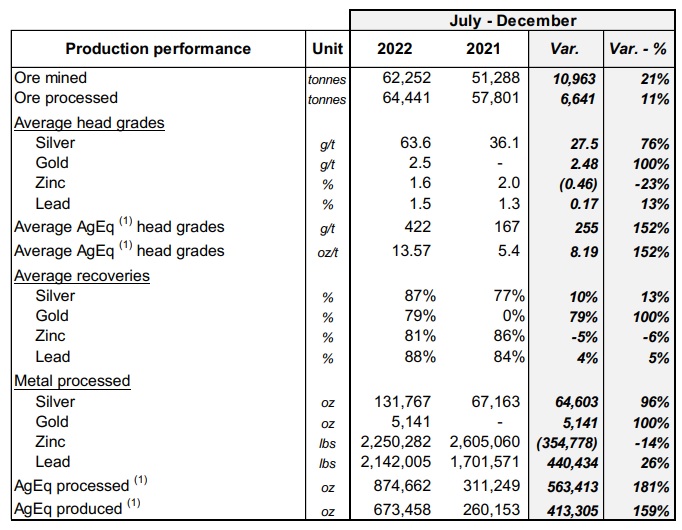

Silver X Mining (AGX.V) reported on its production results for the final quarter of 2022 in January. The company produced a total of just over 300,000 ounces of silver-equivalent in the fourth quarter of the year, which brought the total production for the second semester to 673,458 silver-equivalent ounces.

Silver X processed a total of just over 64,000 tonnes of ore in he second semester at an average head grade of just under 64 g/t silver, 2.5 g/t gold and 3.1% ZnPb. This means gold still is a very important component of the production mix as the market value of the 4,061 ounces of gold that were recovered exceed the value of the almost 115,000 ounces of silver that were recovered.

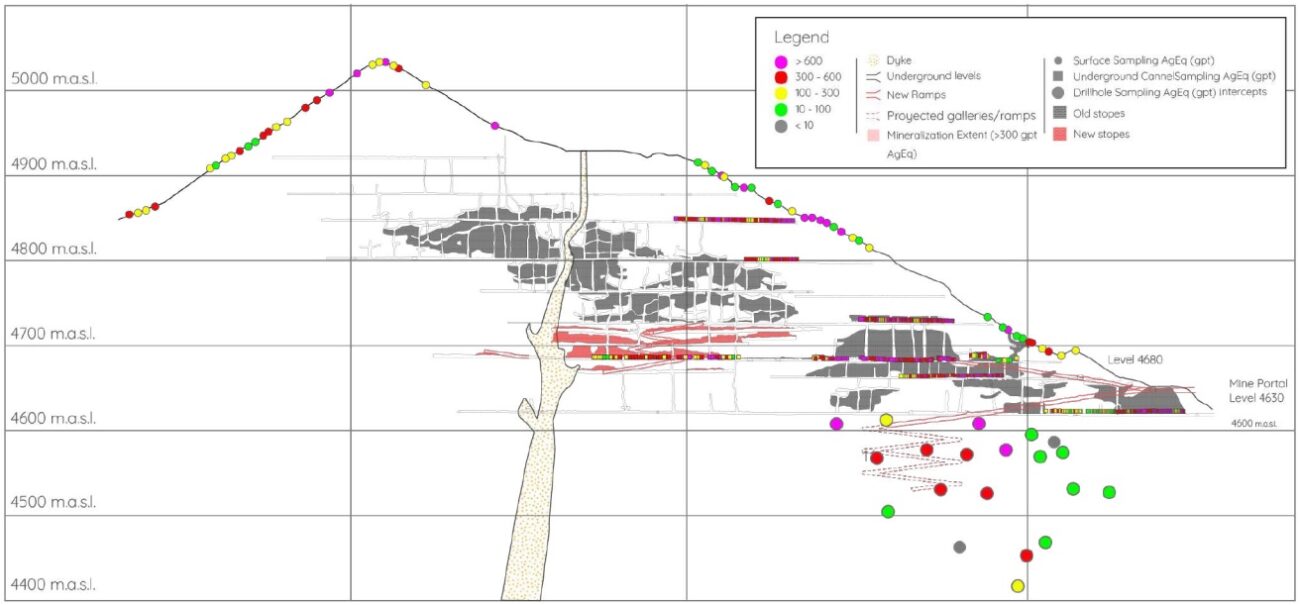

Silver X should be able to ramp up production in 2023 as the average mill throughput in the fourth quarter of 2022 was just over 360 tonnes per day. That’s just over half the mill capacity of 720 tonnes per day. As more stopes will be opened and more rock can be extracted out of the Tangana Unit(s), the production profile will increase as well and the margins should improve as a large portion of the fixed costs can be spread over a higher silver-equivalent production result.

The dust still hasn’t settled in Peru although it has been two months since the coup by former president Castillo failed. The Nueva Recuperada mill and the Tangana mine are not impacted other than some supply chain and logistical disruptions.

2023 will be an important year for Silver X Mining as the company will likely move forward and declare commercial production. We already know the company was profitable in the third quarter, so it already has a sound basis to continue to build value on.

Disclosure: The author has a long position in Silver X Mining. Please read our disclaimer.