Silver Tiger Metals (SLVR.V) has announced it has received all required approvals and permits to construct the El Tigre Stockwork silver-gold project in Mexico’s Sonora state. This means the company is now ready to advance the project towards construction, and the recently announced C$40M raise at C$0.73 (a straight-share financing, no warrants will be issued) will be very helpful.

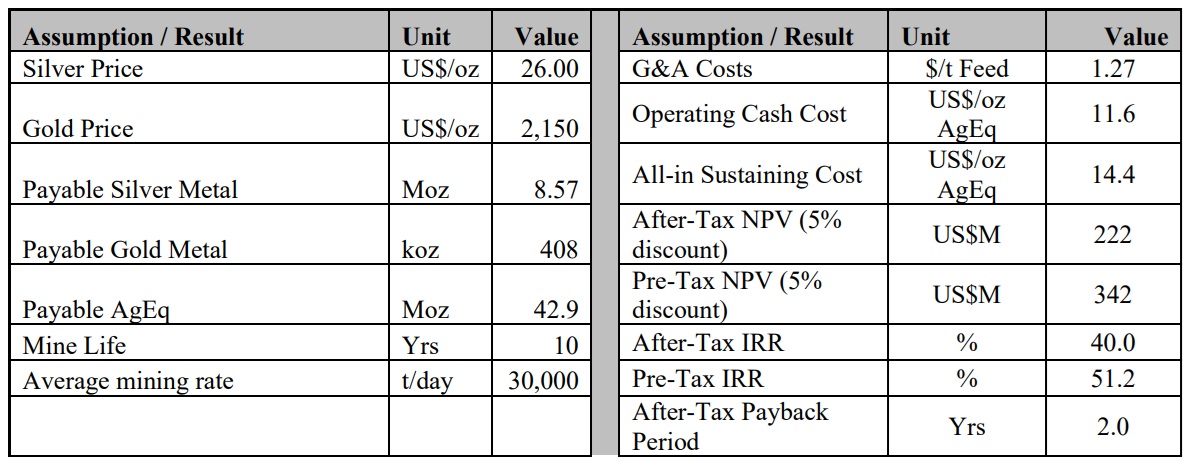

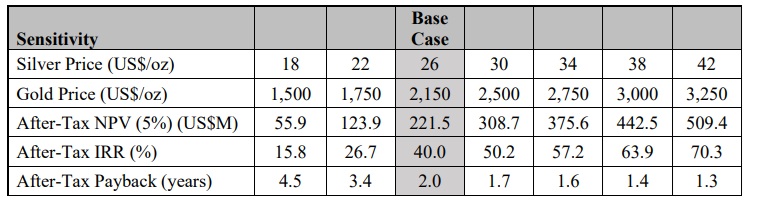

The 2024 pre-feasibility study reported a US$222M after-tax NPV5% but this was based on a gold price of $2150/oz and a silver price of $26/oz. Using a more up to date price deck of $3250/oz and $42/oz respectively (which of course still is well below the current spot price), the after-tax NPV5% increases to US$509M while the IRR jumps to 70% on an after-tax basis. With an initial capex of just US$87M (including 12% contingency), the financing needs are very reasonable.

Silver Tiger also plans to release a Preliminary Economic Assessment on the (permitted) underground resource before the end of this year.

Disclosure: The author has a long position in Silver Tiger Metals. This post is for educational purposes only; be mindful investing in junior mining stocks is risky and you may lose your entire investment if things go wrong. Please read the disclaimer.