Stellar Resources (SRZ.AX), a small tin company in Australia, has been granted a mining lease on its St Dizier tin project, allowing it to mine tin (and other metals) for an initial period of six years. This mining lease will help Stellar to finetune its development options for the Heemskirk Tin project.

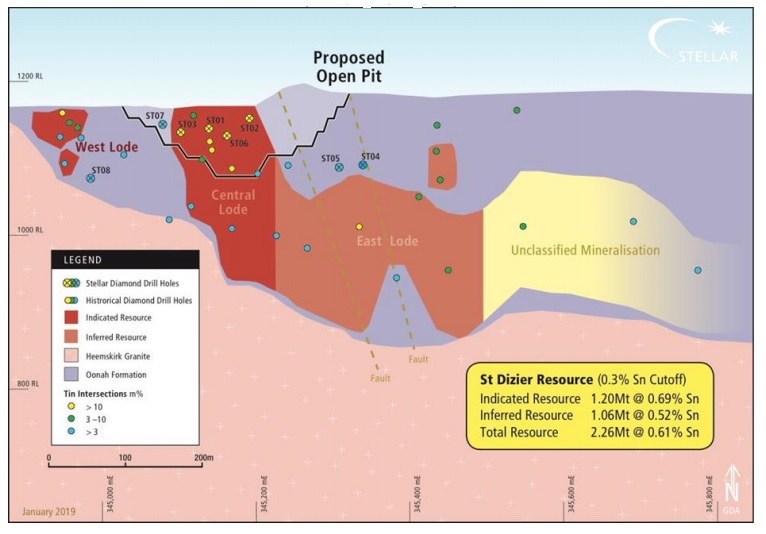

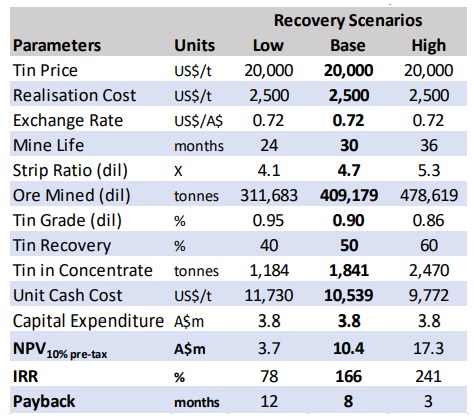

St Dizier hosts a relatively sizeable resource of almost 2.3 million tonnes at 0.61% tin of which just over 400,000 tonnes at an average grade of 0.9% tin have been included in a scoping study due to the limits of the open pit. Way too small to be developed on a standalone basis, but it could be an interesting satellite deposit to the Zeehan project, about 20 kilometers away. According to the scoping study, which takes the transportation costs to truck the rock to the projected plant at Zeehan results in a pre-tax NPV10% of A$10.4M. That’s relatively low considering the average grade and the fact no processing plant will be required (the initial capex is estimated to be less than A$4M), but that’s because Stellar should have another look at the metallurgical aspect of the project.

The mineralization in the samples taken at St Dizier was ‘quite variable’ and there are high losses of the tin mineralization to magnetite, slime and float tails, which resulted in a recovery rate of just 43% (the scoping study assumed a recovery rate of 50%), which could be increased after optimizing the de-sliming process and the acid leaching of concentrate. Increasing the recovery rate is quite important as the sensitivity analysis shows a 70% increase in the NPV to A$17.3M using a recovery rate of 60% and a lower tin grade of 0.86% due to a deeper open pit. And should the tin price increase to US$22,000/t, the pre-tax NPV10% at a 60% recovery rate would increase further to A$22.8M.

Go to Stellar’s website

The author has no position in Stellar Resources. Please read the disclaimer