Sovereign Metals (SVM.AX) has ticked another box at its Kasiya graphite-rutile project in Malawi. The company is keen on attracting the interest from the investor community by putting itself in the picture as the potential supplier of two critical minerals. Based on the pre-feasibility study, the company could become the largest rutile producer in the world with an output of 222,000 tonnes per year while it would also be one of the largest non-Chinese producers of natural graphite. This already attracted Rio Tinto as a major shareholder of the company as Rio acquired a 15% stake in the company.

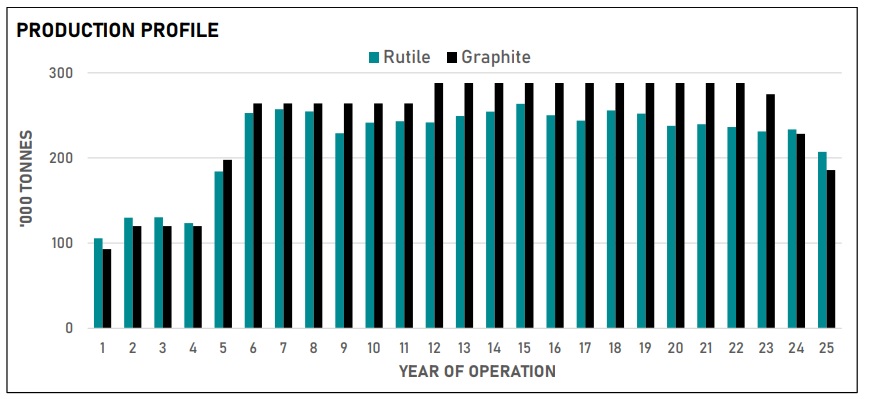

The pre-feasibility study was based on the initial probable ore reserves of 538 million tonnes which represents just about a third of the total resources, so additional reserve expansions appear to be quite likely as the current mine plan is only focusing on a 25 year mine life so there is a possibility to either extend the mine life or further increase the output with the latter option being less likely to avoid too much of an impact on the supply and demand for both products.

The initial capex is estimated at US$597M with an additional US$287M required for expansion investments. An additional US$366M will be required to move the plant to the northern portion of the reserves in year 12. The average throughput is 21.5 million tonnes per year which will be reached after spending the US$287M in expansion capex. According to the company’s calculations, the project should generate US$415M in annual EBITDA. This uses a rutile price of approximately US$1450/t and a graphite price of US$1290/t based on the breakdown of the different types of graphite. As almost 30% of the graphite production will consist of jumbo and super jumbo flake sizes, the weighted average price is substantially higher than for instance the US$558/t applied for the fines.

The after-tax NPV10% of the project based on the aforementioned inputs is approximately US$1.2B.

Disclosure: The author has no position in Sovereign Metals. Please read the disclaimer.