Silver X Mining (AGX.V) has announced it signed an agreement with Alliance Management to acquire the Revenue-Virginius Mine assets in Colorado. This is the mine Aurcana (AUN.V) was hoping to bring back into profitable production but failed, and led to the collapse of Aurcana. There is a silver lining here as Aurcana has spent tens of millions of dollars on the asset in an attempt to become profitable but the company folded before the mine reached that stage.

CEO José Garcia also appears to be optimistic the company’s experience and know-how in narrow vein mining could be used in Colorado as well. As you know, Silver X’s flagship project, the Tangana mine which is part of the Nueva Recuperada Silver district, has an average vein width of approximately 1.5 meters which means the company’s miners have to be very selective in determining which portion of the material it needs to bring to surface. This experience could come in handy at the RV mine.

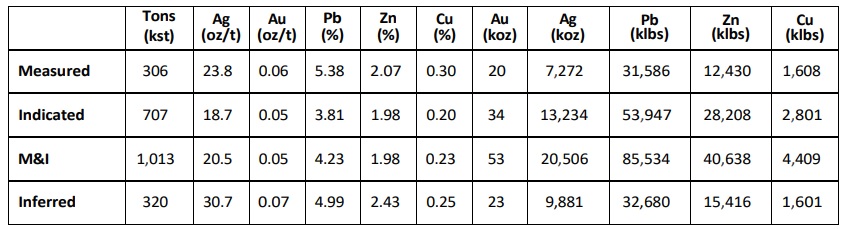

There is an existing resource estimate on the mine with 1 million tonnes in the measured and indicated resource categories and 320,000 tonnes in the inferred resource category. The total silver content across all categories is approximately 30 million ounces of silver with an additional 55 million pounds of zinc and 117,000 million pounds of led as by-products. There’s also about 76,000 ounces of gold but the recovery rate of the gold is the lowest of all metals (68%).

The acquisition terms are straightforward. Subject to a US$5M capital raise, Silver X will be required to pay US$0.2M on the signing of the definitive agreement, US$1M on the closing of the acquisition and US$2M upon the start of exploration drilling or the negotiation of access arrangements with Ouray County where the RV mine is located. A final tranche of US$1.3M in cash is payable before the end of Q3 2024 or upon the publication of a technical report. The total cash outlay to acquire full ownership is US$4.5M but Silver X could elect to make one lump sum payment of US$3.5M before the end of May of this year. This would save the company US$1M.

We will catch up with CEO José Garcia soon and hopefully we will hear more details on the financing plans, the exploration plans and the anticipated annual expenses to keep the Colorado mine in good standing.

Disclosure: The author has a long position in Silver X Mining. Please read our disclaimer.