Silver X Mining (AGX.V) released its September results just after our update earlier this month, and the company continues its upward trajectory. The production results for September were quite good despite the very unfortunate events in the last week of September as the employee of a contractor lost his life in the Tangana mine.

During September, the company produced just over 162,000 ounces of silver equivalent thanks to the very strong head grade of 564 g/t silver-equivalent during the quarter and the good recovery rates of almost 87% for the silver, 85% for lead and just under 75% for the zinc. According to CEO Garcia’s statement in the September update, new equipment has been delivered to site which should help to boost the production rate.

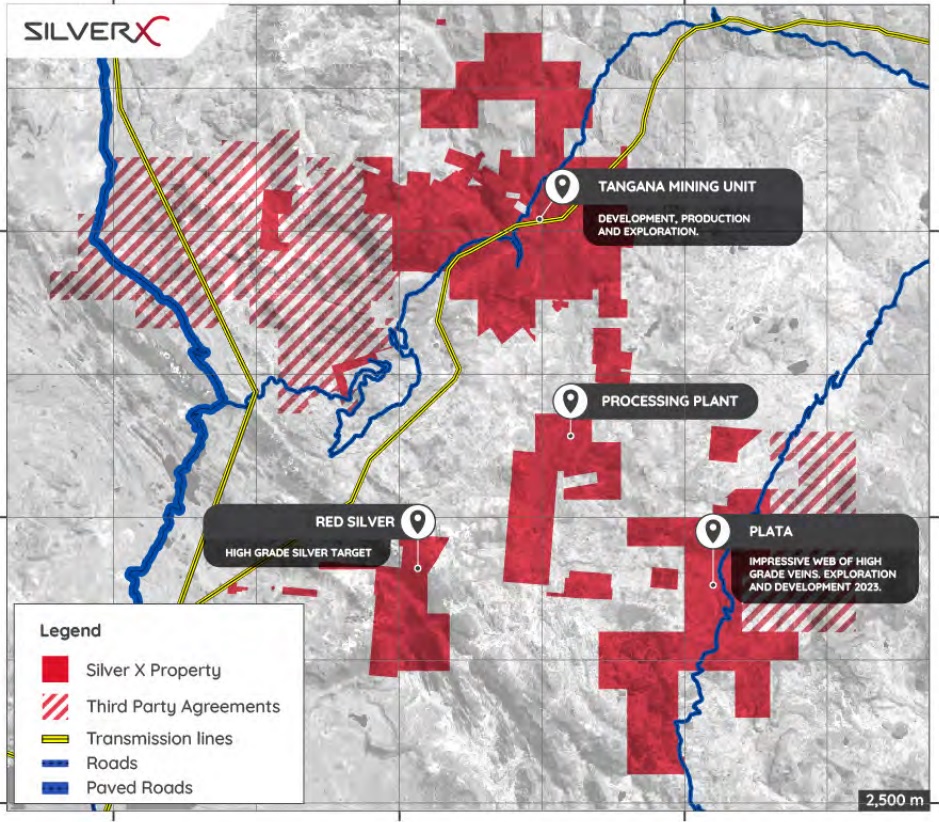

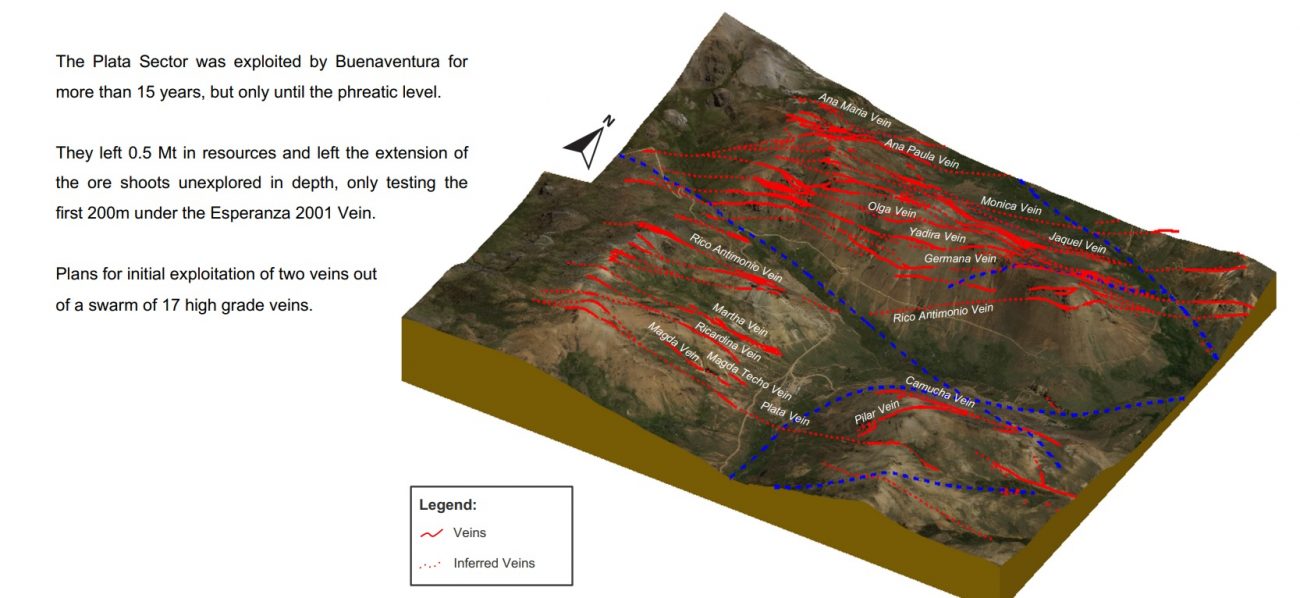

Silver X also announced a private placement to accelerate the exploration activities in the district. While the Tangana mine is cash flow positive, the company is reinvesting the proceeds into additional development activities and paying off the accrued payables on the balance sheet. As the Tangana mine unit is now cash flow positive and there should be some discretionary cash flow in the near future but Silver X doesn’t want to lose any time and that’s the reason for this small placement. Some of the proceeds will likely be used to fund exploration work on the Plata zone (previously called Esperanza) where an area containing dozens of veins remains under-explored.

A first tranche of C$1.9M was closed just days after the original announcement and we expect a small upsize to C$3M due to investor demand. The financing was priced at C$0.22 per unit with each unit consisting of one common share and ½ of a warrant with a strike price of C$0.33 for a period of two years.

Disclosure: The author has a long position in Silver X Mining. Please read our disclaimer.