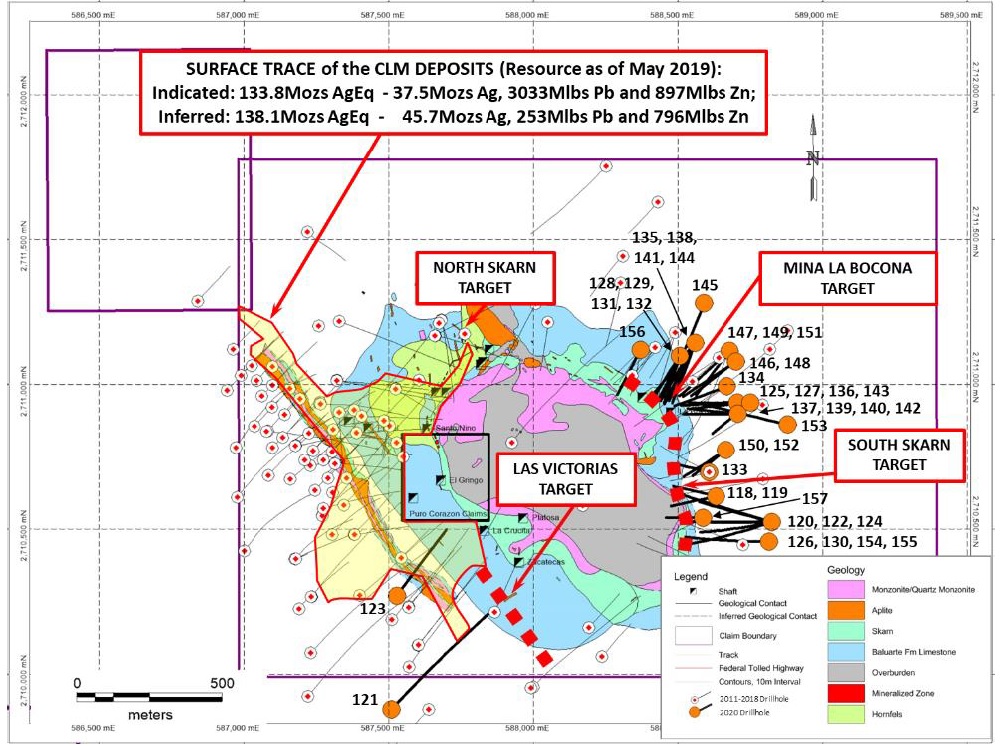

Southern Silver (SSV.V) is fully cashed up and continues to advance its drill program on the flagship Cerro Las Minitas polymetallic project in Mexico’s Durango state.

The company released an exploration update earlier this week from both the Mina La Bocona and South Skarn areas. On the South Skarn target, drilling has now confirmed the continuity of the mineralization for about 350 meters along strike and up to 400 meters down dip. Assays are pending for an additional two holes which were drilled on the northern end of the South Skarn target (towards Mina La Bocona).

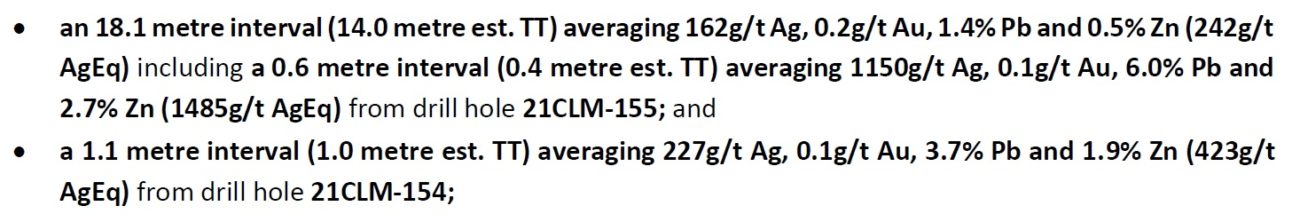

Of interest is the thick interval of 14 meters true width with an estimated 14 meters containing 162 g/t silver, 1.9% ZnPb and 0.2 g/t gold for a silver-equivalent grade of 242 g/t. Within this thicker interval there was a narrower 0.4 meters containing almost 1,500 g/t AgEq but even after removing that high grade section, the average grade of the remaining 13.6 meters true width was approximately 205 g/t AgEq for a gross rock value of about US$175/t which should exceed the cutoff requirements for underground mining.

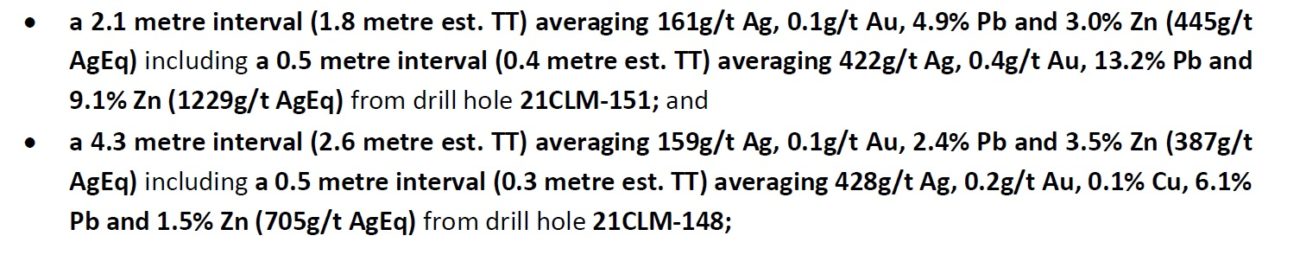

Southern Silver also highlighted two holes drilled at Mina La Bocona with 1.8 meters containing 445 g/t silver-equivalent and 2.6 meters of 387 g/t AgEq (both intervals are based on the true width) and the recently completed holes have been instrumental in expanding the mineralized footprint at Mina La Bocona. Mineralization has now been traced over a 250 meter strike length and 450 meters down dip.

Southern Silver has now already completed in excess of 20,000 meters of drilling since the exploration activities restarted in September 2020. A total of 54 core holes have been drilled, and SSV currently has two active drill rigs at Cerro Las Minitas. The assay results of an additional 11 holes are still pending, and we should see results in the next few weeks.

All drill results will be incorporated in an upcoming resource update and Southern Silver is aiming for a total resource of 30-35 million tonnes at an average grade of 80-120 g/t silver and 4-8% zinc-lead for a total silver-equivalent content of in excess of 350 million ounces. That upcoming resource estimate will subsequently be used as starting point for a Preliminary Economic Assessment in 2022 which should provide a first official indication of the value of this polymetallic project. Both the silver and the zinc price are still pretty strong so we are confident the PEA will be positive.

Southern Silver’s share price has been a bit under pressure since the C$0.50 financing was closed, and this is likely caused by investors exercising the C$0.25 warrants before the exercise price gets hiked to C$0.30 in August.

Disclosure: The author has a long position in Southern Silver. Southern Silver is a sponsor of the website. Please read our disclaimer.