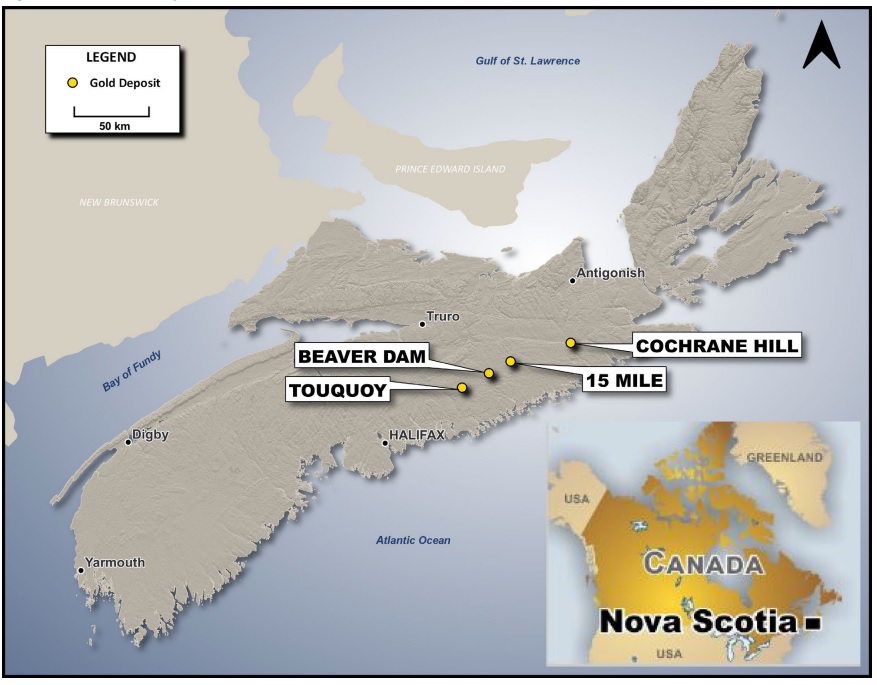

St Barbara (SBM.AX) has released the results from the pre-feasibility study it conducted on its fully owned 15 Mile gold project in Nova Scotia. As St Barbara is an Australian company, the study was conducted based on the Australian standards.

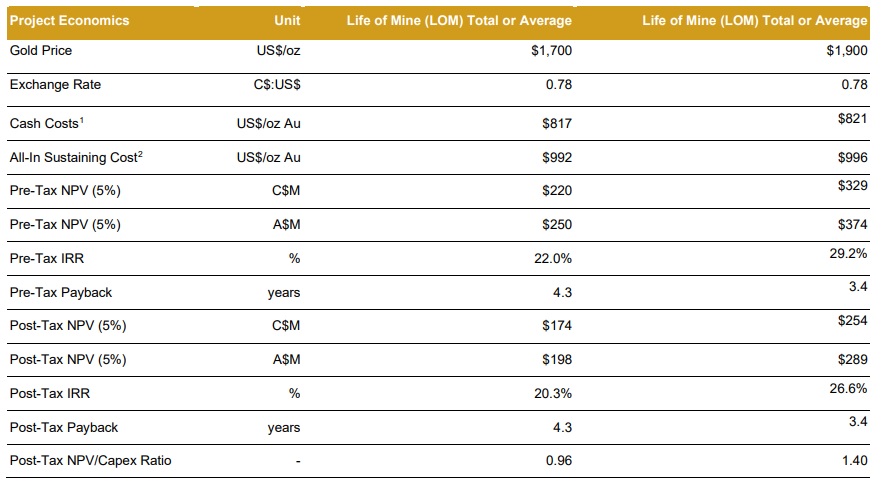

The study was based on the total mineral resources of just under 840,000 ounces of gold and the 618,000 ounces of gold in the mineral reserves. According to the current mine plan, the company was able to design an 11 year mine life with an average production rate of 55,000-60,000 ounces of gold per year, which will be produced at an average all-in sustaining cost of US$992 per ounce. Using a gold price of US$1700 throughout the mine life, the after-tax NPV5% is estimated at C$174M which results in a capex:NPV ratio of almost exactly 1:1 as the initial capex has been budgeted at C$182M.

Using a more optimistic gold price of $1900 per ounce throughout the mine life, the after-tax NPV5% increases to C$289M and this also boosts the Internal Rate of Return from 20.3% to a more respectable 26.6% as the payback period is reduced from 4.3 years to 3.4 years.

While this pre-feasibility study definitely isn’t stellar, the results are pretty robust and the relatively low initial capex will likely be appealing to St Barbara. The NPV calculation is based on the 618,000 ounces of gold in the mineral reserves so if the company would be able to convert some resources into reserves, the mine life could be extended and that would also have a positive impact on the NPV. A relatively small impact as the discount rate obviously also plays an important role.

Disclosure: The author has no position in St Barbara. Please read the disclaimer.