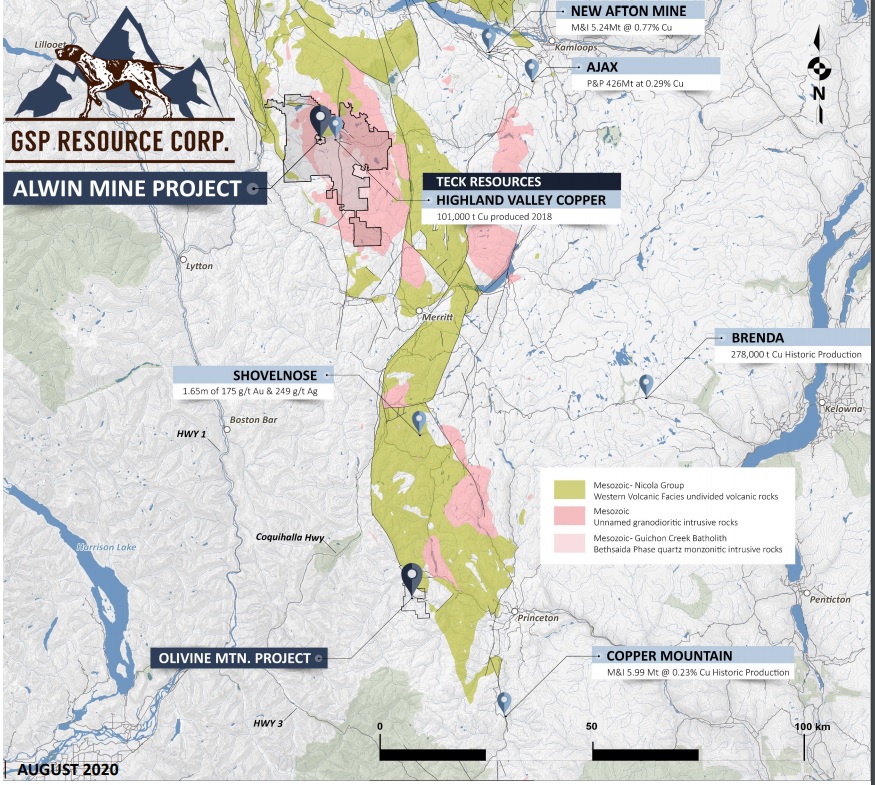

- Perhaps let’s take a step back and look at the bigger picture. What was your main reason to acquire the past-producing Alwin mine with GSP Resources? What are you after? The mines and projects surrounding you are pretty impressive with Teck Resources as your main neighbour whose Highland Valley copper project which is ramping up towards producing 350 million pounds of copper from next year on. Can Alwin be compared to those operations?

We are familiar with the project as my father, Christopher Dyakowski, Current chairman of GSPR worked on the project when he listed San Marco Resources in the mid-2000s. We felt the project deserved another look as San Marco was only able to undertake a very limited drill program back in 2008 at the time of the Great Financial Crisis and Stock Market Crash.

We like the fact that the project is very near the Giant Highland Valley Mine, as well its proximity to other mines in the Area like New Afton and Copper Mountain. The entire region is known to be a “mining corridor” and a great place to explore for more mineralization

- How did you come across Alwin, and why was it still available?

We knew that San Marco had shifted focus in the early 2010’s to projects in other parts of the world and the claims lapsed in 2018. They were reacquired by a local claimstaker over the next several months and we were able to negotiate a deal with him to option the claims in January of 2020.

- How are you doing treasury-wise? You raised C$400,000 in May and then again announced a new placement for C$400,000 with Palisades Goldcorp so you have been keeping an eye on your treasury.

Treasury wise we are sitting at about $900,000. We have had some warrant proceeds trickle in and the 400,000 investment from Palisades Goldcorp closed the same day we announced it (Late July). We have more than enough to complete Phase 1 drilling at Alwin this Fall and still have $500,000 working capital left over after drilling. We have a very low G&A burn rate of less than 20,000$ per month so we are well positioned financially and are able to keep the share structure tight so that shareholders have less exposure to dilution over time.

Disclosure: The author has a long position in GSP Resource Corp.