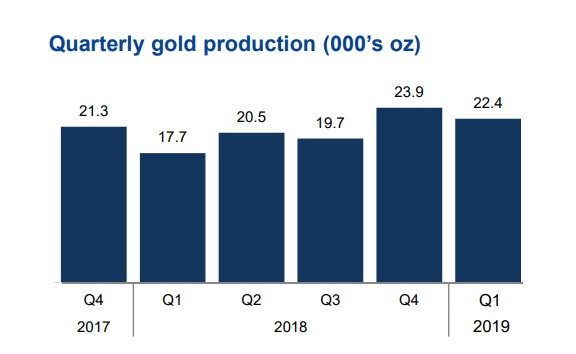

Shanta Gold (LON:SHG) released excellent production results for its first quarter of the current year. The company produced almost 22,400 ounces of gold at the New Luika gold mine in Tanzania and thanks to the very low operating expenses of just $500/oz, the all-in sustaining cost came in substantially lower than the full-year guidance of $740-780 per ounce.

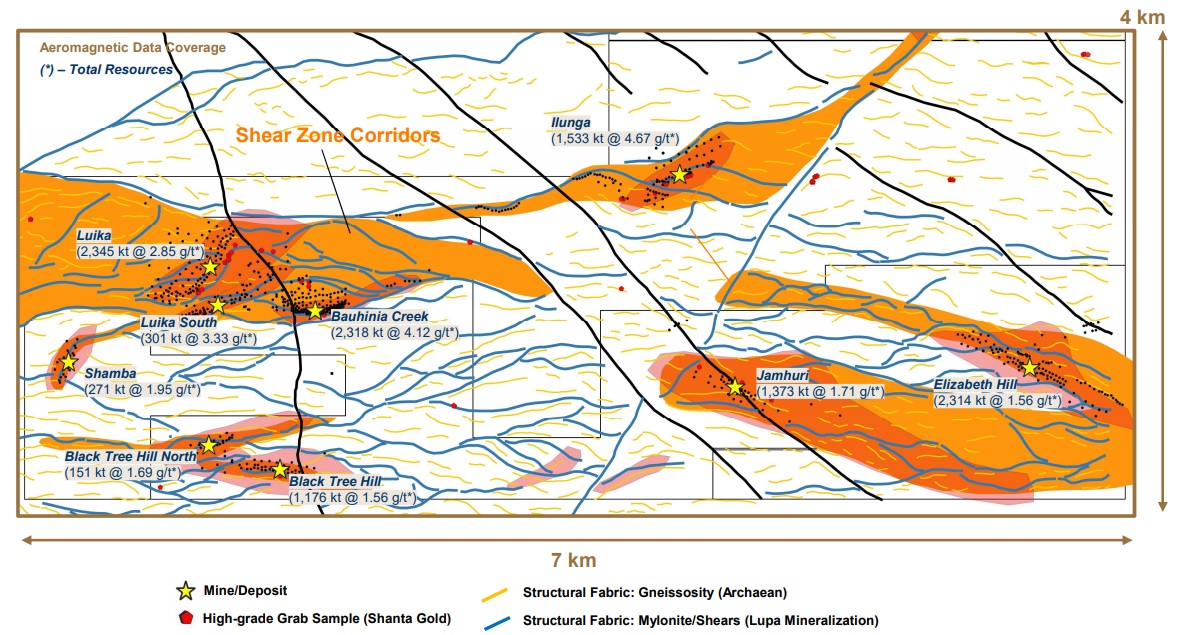

The higher capacity at the processing plant helped to improve the economics of the mine, and Shanta now expects to have converted its net debt position into a net cash position by the summer of next year, fueled by mining and processing rock from the higher grade Ilunga zone (the average grade during the development mining phase was just over 6 g/t gold), which was reached three months ahead of schedule. The average grade in the first quarter was approximately 4.5 g/t as Shanta has shut down its open pit mining component as apparently it wasn’t feasible to continue mining the 1.4 g/t material.

Meanwhile, Shanta Gold will list its local subsidiary which owns the Singida gold project on the Dar Es Salaam stock exchange, retaining majority ownership in the project/company. Shanta eyes to raise at least US$20M which would take care of the equity component of the construction funding package. While it’s a smart move to raise cash on the project level rather than Shanta Gold’s corporate level, the decision to list on the DSE very likely also has political motives as local ownership should boost the political commitment for the project.

Go to Shanta’s website

The author has no position in Shanta Gold. Please read the disclaimer