Sierra Madre Gold and Silver (SM.V) is advancing its hub and spoke model in Mexico, and although most of the attention is still directed towards the Tepic flagship project, Sierra is also advancing the La Tigra gold and silver project in Mexico’s Nayarit state.

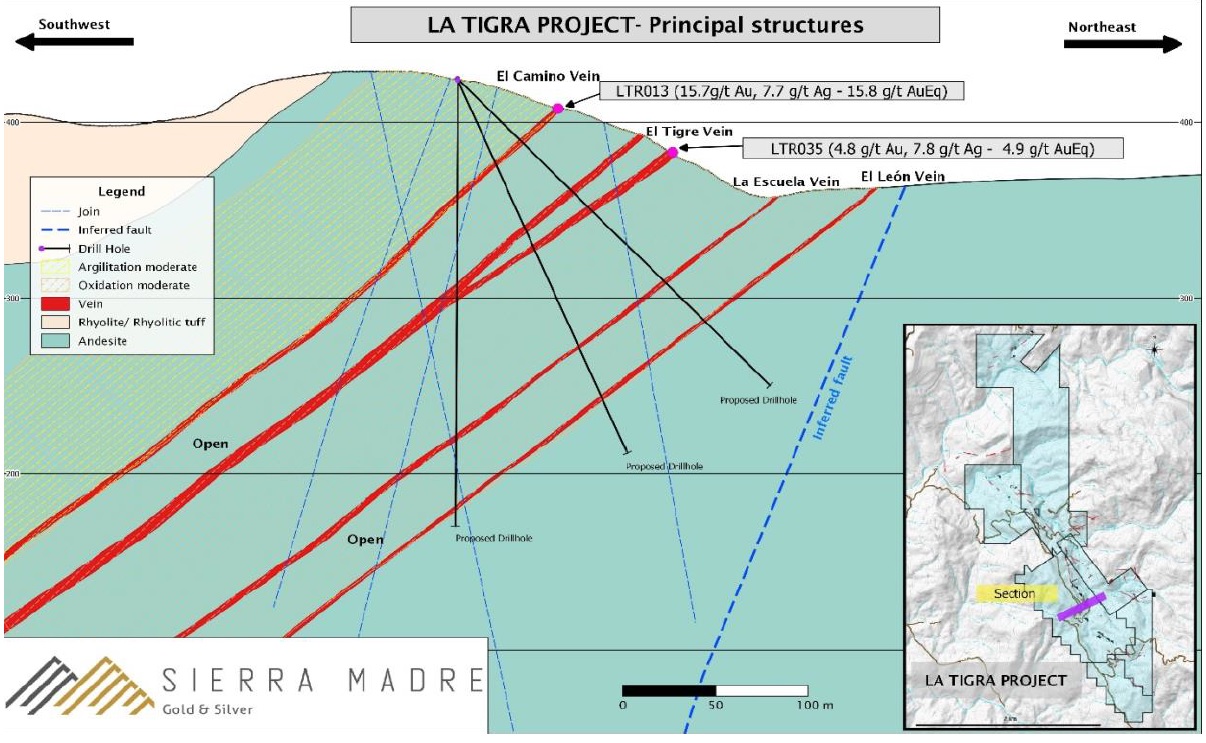

The company has received the assay results for 319 samples ranging from barely anomalous to a high of 18.2 g/t gold for an average of 0.48 g/t gold. 10 of the samples (approximately 3%) had a higher grade than 3 g/t gold while 32 samples (1/6th of the total sampling campaign) had a grade exceeding 1 g/t. This sampling program has identified two structural systems that seem to be hosting gold-silver mineralization in a stacked vein system.

Right now, a trenching program is underway while the field team will continue to sample road cuts. Upon completion and interpretation of the data from the sampling and trenching program, Sierra Madre will start a Phase 1 drill program at La Tigra once all relevant permits have been received.

The agreement allows for Sierra Madre to acquire full ownership of La Tigra by making US$1.5M in cash payments over a three year period and the commitment to complete a NI43-101 resource estimate before the end of that three year period. Additionally, a 2.5% NSR will be issued to the vendor, which can be reduced to 1% by making a payment of US$1.5M in cash.

There is a back-in right for the vendor: should the compliant resource estimate contain in excess of 1 million ounces of gold (the Sierra Madre press release specifically mentions ounces of gold, and not gold-equivalent ounces), the vendor has the right to back in to a 51% stake while Sierra Madre will retain a 49% ownership in the joint venture. Should the vendor indeed execute the joint venture plan, no NSR will be payable and both companies will just a have a straightforward 51/49 partnership.

Disclosure: The author has a long position in Sierra Madre Gold & Silver. Sierra Madre is a sponsor of the website. Please read our disclaimer.