Southern Silver Exploration (SSV.V) recently took advantage of a window of opportunity to fill up its treasury again. The company closed a C$9M bought deal financing (which was upsized from an initial C$7M) issuing 18 million units of the company at C$0.50. Each unit consists of one common share of Southern Silver as well as half a warrant with each warrant allowing the warrant holder to acquire an additional share of Southern Silver at C$0.75 for a period of two years.

Concurrent with the bought deal financing, Southern Silver also closed an additional C$3M non-brokered financing at the same terms. A total of C$12M (and approximately $11M after taking all fees into account) has now been added to the treasury which remains in an exceptionally healthy shape. A smart move by Southern Silver as it will have to pay the final US$2M in cash (and an additional US$2M in stock) to Electrum in September.

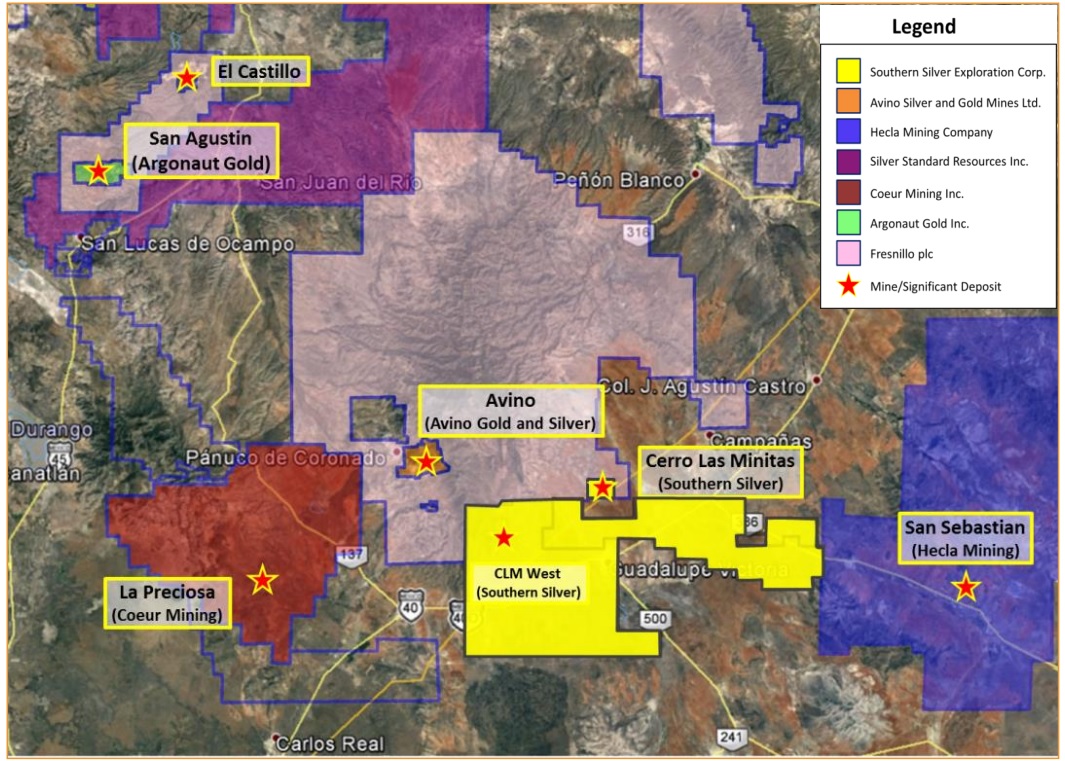

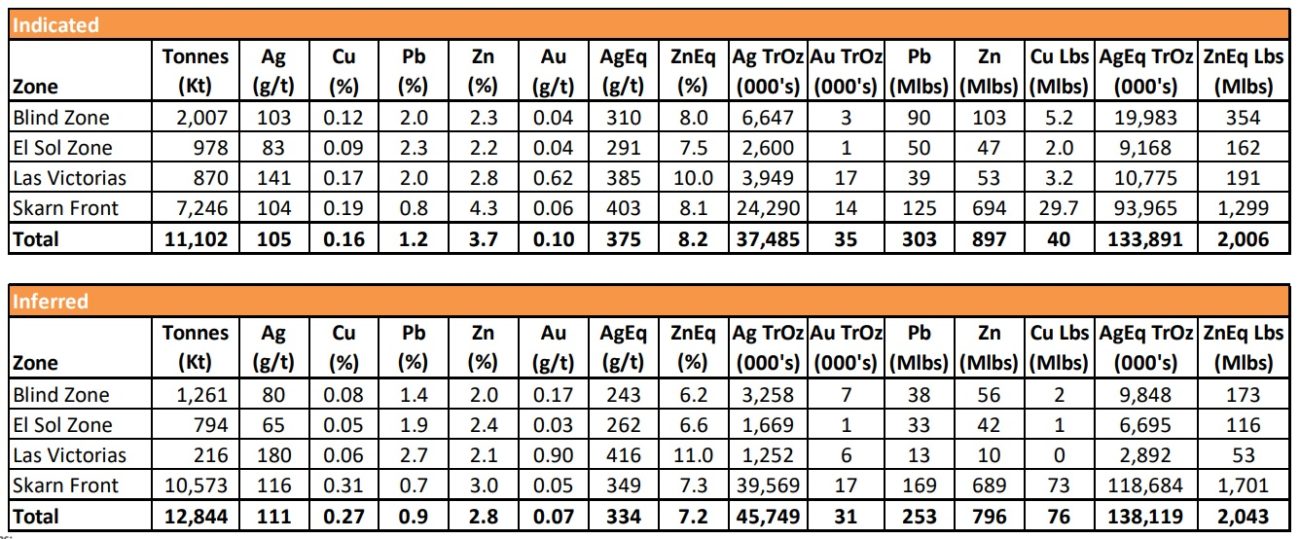

Additionally, the use of proceeds include the continuous exploration activities at Cerro Las Minitas and the nearby El Sol claim, which should result in yet another updated resource estimate in the fourth quarter of this year. Southern Silver will also complete a new drill program on its Oro project in New Mexico. Drilling on this copper-gold-molybdenum project should start in the final quarter of this year.

A good move by Southern Silver as the financings were completed at a unit price that’s almost 20% above the current share price, indicating SSV timed its capital raise very well. There may be some pressure on the share price as the 25 million three year warrants issued in the August 2020 financing can now be exercised at C$0.25 (with an additional 9.5M warrants exercisable at C$0.28), but the exercise price will be hiked to C$0.30 upon the first anniversary of that financing. It’s understandable some investors prefer to exercise their warrants now rather than having to pay 20% more in two months from now.

Disclosure: The author has a long position in Southern Silver. Southern Silver is a sponsor of the website. A company related to the author provided consulting services. Please read our disclaimer.