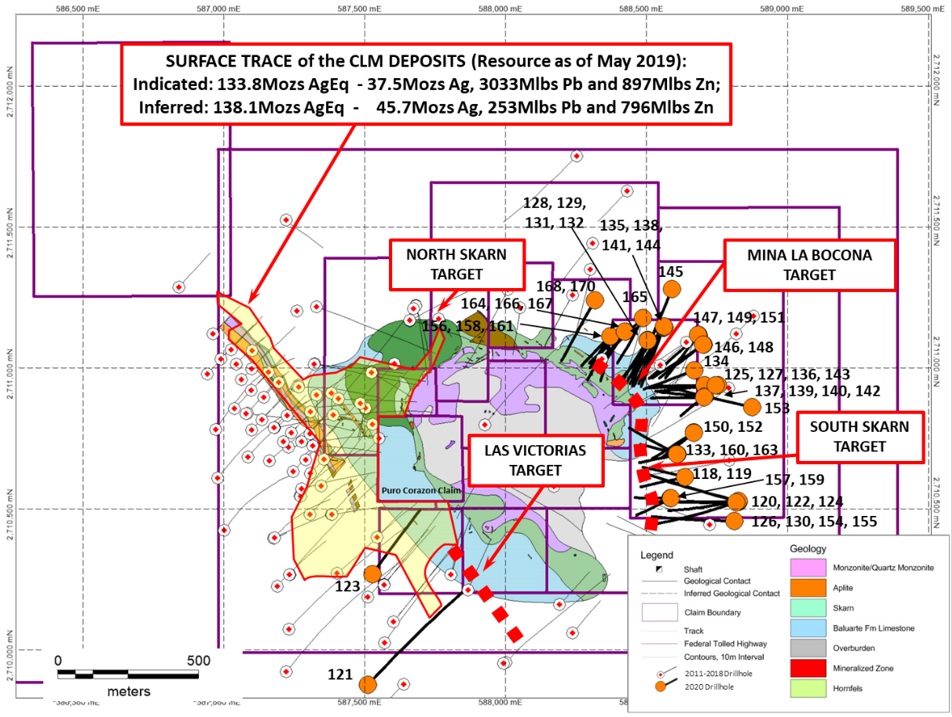

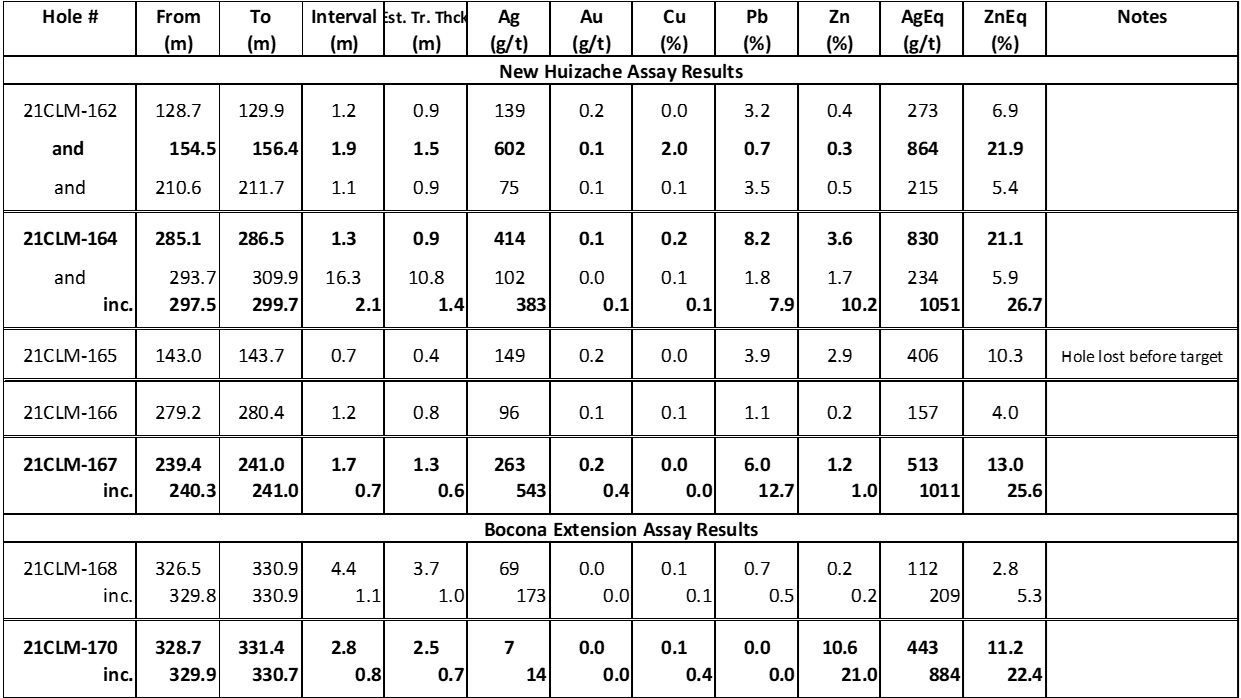

Southern Silver (SSV.V) continues to expand the known mineralization at the flagship Cerro Las Minitas project in Mexico. The company recently released drill results from the Huizache chimney, located just a stone’s throw away from the La Bocona and Mina Pina shafts. The drill bit successfully intersected high-grade mineralization with a 1.4 meter true width interval with an average of 383 g/t silver and 18.1% ZnPb within a broader interval of 10.8 meters (again on a true width basis) containing 102 g/t silver and 3.5% ZnPb.

A second hole drilled at Huizache encountered more high-grade silver-equivalent mineralization with 0.6 meters true width, relatively narrow but containing 1011 g/t silver-equivalent. And in hole 162 there was a nice 1.5 meters of true width grading 864 g/t silver-equivalent.

Good results which further expand the mineralized footprint at Cerro Las Minitas, but the share price remained flat. That’s likely because Southern Silver warrant holders are exercising warrants at C$0.25 before the exercise price increases. As part of the extensive financing conducted last summer, Southern Silver issued ½ warrant with a 3 year exercise period but with a staggered exercise price. The exercise price in the first year was C$0.25, increasing to C$0.30 between now and August 2022, followed by a final year with an exercise price of C$0.35.

It will be interesting to see how many warrants have been exercised at the C$0.25, as that will provide Southern Silver with a nice cash infusion. It will be equally interesting to see how many warrants will remain outstanding.

Disclosure: The author has a long position in Southern Silver. SSV is a sponsor of the website. Please read our disclaimer.